Sometimes a situation arises between relatives when one of them is ready to purchase real estate from the other, but the required amount of money is not available. A mortgage will come to the rescue. But, as it turns out, many banks are not ready to take part in this type of transaction for several reasons.

From the point of view of the law, such a transaction is feasible and permitted, but only if the bank does not have any claims against the parties. Therefore, you will have to spend quite a lot of effort searching for a suitable credit institution.

Why is this so difficult?

First of all, it is believed that an apartment with a mortgage from relatives may be illiquid. A lot of nuances may arise, one of which is considered to be possible collusion between the parties. The price of a mortgaged apartment is not determined according to market rules, hence many negative consequences.

In addition, the bank is concerned about the potential misuse of loan funds that the borrower will receive as collateral for the purchased property. It will take so much time to check the transaction itself to see if it is fictitious, because it is likely that the family wants to spend the money on some other needs.

Selling an apartment with a military mortgage - features and possible risks

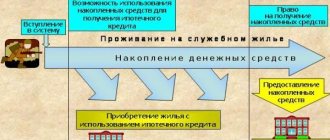

A loan for the military to purchase a home is one of the subtypes of the well-known mortgage loan for those undergoing contract service; it appeared within the framework of a state law implying the implementation of a savings mortgage system to provide the right to purchase an apartment (house). As part of this program, any employee who has been participating in it for 3 or more years has the opportunity to purchase housing (as part of a mortgage loan).

We recommend reading: Chernobyl zone 4 benefits

Officers (including naval officers) and warrant officers who entered contract service after the start of the state program are eligible to participate. Also, the right to participate is granted to graduates of military academic institutions and soldiers who have re-signed their service contracts.

How to buy a home from a relative with a mortgage?

But you can still get a mortgage; to do this, we recommend that you use the following recommendations:

- There are a great many banks today, and each of them offers clients more than one mortgage program. Thus, it will take a lot of time to study all the proposals. You can use the services of a realtor or mortgage broker. Such a specialist will help you choose a mortgage program, take care of collecting documents and submitting them to the bank in a timely manner. But this is not a 100% guarantee of receiving a loan;

- If, due to a lack of money, it is problematic to buy an apartment from relatives with a mortgage, you can take out a simple consumer loan. Without collateral, you can easily get a couple of millions, but the truth is that the rates will not always be pleasant: usually from 16% and above . If you have a salary or any other social card in the chosen bank, you can count on more favorable offers;

- It is better not to hide from the bank the fact that the apartment will be purchased with a mortgage from relatives. The organization is already checking all the information provided and this fact may clearly come to light. An attempt to deceive significantly undermines the bank's trust in you, as a result of which they may not only not issue a mortgage loan, but also blacklist you.

The last point will be especially important if the buyer plans to carry out some manipulations with the property in the near future. In this case, its legal purity is of particular importance. A purchase and sale transaction carried out between relatives is in this case considered completely legal and will not spoil the reputation of the apartment.

Buying with a mortgage from relatives

Advice from lawyers:

1. The tax authorities refused to refund 13% of the purchase of an apartment with a mortgage. Tell me, can I get a tax deduction back on mortgage interest paid when buying an apartment from a relative?

1.1. Good afternoon Based on clause 5 of Art. 220 of the Tax Code of the Russian Federation, this deduction is not provided if the purchase and sale transaction of a residential building, apartment, room or share(s) in them is carried out between individuals who are interdependent in accordance with Art. 105.1 Tax Code of the Russian Federation. According to paragraphs. 11 clause 2 art. 105.1 of the Tax Code of the Russian Federation, interdependent persons are recognized as an individual, his spouse, parents (including adoptive parents), children (including adopted children), full and half brothers and sisters, guardian (trustee) and ward. If you buy from another relative, then you have the right to claim this deduction.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. Sberbank denies a mortgage for the purchase of a share of an apartment from a relative, citing the fact that the relative has nowhere to go, i.e. he has no other housing. What should I do?

2.1. Hello! 1. Secure in the contract of sale the right of the relative to reside after the sale. 2. Or contact another bank. Good luck!

Did the answer help you?YesNo

3. Can I buy a house from my parents using a new rural mortgage from Rosselkhoz Bank? It seems like they say purchasing with such a mortgage between relatives is impossible.

3.1. Hello, in the terms of the rural mortgage program on the Rosselkhozbank website there is no direct indication of the prohibition on purchasing real estate from relatives, but, as a rule, the forms do not like transactions between relatives, so the likelihood of refusal is high.

Did the answer help you?YesNo

4. My husband and I have a registered marriage, 2 children, and have matrimonial capital. There is a private house. The owners are the husband and his mother and father in equal shares. We want to use mat capital to buy out our parents’ shares and thus the house will become ours entirely. The youngest child is not yet 3 years old now. What should we do better? Will the PF approve the purchase from relatives? To avoid a mortgage, we can wait until the child is 3 years old.

4.1. Relatives are not an obstacle to the purchase; for the pension fund it is important that the child receives a share for the mat cap. Everyone is so confused.

Did the answer help you?YesNo

5. We took out a mortgage on the apartment. A refund of 13% of the purchase price was refused because... bought from relatives. Is it possible to get back interest on the money spent on repairs? Secondary. The contract does not indicate that the apartment is unfinished...

5.1. Good afternoon. Unfortunately, you will not be able to return 13%.

Did the answer help you?YesNo

6. My husband and I want to buy a house with a mortgage. Capital from 2 owners, one of the owners is my mother. The mortgage will be issued to the husband, is there a 13% refund on the purchase in this case? Or is it considered purchased from relatives and the tax office will refuse?

6.1. Hello! It doesn't matter from whom you purchased your home. You have the right to a personal income tax refund.

Did the answer help you?YesNo

7. A son buys an apartment from his father with a mortgage. . Will the bank approve the mortgage without checking everyone out of the apartment before the transaction? (are there any obstacles when buying from relatives due to a mortgage). If there is no alternative to buying an apartment, is it necessary to check out before the transaction or is it not important?

7.1. It is not known how the bank will look at this, but this is generally not an obstacle, since the right of ownership is in no way connected with registration, registration, in principle, it is possible to deregister, but let them live there, temporarily, if there is a need.

Did the answer help you?YesNo

8. Maternity capital is not mine. Can they make a power of attorney for me to purchase housing in another city? The landlady is unable to be present when the apartment is purchased. Not a mortgage. I am a relative (daughter). And can I register this apartment in a transaction for myself?

8.1. Dear Yana, Maternity capital is not yours. They can make a power of attorney for you to purchase housing in another city, but you will not be able to register this apartment in the transaction in your name. Best regards, Lawyer Korolev

Did the answer help you?YesNo

9. I filled out the documents to buy an apartment from my father, I have maternity capital, a young family certificate and a mortgage, all the documents are in the MFC, today they said that a law has been passed banning the purchase of housing from close relatives, what should I do and what should I do next?

9.1. Good evening, there is no such law and the law does not prohibit buying housing from close relatives with certificates—demand a written refusal and go to court.

Did the answer help you?YesNo

10. Is it possible to return a percentage of a housing mortgage if the apartment was purchased from close relatives and a percentage return for the purchase of an apartment is not possible.

10.1. Hello, Ekaterina! If you are interested in the property deduction, then the Deduction for the purchase of housing does not apply in the following cases: if payment for the construction (purchase) of housing was made at the expense of employers or other persons, maternal (family) capital, as well as at the expense of budgetary funds; if the purchase and sale transaction is concluded with a citizen who is interdependent in relation to the taxpayer.

Interdependent persons are recognized as: an individual, his spouse, parents (including adoptive parents), children (including adopted children), full and half brothers and sisters, guardian (trustee) and ward (Article 105.1 of the Tax Code of the Russian Federation).

Did the answer help you?YesNo

10.2. If a refund of interest on the purchase of an apartment is not possible, then the first part of your question does not make any sense. Naturally, nothing can be returned.

Did the answer help you?YesNo

11. The question is, my wife and I want to get in line to help a young family buy a home, I am registered in my mother’s apartment with 3 relatives, area 75 sq.m., the apartment is owned, my wife is registered with her mother and 2 relatives, area 54 sq.m. a second apartment with a mortgage, will they be recognized as needy in this case?

11.1. — Hello, they don’t recognize you as needy, especially if there are no children in the family. So rely on your own strength. Good luck to you and all the best. :sm_ax:

Did the answer help you?YesNo

12. Can I get a tax deduction on mortgage interest when buying an apartment from a relative?

12.1. Yes you can. Tax inspectors confirm the right to a tax deduction on mortgage interest when purchasing from relatives.

Did the answer help you?YesNo

13. I would be grateful if you could enlighten me on the topic of maternity capital and shares when buying an apartment. I have maternity capital for my second child, we want to buy a share in our relative’s apartment, how long should we wait for the money to be transferred for the purchase, and how to correctly draw up an agreement with the relative? Is it true that I can only count on maternity capital if I take out a mortgage? And wait 3 years?

13.1. Good afternoon. They will refuse to allocate funds. They will not see any improvement in living conditions.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. Is it possible to get a tax deduction on mortgage interest if the apartment was purchased from a close relative? We were denied a deduction from the purchase price of a home for the same reason!

14.1. Unfortunately you can't get it.

Did the answer help you?YesNo

15. Please explain whether my son, an officer of the Armed Forces, can buy an apartment on a military mortgage from his own father with whom he does not live and is not registered. The apartment was bought by my father three years ago as personal property. And what are the benefits when buying and selling between close relatives?

15.1. There are no benefits provided in your case.

Did the answer help you?YesNo

16. Why can’t I get a deduction for purchasing a share in an apartment if I bought it from a close relative? Despite the fact that a mortgage was taken out.

16.1. Because this is the Law. (Part 5 of Article 220 of the Tax Code of the Russian Federation)

Did the answer help you?YesNo

17. My husband bought a share in the apartment from his dad, they took out a mortgage, they wanted to file a tax claim for 13%, but they refused. They bought it from a close relative, is there really nothing we can do, we can prove that this money was then used to buy another apartment for my dad .

17.1. Is there really nothing that can be done, Hello. No, nothing can be done... the refusal is legal.

Did the answer help you?YesNo

17.2. The proof will be the purchase and sale agreement.

Did the answer help you?YesNo

18. I bought an apartment from my mother (relatives), plus I took out a mortgage to buy the apartment. Can I claim a property deduction?

18.1. Good afternoon. When drawing up a purchase and sale agreement, you have the right to a Property Deduction.

Did the answer help you?YesNo

19. We bought a house for a mat. mortgage capital. House 23 sq.m. living area. Three are registered in it. Wife, daughter 8 years old, and second daughter 10 months old. I am registered with my parents. We want to sell another house of 50 square meters of living space in another city. What about children? Should they be immediately discharged and registered in a new home, or can they be registered after the transaction? Or can you temporarily register with relatives while the purchase and sale of one house and the purchase of another house in another city are going on?

19.1. Hello! You can sell this house and buy another only with the consent of the guardianship authority.

Did the answer help you?YesNo

20. Please help me correctly draw up an application to the pension fund so that I can be approved to pay off the mortgage with maternity capital to buy a house from a relative!

20.1. Good evening. Samples are available directly from the Foundation itself. You just indicate your situation.

Did the answer help you?YesNo

Is it possible to use maternity capital to purchase housing (not a mortgage)

I would like to know: my wife and I have an apartment with a mortgage and one document between us that we are the owners, and my wife is a co-borrower with me.

I bought a 13 m2 hotel room with maternity capital funds and night allowances that were given to me by relatives without a receipt in 2014.

Is it legal for a transaction in which an apartment is purchased from close relatives (part of the mortgage payment, which we pay off with a maternal certificate)

I have this situation. My common-law husband and I bought an apartment with a mortgage.

I was refused to buy an apartment from my mother-in-law, due to a military mortgage, because they said that she was a relative and my wife was previously registered there from 1996 to 2005? They are right?

Is it possible to get an income tax refund when purchasing shares of an apartment from relatives with a mortgage?

Please tell me how I can use the mat. capital until the child turns three years old when buying a house from relatives.

I have 1/2 share in an apartment, how can I get the documents to get a mortgage to buy out my brother’s 1/2 share?

Tell me this is the situation. We took out a mortgage to buy an apartment under the mat. capital.

Please tell me, is it possible to take out a mortgage to buy 1/2 share of a home from my mother-in-law,

Joint purchase of an apartment with a mortgage

Both relatives and “non-relatives” have the opportunity to apply to the bank for a joint mortgage loan for the purchase of a common apartment.

Previously, banks avoided issuing mortgage loans to citizens who were not related (including married). But time passes, demand creates supply, and now banks are ready to consider people formally independent from each other as co-borrowers - including co-investor partners or “common-law spouses”.

A joint mortgage for the purchase of an apartment can be issued in different ways:

- One is the borrower, and the other acts as a guarantor for the loan.

- Both buyers (co-borrowers) act as the borrower.

Financial responsibility to the bank in these cases is different. For example, the guarantor’s liability to the bank is subsidiary , that is, it arises only when the main borrower is unable to repay the loan (in fact, bankrupt). And the responsibility of two co-borrowers to the bank is joint , that is, equal, the same. Here, the bank can demand repayment of the loan simultaneously from both borrowers, both in parts and in full (Article 323 of the Civil Code of the Russian Federation). Borrowers here must agree on who pays their share of the loan and when, otherwise one person will have to pay for both.

In practice, buyer-relatives usually prefer the first option (guarantee), and co-investor partners prefer the second (joint loan).

Is it possible to buy an apartment by proxy? When and how this happens - look in this article.

Private loan

Many NIS participants ask this question: is it possible to purchase an apartment with a military mortgage from relatives? And now this issue is more and more relevant. After all, you can get some benefit from this. For example, negotiate with relatives and receive a certain amount of cash when purchasing an apartment to buy furniture or other property. This situation will benefit both the seller, who will quickly sell the property, and the buyer, who will receive a certain amount of cash if the transaction is completed. To answer the question “Is it possible to buy an apartment for a military man from relatives ,” you need to turn to primary sources. Namely, to the Federal State Public Institution Rosvoenipoteka and the credit institution, since resolving this issue is only within their competence. Indeed, on the official website of the Federal State Institution “Rosvoenipoteka” the answer to the question is given. The essence of the answer is that restrictions regarding the requirements for purchased housing are established by the credit institution. And the possibility of purchasing an apartment with a military mortgage from relatives (family members) is regulated by internal standards and documents directly from the bank itself. In other words, the decision depends on the lending institution.

Please note => Job Description Incoming Control Engineer

Is it possible to build a house with a military mortgage?

According to Federal Law No. 117, NIS funds cannot be used to purchase a plot of land for the construction of a private house.

Refusal to finance the purchase of land plots for subsequent construction is justified by the following reasons:

- It is almost impossible to track where allocated funds are used;

- Construction may be stopped and the borrower will not be able to cover the risks of the financial institution;

- It is impossible to register a house that is being built individually as collateral, since such real estate is not registered until the completion of the work;

- It is impossible to insure unfinished property, as well as the risks of suspension or termination of construction.

Information: it is possible to use military mortgage funds to purchase land and build a private house after 20 years of participation in the NIS program. After the specified period, the serviceman acquires the right to dispose of savings at his own discretion.

Purchasing real estate with a military mortgage from relatives or military spouses.

Is it possible to buy an apartment with a military mortgage from your relatives? The funds received under a military mortgage consist of two parts: a targeted housing loan - money accumulated in the account until the receipt of the NIS Certificate and a bank loan. In the case of purchasing an apartment with a military mortgage from relatives, everything depends not on government agencies, but on the decision of the bank. The procedure for making such a decision is regulated by the rules and documents of the credit organization (bank). Federal Law FZ-117, according to which the military mortgage program operates, does not apply to this. In some banks, a serviceman will immediately be refused a loan in accordance with the internal regulations of the bank itself. For example, the rules of the Housing Mortgage Lending Agency state that purchasing real estate from a close relative using a military mortgage is not allowed. According to the rules, it is not allowed to purchase housing from close relatives of a serviceman, from brothers, sisters or parents of a serviceman; from close relatives of the spouse of a military personnel or from the parents of the spouse. Other financial organizations also do not approve of such transactions, and as you know, the bank is not obliged to give a reason for refusing to issue a mortgage. The main reason why credit institutions refuse to issue a military mortgage when buying an apartment from relatives is that such a transaction can lead to collusion and cashing out of funds through the imaginary sale of real estate, which will still remain in the same family. When purchasing real estate with a military mortgage from distant relatives, the bank’s security service most likely will not have any questions; bank employees will not bother checking all distant relatives. And the bank will not refuse to issue a loan. One more important factor should be taken into account: compliance with the requirements for residential premises imposed by both legislation and the bank: housing must meet technical requirements, have all communications, and not be dilapidated or in disrepair. Accordingly, secondary housing in which relatives live will be checked for all these compliances. In family matters regarding military mortgages, one of the frequently asked questions is - How is a military mortgage issued if the husband and wife are military personnel? Since May 2020, military spouses can now receive one certificate for two with the opportunity to immediately purchase a large living space or apartment in a good area. For a husband and wife, when both are military personnel, the law requires receiving 2 separate certificates and one for both.

voenn-ipoteka.ru

Obtaining a military mortgage if you have housing

Question: “Hello, I need professional help. I have been serving under contract for more than 7 years. I want to become a member of NIS in order to buy an apartment on credit in the future. The question is this: if you already own housing, can a military mortgage be issued?”

Answer: According to the norms of the Federal Law “On Military Duty and Military Service,” every citizen who works under a contract and has a service record of 3 years or more can become a participant in the savings-mortgage system. This means that the serviceman is assigned a personal financial account, and cash subsidies must be transferred to it monthly from the Rosvoenipoteka fund. These funds accumulate and can be used to purchase housing by obtaining a mortgage.

These savings are transferred regardless of whether the military man (or members of his family) owns an apartment, and also without taking into account the receipt of housing under social tenancy rights.

In the future, in order to use such funds to obtain a mortgage, you need to perform the following steps:

- find the property you are interested in;

- negotiate with the seller to sell the house on credit;

- contact the bank with a request for a military mortgage;

- send a petition to the Rosvoenipoteka fund with a request to repay the debt;

- sign contracts.

At no stage of the procedure will information about the ownership of other real estate objects be taken into account, so you can safely proceed to applying for a loan.

You can also rent out an apartment with a military mortgage.

Question: “I serve under a contract outside the locality. We live with our family in a military town, in a so-called service apartment. So we decided to purchase our home with a mortgage. I just don’t know if it’s possible to buy real estate on credit if the family is provided with office living space?”

Answer: First of all, let’s understand what service housing is. According to the norms of the Housing Code of Russia, every serviceman who works outside his place of registration must be provided with a permanent place to live. This can only be a separate apartment, the rights of use of which are formalized in a social tenancy agreement.

Alexander Anatolyevich

Military lawyer, site expert

In December 2020, the Russian President signed Law No. 416-FZ “On Amendments to Article 15 of the Federal Law “On the Status of Military Personnel.” According to the amendments, if a serviceman deliberately worsened living conditions in order to receive money or an apartment, then the right to be placed on the housing queue will now arise only after 5 years.

In fact, a soldier can only use square meters, but not dispose of them. The maximum term of such a lease is limited to the time of service at the place of deployment. In theory, a citizen has the right to purchase ownership rights to an apartment, but only upon retirement.

Attention! A citizen living in official housing is considered to not have his own home, so he has all the rights to receive a mortgage.

Only those military personnel who have served at least 3 years under a contract can take advantage of this right. Moreover, domestic legislation does not stipulate that owners of their own apartments cannot purchase another home with a mortgage.

In addition, it is possible to obtain a civil mortgage for all military personnel.

The main thing is to become a member of the NIS and be ready to serve until the end of the loan repayment period.

APPLICATION FOR ACCESSION TO THE RULES

Back to list of articles

Is it possible to get a mortgage from relatives?

Mortgage lending programs aimed at purchasing liquid residential real estate are today the most optimal solution to many of the borrower’s problems. At the same time, the potential borrower must remember that a mortgage loan requires the person being borrowed to timely repay not only the loan body, but also interest charges accrued for using a cash loan, as well as processing, maintaining and servicing the mortgage.

A potential borrower should be aware that many mortgage lending programs imply certain restrictions, including a ban on the purchase of residential real estate from children, spouses, and parents. If the borrower plans to get a mortgage from relatives, he should know that participation in the mortgage lending program is impossible if the borrower is one of the persons (former or current) who owns this property.

Purchasing housing from relatives with the help of bank funds, in other words, a mortgage from relatives, is legally possible only by individual agreement, which has a certain number of requirements put forward by the creditor bank in relation to the residential property being purchased. These requirements include: the liquidity of the purchased housing, which has permission for gasification and energy supply, as well as the absence of unregistered redevelopment and re-equipment on the territory of the purchased property.

In addition, a potential borrower wishing to purchase housing with a mortgage from relatives must provide the lending bank with documentary evidence that this residential property does not belong to the so-called “dilapidated” housing construction. And that on its territory there are no registered citizens temporarily deregistered due to serving in the Armed Forces or being in prison. It should also be recalled that a mortgage from relatives can only be used for that liquid residential property that is not already pledged under other loan programs or has not been subject to court decisions that have not yet expired.

The experience of our credit portal employees can guarantee potential borrowers legitimate assistance in deciding and finding optimal mortgage programs that allow them to take advantage of a mortgage from relatives. A potential borrower must understand that using the materials and services of our portal is a guarantee of obtaining a loan on the most favorable and convenient lending terms.

It can be noted in conclusion that the correct approach to considering and studying all the lending conditions of a particular mortgage program can at many stages provide the potential borrower with legitimate protection from undesirable situations related to lending violations and litigation.

The nuances of purchasing an apartment with a military mortgage or how to buy living space with a subsidy

Step 8 A serviceman registers ownership of an apartment in the case of secondary housing. The apartment will be double pledged: from the bank and from Rosvoenipoteka until the loan is fully repaid. The home purchase has been completed. Rosoenipoteka will monthly transfer NIS funds to the bank to repay the amount of the military mortgage. For a new building, registration of ownership of the apartment occurs only upon commissioning of the house.

Interesting: Is it possible to trade without a cash register?

In order to buy an apartment with a military mortgage, you need to collect documents. After three years of service, a serviceman can submit a report to the command to receive an NIS certificate. He will use NIS funds as a housing loan.

Is it possible to buy a mortgaged apartment from a relative?

- Suspicion of a conspiracy between people with family ties to lower the price of real estate

- Suspicion of a fictitious transaction in order to obtain a large sum for consumer needs

- The borrower himself may refuse due to the impossibility of obtaining a tax deduction and participating in preferential mortgage lending programs.

Quite often, in the process of collecting information about buying a home from relatives using a mortgage, a potential borrower comes across information that it is almost impossible to conclude such an agreement between relatives. There is a very common misconception that banks do not want to work in this direction due to high risks. Today this is very common, but absolutely erroneous information, since banks have long turned a blind eye to facts that a few years ago served as a significant reason for refusing to provide a mortgage loan.

Interesting: Minimum number of square meters per person