17.05.2016

The possibility of renting out real estate purchased under a “Military Mortgage” is a pressing issue for military personnel.

Quite often, NIS participants purchase an apartment with a military mortgage in the locality where they plan to live after retirement, and perform military service in another region. At the same time, no one has canceled the payment for utilities, and in order to ensure that the apartment does not stand idle, military personnel often think about the legality of renting out such real estate.

The question of the possibility of renting housing to military personnel arises for a reason. The whole catch is that 76-FZ “On the Status of Military Personnel”, Article 10 “Right to Work” provides for types of activities that a military personnel does not have the right to engage in. One of the points of this article is the prohibition on engaging in entrepreneurial activities, personally or through proxies, which raises the question of the legality of renting out their own residential premises to military personnel. We will try to understand this issue so that the conscience of military personnel who want to rent out apartments is clear. Let's start with the fact that renting out to military personnel their own residential premises purchased under a “Military Mortgage” should not be considered as entrepreneurial activity.

In accordance with paragraph 1 of Article 2 of the Civil Code of the Russian Federation, entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, the sale of goods, the performance of work or the provision of services to persons registered in this capacity, in the manner prescribed by law. .

In addition, it is worth noting an important point: in accordance with Article 608 of the Civil Code of the Russian Federation, the right to rent out property belongs to its owner. In this case, property also means residential premises owned by right of ownership, and in order to be a lessor, an individual does not have to be registered as an individual entrepreneur.

Also, in accordance with the letter of the Ministry of the Russian Federation for Taxes and Duties No. 04-3-01/398 dated 07/06/2004 “On the leasing of premises (hiring)”, the activity of leasing residential premises owned by an individual is not should be regarded as entrepreneurial activity.

At its core, the rental of residential real estate owned by right of ownership is considered as a legal act certifying the fact that an individual is using his legal right to dispose of his property, and does not contain signs of economic activity.

In this letter, the Ministry of Taxes and Duties explains that the lessor (in our case, a military serviceman) receives income in the form of rent stipulated by the lease agreement, which is subject to income tax taxation (at a rate of 13%), and does not pay on his own the risk of any economic activity, since it is the lessee who carries out the activity using the leased property.

Summarizing the above, we come to the following conclusion: a serviceman can rent out an apartment, house, or townhouse purchased with a “Military Mortgage”! The main thing is to comply with the legal norms for renting out your own real estate. So, if a decision is made to rent out residential premises, the serviceman must take the following actions.

Coordination with mortgage holders

Due to the fact that the bulk of apartments and private houses are purchased by NIS participants using a mortgage loan under the Military Mortgage program, the first person with whom it is necessary to agree on the possibility of renting out mortgaged housing is the creditor bank, which is also the first mortgagee. Renting out residential premises without the consent of the bank is a direct violation of the terms of the loan agreement with the ensuing consequences, since basically all banks have these conditions spelled out in the agreement itself.

Any residential premises purchased by an NIS participant using funds from a targeted housing loan is pledged in favor of the Russian Federation represented by the Federal State Institution Rosvoenipoteka. This should also be taken into account when making a decision to rent out such housing, and agree on this option for disposing of your own property with the Federal State Institution “Rosvoenipoteka”.

Coordination with the insurance company

In addition, the possibility of renting out residential premises should be discussed with the insurance company. Real estate purchased under the “Military Mortgage” program is collateral in accordance with the Federal Law “On Mortgage (Pledge of Real Estate)”, the mortgagor (in our case, a military serviceman) is obliged to insure the pledged property, and in the case of renting out the risks of loss and damage to the collateral assets increase. Obviously, in this case, the insurance company can quite naturally calculate the insurance premium at an increased rate, but if any insured event occurs during the period of renting out the premises, the insurance company will compensate for the damage. Otherwise, if the hiring agreement was not carried out, the insurance company will legally refuse to compensate for the damage, and the burden of restoring the collateral or repaying the loan debt will fall entirely on the shoulders of the borrower.

Any agreement with both the mortgagee and the insurance company must be made in writing and have written approval from all interested parties. In cases with a creditor bank and an insurance company, a written request should be prepared; it can be sent either by mail or submitted directly to the organization’s office.

When making a request to the Federal State Institution “Rosvoenipoteka”, it is recommended to prepare a written application (it is advisable to have the bank’s consent in hand at the time of sending this application and attach a copy of this consent to the application). It should be taken into account that in accordance with 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation,” a written appeal from citizens is considered within 30 days from the date of registration of such an appeal.

Once all approvals have been received from both the mortgagee and the insurance company, the service member should enter into a rental agreement. Banks that approve the rental of premises are asked to use their standard rental agreement form. If the bank does not insist on using a specific form of agreement, the serviceman should carefully consider its drafting, and it would not be a bad idea to seek the help of a qualified lawyer.

Residential rental agreement

When drawing up a rental agreement, you should take into account the basic provisions in order to protect yourself in the future from possible risks.

In accordance with Article 671 of the Civil Code of the Russian Federation, under a rental agreement for residential premises, one party - the owner (lessor) - undertakes to provide the other party (tenant) with residential premises for a fee for possession and use for living in it. The agreement is drawn up in simple written form. The contract should specify the subject of the contract, full information about the residential premises, including the exact address, area, total number of rooms.

It is advisable to include in the text of the contract: the rights, obligations and responsibilities of the lessor; rights, duties and responsibilities of the employer; a list of citizens living with the employer on a permanent basis and temporarily residing; conditions for current and major repairs of residential premises; size, terms and procedure for payments for residential premises; term of the rental agreement; other conditions (for example, conditions of operation of movable property, conditions of keeping animals, etc.); conditions and consequences of termination of the contract; procedure for resolving disputes; full details of all parties to the contract (full passport details, contact details).

Also an integral part of the contract is the act of acceptance and transfer of residential premises. The transfer and acceptance certificate must reflect the actual state of the property being transferred for use, the state of communications of the transferred movable property, and, if any, the condition of furniture, equipment, and the very fact of transfer in due time. If there is an agreement to transfer the payment by cash payment, a free-form schedule table should be drawn up, where the employer and the lessor will record the fact of transfer of funds, indicating the date, amount and purpose of payment, and it is possible to issue a receipt. If the rent is transferred by bank transfer to the landlord's bank account, payment is confirmed by a bank payment order or receipt.

At the end of the contract, care should be taken to draw up an act documenting the transfer of property intact and the absence of claims from both parties.

It should be noted that a rental agreement concluded between individuals is not subject to registration, regardless of its validity period. A rental agreement, in accordance with Article 35 of the Civil Code of the Russian Federation, is an independent agreement and is not a type of lease agreement (Article 34 of the Civil Code of the Russian Federation), and, therefore, the rules on state registration of a rental agreement do not apply to the rental agreement.

One of the elements of the legality of disposing of residential real estate in the form of rental is the declaration of income in accordance with the Tax Code of the Russian Federation. In accordance with paragraphs. 4 paragraphs 1 art. 208 of the Tax Code of the Russian Federation, income received from renting out premises is subject to personal income tax. Military personnel receiving payment from the rental of their living quarters are required to independently, before April 30 of the year following the period of receipt of income, submit a declaration in form 3-NDFL to the tax office (at their place of residence). Payment of the tax itself is carried out after verification of the submitted declaration, until July 15.

Hiring “on the sly,” at your own peril and risk, may be of interest to both the prosecutor’s office and commanders. Having all approvals, contracts and confirmations of tax payment in hand allows you to avoid situations involving loss of trust and live with a clear conscience, according to the law.

The funds received from the rental of residential premises can be used by the military personnel at their own discretion. However, Military Relocation believes that it would be more appropriate to use these funds for partial early repayment of the mortgage loan received under the Military Mortgage program. Directing funds for partial early repayment helps reduce the loan term and interest payments for using the loan, and, consequently, reduces the cost of the loan itself.

As a result of early repayment of the debt from the bank under the “Military Mortgage”, funds allocated from the budget of the Russian Federation and previously allocated to repay the loan will be formed in the personal savings account of the NIS participant, and after the right to use the savings becomes available, they will be paid to his personal bank account.

As a rule, apartments are purchased with a mortgage loan by those people who want to get their own home to live in. It's simple. But some borrowers are trying to make money in this way, so to speak. For example, a person has a certain amount of funds that he can use as a down payment. After purchasing an apartment on credit, the borrower does not move into it, but begins renting it out to tenants. The borrower transfers the amount received from renting out the apartment to the bank account, that is, repays the debt. Thus, the apartment, as they say, processes itself.

Recently, the so-called military mortgage, that is, a mortgage loan for military personnel, has gained wide popularity. This raises the question of whether it is possible to rent out an apartment with a military mortgage.

As you know, many landlords prefer to rent out an apartment without declaring income, although in reality this turns out to be a commercial activity. But a military serviceman does not have the right to engage in commercial activities in accordance with paragraph 7 of Article 10 of the Law “On the Status of Military Personnel.” Military personnel have no right:

Engage in other paid activities, with the exception of teaching, scientific and other creative activities, if they do not interfere with the performance of military service duties. At the same time, pedagogical, scientific and other creative activities cannot be financed exclusively at the expense of foreign states, international and foreign organizations, foreign citizens and stateless persons, unless otherwise provided by an international treaty of the Russian Federation or the legislation of the Russian Federation;

Engage in entrepreneurial activities personally or through proxies, including participation in the management of commercial organizations, with the exception of cases where direct participation in the management of these organizations is included in the official responsibilities of a military personnel, as well as assist individuals and legal entities in carrying out business activities, using their official position.

Based on what was written above, it is easy to conclude that in this case the borrower cannot rent out the apartment. True, someone may say that a military man can place tenants in an apartment and pass them off as his friends or relatives - and he will be right, since it is difficult to prove entrepreneurial activity in this case.

If we were talking about a regular mortgage, which is issued to ordinary citizens, then we could say that they cannot rent out mortgaged housing - the corresponding clause is usually stated in the loan agreement. But since the mortgagee of the apartment is the Ministry of Defense of the Russian Federation, which pays the loan debt for the borrower, you can turn to Article 40 of the federal law “On Mortgage”. Here's what it says:

Unless otherwise provided by federal law or the mortgage agreement, the mortgagor has the right, without the consent of the mortgagee, to lease out the pledged property, transfer it for temporary free use and, by agreement with another person, grant the latter the right to limited use of this property.

This means that if there is no clause on the rental of housing in the contract, then, theoretically, the apartment can be rented out. Just don’t forget that this is still a commercial activity, which military personnel cannot engage in. This is a twofold situation.

The life of military personnel is unstable, and this also applies to living conditions.

It may happen that you have received housing, but you need to go to live in another region due to work.

But what to do with the apartment so that it does not stand idle?

In this article we will look at how you can rent out an apartment to a military personnel if it is owned.

Is it possible to pay off a military mortgage with maternity capital?

Here you should rely on the following points of both state programs:

- When repaying a home loan, military personnel are not required to report the source of their financing. In other words, it does not matter to the bank where the funds for mortgage payments come from. In this case, early repayment of the entire amount or part of it is allowed.

- Purchasing residential real estate on credit is possible using maternity capital finance.

- Matkapital can be used to pay off an existing mortgage loan (regardless of the type of mortgage agreement), pay off part of it, or make a down payment. In this case, you don’t even need to wait until the second child reaches 3 years of age.

It is also important to remember that the purchase of residential premises under a military mortgage presupposes the subsequent registration of ownership of the apartment in the name of a participant in the state program. While improving living conditions when using maternity capital requires dividing the acquired real estate between all family members in equal shares. In this case, existing and all subsequent children are taken into account.

This is important to know: Regional maternity capital Yakutia 2020

This was the main controversial point that emerged earlier when questioning the joint use of two state support programs. But in May 2020, Resolution No. 627 of the Government of the Russian Federation came into force, amending the rules for issuing housing loans to NIS participants.

The innovations state that a serviceman, using maternity capital funds to repay a loan, part of it, or pay the down payment, undertakes to register ownership of the premises within six months after the removal of encumbrances on the property, taking into account all family members. Accordingly, now there are no restrictions in this matter.

Is it possible for a military man to rent out an apartment?

It is impossible to give an exact formulated answer as to whether military personnel can rent out their housing.

Each case has its own characteristics that must be followed in order not to break the law.

To figure out whether it is possible to rent out housing, you need to understand how a military member owns real estate.

If it is owned

Important: Renting out your own home is not considered a business activity and is not punishable by law.

There is an opinion that if an officer rents out his home, this is called the activity of an entrepreneur. The Law (On Military Duty, Articles 10 and 27) strictly prohibits military personnel from conducting business activities, otherwise the consequences will be dire.

But this opinion is incorrect, because the owner has the right to dispose of his housing as he wants, that is, the law does not prohibit renting out living space.

That is, a serviceman can rent out an apartment; for this he does not even need to register an individual entrepreneur . To legally rent, you must enter into an agreement with the tenant and pay a tax of 13% of the money received.

Under a social tenancy agreement

If this is a social tenancy agreement (STN), then the situation is different from that of owning housing. Article 67 of the Housing Code of the Russian Federation states that the tenant can sublet living space.

But Article 92 of the Housing Code of the Russian Federation states that residential premises that are included in the housing stock intended for specialized purposes (in this situation, this is service housing) cannot be rented out in this way. That is, you can rent out an apartment only if it is your own. Another person cannot rent this property under a power of attorney or rental agreement.

Purchased with a military mortgage

So, is it possible to rent out an apartment purchased with a military mortgage? Recently, housing purchased under a special housing loan program has become popular. In this case, apartments in the capital and St. Petersburg are not popular, as they are very expensive.

As a result, the serviceman purchases housing in another region, and when he leaves for service in the above-mentioned cities, the apartment remains empty. A good solution here could be renting out as additional income.

Most of the problems are associated with the fact that housing with a mortgage is pledged by both the bank and the state. Also, the serviceman may have had to insure the collateral property. What to do with this problem, is it possible to rent out an apartment in which no one lives?

You need to take care of this even before you get a mortgage. It is necessary to ask the bank issuing a loan for the future purchase of real estate whether it is possible to rent out the apartment. If the bank is not against such a solution to matters, you can rent out the apartment without any problems. If the bank does not provide rental rights, it is worth looking for another bank.

In the case of an already concluded mortgage agreement, you need to carefully study the agreement - it should indicate whether the property can be rented out. If possible, again, you can take it without any problems. Most banks are not too concerned about whether the apartment is for rent or not , therefore, most likely, you can find a note in the contract that the living space can be rented out.

As for property insurance, it is also advisable to agree with the insurance company about the rental in advance.

If you already have an insurance contract and the nuances of the lease are not specified, there may be problems in the event of an insured event - it will not be possible to obtain it even through legal proceedings.

Since the property is pledged not only to the bank, but also to the state, you must also obtain its permission. To do this, you need to contact the officials. If you rent out an apartment without permission from the state or the bank, the bank may check the property as collateral and you will have to repay the loan ahead of schedule because the loan terms have been violated.

Important: If the apartment will be rented out, the amount of insurance may be larger than usual, since in a rented property the possibility of an event against which it is worth insuring is much more likely. .

How to get money on a military mortgage

Money transferred by the state to the individual account of a serviceman can only be spent on the purchase of real estate, except in cases stipulated by the legislator in Article 10 of Federal Law No. 117.

Important! The right to receive military mortgage funds accrues to a person liable for military service who has a length of service of 20 years or more, both in calendar and preferential terms.

Having served for more than 2 decades, a contract employee has the right to use this money for purposes not related to the purchase of real estate. Receiving a certificate of life certificate does not oblige the serviceman to retire; he can continue to serve without ceasing to be a member of the NIS.

The law provides for cash payment of accumulated funds even before full service. A period of service of more than 10 years entitles you to receive money in the event of dismissal on preferential grounds. These include:

- the attainment of the maximum permissible age for service;

- conclusion of the Military Military Commission on the impossibility of further service due to health reasons;

- organizational arrangements, as a result of which the current position is abolished and there is no suitable vacancy in the army;

- family circumstances leading to the impossibility of continuing military service.

Note! Funds accumulated in an individual account are subject to payment regardless of the length of service upon dismissal for medical reasons.

Relatives of a contractor will be able to receive a military mortgage in cash if he died or was legally declared missing. If, before his death or disappearance, a serviceman purchased housing with a mortgage, then his relatives do not have to return the funds to the state and can continue to pay off the mortgage loan.

Other reasons for dismissal are not grounds for payment of CJZ funds to the army soldier. If a person dismissed for negative reasons has already managed to purchase housing using a mortgage program, he is obliged to return the entire loan amount to the state within 10 years. The responsibility for paying off the mortgage of a dismissed employee rests entirely with him. These measures are an additional incentive to continue to serve under the contract and perform their duties in such a way that management has no reason to initiate the dismissal process for negative reasons.

The rules for writing a report on a military mortgage were described in the article.

Under what conditions is it feasible?

As mentioned above, under certain conditions, officers’ apartments can be rented out. Otherwise it may be punishable.

- So, first you need to determine on what basis the serviceman owns housing. Based on this, it becomes clear whether the apartment can be rented out.

- Owned housing is possible.

- According to the DSN - it is impossible.

- Housing with a mortgage is possible if you have permission from the bank and the state.

- If this property has a mortgage and there is no permission from the bank or state yet, you need to get them.

- Once all permits have been received, you can rent out the living space. Everything is done as usual: the tenant must sign a lease agreement and pay 13% tax annually.

How to provide housing for rent?

Military tenants are different from ordinary tenants, because their housing is paid for by the military unit. It is quite difficult to rent a one-room apartment to military personnel; high-ranking officers usually live in such apartments.

The most popular are 2- and 3-room apartments, in which 2-3 military personnel will live.

The big feature here lies in the execution of the contract. They come in two types:

- the contract is drawn up for one person, the one who is considered the eldest among the rest. The names of other residents are simply written down in the contract, but payment is taken from everyone in an equal share, added together.

Several contracts - according to the number of rooms in the housing, as if everyone rents housing separately, but from the same owner. The cost of housing is also divided equally among everyone and paid in total to the landlord.

To rent out an apartment to military personnel, you need:

- make copies of documents confirming that the housing being rented is owned.

- Sign the agreement that is issued to the military in the unit.

It contains a minimum of information: you need to fill in the price, names and passport details. No other information can be entered into it. It must be filled out without errors, since tenants have only one document and do not have a spare one. For this reason, you can invite them to sign another regular agreement, which spells out all the nuances of renting housing, so that an adequate relationship can be built between the tenants and the landlord. - Copies of the property documents and part of the contract in both copies are sent to the military unit for verification; after receiving the seal, one copy is returned to the lessor.

Just in case, you can take a deposit - this way you can be sure that the military will return. Now you can move in the military.

Important: Money is transferred to military personnel after the fact, that is, when they have already lived in the apartment for a month. For this reason, the military formalizes the agreement retroactively.

apartment rental agreements for military personnel

It is profitable and honorable to be a military personnel, but at the same time, many prohibitions and obligations are imposed on this person. It is important to take them into account when renting and renting out housing in order to avoid problems with the government. You need to carefully read all the documents and think about renting in advance, then solving problems will be much easier.

Many military personnel, knowing 76-FZ “On the status of military personnel”, Article 10 “Right to work”, are afraid to rent out their apartments purchased under the loyalty program. After all, it states that a serviceman does not have the right to engage in entrepreneurial activity not only personally, but also through trusted persons. To avoid unpleasant situations, you should take into account the peculiarities of renting housing purchased on preferential terms. So is it possible to rent out an apartment with a military mortgage?

Based on Article 608 of the Civil Code of the Russian Federation, only the owner can rent out a house. In order to be a renter, the homeowner does not have to register as an individual entrepreneur.

In addition, based on the letter of the Ministry of Taxes dated July 6, 2004 “On the rental of premises,” the rental of living space is not considered entrepreneurial if the owner is an individual. face.

Thus, answering the question “Is it possible to rent out an apartment purchased with a military mortgage” and taking into account all the legislative aspects, we can answer in the affirmative. The only thing that is important is to follow this order:

- Bank permission is required.

- Take permission from Rosvoenipoteke.

- Make a contract.

- Pay taxes.

Requirements for the contract

Persons liable for military service have the right to compensation for renting premises if the commander of a unit (unit) is unable to provide his subordinate with official housing (what is the procedure for drawing up, concluding and terminating a rental agreement for official residential premises?). Officers are forced to enter into lease agreements with apartment owners who rent them out.

If a serviceman, in the case of renting residential premises, intends to reimburse part of the money spent at the expense of the state, he needs to enter into an official agreement. Executed between the owner and the tenant. Legal entities, individuals and municipal authorities can act as the owner.

The definition of lease or lease is located in the Civil Code (Chapters 34 and 35, respectively): under a lease (property lease) agreement, the lessor (lessor) undertakes to provide the lessee (tenant) with property for a fee for temporary possession and use.

When the residential premises belong to the city, the tenant of the housing, based on

social rental agreements

and, with the written consent of the landlord (relevant government bodies), enters into a sublease agreement with the tenant.

Read about who the lodger, tenant and tenant are, what rights and responsibilities they have, here.

For an individual, a rental agreement (Article 671 of the Civil Code of the Russian Federation) for a certain period is usually used.

Article 671 of the Civil Code of the Russian Federation. Residential rental agreement

- Under a residential lease agreement, one party - the owner of the residential premises or a person authorized by him (lessor) - undertakes to provide the other party (tenant) with residential premises for a fee for possession and use for living in it.

- Legal entities may be provided with possession and (or) use of residential premises on the basis of a lease or other agreement. A legal entity may use residential premises only for the residence of citizens.

More on the topic: They didn’t pay your salary when you quit, where to go, what to do and what threatens the employer

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

The grounds for payment of compensation are:

- copies of identification documents of all family members;

- rental agreement;

- statement of enrollment in the military unit;

- report addressed to the commander;

- certificate of family composition.

Payment may not be made if the person liable for military service is not in line for service housing or refuses it for unknown reasons.

The lease agreement is concluded in writing. It should reflect the following basic data:

- date of conclusion of the contract;

- passport details of the owner and tenant;

- document confirming ownership with a copy attached;

- address;

- total and living area of the premises;

- term of the contract;

- monthly payment amount;

- calculated number.

Terms of imprisonment

The term of the lease agreement can be any, from one month to infinity. And hiring is for a maximum of 5 years. If the contract does not specify a term, it is considered to be concluded for 5 years. Read about how to properly rent and rent out an apartment for a long period of time here.

Payment order

The serviceman pays for the rent of the premises independently from his own funds, then monetary compensation is received along with his allowance every month to the serviceman’s personal account. If for some reason compensation has not been received, you must contact the financial authorities assigned in accordance with the established procedure to the military unit in writing or by telephone.

At this point in time, registration of lease agreements by military personnel and members of their families is not provided, provided that it is concluded for a period of less than 12 months. If necessary, you can apply for registration to specialized organizations (Rosreestr, MFC), the preparation of the necessary documents requires a certain period of time from 7 to 14 working days.

Upon formalization of the contract, the owner will be required to pay income tax at the end of the year.

Bank requirements

When deciding to rent out an apartment with a military mortgage, it is correct to initially contact the bank that issued the amount for the purchase of living space. There you must be given permission to rent out your home. At the moment, such permission is given by only one bank - VTB. To do this, the borrower needs to personally visit a bank branch, but first fill out the appropriate application on the bank’s website. In addition, after this you need to pay a commission in the amount of 1500 to 3000 rubles. Next, you need to send scanned copies of documents to the bank, which must include a lease agreement.

Other banks, including Sberbank, refuse, or ask you to contact your local branch for advice.

Military mortgage

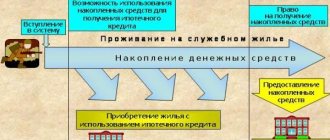

The program for purchasing housing for military personnel is a savings mortgage system (NIS), in order to participate in which a citizen serving must submit a corresponding report.

The NIS mechanism involves the annual crediting of a fixed amount taken from the state budget to the military account. Payment is made during the entire service life.

3 years after inclusion in the program, a citizen acquires the right to use the accumulated funds to purchase housing on credit within the framework of the “Military Mortgage” project. It is possible to carry out a transaction only in banks that provide such a service.

Resolving the issue with the mortgagee

After purchasing a living space for a military personnel under the loyalty program, the first thought is whether it is possible to rent out an apartment with a military mortgage; one of the main “permitting” institutions is the bank. If you do not do this, then you will violate one of the clauses of the agreement with the bank, which will entail unpleasant consequences.

In addition, housing purchased under the loyalty program is pledged to Rosvoenipoteka, so it is important to resolve this issue with representatives of this body.

Procedure:

receive a certificate of participation in the NIS program;

find housing and a bank;

contact the bank to sell a military mortgage;

conclude a mortgage agreement with the bank;

submit an application to the Pension Fund, which will indicate the desire to use maternity capital to repay the loan/mortgage.

This is important to know: Maternity capital after 3 years: how to use it, what you can buy

After that all you have to do is wait:

checking the availability of all certificates and the authenticity of documents;

transfer of maternity capital funds to repay a loan to a credit institution.

There is a danger here that some certificate has been completed incorrectly, and the Pension Fund will delay the transfer of funds. Then the borrower will have to make up the shortfall at his own expense.

Coordination with the insurance company

The second authority you will need to visit is the insurance company. Contacting this authority is mandatory because you are dealing with collateral.

A military man can rent out an apartment purchased with a military mortgage only after notifying the insurance company. In this case, the cost of the policy may be slightly higher due to increased insurance risks. But if something happens to it during the delivery of the property, the company will compensate for damages under insured events.

If the insurance company is not notified of the decision to rent out the living space, then the damage will be compensated from the owner’s funds, which will entail additional costs.

What taxes do you need to pay?

Those who decide that they can rent out an apartment that they took out with a military mortgage should not forget about paying taxes. In accordance with the Tax Code of the Russian Federation, Article 208, Article 1, this process is carried out by declaring income. Military personnel who decide that it is possible to rent out an apartment purchased with a military mortgage must, by April 30 of the year following the one during which the income was received, be required to submit a declaration at the place of residence to the inspectorate in the form 3-NDFL. The tax itself is paid after checking the declaration by July 15 in the amount of 13% of the amount of income.