Financial transactions have become firmly entrenched in our daily lives, but with them come financial fraud, account blocking and other troubles. Many problems in business or when collaborating with banking organizations can be easily avoided if you know how to check an organization’s current account using the TIN. In the article you will find recommendations that can help when collecting debts, when checking the current account of your individual entrepreneur, or simply before conducting new transactions with unknown partners.

Current account structure

A current account (CA) is a sequence of 20 digits issued by a bank to its client - an organization or an individual entrepreneur. Having this digital combination in hand, you can find out a lot about its owner, for example, the purpose of using the account, what currency the money is stored in, and even the number of the branch where it was opened.

Let's now take a closer look at what each number (or rather, a group of numbers) means using an example. Let's say the account is 111.22.333.4.5555.6666666. Each group in this combination has its own meaning.

| Group | Meaning |

| 111 | First order of bank balance. Allows you to obtain information about the account opener and intended use. |

| 22 | Second order of the bank balance. Reveals the specifics of the account owner's activities. |

| 333 | The currency in which the money in the account is stored. |

| 4 | Security Code. |

| 5555 | The number of the bank branch where the account is opened. |

| 6666666 | The bank account number itself. |

The first 5 digits of the current account have a separate interpretation. In addition, each account currency also has its own digital value. But this is described in detail in the article Decoding the current account number.

Ways to find out whether funds have been credited to your Sberbank account

Sberbank offers its clients to receive a notification that money has been deposited into their account remotely. But messages do not always arrive, and you need to know how you can additionally check the status of your own account. Most methods are free, but they differ in the time frame for obtaining information and the need for additional actions. At the same time, it is important not only to find out about the receipt of money in the current account, but also about the current balance in order to manage funds productively.

Through Sberbank Online

Sberbank's Internet system allows each client to find out whether money has been credited to their account without leaving home.

First of all, you need to register on the website by entering the card number belonging to the client, as well as confirming the registration actions using the code sent to the phone connected to the bank. Immediately after this, you can log in to the system using your login and created password. After logging into the service, on the main page you can see a list of client cards with their balance, which is immediately displayed. If you click on a specific card, you can view the history of payments and receipts, and it is in this column that information will be available about whether money has been received. You can also immediately make payments and other transactions in the system, so this is the most convenient way to check your balance.

READ The procedure for replenishing a Zonatelecom card using Sberbank Online

Via mobile application

If a client wants to use a smartphone to check the current balance and received receipts, then he can download a program from Sberbank from the application store. You can log in using the username and password that are used in the browser version. After logging into the application, you will be able to see your customer cards and a brief balance on the main page. As in the full version, you can click on a specific plastic number and open the card history, where you can see the latest receipts to the account.

Via the hotline

The Sberbank hotline allows you to quickly find out whether money has been deposited into your account. To do this, you need to call the number 8-800-555-55-50, but if the client uses Beeline, Megafon or MTS, then the short number 900 is available to him. To contact the operator, you need to follow the voice menu prompts, but the bank employee will ask you to name four the last digits of the card number, as well as the code word. It fits into the contract and is any word that the client can come up with; it is this that will allow you to confirm that the account owner is personally contacting you by phone.

There is also a “Mobile Bank” for your phone, which allows you to find out about your balance and recent transactions. To do this, send an SMS to 900 from the number to which the service is connected. The text indicates the “HELP” operation and adds the last four digits of the card. If the account owner has activated the full package, then he will receive an automatic notification about any actions, including crediting, withdrawing or making a payment.

Important! For the “Economy” package, each request will cost 3 rubles, but if the client has activated the “Full” tariff, then he can use an unlimited number of commands. The fee for this will be only 60 rubles per month in the case of classic cards, and for gold versions you need to pay only 30 rubles per month.

Via ATM

At an ATM, you can check not only your balance, because the service of ordering a statement is also available. To use these functions, you need to insert the card into the Sberbank receiver and enter the PIN code of the plastic card. After authorization, a button is pressed that transfers the client to the “Information” section, after which a balance or card statement is requested. The balance can be viewed on the screen, but you can also print a receipt with this information; in the case of an extract, it will always be paid, like any printout of an informational nature.

READ Transfer of funds from Germany to Russia to a Sberbank card: algorithm of actions, features

To find out only the balance, you can use the free display of the current amount on the screen, but if you need to see the full amounts credited recently, it is better to order a paid printout. This is the most convenient method, especially for people who do not trust online banking systems.

Through the branch

This way to find out about the receipt of money into your account is not very convenient, primarily due to the fact that you need to wait in line at the branch. You should also have a passport with you to confirm your identity, but if the consultant is free, the operation will take no more than a minute. But still, it is better to go to the branch to simultaneously receive other banking services, for example, ordering an account statement certified by a bank seal.

If there is a long queue, you can use the Sberbank electronic terminal or an ATM, which are available in every office of the company. It is necessary, as in the previous case, to insert the card and go through authorization, and then request the balance. If you do not take your passport with you, the consultant may refuse service because he cannot be sure that the real owner of the account is in front of him. Then all that remains is to use self-service devices, and if difficulties arise with this, you can ask a bank employee to help in using them.

Is it possible to find out the account number on the Federal Tax Service website?

It is impossible to check the RS number directly on the Federal Tax Service website, since the tax office issues this information only after going to court. And the court considers such appeals in situations where there is already some kind of violation. For example, there is a debt that has not been repaid on time.

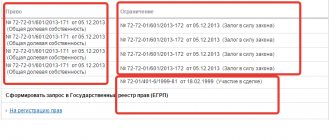

However, you can check the organization’s current account online through the website form service.nalog.ru/bi.do. In the window that opens you will need to enter the following data:

- request type – “Request for current suspension decisions.”

- TIN of the organization or individual entrepreneur;

- BIC of the bank that opened the RS for you;

- Your email address.

Take note! BIC is a bank identification number. Using the BIC, they usually check the correct spelling of the RS, as well as the validity of any account. The BIC consists of 9 digits: 1 and 2 – 04 (for Russian banks), 3 and 4 – the number of your region, 5 and 6 – the correspondent account number, and 7, 8 and 9 – this is the connection with the RS.

Such a request is absolutely free, and anyone can submit it. The system will automatically check all the data and send you a detailed email, which will indicate the time the PC was blocked, if present, the amount of debt, as well as a link to the claim for collection or other reasons for blocking.

Important! If you are sure that the information received is false, then you need to personally visit the local branch of the Federal Tax Service and double-check all the data.

We find out the account through payment cards

If you have already had some kind of financial relationship, you can check the organization’s RS number through the history of bank payments. All payment transactions are saved in the client-bank personal account.

For example, you can find out any current account of an organization through Sberbank in the following ways:

- On the bank’s official website in the “20-digit account verification” section. All you need to do is know the name and enter the TIN.

- through the Sberbank Online application. You need to log into your Personal Account, then select the “Deposits and Accounts” tab. In the section, find the account you are interested in and go to the “Deposit Information” tab. If the information received is not enough for you, simply go to the “Transfer details to the deposit account” tab. This will allow you to view complete information about your account details.

How to find out about the status of an individual personal account for compulsory pension insurance

From 2020, all funds deducted from wages go to form the insurance part of the pension.

Rice. 1. How insurance coverage is formed

Contributions do not go towards the creation of savings provision, since a moratorium has been imposed on this type of contribution, which has been extended until 2020. It turns out that 22% of wages are sent to the Pension Fund as an insurance contribution. Funds are distributed:

- 6% - to provide a joint pension, which, when the pension is calculated, is paid to the insured person in the form of a fixed payment. That is, these funds are not accounted for in a separate account and do not affect the amount of future payments.

- 16% – for the formation of individual payments for pension insurance (labor pension). However, all funds are accounted for in a personal account not in the form of monetary units, but as pension points, calculated according to an established formula, as ten times the ratio of individual contributions to 16% of the maximum possible contribution base. It is these points that accumulate on an individual account and are the basis for calculating payments in old age.

In fact, in this situation, pension points act as savings. But the insurance period also plays an important role when applying for a pension. You can only find out how many points you have accumulated during your participation in the OPS program and how much experience has been taken into account at the Pension Fund of Russia. To do this you need:

- personally contact your local branch, where they will provide the necessary information upon request;

- view data on the Pension Fund website in your personal account;

- use remote ones.

Find out what your old age pension depends on

Via the Pension Fund website

To obtain data through the Pension Fund:

- Go to the Pension Fund website and select the “Citizen’s Personal Account” tab.

Rice. 2. Citizen’s personal account

- Expand the form.

Rice. 3. Search form collapsed

- In the “Individual personal account” column, go to the “About generated pension rights” section.

Rice. 4. Here you can go to the tab for ordering a certificate, statement of an individual account

- Go through authorization by entering SNILS (phone number) and login.

Rice. 5. Authorization in your personal account

Note! To gain access to your personal account, you must be registered on the State portal in the Unified Identification and Authentication System (USIA).

All information stored on an individual personal account is displayed in expanded form.

Rice. 6. Personal account information

Information about:

- insurance record recorded in the system;

- the number of accrued pension points;

- periods and places of employment;

- the amounts of contributions transferred by the employer.

The information received for the selected date can be saved as a Word document and printed.

Here you can also use the “Pension calculator” option to calculate your insurance pension for the current date or for future periods.

On topic: Increasing payments by 1,000 rubles: who will receive the bonus in January 2020

Find out the account number through government agencies

You can check the RS of an organization or individual entrepreneur not only with the help of the Federal Tax Service, but also with the Pension Fund of Russia. The latter also does not disclose information to third parties. Therefore, it is better to go to the Pension Fund through the court, as well as to the tax office.

In this case, the judicial authority issues a writ of execution, which is attached to the application for verification of the account.

In addition to such drastic methods, you can use legal portals - Bailiffs of the Russian Federation or Kartoteka.ru.

Note! Other resources offering you to find out your TIN, BIC, and also check your RS for money are scammers. Such data is obtained either through the listed methods and sites, or through the Pension Fund and the Federal Tax Service.