- 24.4.2018

- 55809

If you refuse the services of an agent, you can save several tens of thousands of rubles on checking the legal purity. With the proper approach, even an independent check will reveal possible weak points of the object. Moreover, some of the verification stages can be carried out using Internet resources, in particular, the Rosreestr website. The METRTV.ru portal provides several recommendations with which the buyer can independently check the legal cleanliness of the site with a house before purchasing. The recommendations are also suitable for cases of purchasing a plot with an unregistered house.

In the eyes of a significant part of buyers, it is an unregistered private house that is more interesting for purchase. It is cheaper in price. In addition, until the house is registered with the cadastral register, you do not have to pay tax on it (usually more than 10 thousand rubles per year). However, even when buying such an “unofficial” property, you need to be sure that it is built in accordance with building and fire regulations, and it can be registered if such a need arises (for insurance, inclusion in a will, etc. ).

How to receive a property tax notice through government services

Article 57 of the Constitution of the Russian Federation states that fulfilling tax obligations to the state is the duty of every citizen. Refusal to fulfill this obligation entails the imposition of financial and administrative sanctions on the guilty person. But tax debt does not always arise due to deliberate non-payment of taxes; often we simply do not know what obligations the state has imposed on us. Today, thanks to the State Services ru portal, taxpayers have the opportunity to find out the amount of real estate tax via the Internet. Content:

Note: Pictures can be enlarged by clicking on them. Login to your personal account nalog.ru The taxpayer’s personal account for individuals is located at https://lkfl.nalog.ru/lk/. In it you can find out taxes, pay transport tax through government services and property tax. Users can log into the site in several ways. The simplest is through an account on the State Services portal (USIA), but if you received a login and password from the tax authority, you can authorize in this way. Follow the link “Log in/register using your public services portal account.”

Interesting: Lands of settlements and private housing construction, what is the difference?

In what situations do you need to know about a person’s real estate?

Data about a person’s real estate may be required in a number of cases that a citizen often encounters in everyday life. The fundamental factors in any situation are the authenticity of the information, and sometimes the officiality of the information received.

The most common situations:

- Buying and selling real estate.

- Re-registration of municipal property.

- When registering housing using a mortgage loan or using a state certificate.

- Litigation.

- The desire to know a person’s solvency.

Ways to find out your apartment tax

The third option to find out the amount of property tax from the Federal Tax Service is to use the Internet resource of the tax service. Debt for any taxes can be found in the taxpayer’s personal account on the Federal Tax Service website. However, it is worth considering that initial access to the taxpayer’s personal account service is available only after a citizen’s personal visit to the tax service.

Interesting: Service life of hot and cold water meters according to the law

In particular, to find out the amount of property tax, you can personally contact the territorial division of the Federal Tax Service, presenting your general passport and giving the tax specialist your registration address. Here, at the territorial tax service, you can receive a receipt for payment of tax debt for the apartment.

Is it possible to find out the property tax at the address?

Banking How to find out apartment tax via the Internet? Now many banks offer. After receiving the data, you can quickly pay the payment issued by the system via the Internet. All banks allow you to learn about debts in approximately the same way. For example, Tinkoff Bank offers the Taxes service. In just a few clicks you can get information about all tax debts, including for an apartment. In order to use the service, you need:

Regional authorities also have the right to make certain adjustments on this issue. How to find out property tax? Tax officials are responsible for calculating property taxes for citizens. No later than a month before the deadline for payment of this payment, a notification must be sent to the citizen by mail from the tax office, informing about the last possible date for depositing funds and their amount. Individuals If the receipt does not arrive within the prescribed period, the citizen must apply for clarification of information directly to the Federal Tax Service office.

Interesting: Name of standard industry standards for issuing personal protective equipment

Property verification by last name

The format of the agreement is not strictly defined, but there are some sections that must be present. All the subtleties of this type are covered in article No. 550. Accordingly, property rights must be properly registered.

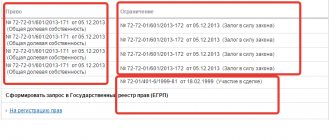

A service for ordering an extract from the Unified State Register, which we ourselves use. An extract from the Unified State Register is provided in electronic and paper form. The electronic version is great for finding out who the owner of the apartment is. An extract can be ordered by anyone (not even a citizen of the Russian Federation) for any real estate in the Russian Federation and can be opened both on a computer and on a smartphone. There is no need to install any additional programs. After payment, the statement will be sent by email. It can also be printed. Previously, we ordered an electronic statement on the official website of Rosreestr, but now we use the Ktotam.pro service (order instructions below). The cost of statements on both sites is the same - 250 rubles, but: 1) with Ktotam.pro they send them much faster - on average in 32 minutes.

We recommend reading: Land Survey Plan: What is it for?

How to find out who is the owner of an apartment

Important

This time the statement was ready in 37 minutes; below is a screenshot of it. To download the statement, click on the middle button with the down arrow.

The statement is downloaded in .html format, which can be opened in any browser. The picture below shows everything. To print, click on the button on the right with the printer sign.

To download the source file of the extract with the electronic digital signature of the Rossreestr registrar (EDS), click on the button on the left. The archived file in .sig format is a digital signature.

Here is a screenshot of an example letter, from which you can also download a document. Here is the extract itself, which we ordered as an example. In section No. 2 in clause No. 1.1 “Copyright holder” the full name of the owner of the apartment is indicated.

The full name in the sample was painted over, because We have no right to “shine” such things without permission.

A new service on the government services portal will simplify access to information about the pledge of property

MOSCOW, May 11. /TASS/. A new service on the government services portal, which combines the register of notifications about the pledge of movable property and the unified federal register on the facts of the activities of legal entities, individual entrepreneurs and other economic entities, will simplify access for Russians to information about the pledge of property. This was reported to TASS by the press service of the Federal Notary Chamber (FNP).

From May 11, on the government services website it will be possible to check whether an object is under encumbrance (for example, when buying a car). From this date, the law on simplified search for information on movable property comes into force.

“Citizens who already use the unified portal of state and municipal services (EPGU) will find it convenient to receive information on this site without a special visit to the other two resources. The innovation will simplify access to information about encumbrances due to the possibility of end-to-end search in the specified registers using the EPGU. That is, in essence, a convenient additional service will be launched that combines two registries,” the chamber’s press service said.

They noted that information about the presence of encumbrances is useful to anyone who plans to purchase a car, production equipment, consignments of goods, even, for example, cattle and any other movable property on the secondary market. In particular, according to the chamber, almost half of the cars in Russia were purchased on credit, that is, they are pledged. Thus, when buying a vehicle secondhand, there is a risk of purchasing a car with an encumbrance. However, even if the seller hides information about the collateral, it can be found by checking the property using the service. Checking movable property for the presence of encumbrances yourself via the Internet has been and will remain free, the notary chamber reported.

The press service added that in 2020, the register of notifications of pledge of movable property was accessed 2.5 million times through the FNP Internet portal. The Notary Chamber expects that demand on the public services portal will also be high. “For its part, the Federal Notary Chamber has carried out all the necessary technical work and is ready to provide access to the data of the register of notifications of pledge of movable property through the EPGU,” the chamber said.

They also noted that you can additionally contact a notary to receive an extract certified by him from the Register of Notifications of Pledge of Movable Property, which in the event of a trial will become exhaustive evidence of the purchaser’s good faith. “This document acts as an additional guarantee that if this property at the time of acquisition was not indicated in the register of notifications of pledge of movable property, then the buyer is in good faith, and neither the seizure of the acquired property nor the payment of other people’s debts threatens him,” the press reported. -service.