Paying taxes is one of the most important responsibilities of citizens. Evasion, untimely entry and other similar actions are considered a violation of the law and entail administrative liability.

However, not everyone knows how to pay the accrued tax for an apartment if there is no receipt. Meanwhile, the lack of notification is not considered a valid reason.

What to do if the receipt has not arrived

Starting from 2016, all responsibility for paying taxes has been completely shifted to citizens. Thus, the Federal Tax Service was relieved of the obligation to notify payers of accrued fees. If previously everyone who did not receive a notification could refer to this very circumstance as the reason for the delay, now this number does not work.

Currently, if documents are not sent from the fiscal department, then citizens must contact them themselves and find out how much they are owed.

There is also a rule according to which tax authorities are required to send out notices starting from August 1. Thus, if you did not receive this paper on time, do not think that you have been forgotten. However, if the notification has been received, then you have exactly 30 days to pay. After the specified period of time has passed, penalties will begin to apply.

According to the current law, property taxes are paid no later than December 1. Moreover, the receipt must be sent to you in such a way that you receive it before November 1 inclusive.

Payment of taxes in your personal account on the Federal Tax Service website

The bank will transfer the money to the desired treasury account. And the tax office, very likely, will not carefully study your payment slip. It will automatically post the payment data to your budget payment card - after all, you are indicated in the “Payer” field.

The above message, accompanied by copies of title documents, must be submitted to the Federal Tax Service in respect of each taxable object once before December 31 of the following year.

This is interesting: The act of inspecting the premises after a fire; further residence is impossible; there is a danger to life and health

How to find out your debt

Finding out how much you need to contribute to your budget is not difficult today. There are several more or less convenient ways.

In particular, you can find out the amount of tax debt:

- on the official website of the Federal Tax Service;

- contact the fiscal service unit at the place of registration of real estate in person;

- call the tax office by phone.

If you don’t know how much you need to deposit, then proceed in this order:

- use the search engine to submit the request “Property Tax”;

- in the results you will find a calculator, with the help of which you can easily calculate the fiscal tax, indicating the region, the cost of the apartment according to the cadastre and its area.

- then all that remains is to deposit the money.

It is not difficult to find out how much your apartment is valued in the cadastre - contact Rosreestr.

Citizens who have their Personal Account on the Federal Tax Service resource will learn about all their debts there. To get one, you will still need to go to an appointment with the tax office, having your passport with you. There, after registration, you will be given a personal password. This measure will save a lot of time in the future.

How to check the accuracy of rent and utility payments

- Via payment receipt ;

- Contact the management company or resource supplying organization in person or by phone;

- At a cash settlement center , bank or terminal for paying for utilities;

- On the websites of resource supplying organizations, management companies, the Unified Settlement Center, a bank, and on the State Services portal.

- exact footage of the apartment (total and living area);

- number of residents living;

- the amount of tariffs established by state or municipal authorities;

- the size of the standards if measuring instruments are not installed in the apartment;

- benefits valid for certain categories of residents established by authorities.

Payment Methods

Undoubtedly, the most convenient option that allows you to save a lot of time is visiting the Federal Tax Service web resource. In particular, if you know the payment amount, then you should proceed as follows:

- on the main page there is a tab “Pay taxes” - click on it;

- a page will open from which you can go to all the main services of the site, in particular to your Personal Account;

- select the “Pay taxes” button;

- indicate the type of payment, its purpose and amount;

- enter the address, full name, Taxpayer Identification Number (optional);

- click the "Pay" button.

There are several other payment options:

- Postal transfer;

- through the cash desk of any bank;

- using the State Services website;

- through Internet banking.

An important point is that the entire amount due should be transferred at once, in full. Now almost all financial institutions accept taxes, but it is most convenient to contact:

- Alfa Bank;

- Gazprombank;

- Sberbank.

The latter's Internet service allows you to pay the fee quickly and easily. The procedure is as follows:

- register in the system;

- go to your personal account;

- click on the “Payments” tab;

- find the Federal Tax Service in the menu;

- find the desired item in the list that opens;

- fill out the form following context clues;

- click the “Pay” button.

In addition, those using the Sberbank mobile application are given the opportunity to deposit funds using a QR code - this is now supplied to all payment cards. All you need to do is scan it and confirm the transfer of funds.

What to do if there are no rent payments

If there is a debt for a particular service, you should try to cover it as soon as possible, especially since now this can be done in many ways: through terminals, online, and the old fashioned way at the post office/bank, etc., but in the future you can rest assured that the service will not be disconnected on any day or penalties will not be charged

The next similar problem: receipts for utility bills from another organization began to arrive. Although the management company was not changed. Not everyone knows what to do in such a situation. However, legal advice will quickly put everything in its place.

Payment at the branch

When there is no access to the Internet, you will have to find out the amount of the fee by visiting the fiscal department at the location of the property. Here you will be presented with all the information with which all you have to do is go to the nearest branch of Sberbank (or any other) and transfer money.

In particular, it is the institution named above that provides this type of service throughout Russia. You should have with you:

- passport;

- receipt from the Federal Tax Service;

- the required amount in cash or a plastic card.

The cashier will do everything for you and issue a certificate confirming the fact of the money transfer.

Benefits for paying utility bills in 2020

- Heroes of the Soviet Union or Russia;

- full holders of the Order of Glory;

- blockade survivors, family members of deceased WWII participants/disabled veterans;

- citizens awarded the title “Hero of Socialist Labor”;

- disabled people, veterans of the Great Patriotic War;

- their close dependent relatives;

- disabled relatives of military personnel who died in combat or as a result of diseases acquired in service;

- people affected by radiation who participated in the liquidation of accidents at nuclear power plants;

- disabled people of all groups;

- including disabled children;

- families caring for disabled children.

- single pensioners;

- disabled people living alone;

- minor orphans who own apartments;

- families that include only disabled people or pensioners and children under 16 years of age;

- large families who live in low-rise buildings owned by the city.

Each region has its own list of exceptions and preferences. It is necessary to learn about the subtleties and nuances of legislation in service provider organizations.

What happens if you don't pay tax?

Russian legislation provides for liability not only for non-payment of property taxes, but even for missing the deadlines allocated for the transfer of funds. First of all, we are talking about foam. Here, every day the amount of debt will increase by 1/300 of the fiscal tax rate accepted in the region.

There is also a penalty for late payment - it is 20 percent of the total tax.

If it can be proven that the citizen deliberately evaded the fee considered in this article, then the penalty will amount to 40 percent of its amount. It goes without saying that the tax itself will have to be remitted in full.

When the debt exceeds 3 thousand, and the delay reaches 6 months, tax authorities have the right to file an application for forced collection in court. In this situation, an encumbrance is placed on the defendant’s property.

Finally, the Federal Tax Service can send a notice to the debtor’s employer, and then the money will be deducted from the salary.

Hello from the past. Chelyabinsk residents received receipts with debts from 2 years ago

Hello from the past.

Chelyabinsk residents received receipts with debts from 2 years ago. Chelyabinsk residents received greetings from the past. Receipts with unpaid bills arrived from the company Chelyabenergosbyt, a former electricity supplier. Moreover, the debts date back two years, reports cheltv.ru. Pensioner Zoya Pestova says that she always paid for electricity regularly. Imagine her surprise when the receipt arrived for 2018! And there is a debt - sixty-two rubles! But what is this – the neighbor is generally tearing his hair out.

“Okay, you have 62 rubles, I have a debt of 2 thousand!” the man is indignant.

Hello from the past. Chelyabinsk residents received receipts with debts from 2 years ago

Payments are sent by Chelyabenergosbyt. Residents are perplexed - after all, the company went bankrupt a year ago. Some have a vague anxiety - what if the house is left without the most important thing?!

Zoya Nikolaevna loves to watch TV, however, receipts with debts have arrived, and the electricity may be turned off.

Together with the pensioner we go to the company office. But there is a notice on the door with the address of the new supplier. It was Chelyabinsk, but it became Uralenergosbyt. Let's go there. There is no crowd in the waiting room: there is a grateful audience all around. It was as if they were just waiting for us.

– Do you also have debts? - ABOUT! You've finally arrived, who called you?!

This phone is very popular. No wonder - this is the only connection with Chelyabenergosbyt, the one that sends out incomprehensible receipts.

- Well, he went bankrupt, right? – You see, they installed a special telephone and communicate only by phone.

Hello from the past. Chelyabinsk residents received receipts with debts from 2 years ago

Unlike the talkative security guard, the employees are apparently not happy about the appearance of the camera.

We call the number on the receipt. But it's always busy there. Pensioners are seriously scared - they are threatened with bailiffs for non-payment. But lawyers reassure.

“If you do not agree with the requirement that was received in pre-trial order, wait until a statement of claim is filed in court against a specific person, and then justify why this debt either does not need to be paid at all, or, accordingly, recalculated,” - explains lawyer Nikolai Popov.

But instead of going through bureaucratic pains, some residents chose to give up. The other day Zoya Pestova went to the bank and paid the same sixty-two rubles that she could have disputed.

Is he talented at making faces? Chelyabinsk schoolgirl moved Tik Tok stars

Information service cheltv.ru, photo: argumenti.ru, archive cheltv.ru

General recommendations

To avoid future conflicts with fiscal authorities and simplify your life, you should:

- calculate the amount of property tax in advance using the calculator available on the Federal Tax Service website, without waiting for a notification to arrive;

- closely monitor changes made to legislation;

- do not try to deceive the state;

- avoid debt formation.

We have a unique offer for visitors to our website - you can get a free consultation with a professional lawyer by simply leaving your question in the form below.

Payment for utilities (energy resources) in the Astrakhan region

RC Astrakhan LLC receives citizens regarding payment for services: heating, hot water, electricity and waste removal at 5 points located at the following addresses: st. Tatishcheva, 22/2, st. Zvezdnaya, 49 building Z, st. Yablochkova, 27, st. Boulevard, 7/3, st. Tuvinskaya, 47 (Trusovsky district). The points operate according to the schedule from 08:00 to 17:00 from Monday to Friday, lunch is floating, on Saturday reception is carried out at two points: st. Tatishcheva 22/2 and Boulevard 7/3 from 09:00 to 13:00 without lunch. Currently, RC Astrakhan LLC is considering the possibility of changing the operating hours of RC Astrakhan LLC points for the convenience of the population, taking into account the requests and wishes of citizens.

This is interesting: Transport benefits for labor veterans in St. Petersburg in 2020

In connection with the receipt of citizens' appeals to the Office of Rospotrebnadzor in the Astrakhan Region and the publication of articles in the media about problems in the activities of Astrakhan Settlement Center LLC, the Office sent letters to the Settlement Center, as well as to energy supply organizations that have entered into contracts with the Settlement Center proposal to take measures to restore order.

The concept of fraud in the field of utilities and the corresponding article of the Criminal Code of the Russian Federation

A large number of payers, even with small additions, can bring significant unjust income to the director of the management company or the chairman of the HOA, since criminal intent can only be detected when greed prevails over caution and the theft of funds is carried out in large amounts at once.

The transfer by the state of control over the maintenance of residential buildings and their adjacent territories to the farming of various management companies and associations of residential space owners could not leave those who love easy money by deceiving voluntary payers indifferent. After all, the decades-old belief that you need to pay for an apartment without delay, otherwise it may be alienated, eliminates the need to make efforts to seize other people's funds, which can be done simply by printing the required amount on a payment receipt and throwing it in the mailbox.

This is interesting: Is it possible to refuse Chernobyl Payments

How to understand an apartment receipt

Housing and communal services receipt

is an official payment document that reflects information about the amount of debts of consumers for past billing periods to housing companies that provide utility services. Since different types of services can be provided by different companies, the consumer receives several receipts.

In multi-storey buildings, there is a separate nuance in the calculation of drainage: in this case, the calculation is made according to the indicator of the general building meter, and not for each apartment separately. If there is none, the management company makes calculations according to current standards and issues an invoice to the residents.

How long should you keep utility bills?

There is not a single law or regulation that clearly states the mandatory retention period for utility receipts. But a hint can be found in the Civil Code of the Russian Federation. It includes the concept of “statutory limitation” - this is the period during which you can sue to protect a violated right. It is equal to three years. This means that receipts must be kept for at least three years.

Knowledgeable lawyers advise keeping receipts after payment for as long as possible. They say that even though there is no such law, these documents may still be useful to you three years later. Litigation between providers and consumers of utility services is not uncommon. The longer you keep the receipts, the more arguments in your favor you can attach to the case.

11 Mar 2020 lawurist7 228

Share this post

- Related Posts

- When will there be an increase in pension for children?

- Law of Silence in New Buildings

- Can Bailiffs Take A Garage?

- Can Bailiffs Describe the Only Housing

How to pay apartment tax if you lost your receipt

This is another popular destination used by citizens.

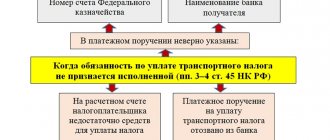

It is not difficult to guess that most often the population uses the Sberbank Online service. To pay for a car you will need:

- Log in to the site.

- Select "Payments and transfers".

- In the search bar at the top of the page, enter the recipient’s Federal Tax Service INN.

- Click on the desired organ in the search results.

- Fill out the transport tax receipt. Usually you need to specify the payment type and taxpayer information.

- Place the card from which funds will be debited in the designated field.

- Indicate the amount due for payment.

- Complete payment. To do this, you need to enter a secret code in a special field. It will come to your mobile device.

But that's not all.