Often, people who are concerned about how to properly register an apartment as an inheritance and pass it on to their relatives have a question about what is better: a deed of gift or a will.

To resolve this dilemma unambiguously, you first need to define these legal concepts, take into account all the pros and cons, and only then make a conclusion. Plus, you need to make sure how relatives or other successors will behave when registering property in their name.

We need to clarify one more nuance: are people close to you ready to inherit property? Or should the property issue be resolved during the owner’s lifetime and formalized as a donation?

What are the concerns of the parties?

They may be associated with various circumstances and factors. First of all, you need to take into account internal family relationships. Whether there is trust in each other or not.

Sometimes legal successors refuse property, fearing any “spoils in the wheel” in the process. First of all, this is due to the lifestyle of the deceased and other circumstances.

Many factors can contribute:

- fear of fraudulent schemes;

- illegality of ownership;

- taxation;

- other difficulties that arise.

Then you definitely need to think about where the testator himself will live after registering his property with his successors; if he needs care, then who will take care of him.

What kind of financial investments will this procedure entail for the registration of documents for the owner of the apartment and the right to own property for the successors.

You need to think carefully about all this before making an important decision on choosing one of the two: draw up a will or donate your living space to your heirs.

Let's understand the concepts

So, the first step has already been taken, that is, the choice has been made in the direction of donation or will, and not transfer of inheritance by law. Let's define the concepts of these two transactions and what role they play in the transfer of property.

The preparation of these legal acts is justified by the owner’s intention to donate or bequeath his living space to relatives, any legal entities or a municipal institution of the city where he lives.

A deed of gift (donation) is a legal document that does not require certification by a notary; it streamlines the transfer of rights to property as a gift, in our case, to real estate.

A will is a document that must be certified by a notary; it is an act of will that provides unlimited freedom in the transfer of property and regulates the civil legal relations of a citizen in the event of his death.

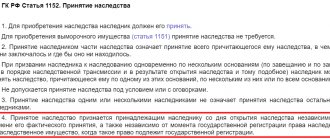

Legislative framework and regulation

It is necessary to take into account that both a will (Chapter 62 of the Civil Code of the Russian Federation) and a gift agreement (Article 574 of the Civil Code of the Russian Federation) are transactions and, by force of law, can be challenged by interested parties (Article 179 and Chapter 32 of the Civil Code of the Russian Federation). In order to avoid legal proceedings, their registration must be approached with all responsibility, having fully thought through each subsequent step.

Basic legal awareness will not hurt in this transaction. If the owner wants his property to be transferred to another person immediately, then it is best to draw up a deed of gift, otherwise, draw up a will.

After all, a gift agreement provides a number of other advantages: the absence of litigation with other relatives and unnecessary red tape with registration authorities.

According to the will, successors realize their inheritance rights only after the death of the legal owner of the property.

There is some difference between drawing up a will and executing a gift deed. It lies in the fact that the owner, drawing up a deed of donation, will no longer have any rights to his property.

When the second document, a will, is drawn up, the rights are transferred to the heirs in the event of his death. In addition, a bequeathed apartment is mainly transferred to relatives, while it can be gifted to absolutely anyone.

This is the basis of how a deed of gift differs from a will!

Procedure for registering a will

A will is an administrative document, which (except for the cases described below) is executed through a notary.

The order of human actions:

- collection of necessary documents for property;

- contacting the nearest notary office;

- drawing up a will (you can draw up an administrative document for the house);

- registration of a will with a notary.

Types of will

Let's look at the types of wills:

- notarized, issued on a general basis;

- drawn up in emergency conditions (if a threat to a person’s life arises, he can draw up an administrative document in the presence of two witnesses without notarial notification, but if the threatening circumstances are canceled, the will must be registered with a notary within a month from the date of drawing up);

- closed - the contents of the document are not available even to a notary (disadvantage - there is a risk that the will was drawn up with significant errors, which may lead to its cancellation);

- wills equivalent to notarial wills (it is not possible to attract a notary for objective reasons, so the document is certified by the official in whose care the testator is - the head of a military unit, the chief physician of a hospital, the captain of a sea vessel, the head of a temporary detention center for a convicted person).

A will may be closed when the contents of the disposition are prepared by the testator. The contents are not revealed even to a notary. The announcement occurs after the death of the testator, and the notary does not look for the heirs specified in the agreement. An executor can be involved in the process to ensure that each candidate receives the property they are entitled to.

Snezhana Pogontseva

Lawyer, author-editor of the website (Family law, 11 years of experience)

Will form

There can be only one form of a will - written (oral form is not allowed, even if there are witnesses). Certification by a notary is required, except in case of emergency or threat to life. The form requirements are specified in Chapter 62, Art. 1124 of the Civil Code of the Russian Federation and must be strictly observed, otherwise, a will that is not drawn up in accordance with the form can be easily challenged in court.

Required documents

The testator must have the following documents with him:

- original and copy of passport;

- title documents for property;

- document confirming registration;

- receipt of payment of state duty.

In order to prevent disputes in the future, you can submit an original certificate from a narcologist and a psychiatrist confirming the person’s mental health and sanity.

Contents and sample of the will

The document is drawn up in free form, but with the following information specified:

- personal data of the testator;

- a list of property that is inherited;

- detailed characteristics of the property;

- assessment of each object;

- list of heirs;

- designation of which heir will receive what share of the property.

When approving the document, the notary, upon signature, acquaints the testator with the consequences of drawing up a will.

Sample will for an apartment: alt: Will for an apartment

Registration cost

The testator's expenses consist of the following items:

- state fee for document approval – 500 rubles;

- drawing up a will by a lawyer (from 500 rubles per page);

- certificate of a hidden will (from 900 rubles per 1 page);

- additional services (making copies, checking documents, consulting) – 1-2 thousand rubles.

Cancellation of a will

The original document remains with the notary after approval. The testator can change his order, make changes to it, or cancel it completely. To cancel a will, it is enough to contact a notary with a handwritten statement.

There are cases when failed heirs try to revoke a completed will. And since the administrator of the property has already died, it is easier to cancel the document. The testator can no longer confirm the voluntariness of participation in the transaction.

Need help with an inheritance?

Lawyers will answer your inheritance question free of charge and in detail. Ask a question so you don't waste time reading!

Registration and registration

The gift agreement has legal force from the moment of state registration of the transfer of ownership in the relevant body - the Office of the Federal Registration Service.

The deed of gift is drawn up in simple written form; as already mentioned, it does not require notarization. This document can be drawn up either independently or by seeking legal assistance.

The second option is the most acceptable, because only a legally literate person will perform this procedure correctly, referring to the legislation, so that later there will be no difficulties when submitting this document to the registration authority.

Once the donation agreement has been registered with the relevant authority for the transfer of ownership, it can no longer be annulled.

Another way to dispose of property is to draw up a will. This act requires notarial confirmation and comes into force after the death of the testator. This document may be changed and canceled during the lifetime of its originator.

How to make a donation for an apartment

A deed of gift for real estate is a fairly simple document to draw up. To be completed in written and free form. The example can be downloaded on the Internet; there are many sites for this.

It does not need to be certified by a notary office, which also frees you from unnecessary financial expenses and running around the authorities. However, information is required to be entered into Rosreestr.

You can register either yourself or by proxy through authorized persons.

There are a number of other features that should be approached with caution:

- The donation cannot be re-registered by law.

- If this document is entered into the Rosreestr, there is no opportunity to change it or make any amendments to it. In any case, the property will go to the donee, and it will be extremely difficult to terminate the contract (there is one loophole in the law, which will be discussed below).

- Property transferred by gift belongs exclusively to the person to whom it was provided under the agreement.

Let's give one example. If the spouses decide to divorce, the property that was gifted to one of them is not included in the division. Therefore, when a father presents an apartment to his son, being unsure of the reliability of his family, then you can safely draw up a gift agreement.

And yet, the law prohibits the donation of real estate to civil servants, social workers. spheres, if the named persons are not related to the author of this act.

Features of drawing up a will

In order to avoid complications in the distribution of the testator's property to successors, as specified in the will, you need to secure your property. To do this, it is recommended to hire an indifferent person (executor) who does not have the right to the willed property.

This must be a lawyer or lawyer. His competence in this matter can be stipulated in the will itself and certified by a notary.

To properly prepare a document, you should adhere to certain rules (tips):

- All points must be interpreted clearly and legally competently, without ambiguous understanding of the meaning.

- Try not to indicate common ownership to different heirs, so that this does not lead to disputes between them and further divisions into shares of the apartment.

- If there are several real estate objects (apartments), then distribute them among different legal successors.

- When writing a document, pay attention to which heirs should be given the right to property before the opening of the inheritance or simultaneously with it immediately after the death of the owner. To whom will the property be transferred from the heirs in the event of failure of another successor, etc. The law provides for the additional appointment of heirs.

- Think about safety (hire a lawyer).

Regarding the last point, it is worth adding one more fact.

There are such circumstances that the primary heirs live in another region, while the successors for other objects, located next to the inherited apartment, or not specified in the will at all, illegally use the apartment for their own purposes and remove expensive property from it.

It will be almost impossible to return these things after inheriting the apartment; this requires clear evidence, which, apparently, will not be available.

What is the difference between a will and a deed of gift?

Both legal structures are much more diverse than is commonly believed. Let's find out how a deed of gift differs from a will. A gift may consist in releasing the donee from fulfilling a demand addressed to him to pay a debt. After concluding such an agreement, the recipient does not become the owner of a new benefit. Its benefit lies in the absence of loss.

A will changes the order of inheritance specified by law and allows:

- exclude any of the relatives from the heirs;

- leave property to a selected person or organization;

- distribute assets between future successors in ideal shares (for example, 1/5) or according to a list (indicate what will go to whom);

- make inheritance subject to the condition of performing a certain action in favor of a third party, group of persons or territorial community (testamentary refusal and assignment);

- to appoint a sub-heir, thereby determining who will receive the assets if the main heir dies, turns out to be unworthy, refuses the inheritance, or passively does not accept it.

A will does not always establish the transfer of a certain benefit to the heir or the release of him from an obligation. The content of the document may be limited to a testamentary refusal or deprivation of the inheritance rights of a spouse or one of the relatives.

The main difference between a will and a deed of gift for real estate is the moment of transfer of assets into the ownership of the person chosen by the alienator. The recipient becomes its owner immediately after the state registration of the agreement in the Unified State Register of Real Estate, the heir - at the end of the life of the testator.

The legislator allows agreements that combine the characteristics of several independent transactions. However, this does not apply to gifts and wills. A deed of gift, in which the transfer of assets into the property of the donee is postponed until the death of the donor, is void. A will or deed of gift is a question that worries many.

Will or deed of gift - this issue should be looked into in more detail so as not to regret it later.

| Basis for comparison | Gift deed | Will |

| Agreement type | Bilateral transaction (agreement). Two people express their will - the donor and the recipient. | One-sided deal. The will of the testator is sufficient. |

| Circle of alienators | Individuals, organizations | Only individuals |

| Number of alienators in one transaction | Unlimited | Limited to one person. In the Russian legal field there is no concept of “spousal will”. |

| Effective date | The day the agreement is signed by the participants or their representatives. If the subject of the agreement is subject to state registration (land, real estate), the deed of gift becomes valid after its completion. The last rule applies to notarized deeds of gift. | Comes into force upon the death of the testator. A will in emergency situations that has not been certified by a notary or other authorized means becomes valid after confirmation of its validity by the court. |

| Subject of the transaction | A thing or property right expressly specified in a contract. | May be defined in different ways: • all assets; • their ideal share; • a certain thing, property right. |

| Ownership of alienated assets | You can give what you own. | The testator may dispose of assets that he does not own, but is likely to own. If the property specified in the will does not belong to the testator at the time of death, his orders regarding it are not executed |

| Encumbrances on the subject of the transaction | Prevents alienation. The donation of mortgaged property requires the consent of the mortgagee, and the donation of collateral requires the consent of the mortgagee. | Does not affect the possibility of making a will in relation to property. However, this does not mean that the heirs will receive the assets “clean” without debts and encumbrances. Potential proceedings with the testator's creditors are simply postponed in time. |

| Prohibition of alienation of property in relation to the alienator | Prevents alienation. Domestic legislation allows a debtor to be prohibited from disposing of property even if a judicial dispute or enforcement proceedings do not directly concern this property. Example: the culprit of a fatal road accident has been asked to pay monetary compensation to relatives. To secure the claim, the court seizes the debtor's assets up to this amount. | Does not prevent the making of a will. |

| Possibility of imposing any obligations on the beneficiary | Absolutely absent, even if the costs associated with the fulfillment of such obligations are obviously incomparable with the value of the gift. The donor of real estate cannot include in the text of the agreement the following conditions: • on reserving to him the right to use all or part of the alienated real estate; • about looking after the donor's pet; • about landscaping. An exception is a donation agreement (a type of gift), under which the recipient undertakes to use the gift for socially beneficial purposes. Example: donating rehabilitation equipment to a medical institution. | Exists in two forms. 1. A testamentary refusal establishes the obligations of the heir to act in a certain way in the interests of a third party. Example: the testator leaves a house and land in the village to his son, but obliges him to purchase a car of a certain brand for his daughter. 2. Testamentary assignment - an obligation to perform a generally beneficial action at the expense of inherited assets. |

A separate expense column is taxes. Transfer of property during your lifetime requires payment of 13% personal income tax. The basis is the total assessed amount of the property. Taxes are paid by the party who received the property, if both parties are not related - the main advantage of the transaction.

Inheritance involves paying tax if the value of the received object exceeds the MMORT by 850 times. Additionally, payment of state duty is required.

How to protect the owner of an apartment

An apartment or other living space is the most common case when drawing up a deed of gift for it. Of course, if a will is drawn up, then there is no danger here, the property will remain with its owner until his death, and no one else has the right to it until his death.

The situation is different when writing a deed of gift. The point is that as soon as the registration of the living space is completed in Rosreestr, the gifted person will be able to dispose of this apartment at his own discretion with all the powers.

And it may happen that the donor will simply be thrown out into the street, if that’s what the new owner wants. Therefore, in order to protect the donor - the owner of the property, you need to think carefully before registering this document.

If this is not a close relative, then it is better to get to know the person to whom you want to present the living space, whether you can trust him.

Attention is important! Be sure to include a clause in the donation agreement that, yes, the apartment belongs to the new owner, but it reserves your rights to continue living in the specified living space!

Is it possible to return the apartment if I change my mind about donating it?

If the donor has changed his mind about transferring his living space to another person and the deed of gift has not yet been processed, then you can quickly withdraw the application and return the property only if the transaction has not passed state registration!

In the ruling dated November 1, 2011 in case No. 33–24559/2011, upon the appeal of Mrs. G.E. with a claim to the court with a request to determine her share in the assigned living space, it is said: “In the application, the plaintiff wrote that due to the departure of her husband from the family, he decided to donate the specified share in the apartment.

The act was endorsed, the documents were transferred to Rosreestr for registration, but according to the decision and request of the defendant, they were canceled.”

Judge Grigorashenko rejected the claim on the basis that the defendant reconsidered his decision to issue a deed of gift to his wife because she showed unlawful actions towards him, kicked him out of the apartment and behaved inappropriately.

But this is because the documents were not included in Rosreestr, otherwise the situation would not have been resolved positively for the defendant.

If the transaction does take place, then it will be extremely difficult to terminate the gift agreement. Article No. 578 of the Civil Code of the Russian Federation provides for some situations in which it is possible to revoke an agreement, but this is unlikely.

List of documents for a will

Whether it is better to draw up a deed of gift or a will often depends on the circumstances.

It happens that the need to re-register real estate takes interested parties by surprise when the title documents are not in order and there is no way to obtain them. It happens that the parties to an upcoming transaction are located in different parts of the country or together, but far from the alienated property. The problem can be aggravated when the alienator is seriously ill or elderly. He may simply not live long enough or be of sound mind at the time when the formalities are settled. In such cases, instead of a bilateral agreement, you can make a will.

The list of documents for making a will is limited to the personal documents of the testator:

- passport or other identification document (for example, military personnel identification card, residence permit);

- certificate of tax code assignment.

The notary is obliged to certify the will despite the fact that he cannot verify the personal data (name, tax code, place of residence) of the heir or even the existence of such a person. But if you have photocopies of the heir’s passport, it’s better to take them. It is important to correctly include sufficient personal information in your will. This will allow you to reliably identify the heir and eliminate claims from namesakes.

A notary has no right to demand title documents for assets, even if the testator wishes to dispose of a specific house, apartment, or car. However, it is better to have them with you to ensure that the data is indicated correctly.

Potential alienators and recipients of real estate often wonder: “Will or deed of gift: which is better and cheaper?” There is always more trouble with a gift. Approximate list of required papers:

- personal documents of the donor and donee or their attorneys;

- power of attorney (applies to the attorney);

- title documentation (agreement, court decision, commissioning act);

- cadastral or technical passport;

- extract from the Unified State Register of Real Estate/certificate of ownership;

- consent of the spouse to the gratuitous alienation of common assets.

Opinions about whether a will or a deed of gift for an apartment is better are controversial. The simplicity of making a will is offset by the increased risks of this transaction. Donation, on the contrary, guarantees the necessary stability of legal relations.

Will. This is a way to dispose of your property after death. In fact, this is a one-sided transaction. You can bequeath anything to anyone. We have already talked in detail about how to draw up wills and what rights the testator and heirs have.

Ownership of property under a will passes only after the death of the owner. A will can be changed or revoked at any time, as if it had never existed. This means that you can now bequeath your apartment to your grandson - after your death, he will be the owner of the property. But while you are alive, your grandson will not be able to sell this apartment, invite tenants there, or mortgage it.

Giving. This is also a contract, but two-sided: one person gives, and the other accepts the gift. But this agreement is always free of charge. If you write that you need to do something in exchange for a gift, the transaction is insignificant.

You can only give while you are alive. You cannot write in the gift agreement that the gift will pass only after death. The real estate donation agreement must be concluded in writing, and the transfer of ownership is subject to mandatory state registration. We also talked in detail about the gift agreement.

When you give your grandson an apartment, he will immediately become the owner. This means that you will lose some of the benefits regarding the apartment, and your grandson will acquire responsibilities. For example, now he will be charged property tax, and not you, taking into account benefits and exemptions.

When choosing a way to transfer an apartment to a relative, think not only about his expenses, but also about your rights. Getting an apartment from your grandfather is, in any case, more and more expensive than any state fee and additional notary service. If after your death your grandson becomes an heir, he will somehow cope with paying these expenses.

If you decide to donate an apartment, you will forever lose the rights to it. Anything can happen. Sometimes grandfathers outlive their grandchildren, then strangers become the owners of the apartment, and the grandfathers are kicked out onto the street. Protect not your grandson’s money after your death, but your rights during your lifetime.

https://www.youtube.com/watch?v=sZagUhupgRU

Passport. The notary certifies the will and must ensure that the document is signed by the person whose name is on the will. You do not need to submit any documents, such as proof of ownership of the house and land.

For example, now you have only one house with a plot of land, but you are going to build a bathhouse or a guest house there. It is not necessary to rewrite the will - you can immediately write that you will bequeath to your chosen heir the house and land plot that you own, as well as any other house or houses that will be located at the same address.

What is easier and how to challenge a donation or will

Judging from the previous section of the article, it is almost impossible to challenge a deed of gift that has been registered. As for the will, it can be redone during the life of the testator, changes can be made to the original text, clauses can be changed and deleted many times.

Even if after the death of the testator, many versions of this document remain, and they will all differ and contradict one another, then only the final version of the document is taken for legalization.

Who is eligible

Many people mistakenly assume that a notary has the right to cancel a gift agreement, but this is not true!

To cancel a deed of gift, you need to go to court, and only he has the right to cancel this document if registration with Rosreestr has not yet occurred.

The court may declare this act invalid in accordance with current legislation within a specified period. If this deadline has been missed, the court may also extend it.

A will can only be revoked by the person who made it at any time throughout his life. In this case, the testator is not obliged to explain to anyone the reasons for his actions.

Cancellation of a will is accomplished by the following actions:

- a new version of the document is compiled;

- an order is given to cancel the previous document.

The new version of the will must also be notarized. This does not apply to types of wills that were made in emergency cases or to funds held in financial institutions.

If the document is completely cancelled, the rules of inheritance by law come into force. A canceled will is not restored, except in cases of a court order recognizing the validity of another will drawn up by the testator during his lifetime.

Conditions for cancellation

Interested parties are not deprived of the right to challenge the gift transaction in court within a year on the grounds of the donor's incapacity, if the transaction was carried out under duress, as well as if the property is common, but was registered in the name of one spouse and donated without his notarial consent.

In accordance with Art. 1131 of the Civil Code of the Russian Federation, a will can be challenged after the statute of limitations has expired. Part 1 of Article No. 181 of the Civil Code states that the limitation on claims for recognizing the invalidity of this document is three years.

The period begins to be calculated from the moment the transaction enters into force. That is, the statute of limitations for a request to terminate a will due to its cancellation is calculated from the moment the inheritance is opened due to the death of the person who compiled it (Article No. 1113 of the Civil Code of the Russian Federation).

Examples of this are the Decree of the Moscow City Court dated April 12, 2016, number 4g-3244/2016, procedural acts of appeal of the City of Moscow in cases dated November 26, 2020. and No. 33-44569/2015 and dated October 28, 2020. No. 33-36342/15.

It should also be remembered that from September 1, 2020, new rules of law on the period for opening an inheritance came into force, as stated in Federal Law No. 79 of March 30, 2020.

From this date, according to paragraph 1 of Article 1114 of the Civil Code of the Russian Federation, it is customary to consider the “day of opening of the inheritance” in the understanding of the date of death of the testator as the “time of opening,” which specifies the moment of the death of the testator.

The limitation period for a request to cancel a disputed document and to use sources of its nullity is provided for a period of one year from the date of actual or alleged notification of the plaintiff about the reasons for recognizing the will as inauthentic.

This is stated in paragraph 2 of Article 181 of the Civil Code of the Russian Federation. Examples: procedural acts of appeal of the city of Moscow in cases dated August 14, 2015. N 33-26004/2015 and dated July 28, 2020 No. 33-25682/2015.

Which is better: a deed of gift or a will for an apartment?

There is no clear answer to the question: “What is cheaper or what is more profitable – a will or a deed of gift for an apartment?” You should act based on the current situation.

For close relatives who are direct heirs of the owner of the property, it would be preferable and more reliable to draw up a gift agreement. This is due to the fact that you do not need to wait six months before taking over your rights - the deed of gift gives them immediately after signing. In addition, there are no tax obligations for related persons.

For those persons who are not relatives, but are applying to receive an apartment or a good house as their own, it would be better to draw up a will. Since all inheritance taxes have been abolished since 2005, they will not incur any costs.

The main differences between a deed of gift and a will: table

When both acts are drawn up and registered, all powers from the testator are transferred to the legal successors. There are only a number of differences between these two documents, and in order to finally decide which one to choose to transfer your acquired property to relatives or other close people, we will consider in more detail.

So, what are the differences between a gift and a will ? The basic principles are given in the table.

| Characteristics | Gift deed | Will |

| Transaction type | Double sided | One-sided |

| Registration time | The processing time does not exceed 18 days from the date of drawing up the donation agreement, payment of the state duty and submission of documents to Rosreestr | Difficulties arise only in the fact that the successor enters into the inheritance after the expiration of the established six-month period after the death of the testator |

| Fact of ownership and disposal | The donee receives the property during the life of the owner and has full authority to dispose of the property at his own discretion. | The successor receives ownership of the property and has authority over it only after the death of the testator and registration of rights to the property. To do this, you need to go through 2 stages: after opening the inheritance, collect a complete package of documentation, officially receive all rights to the property after the completion of the inheritance case |

| Possibility to change or cancel | A deed of gift is a type of transaction that is virtually impossible to abolish, with the exception of certain situations: the person’s incapacity for work, if the deed was drawn up under the influence of violent acts, as well as if the property is common, but was registered in the name of one spouse and donated without his notarial consent | A testamentary document is the will of the testator; during his lifetime, he can change it countless times. However, only the latest version of the document will be legally recognized. This act will not be recognized as valid if it was annulled during the life of the testator |

| Cash expenses | The state duty will be 1000 rubles. for registration of transfer of authority over property | You need to pay for the work of an appraiser of the market value of the property. The notary will also charge a fee for document certification and legal and functional services six months before entering into inheritance. Plus, 0.3–0.6% of the appraised value of the entire property will be the fee for the certificate |

| Paying taxes | Personal income tax for registration of a deed of gift will be 13% of the cadastral valuation of the apartment | If the apartment valuation exceeds the minimum wage by 850 times, then the successors are required to pay tax on property received as an inheritance |

| Risks | In fact, the gift agreement cannot be challenged or any amendments made, so choosing this path must be approached carefully and with all responsibility. For the recipient of property under a deed of gift, such a deed is considered a win-win option from all aspects of consideration | Do not forget that disabled people, people of retirement age and young children have the right to receive a share, despite the provisions of the will |

Well, by all indicators it becomes clear that the act of will is more harmless for the owner of the property, since it provides for the legal right to make changes to this document.

And, conversely, for someone who receives property under a gift agreement, this document is better, because this act is not subject to modification, with a few exceptions.

The heirs under the will have only one difficulty: if there are relatives close to retirement age, incapacitated and minors, in this case they will have to be taken into account, despite the will.

What is a will

A will is an official document that contains the last will of the testator regarding the future fate of movable and immovable property after his death, defining the identities of legal successors. It is drawn up in the presence of a notary and certified by him. Only after this the paper is considered valid. But there are also exceptions, when a person’s life is in danger and he does not have the opportunity to properly draw up and formalize an inheritance order, he can express his last will in free form in writing. On an ordinary blank sheet of paper, the testator can write his statement of will and indicate the person to whom all rights to the property owned by the testator will be transferred.

When drawing up a document, a person can put forward certain requirements for his heirs, having fulfilled which, they will be able to enter into inheritance rights, otherwise they will lose such a right. Such situations are known as the right of “testamentary refusal”. This means that if a potential heir refuses to fulfill the last will of the deceased, then he is automatically deprived of his share of the inheritance.

Example. Before his death, the father drew up a will, which indicated that his house, dacha and car would become the property of his son, but only on the condition that he would not throw his illegitimate daughter out of the house and allow her to live there until the end of her days. In case of disagreement with the will of the testator, the right to own the house remains with the illegitimate daughter, and the son only has the dacha and the car. In this case, the son may refuse to comply with the conditions and lose his parental home, and the daughter of the deceased will become another legal successor who will inherit this house. The son can challenge the document, but since he got a car and a country house with a plot, it is unlikely that the court will rule in his favor.

Advantages and disadvantages

To understand what is more profitable - a will or a deed of gift, you need to find out what the pros and cons are in both cases.

Table. Advantages and disadvantages of a will.

| Advantages | Flaws |

| The document is primarily beneficial for the testator himself, since no one knows how fate will turn and how life will turn out. Therefore, it is beneficial for the testator to have the opportunity in the future to revise his will, cancel it or make some changes (change shares in the inheritance, names of heirs, conditions for entering into inheritance rights, etc.). | The main disadvantage of the document is the ability to challenge it in court if there are compelling reasons:

|

| After drawing up a will, the testator does not lose his ownership rights to the bequeathed property and has full right to dispose of it until the end of his life (donate, sell, exchange, etc.), but in this case the document loses its validity | The right of ownership passes to the heirs under the will only six months from the date of death of the testator and subject to the fulfillment of all the requirements of the deceased, if any. |

| The testator can put forward his conditions to future legal successors, only by fulfilling which they will be able to receive the bequeathed property | To enter into inheritance rights, you must go through a complex procedure consisting of several stages:

|