How to avoid fraud when buying an apartment?

In order not to run into one of the deception schemes when selling an apartment, you need to be sufficiently vigilant:

- Check all the owner’s documents and independently order an extract from the Unified State Register of Real Estate.

- Check whether the seller is listed in the Data Bank of Enforcement Proceedings. If it is there, it is possible that the apartment is under arrest.

- Ask to see an extract from the house register to verify that there are no registered people in the living space.

- Request a certificate of absence of debts for housing and communal services.

Legal advice: in order not to run into scammers, it is advisable to find a competent realtor. He will help you choose the best housing and will check the transaction for legal purity, if this service is specified in the contract. The cost of realtor services averages 50,000-100,000 rubles, which is usually included in the price of housing.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Are you planning a deal to buy or sell an apartment?

Lawyers will answer any question regarding the transaction free of charge and in detail. Ask a question so you don't waste time reading!

What is the minimum amount that can be specified in a contract for the sale of part of an apartment?

The cadastral value of the site was 5 million rubles; in July 2017, the cadastral value was updated and amounted to 10 million rubles.

In August Sizov A.A. sold the said plot for 3 million rubles. Since Sizov A.A. sold the plot at a price below 70% of the cadastral value, the tax on the sale of land will be calculated from 3.5 million rubles. (5 million rubles (cadastral value as of January 1, 2020) x 70%). How to find out the cadastral value? You can find out the cadastral value of a property in one of the following ways:

- Many real estate purchase and sale agreements indicate the cadastral value of the property at the time of sale.

- Online on the Rosreestr website.

To do this, in the form that opens, you need to enter the cadastral number of the object or its address and click “Generate a request.” You will be shown several sources of information about the property: State Property Committee and Unified State Register.

The right of 3 years of minimum ownership of real estate to avoid tax levies will continue to be enjoyed by persons: If the period for obtaining ownership of an apartment is more than five years (more than three years for exceptions), then the citizen not only may not pay taxes after the sale of the apartment, but has the right do not declare your income.

Proof of expenses incurred on the property A citizen who sells real estate owned for less than three years can attach to the tax return the original purchase and sale agreement for the apartment, receipts and invoices for contracts, projects and purchases aimed at improving, repairing and finishing the purchased home .

Case 1. A man bought an apartment for 2.5 million, made repairs for 700 thousand, which he confirmed with checks and invoices, and a year later sold the property for 4 million.

Information from the State Property Committee will be provided no later than 5 working days from the date of receipt of documents. If the cadastral value is not determined? The situation when the cadastral value of an object is not determined is now quite rare. However, for such situations, the Tax Code regulates that if on January 1 of the year of sale the cadastral value of the object had not been determined, then in this case the income is calculated at the value specified in the agreement (as before January 1, 2020) (clause 5 of Article 217.1 Tax Code of the Russian Federation).

(as in the contract). Applying the standard property deduction for the sale of housing (1 million rubles.

What tax must be paid on the sale of an apartment in 2020: personal income tax amounts, how to reduce calculation examples After the sale of the apartment, the certificate of ownership is deleted from the RosReestr database and given to the former owner. It is no longer valid, but will be needed by the tax office to confirm the period of ownership of the apartment.

When calculating the tax, the contract price of the apartment is used. The amount indicated in the purchase and sale agreement between the parties is the basis for payment of personal income tax. The minimum amount specified in the agreement for the purchase and sale of an apartment according to the law. Will the justice register such an agreement? Yes, the parties have the right to independently determine the amount in the contract.

Tax on the sale of an apartment in 2020: calculation rules and deadlines for payment

- When calling from the bank's security service - you will name the price specified in the contract, and not the real one

- All advertisements with the actual price will be removed from advertisement sites, otherwise the bank may have doubts and refuse to issue a loan.

Why is overpricing dangerous for the Seller?

- If you made a mistake regarding your income tax obligation, overestimation leads to an increase in the amount of deductions

- If the receipt is not destroyed, it may end up with the tax service, perhaps by mistake of the Buyer, or perhaps on purpose, and the consequences are unpredictable.

- If the contract is terminated by a court decision, the court will oblige you to repay the Buyer the entire amount specified in the contract.

In any case, changes in the actual price require a careful assessment of the situation!!! Always happy to clarify.

Share ve. purely formally

- 1 answer to the question on the topic "apartment="" relative"="" alt="The minimum amount specified in the purchase and sale agreement for an apartment according to the law" What should be stipulated in the apartment purchase and sale agreement, and what should you be wary of

- What price should be indicated in the apartment purchase and sale agreement? What tax should you pay on the sale of an apartment in 2020: personal income tax amounts, how to reduce calculation examples

A sample agreement for an apartment purchase and sale transaction, current for 2020. The text of the document includes its details: series, number, date of issue and name of the authority that issued the document. Not every premises can be the subject of: Parties to the transaction Individuals and organizations can enter into a transaction for the purchase and sale of an apartment.

Question - answer What is the minimum amount that can be specified in a contract for the sale and purchase of a share in an apartment? Tsallagova Irina (Order a consultation) This issue is resolved solely at the discretion of the seller. Also keep in mind that in the event of disputes, a transaction with a provision for an obviously (excessively) reduced sales price may be invalidated as a sham transaction covering up a transaction for a larger amount.

For example, when establishing the fact that the parties, in order to cover up a transaction for a large amount, made a transaction for a smaller amount, the court recognizes the transaction concluded between the parties as concluded for a large amount, that is, it applies the rules related to the covered transaction.

Although there are also a lot of disadvantages that either side may encounter at any time.

you will have to pay 390 thousand rubles! The amount is quite significant, so it is not surprising that the seller is ready to go to any lengths to manipulate documents in order not to pay tax.

We invite you to read: Payments upon retirement from old age pension

But is it worth taking this step for the buyer? Let's try to find out what risks he may face.

March 30, 2020, 17:48 Anna,

Saint Petersburg

According to the new law, the amount in the purchase and sale agreement must be at least 70% of the cadastral value.

For example, an apartment costs 4 million rubles, its cadastral value is 3 million rubles, which means the minimum tax base will be (70%) 2.1 million rubles.

Minus the standard deduction of 1 million rubles. It’s as if I wasn’t asking about this. Looking for an answer? to our lawyers - it’s much faster than looking for a solution.

Hello, the price is an essential condition of this agreement and must be agreed upon by the parties. The law does not contain restrictions on the price of the contract. Help from a lawyer in St. Petersburg and the Leningrad region at affordable prices.

You can indicate any amount, even 1 ruble. The main thing is that it does not harm you later... Murmansk.

st. Egorova, 17 office 3

Understatement of the price in the contract in a real estate purchase and sale agreement or overestimation of the price is not uncommon

situation in purchase and sale transactions.

It’s nonsense, of course, but alas, these are the realities of our lives. Let's look in detail in what situations one of the parties to the transaction asks for a lower price in the contract or an inflated price in the contract. Buyers of real estate may be faced with an offer from the Seller to lower the price in the contract.

This is still a fairly common practice of tax evasion or concealment of the true sale price by one of the spouses or a trusted person for the purpose of profit. Most often, in this way the Seller wants to avoid paying income tax in the amount of 13%.

There are frequent cases of overestimation or underestimation of the price of housing by the parties to the contract; such actions can lead to serious negative consequences for both the seller and the buyer.

When concluding a purchase and sale transaction, it is necessary to take into account the cadastral value of housing, and we must not forget about the likelihood of obligations for tax payments. In the process of buying and selling a property, determining the cost of housing is of primary importance.

The price of the property is an essential condition of the contract and must be stated in it, otherwise, the document will be considered not concluded at all, even if all other conditions of the written agreement are met (Art.

It is no longer valid, but will be needed by the tax office to confirm the period of ownership of the apartment. When calculating the tax, the contract price of the apartment is used.

The amount indicated in the purchase and sale agreement between the parties is the basis for payment of personal income tax.

The minimum amount specified in the agreement for the purchase and sale of an apartment according to the law. Will the justice register such an agreement? Yes, the parties have the right to independently determine the amount in the contract.

That is, the cost of an object of 2 million requires a personal income tax deduction in the amount of 130 thousand rubles. For what minimum amount can you sell an apartment to a relative (indicate in the purchase and sale agreement), i.e. purely formally? For what minimum amount can you sell an apartment to a relative (indicate in the sale and purchase agreement), i.e.

The title documents that give the seller title to the property.

Their details must be indicated in the contract.

Buyers of an apartment become payers of property tax for individuals, but they have the right to return previously paid personal income tax by applying a property tax deduction. What is the minimum amount that can be specified in the purchase and sale agreement for part of an apartment March 30, 2020, 17:48 Anna, St. Petersburg According to the new law, the amount in the purchase and sale agreement must be no less than 70% of the cadastral value.

For example, an apartment costs 4 million rubles, its cadastral value is 3 million rubles, which means the minimum tax base will be (70%) 2.1 million rubles.

- What to include in an apartment purchase and sale agreement?

- What is the minimum amount that can be specified in a contract for the sale of part of an apartment?

- Looking for an answer?

- My realtor in Khabarovsk

- Understating the cost of an apartment in a purchase and sale agreement

How to register the sale of a house with a land plot To register the sale of a house with a land plot, the owner must have all the papers indicating that he is the owner of the property. Copies do not count; originals must be included. To secure the transaction, an advance is made and a preliminary agreement is concluded, which must be certified by a notary.

- Cadastral passport for the plot.

- A technical plan drawn up by a BTI engineer and a cadastral passport for the house.

- Confirmation of the absence of debts on utility bills, land and property taxes.

- An extract from the Unified State Register, a certificate from the district court stating that there is no seizure of property or other encumbrances.

- Notarized consent of the spouses of the parties to the transaction (if necessary).

- Permission from the guardianship authorities if a minor is involved in the transaction.

- When selling real estate that is in joint shared ownership, there must be a statement from the co-owner waiving the right of first refusal.

- For a residential building, a certificate about the persons registered in it is required.

- It is necessary to pay attention to the category of the acquired plot and the type of its permitted use.

Lawyer's answers to frequently asked questions

We are going to buy a house. We found out that it was built with capital, the shares were not allocated. The seller offers to conclude a preliminary agreement with a deposit, and within a month he will allocate the shares and receive permission for guardianship. Is it worth agreeing to such a deal?

The seller knew in advance that he was obliged to allocate shares, but did not do this and tried to sell the house. This should be alarming. A pre-contract can be drawn up, but specifying the time frame within which the owner must receive all documents, as well as the return of the deposit in double amount if he does not fulfill his obligations.

Is it possible to avoid mortgage fraud? Does the bank check the property?

A mortgaged apartment is usually checked not by a bank, but by an insurance company. The risks for the buyer here are much lower, since he, the insurer and the lender are interested in ensuring that the borrower remains with the home and that he pays off the mortgage.

Are there fraudulent schemes with apartments from buyers?

Yes, but often they are meaningless. For example, the buyer may delay the transfer of the amount remaining after registration. But in this case, the seller has the right to cancel the registration and return the deposit.

I am buying an apartment with an encumbrance. The seller asks for a large deposit to remove the deposit. What are the risks?

Such transactions are common in the real estate market, and usually go through without problems. The risk is that if the seller dies before registration, he will have to sue the heirs and prove that the contract was concluded and must be executed.

I fell for an apartment scam. Initially, the realtor showed me one apartment, I liked it. We entered into an agreement with the owner and it turned out that the purchased property was located at a different address and was not in the best condition. Is it possible to challenge the contract?

Such fraud occurs quite often when selling an apartment. It will be difficult to challenge the contract: it was necessary to check the addresses before signing. You can try to go to court, but the chances are minimal. You will have to prove that the apartment was originally shown in a completely different location.

Purchase and sale of an apartment between close relatives, agreement and tax deduction

(cadastral value) - 2 million rubles. (purchase costs) x 13% (tax rate) = 195 thousand rubles. At what point is the cadastral value taken (If the cadastral value has been changed)? The cadastral value of a real estate property is taken as of January 1 of the year in which the sale of this property was carried out (clause 5 of Article 217.1 of the Tax Code of the Russian Federation). Example: Sizov A.A. owns a plot of land.

We invite you to read: Agreement in favor of a third party

The sources of such income are very different:

- renting out an apartment or house;

- transfers have been received from another country or from Russia;

- winnings and others.

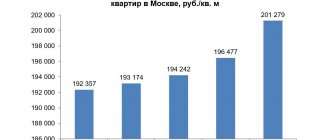

Tax calculation is based on the difference between sold and purchased real estate. To ensure that citizens could not take advantage of this law for personal gain, a calculation based on cadastral value was introduced. Cadastral value The present legislation provides for calculating tax based on the cadastral value.

Cadastral value is information stored in Rosreestr. It is updated every year, at the very beginning of the year. The cadastral value differs from the market value. Firstly, in total, and secondly, by the fact that it is almost never higher than the market price. In case of exclusion, the owners have the right to submit an application to the local branch of Rosreestr with a request to revise the cost of the apartment.

When selling a home, the owner generates income on which he must pay income tax. To reduce taxes, many owners use a trick, underestimating the cost of housing in an official contract (thereby hiding part of the income from the tax authorities).

To combat this practice, changes were made to the Tax Code in 2020, which established that taxable income depends not only on the amount specified in the agreement, but also on the cadastral value of the property being sold. In this article we will look at how and when the cadastral value affects the tax when selling real estate.

If the property was purchased before January 1, 2020 If the property was purchased before January 1, 2020, taxable income is determined “the old fashioned way” - from the purchase and sale agreement. The cadastral value of an object does not in any way affect the tax upon its sale (clause 3 of Federal Law No. 382).

Federal Law Before the adoption of amendments to the law, individuals could not pay tax if they owned it for 3 years or more. Another right related to the sale of an apartment concerned tax deductions. The maximum was 1 million rubles. All these benefits contributed to the development of the “black” real estate market.

This was the opinion of the State Duma deputies on the issue of tax on the sale of apartments and houses. In order to prevent the development of resellers in the real estate market, amendments to the Tax Code were adopted. The period of ownership of real estate under Federal Law No. 382 has increased from three to 5 years. If you bought an apartment earlier than five years ago, you do not have to pay tax.

- Agreement for the sale and purchase of an apartment share

Lawyers' answers (1)

- All legal services in Moscow Arbitration tax disputes Moscow from 50,000 rubles. Support of tax audits Moscow from 20,000 rubles.

In Art. 220 of the Tax Code of the Russian Federation contains a list of conditions and features in accordance with which tax authorities provide tax deductions.

Those motorists who have sold a car that they have owned for less than 3 years have the opportunity to receive it. In accordance with sub. 1 item 2 art.

After filling out the declaration, the citizen will need to collect a package of title and financial documentation confirming the fact of the sale of the car, which includes a copy and original of the vehicle purchase and sale agreement.

Or provide a link to this page or directly to Article 220 of the Tax Code.

If the seller continues to insist on a reduced amount in the contract, then with some degree of probability he is a reseller or is afraid that you will try to return the money paid to him in the future. Agree that a normal seller can write the full price and are not afraid of extra taxes. But you risk being left with nothing (or with a formal 10 thousand) if the car, for example, ends up being pledged and you have to sue the seller.

In general, the conclusion is this: writing the full cost of the car in the car purchase and sale agreement is not only possible, but also necessary. In 90% of cases, a conscientious seller will not have any unnecessary problems with the tax authorities. And the buyer will not have problems selling this car in the future.

Every car enthusiast is faced with a situation where it is necessary to sell an old car and buy a new one.

Thus, after the contract is signed, the buyer will have the right to pick up the car by paying the cost that was reflected in the documents. And even court proceedings will not help the seller defend his rights: according to the documents, he himself agreed to sell at the price reflected in the contract, so the court will not have any grounds to annul the contract.

If you try to cancel the agreement, citing as justification the fact of an intentional artificial decrease in value, from the point of view of the law, such a seller may be held liable. You should figure out whether you should be afraid of reflecting the real price in the DCT, and what are the financial consequences of such a step.

This happens when a person purchasing expensive real estate, for example, has large “gray” income. In this case, questions may arise to him regarding the source of funds for the purchase of such housing, which, of course, he does not need.

The penalty for failure to file a return will be 5% of the unpaid tax for each full or partial month of delay. And you, as a buyer, may lose tax deductions.

The following may serve as title documents: purchase and sale agreement; annuities; barter; lifelong maintenance agreement with dependents; certificate of right to inheritance by will or law; the court's decision; administration resolution, if we are talking about a land plot, etc. What price should be indicated in the apartment purchase and sale agreement?

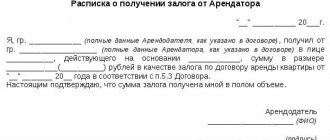

380 Civil Code of the Russian Federation). It is important to state that the transferred amount is precisely a deposit, and not, for example, an advance payment or advance. Receipt by the seller of the amount of money must be confirmed by a written receipt issued to the buyer.

We invite you to read: Refund of money under an unfulfilled contract

If previously the amount that was taxed was considered the amount specified in the agreement for the sale of the apartment, then from 2020, the amount of income from the sale of the apartment that must be declared is considered to be:

- the cost of the apartment under the contract, if it exceeds the cadastral value of the apartment multiplied by the reduction factor (0.7);

- cadastral value of the apartment, multiplied by 0.7, if it is higher than the cost of the apartment indicated in the agreement between the buyer and seller.

The cadastral value of an apartment is taken based on data as of January 1 of the year in which the real estate sale transaction is made. Tax on the sale of an apartment in 2020: do we take into account the tax code of the Russian Federation A 1,700,000.0? -Excuse me, they do not apply to the apartment purchase and sale agreement! And this is another trial that will last for years.

Maybe three kopecks will be returned, who knows.

The property was received as a gift from my brother, so there are no purchase costs. In such a situation, the personal income tax calculation will have the following form: (3,700,000 – 1,000,000) * 13% = 351,000 rubles - this is the amount Vulova is obliged to transfer to the budget based on the results of the transaction.

Features of the application of this type of benefit are as follows:• The deduction is used once in the tax period.• The amount cannot be divided into several real estate properties. Sokolovsky K.Z. sold two apartments in 2020 at prices of 2.5 million.

rubles and 5.6 million rubles. The procedure for calculating tax will be as follows, taking into account the current restrictions: ((2500000 – 1000000) 5600000) * 13% = 7100000 * 13% = 923000 rubles. As can be seen from the example, the deduction applies to only one piece of real estate. Sokolovsky could take advantage of the deduction again if he sold his second apartment next year.

The parties to the transaction are called the seller and the buyer, respectively. We recommend reading: The process of checking out of an apartment 2. Essential conditions The essential conditions of the apartment purchase and sale agreement, in particular, include the following conditions. 2.1. Subject of the agreement In addition, other identifying features may be indicated: floor, entrance, number of levels of the apartment, number of storeys of the entire building, etc.

Understatement of the cost of an apartment The amount is calculated from the cost of housing indicated in the deed. The registration authority transmits information about the property transaction to the local branch of the Federal Tax Service, which regulates further orders on the terms of payments. The money is withheld in the amount of 13% of the price of the object specified in the contract.

One million rubles, which is not taxed, is deducted from the specified amount. The balance minus a million directly affects the amount of the deduction. For the same apartments that were purchased before the specified date, the period of ownership must be more than 3 years. That is, if you are selling an apartment purchased before January 1, 2020, and the period of ownership of this property is more than 3 years, but less than 5, then you will not pay tax.

- 1 answer to the question on the topic "apartment="" relative"="" alt="The minimum amount specified in the purchase and sale agreement for an apartment according to the law" What should be stipulated in the apartment purchase and sale agreement, and what should you be wary of

- What price should be indicated in the apartment purchase and sale agreement?

- What tax should you pay on the sale of an apartment in 2020: personal income tax amounts, how to reduce calculation examples

- The minimum amount specified in the purchase and sale agreement for an apartment according to the law

- Using a deduction in an amount not exceeding a total of 1,000,000 rubles within one tax period.

- Reducing the tax base by the amount of funds actually spent on purchasing a plot of land and building a house.