Grounds for re-registration of land to another person

To convert a land plot into ownership, it is necessary to have not only title documents, but also certifying ownership. It is also necessary to draw up a civil agreement on the conclusion of a transaction between the parties.

The legislator defines such transactions as:

- gratuitous transfer of land (donation);

- paid transfer of land (purchase and sale).

After the type of transaction has been determined, it is necessary to draw up a civil agreement that specifies the conditions for the transfer of the land plot.

It is necessary to complete the procedure for transferring a plot in accordance with the requirements of Federal Law No. 122-FZ of July 27, 1997. To do this, you need to contact a modern multifunctional center, provide all the required documents, and after the expiration of the established period, receive a document registering the plot of land in the name of the new owner.

Re-registration of land to another person

Legal entities that own land plots quite often face such a problematic procedure as re-registration of a land plot. A land plot can be re-registered if, for example, a legal entity, at its own discretion, wants to re-register the right of permanent use of the plot to ownership.

Also, the land plot may be leased, and in case of any changes in the structure of the legal entity, the lease agreements must also be renegotiated.

How to transfer land to another owner

Transfer of a land plot into ownership of another person (individual or legal) is possible only if the transferring party has already registered ownership rights. In all other situations, re-registration of a plot on which buildings are already located occurs upon acquisition of the right to this property.

Regardless of the closeness of relationship between the persons transferring property rights, in such cases the legislator does not allow direct re-registration. Property rights to property can only be transferred by drawing up an appropriate legal agreement.

Documents for re-registration

In order to re-register a land plot, it is necessary to provide the necessary package of documents to the registration organization, namely:

- identification card of both parties to the contract (passport);

- if the interests of one of the parties are represented by an attorney, then a notarized power of attorney is required;

- three copies of the agreement on concluding a property transaction;

- registration certificate of ownership;

- confirmation of land ownership;

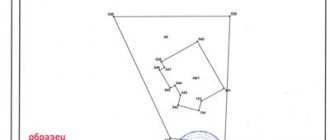

- cadastral passport of the plot involved in the transaction;

- a receipt indicating that the state duty has been paid.

For this type of property transactions, the state duty is set at 2,000 rubles. The deadline established by the legislator for making changes to the real estate register and issuing documents is 21 days (excluding weekends and holidays).

After this time, the new owner is issued:

- transaction agreement certified by the relevant authority;

- certificate of registration of ownership;

- cadastral passport.

How to register a plot of land as a property?

How to register land ownership without documents,

Re-registration of land upon sale

In order to re-register a plot of land to a new owner using a sales contract, several mandatory conditions must be taken into account:

- the land plot that is the subject of the agreement must have a cadastral number;

- When selling, the person alienating the property is obliged to notify the buyer whether there are any encumbrances placed on the land (subject of litigation, loan collateral, etc.).

In order to protect both the buyer and the seller as much as possible, the property agreement is signed directly in Rosreestr. Thus, the relevant employee representing the interests of the state, before accepting the agreement for registration, must verify the identities of the representatives of each of the parties to the transaction. This is necessary primarily in order to prevent fraudulent activities.

To register ownership rights, it is necessary, in addition to the property agreement itself, in three copies (a copy of each party and a copy to Rosreestr), to provide the following documents:

- passport of the representative of each party;

- a document giving the right of ownership to the seller (donation agreement, privatization agreement, registration certificate);

- cadastral passport of the transaction object;

- notarized power of attorney, if a representative is involved in the transaction;

- payment of state duty.

When the re-registration of ownership of a land plot occurs between individuals, the state duty is set at 2 thousand rubles. The legislator regulates the period for registration of title documents by a state body - 21 working days.

Then the originals of the documents submitted for registration are returned to the parties, and the new owner is given an extract from the unified state real estate register and a cadastral passport. Also, both the seller and the buyer are given certified copies of the property agreement, certified in the prescribed manner.

Features of re-registration of a land plot

The right to re-register land has its owner, secured at the legal level. He must have documents confirming ownership. This is a certificate and cadastral passport, which are issued upon registration of land ownership. If the land is not privatized, it cannot be re-registered.

In this case, before proceeding with the transfer of land, it must be registered, and only then figure out how to transfer the land plot to another person. A qualified lawyer can help resolve this issue. He can not only provide advice, but also help with the collection and execution of all necessary papers, and, if necessary, protect your interests in court.

The documents that will be needed to re-register land are a corresponding application, passports of the previous and new owners; papers on the ground; agreement between the parties; receipt of payment of state duty.

According to the law, there are two options for re-registration of a land plot - by donating it or by selling it. And corresponding agreements are concluded between the parties. Let's look at each of them in more detail.

Re-registration of a land plot upon donation

Often, when registering a land plot, the question may arise whether it is possible to avoid paying a tax in the amount of 13% of the cadastral value of the land. Yes, the legislator gives such an opportunity - to draw up a gift agreement. However, if the conditions for the transfer of ownership free of charge are violated, then very unpleasant incidents may subsequently occur, which may result in the cancellation of the contract in court or prosecution for non-payment of taxes.

Before making a final decision on the method of registering ownership, it is necessary to take into account the family ties between the parties to the transaction. If the land is received from a close relative, then donation will be the ideal way to register it.

To register a gift agreement with government agencies, the same package of documents is required as when registering a purchase and sale agreement. But unlike the purchase and sale agreement, various intangible conditions may be included in the deed of gift.

For example, the donor obliges the recipient to build a house on the plot within the next five years, or that the gift agreement will come into force only after the recipient enters into an official marriage, or the person taking away the land obliges its new owner to obtain a higher education. There may be several such conditions included in the contract, but each of them must be strictly non-material in nature.

The procedure for re-registration of a land plot

The law requires re-registration of a land plot transferred to another. However, first the parties must formalize the transaction, which will become the basis for the re-registration procedure.

We suggest you read: Where to go if you don’t want to accept insurance

There are three options:

- donation;

- sale of land;

- inheritance.

Each transaction requires the drawing up of a special agreement and its approval by the parties.

| Transactions | Features of the event, documents |

| Purchase and sale | When one person, the owner, transfers a plot of land to another after signing an agreement and making payments. The parties meet, discuss the details, and draw up an agreement. Lawyers believe that it is better to secure additional insurance for such transactions. Contact an experienced notary, he will examine and certify the papers. The contract has been signed, payments have been partially made (the buyer has made the first payment). Now the parties go back to the site. If the client has no complaints and approves the purchase, he signs a special Acceptance Certificate. Later he deposits the remaining amount. The calculation has been made, it’s time to re-register the allotment. Required documents: ● title document – provided by the seller; ● passports of the parties; ● power of attorney, if there are proxies instead of participants; ● cadastral passport; ● there are some buildings on the site - a cadastral passport plus a certificate that these buildings are already ready and put into operation for further use; ● signed agreement; ● permission of the spouse (husband/wife) or other share owners (when available); ● receipt (issued after participants have paid the state fee); ● acceptance certificate. In Rosreestr, the new owner confirms the fact of ownership of the acquired plot. Having submitted documents, in return citizens receive an extract, which, in addition to the list of documents received, contains the date when they can return for a certificate. The entire procedure will take approximately 10 days, if there are no difficulties. After which the person will receive a special extract from the Unified State Register of Real Estate instead of a certificate, where, in addition to his data, the characteristics of the received land will be indicated - its agricultural purpose, area, date of surveying. |

| Donation | When a citizen-landowner decides to transfer the allotment to another. Often this is a relative. It doesn’t matter if it’s a son or a spouse or a grandson. To do this, you need to draw up a deed of gift. It will give another person a lifetime right of free possession of the subject of the transaction. The peculiarity of the procedure is that it is free of charge. The recipient only receives the gift without providing any payment or additional encumbrances. By the way, the deed of gift must indicate in detail the details of the plot. Is there a country house or residential building there, to which local gardening association does the plot belong? The finished document can be additionally certified by visiting a notary. What is important, the deed of gift allows the recipient to register the object of the transaction in his name immediately after signing the deed of gift. The registration procedure will be similar to that described above, as well as the list of documents. The only difference is that instead of a purchase and sale agreement there will be a deed of gift. Important: joint property can be donated/sold or bequeathed with the written consent of all other owners. |

| Inheritance | A landowner decides to make a will to transfer his land to someone. According to the law, citizens have the right to bequeath everything they own to their descendants. Land is considered real estate and can also be transferred to others. A will is drawn up by a person in a notary's office, after which the finished document is signed by two more persons as witnesses. The text should clarify the basic data of the subject of inheritance - area, cadastral number, total cost. Was construction carried out or planned there, what kind of site - individual housing construction, SNT or another category. Is there an encumbrance (it was mortgaged, bought out, was the subject of early transactions, is currently being rented out). The heirs have the right to initiate the procedure for re-registration and acceptance of the inheritance when at least six months have passed since the death of the testator. They turn to the specialist where the testator previously made and left a will. He reveals a list of heirs and calls them. If the period specified by law has expired, the envelope is opened. After studying the text of the document and distributing the inheritance, the notary gives special certificates to the heirs. Having received it, citizens visit Rosreestr or the MFC to carry out re-registration there. The list of documents is described above, the only thing is that instead of a purchase and sale agreement there will be a certificate and a will. |

We suggest you read: Are you really fined for having a fire in your dacha?

Six months is the minimum established period. The heirs need to declare their rights in time, otherwise they will then have to defend them in court.

Re-registration of a land plot to another person after death

The procedure for registering ownership of a plot after the death of the previous owner has several features. A plot of land, which is registered as a property in accordance with the provisions of the Law, after the death of the owner is inherited by his relatives. The order of priority for receiving an inheritance is regulated in the Civil Code of the Russian Federation.

If the relatives of the deceased cannot come to a common decision and several people claim the land, then an agreement can be concluded that allows:

- shared ownership;

- redemption by some heirs;

- redemption by the sole heir of all shares;

- refusal of some heirs to inherit.

If the agreement is not formalized, then all heirs own the land without allocating shares.

To establish the right to property, you must contact the MFC with all documents for the land and documents on entry into inheritance. A state fee of 2,000 rubles is also required.

Re-registration of a summer cottage to another person or relative

In addition, the administrative authorities will need to provide a cadastral passport of the site, a technical passport and documentation for the house and other buildings, if any. If any evidence is missing, it will have to be restored. After the transaction under the gift agreement takes place, the relative is issued a document of ownership, which is then registered with the registration services.

After this, the new owner receives documents establishing the right. This is the easiest and most economical way to re-register a plot of land to a family member, however, it takes a lot of time and is often associated with certain difficulties. Such difficulties can be foreseen and eliminated by the employees of our company, who have been dealing with such issues for many years.

A summer cottage plot is exactly the same piece of real estate as, for example, a house or apartment. Each owner has the right to freely dispose of his land plot, for example, he can transfer it to someone else. But how can you re-register a dacha plot, for example, in the name of your close relative or son? After all, you won’t enter into a land purchase and sale deal with them, as you would with a stranger.

To re-register a land plot, enter into a gift agreement. If you want to transfer the ownership of a land plot to one of your close relatives, the most profitable option is to simply give it to him. More precisely, it’s not easy, but for this you need to draw up a special agreement with a notary, which is called a gift agreement. The benefits of such a deal are obvious. When drawing up a deed of gift, a notarized permission is required if the situation is similar to the above. If the dacha is inherited, then before registering the plot it is necessary to enter into an inheritance; all documents are drawn up within 6 months from the date of death of the owner. In this case, it will be possible to register the land in six months, when the right to inheritance is formalized.

These points are explained in more detail in Section 5 of the Civil Code of the Russian Federation. The procedure for entering into an inheritance can take place both through a notary and in court. If there is a need to transfer a plot of land to a husband, wife, son, daughter, parents or other relatives, then you can issue a deed of gift.

It is advisable to draw up these circulars from a notary or entrust its preparation to a person who has sufficient experience and knowledge in this area.

How to re-register a plot of land to a relative

Naturally, every person who wants to give their land to someone close to them is afraid that during re-registration they will have to spend not only a lot of time, but also money. However, the legislator allows you to avoid paying taxes if a donation procedure is carried out.

When such an agreement is concluded, the plot of land is alienated into the possession of the new owner free of charge.

For such a procedure, it is necessary to provide the owner’s title documents (certificate of registration of rights, purchase and sale agreement, inheritance) to the appropriate authorities. You will also need to provide a cadastral passport of the site, technical documentation for all buildings located on the site.

After registering the donation agreement with a government agency, the new owner of the plot is issued a certificate of registration of ownership and he can dispose of the newly acquired plot at his own discretion.

Was the Recording helpful? 255 out of 301 readers found this post helpful.

How much does it cost to re-register a plot of land to a relative?

Of course, many transactions involving real estate are accompanied by tax costs. The party considered “rich” pays. For example, a donor, if he gives land to someone for free, does not pay anything. The recipient is considered to have received a profit.

How applicable are these requirements if the parties to the transaction are relatives?

Buying and selling will be difficult. After all, the law requires financial calculations. If the contract initially specifies a certain amount, and the parties only re-register the property, without money such a transaction will be considered invalid. In addition, a close relative will then not be able to receive a special tax deduction (13% refund on the specified cost of the loan). He will have to pay 13% personal income tax (from 1 million) if the acquired plot was previously owned for less than 3 years.

Among all transfer options, deed of gift is considered the most profitable. Why? When making a will, you must wait until the testator dies. Then another six months. Buying and selling, if carried out by relatives, is useless. According to the deed of gift, people can immediately re-register the land as soon as the owner signs the document.

Several heirs. It happens when a testator leaves property belonging to him to several equal heirs. According to the law, when receiving an inheritance, citizens are required to pay a special fee, each separately. That’s why people sometimes write refusals on purpose, and only one person does the processing. It's cheaper that way. Then they divide the property when the bureaucratic procedures are already completed.

Registration and re-registration of a land plot is the right of any owner, which he can use at his own discretion in favor of another person. But at the same time, the owner is obligated to pay state duty and other expenses for re-registration of the land plot.

How much does the allotment re-registration procedure cost:

- Carrying out cadastral works (from 4,000 rubles). Real estate requires state registration, which is associated with cadastral work and obtaining a land passport. How much does land surveying cost? This depends on the size of the area and the nature of the work being carried out.

- Obtaining a site plan and passport (200 rubles for individuals, 600 rubles for legal entities). Based on the results of cadastral activities, the land owner receives a cadastral passport and a site plan. During registration you will have to pay a state fee. The cadastral passport is a guarantee of the legality of the transaction.

- Re-registration of the site (200 rubles). If you have all the documents for the land, the cost of the procedure includes only the state fee for registering the rights of the new owner.

- Notary support (1% of the cost). The cost of re-registration includes payment for notary services, which amount to at least 1% of the cadastral value of the land plot. The final calculation is carried out by the local administration. The starting point is the cost of 1 sq. meter of re-registered land.

- Tax on income from the sale of land (5% of the price of land). Finally, another expense item is the payment of 5% tax on the cadastral value of the site. Despite the fact that the law obliges both parties to the transaction to pay tax, most often the buyer bears the obligation.

Thus, the cost of the procedure depends on several factors. It is difficult to name the exact amount of expenses - it is related to the size of the plot, cadastral documents and the cost of notary services. But in general, re-registration of land is not a very expensive process, and in the case of a gift agreement it will be much cheaper.

It is in the interests of the owner to take care of timely cadastral work on the land (determination of boundaries, category of land, approximate cost, boundaries, etc.). Otherwise, the plot will not receive a cadastral number in the state database, which means it will be impossible to re-register the property to another person.

Re-registration of a plot of land: regulations, grounds

Registration of land transfer takes place in accordance with regulatory act No. 122-FZ of July 27, 1997 and the Land Code (Land Code of the Russian Federation). In addition, owners take advantage of the new law (No. 93-FZ of June 30, 2006), which provides for a “dacha amnesty,” which is a simplified way to change the owner of a land plot.

There are several reasons for changing the owner of land:

- inheritance;

- privatization;

- sale;

- renting a plot owned by the municipality (more details on how to rent municipal land);

- transfer of ownership for lifelong use;

- donation.

In these cases, the process starts and the preparation of documentation begins. After determining the type of transaction, an agreement is drawn up describing all the terms of the acquisition.

Re-registration of a plot of land in favor of another person

Legislation protects the rights of land owners. So, according to Art. 40 of the Land Code of the Russian Federation, land managers have the right to carry out any transactions with real estate, including sale, lease, gift or inheritance.

This is interesting: What costs can be classified as variable costs

Re-registration of a land plot in favor of another person is associated with a change in the type of right. The following re-registration options are distinguished:

- Transfer of land to a new owner.

- Rent a plot.

- Indefinite use of the allotment.

- Free immediate use.

These types of legal relations fall under the provisions of the Land Code of the Russian Federation. Re-registration of a land plot to a relative must be carried out in strict accordance with the articles of the regulatory legal act.

Features of re-registration of the site:

- The procedure involves concluding a contract (sale or gift) with another person. The main points of the transaction are stated here, indicating the buildings located on the land.

- The law does not allow the re-registration of land separately from residential and non-residential buildings. In this case, the transaction is single and affects the entire property.

- Re-registration of a land plot in the name of a spouse is associated with the use of common property, which imposes certain difficulties on the transfer of rights to another spouse.

- The procedure requires notarization. Accordingly, the final amount of the transaction will depend on how much notary services cost in the region.

Let's move on to consider the procedure for re-registration of the allotment. As already mentioned, the type of transaction plays an important role: purchase and sale or gift.

Re-registration of land ownership: step-by-step instructions

In this case, inheritance is not considered, and registration occurs exclusively under a property transaction agreement in 2 options: donation and sale and purchase.

Step 1. Documents

First of all, you need to have on hand the papers that establish ownership, and other acts necessary for registration. Strict execution of instructions is a guarantee of a successful transaction.

The owner often does not have a cadastral passport, which will be a serious obstacle in the purchase and sale process. From January 1, 2017, instead of a passport, an extract from the Unified State Register is issued. You can get help in several ways:

- personal visit to the Cadastral Chamber or Rosreestr;

- submitting an application to the MFC;

- official portals (State Services, Rosreestr).

The service requires payment of a fee, the amount of which is 350 rubles.

Step 2. Contacting the administration

The absence of some papers puts the owners in a difficult situation; problems may arise during re-registration. For example, ownership of a summer cottage does not require confirmation of ownership with a special document, but the transaction cannot take place without it. To obtain a certificate, perform the following steps:

- land surveying of a garden area (read about what land surveying is);

- contacting the dacha association or SNT for an extract;

- registration of the act in the management of the Federal Reserve System.

The old document issued before 1998 is replaced with a new one.

Step 3. Transfer of papers to Rosreestr

Having received the necessary acts, both parties go to Rosreestr to transfer the package and purchase the plot. The main document will be a donation or sale agreement, which specifies the clear terms of the agreement, the buildings located on the site, and the agricultural purpose of the property.

After a period determined for the authorities, the right of ownership passes to the receiving party, which is confirmed by certified acts.

Transfer of land by sale and purchase: instructions

Stage 1. Collection of documentation

Required documents:

- Identity cards of the parties (passports).

- Ownership of the transferred plot.

- Property transaction agreement. Provided in 3 copies.

- Extract from the Unified State Register or cadastral passport.

- Receipt confirming payment of the state duty.

- Notarised power of attorney. Submitted if a representative of one of the parties participates.

- A deed confirming ownership.

The price for a gardening project may be formal if the buyer is a relative.

Stage 2. Applying and submitting the package to the registration authorities

Having collected a package of papers, the parties apply to the MFC, and then to Rosreestr.

After paying the state fee in the amount of 350 rubles, after 21 working days the receiving party receives papers confirming the status of the owner of the land plot: an approved contract, a new cadastral passport and a certificate of ownership. To make changes to the real estate register, 3 weeks are given.

How to re-register a plot of land to another person

When transferring land to another person, an agreement is assumed between the parties. The document notes all technical characteristics, including the presence and types of buildings located on the territory. This rule cannot be broken. Legally, a transaction is only possible upon the transfer of everything located on the territory. It is also necessary to take into account the need to involve a notary in the procedure, which is associated with additional financial expenses.

If we are talking about selling land, the owner must prepare a package of documents for further contact with the appropriate service. It includes:

- documents confirming the identity of the owner and buyer;

- cadastral passport and certificate of ownership of the land being sold;

- contract of sale;

- a statement confirming the intention to implement the procedure.

Note!

If property is transferred through a deed of gift, then similar documentation should be prepared. The only difference is that the purchase and sale agreement is replaced with a document confirming the donation. The advantage of donation over sale is the absence of taxation of the transaction.

Re-registration of a plot to a relative: procedure and features

The most beneficial option for both parties would be a change of owner through a donation. You can also issue a bill of sale, but you will need to pay taxes and fees. The main distinguishing points of transferring land to a relative:

- minor relatives can only accept land as a gift;

- when selling land to an individual who is related, the 13% tax is not refunded;

- the sale procedure is taxable if the plot has been owned for less than 3 years;

- concluding a gift agreement is tax-free;

- Only official spouses can participate in the donation - general rules apply to cohabiting people;

- In the case of joint ownership of the land plot by both spouses, the transaction requires the notarized consent of each.

To successfully carry out the transfer, documentary proof of relationship is required.

The costs of the procedure will be much less in the case of a deed of gift. The main thing is that the main papers are correctly drawn up. You need to take care of their availability in advance.

Donation of land: step-by-step scheme

The main positive aspect of this option is the tax exemption. Thus, there is no need to pay cadastral fees. The main thing is to carry out the entire process in accordance with the law - otherwise, if violations are identified, cancellation through the court is possible.

The general package of necessary certificates and acts is similar to what is submitted when selling a land plot. Only the contract is different. It is drawn up in the form of a deed of gift, which is certified by a notary. The clauses of the agreement may contain special conditions that are not related to the material side. For example, the former owner may oblige the future owner to build a residential building on the property or to marry within a certain period of time.

Step 2. Determine the essential provisions

Points, failure to comply with which threatens to declare the agreement void or voidable:

- name indication of the donee and the donor;

- a clear definition of the subject of the agreement, indicating all the characteristics of the object;

- transfer timing (may be delayed for several years);

- terms of transfer and termination of the agreement, if any;

- force majeure circumstances.

Agreements are provided in 3 copies: one for each party, the third - to the authorized body.

Step 3. Payment of duty

Each participant is required to pay a fee of 350 rubles on a receipt and provide a receipt to the registration authority when submitting a package with documentation.

As you can see, there are a lot of subtleties in drawing up an agreement. To competently resolve the issue and avoid undesirable consequences, it is recommended to contact lawyers who know all the nuances of executing such transactions.

Inheritance of land

After the death of the owner, after 6 months, the next of kin apply to the registry office to re-register the property. Be sure to include a will, if one was written, and proof of relationship, as well as a death certificate. Process Features:

- in the absence of close relatives, distant relatives take over;

- several heirs enter into equal shares or those designated according to the will;

- one heir has the right to buy out the share of another;

- the refusal of one successor in favor of another is possible;

- refusal of all heirs is possible.

You may be interested in how to formalize a waiver of the right to a land plot.

Documentation

To determine ownership it is necessary:

- death certificate;

- will;

- documentary evidence of relationship;

- significant acts on land.

Submission to authorities

After collecting the information, you need to contact the nearest MFC. Before this, each citizen pays a fee of 350 rubles.

Legal disputes

Quite often, legal proceedings arise regarding the cancellation of a deed of gift for a land plot. There may be several reasons for this:

- improper handling of the object of donation, if it is of value to the donor;

- death of the donee before the donor;

- causing significant harm to the donor by the donee;

- donation under pressure;

- conducting a transaction in violation of the law.

A striking example is the cancellation of a deed of gift written under the influence of external factors.

Citizen N goes to court with a claim to invalidate a deed of gift received in violation of the law. As a basis, it was stated that she, the sole owner, under pressure from relatives, wrote a deed of gift for her daughter. The plaintiff was not explained the consequences when registering with a notary. During the signing of the papers, the citizen was in a depressed state due to the death of a close relative.

It was stated that living in the donated house became impossible due to pressure from the recipient. The claim contained a demand to recognize the deed of gift as void in accordance with Article 178 of the Civil Code of the Russian Federation.

The defendant categorically did not accept the demands. The plaintiff’s daughter indicated that neither she nor her relatives had any influence on her mother. The notary, according to the instructions, explained to the plaintiff the consequences of signing the agreement. The court did not satisfy the plaintiff’s demands; the appeal also did not find any violations in the agreement due to the lack of evidence of misrepresentation and the inability to make informed decisions.

The process of registering and changing the owner of a land plot has many pitfalls. Incorrect collection of certificates or incorrect filling out of applications is fraught with refusal, and sometimes even legal proceedings. In order to avoid problems, save time, nerves and money, you need to contact a specialized law firm. Professional practicing lawyers who know a lot about these types of transactions will do the bulk of the work and certainly won’t make a mistake. Entrusting the case to lawyers means saving yourself from difficulties and achieving your goal with small sacrifices.

In order to register ownership of another person, you will need documents confirming the rights of the current owner and documents for the land. It is necessary to conclude an agreement formalizing the transaction for the transfer of the site.

Attention! According to civil law, such transactions can be divided into two types:

- gratuitous transactions (donation),

- paid transactions (purchase and sale).

After choosing the type of transaction, an agreement is drawn up defining the conditions under which the land is transferred into the ownership of one of the parties. When completing this transaction, it is necessary to comply with the provisions of the Federal Law on State Registration of Rights to Real Estate and Transactions with It dated July 21, 1997 No. 122.

Contact the MFC, submitting the required documents in full, to receive documentary evidence of the transfer of rights to the land plot to the new owner.

Registration of a land plot from lease to ownership.

Grounds for re-registration of a land plot

The owner of real estate has the right to dispose of his property himself. Therefore, the transfer of property can occur on the following grounds:

- conclusion of a civil contract;

- as part of inheritance;

- as a result of privatization;

- by acquisitive prescription.

This is interesting: Harmful work experience list of professions

The most common option is to carry out civil transactions.

If there are buildings and structures on the site, the right to them must be re-registered along with the land.

Conclusion of an agreement

Any type of real estate transaction must be reflected in a written agreement, which can be concluded either on a paid or gratuitous basis.

Compensatory contracts include:

When transferring rights to real estate free of charge, the best option is a gift agreement. If the property is re-registered for a certain period, then a free use agreement is concluded.

Contractual relations relating to land are regulated by chapters 30-32, 34, 36 of the Civil Code of the Russian Federation.

Inheritance

If the owner of the plot dies, then his property is inherited by his legal successors. The estate will include real estate that belonged to the testator under the right of ownership or lifelong inheritable ownership.

You should know! The assignee receives the right to the soil, artificial reservoirs and vegetation located on the site.

Inheritance is carried out according to a will. If it is absent, the inheritance is transferred to the legal successor according to the law, taking into account the norms of Section 5 of the Civil Code of the Russian Federation.

Privatization

By decision of the authorized bodies, state and municipal real estate can be transferred into the ownership of citizens free of charge as part of privatization.

Its rules are established by the provisions of Art. 39.1, 39.5, 39.10 of the Land Code of the Russian Federation, Federal Laws No. 178-FZ dated December 21, 2001, No. 119-FZ dated May 1, 2016.

Acquisitive prescription

A citizen has the right to acquire land by acquisitive prescription. If he has owned real estate in good faith, openly and continuously for 15 years and used it as personal property, he can register it as his own. The right of ownership on such grounds can be transferred to the copyright holder only by a court decision.

We must remember! Acquisitive prescription does not apply to state and municipal property.

How to register land in the name of another owner

Only a person who has legal ownership of such a plot can transfer a plot of land into the ownership of another person. Otherwise, the initial acquisition of ownership of the land will be required.

It should be noted that the degree of relationship does not affect the procedure for re-registration of rights; in any case, documentary evidence of such a transfer will be required. The transfer of ownership of the plot is carried out exclusively within the framework of the contract.

agreement for the gratuitous transfer of land into ownership free of charge in word format

To register the transfer of ownership of a plot of land, you will need to submit the following documents to Rosreestr:

- passports of each party,

- if a representative acts on behalf of a party, a power of attorney is required,

- agreement confirming the transaction for the transfer of the site, in triplicate,

- document confirming ownership of the plot,

- cadastral passport of the land plot that is the subject of the transaction,

- a receipt confirming payment of the state duty.

In this case, the state duty is 2000 rubles. It takes 21 working days to complete the transfer of rights, make changes to the register and prepare new documents.

ATTENTION! Look at the completed sample agreement for the gratuitous transfer of land into ownership:

Important! After this, the owner receives the following documents:

- a certified agreement formalizing the transaction for the transfer of the site,

- certificate confirming registration of ownership,

- cadastral passport.

Is it necessary to join SNT if the land is owned?

Read here how to abandon a plot of land to avoid paying taxes.

free land purchase and sale agreement in word format

Before submitting your application, you should prepare a number of documents. You can obtain up-to-date information about their list at the Rosreestr branch.

To complete a purchase and sale transaction for a plot of land, the following documents will be required:

- passports of each party,

- a copy of the purchase and sale agreement,

- if a representative acts on behalf of a party, then a power of attorney is also required,

- cadastral passport and certificate confirming the rights of the seller as the owner of the plot,

- application to Rosreestr.

ATTENTION! View the completed sample land purchase and sale agreement:

How to obtain a cadastral passport through the MFC?

For a gift agreement, it is necessary to collect similar documents. If the transfer of the plot is carried out to a relative, a document will be required that confirms the existence of a family relationship between the parties.

The advantage of a gift agreement is the fact that the transfer of land to relatives is not taxed, which is economically beneficial. The land obtained as a result of a purchase and sale transaction is subject to tax.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

How to re-register a land plot if it is sold

Before contacting the registrars, you will need to collect a list of documents. You can find out about it at the nearest branch of the FUGRTs.

List of documents for the sale of land:

- Passports of the seller and buyer;

- Certificate of land ownership and cadastral passport (from the seller);

- A copy of the purchase and sale agreement;

- Power of attorney to complete a transaction (if a representative of the seller or buyer is involved in it);

- Application to the Federal Registration Department (FUGRTs).

We invite you to read: Non-payment of land tax - advice from lawyers and lawyers

When completing a transaction under a gift agreement, you will need to collect a similar list of documents with the exception of the purchase and sale agreement. If the plot is re-registered to a relative, then in addition to the list, you will have to prepare confirmation of family ties with the seller.

Unlike purchase and sale, donations of land to relatives are not subject to tax. This is especially beneficial if one of the parties to the contract is experiencing financial difficulties and cannot bear the costs.

How to re-register land when donating

As a rule, ownership of the plot passes to the donee upon completion of the paperwork, however, the moment of transfer of the plot may be determined in a different way in the agreement.

Donation is prohibited, the condition of which is the transfer of property after the death of the donor.

You can use a standard form for drawing up an agreement, for example, the 1994 model developed by the Russian Federation Committee on Land Resources.

land donation agreement for free in word format

Please note! The contract must include the following information:

- names of the parties (they are the donor and the donee),

- information about the subject of the contract, with the help of which you can clearly individualize it. In the case of a land plot, such information includes: its area, cadastral number, information about the buildings located on it (both residential and non-residential),

- cadastral value of the plot,

- information about the existence of other rights to the site on the part of third parties,

- rights and obligations of each party,

- applications.

If you are going to seek advice from a law firm, carefully study the cost of the services they provide. They can charge from 5,000 to 10,000 rubles for preparing the contract.

If a plot of land is transferred to a person who has not reached the age of majority or is legally incompetent, then the consent of his legal representatives in writing is required. A minor citizen cannot be a donor of a plot of land.

Remember! To have a deed of gift certified by a notary, prepare the following documents:

- three copies of the contract,

- documents that prove the identity of each party,

- cadastral plan,

- a document containing information about the cadastral value of the site (based on the results of the assessment),

- a certificate confirming the absence of buildings on the site, or an extract from the Unified State Register of Real Estate confirming the rights to them,

- documents confirming the rights to the site.

Separate registration of the agreement itself with the Rosreestr authorities is not required.

ATTENTION! Look at the completed sample land donation agreement:

The process of re-registration of a plot after the death of its owner has a number of distinctive features. A plot of land is included in the inheritance mass, the rights to it are transferred by inheritance by law or by will.

The heirs according to the law are the relatives of the deceased, who form several lines depending on the degree of relationship, and the heirs under the will can be persons who are related to the testator or not.

As a general rule, within the framework of one inheritance line, the inheritance is divided equally, shares are not allocated, however, the heirs can enter into a special agreement on the division.

Within the framework of such an agreement, the following options are acceptable:

- redemption of the plot by one heir,

- registration of property of all heirs, allocation of the share of each of them,

- redemption of the plot by part of the heirs,

- the heir's refusal of his share in favor of another heir.

Re-registration of rights to a plot is carried out at the MFC.

Required documents:

- death certificate of a relative,

- passport and birth certificate of the heir. This is necessary to confirm the relationship between the heir and the testator,

- a certificate confirming ownership rights to real estate located on the site (please note that you do not need to submit a technical passport),

- state act on the right to use a plot of land,

- other documents confirming the existence of property (for example, a passbook, etc.)

How to register land in the name of a relative

The Family Code of the Russian Federation establishes the circle of close relatives. Such persons do not pay tax when re-registering a country house. Other citizens pay personal income tax, which is 13% of the price of the purchased house.

If a parent is going to transfer the dacha to their child, he can draw up a deed of gift.

The registration procedure can be divided into the following stages:

- collection of documents for the land plot and the house located on it in full,

- obtaining consent from the spouse to carry out such a transaction. If the property is jointly acquired, the consent must be notarized,

- drawing up a deed of gift in triplicate. You have the right to have the contract certified by a notary at your discretion, but such an obligation is not legally established. Indicate in the document that the transfer of real estate is confirmed, so as not to draw up an additional transfer and acceptance certificate,

- registration of property rights in Rosreestr,

- obtaining an extract from the Unified State Register of Real Estate.

The entire procedure will take approximately one month.

You can submit your application in the following ways:

- upon personal contact with Rosreestr,

- through the State Services portal,

- through MFC.

If the application is submitted by your representative, a power of attorney is required.

Watch the video. How to properly register a plot of land as your property:

How to re-register a plot of land to a relative without selling it

Info

Firstly, if a gift agreement is concluded between close relatives, they do not have to pay tax on the acquired property. This is directly stated in Article 217 of the Tax Code. Secondly, you do not have to worry that in the event of a divorce between spouses, they will begin to divide the land.

Important

The fact is that a donation is a gratuitous transaction, and property acquired as a result of such a transaction does not become the joint property of the spouses, as happens, in accordance with the law, as a result of a compensated transaction - in particular, a purchase and sale. However, donation is beneficial only in cases where we are talking about close relatives. Their list is indicated in Article 14, paragraph 2 of the Family Code of the Russian Federation.

Cost of the procedure

The amount of state duty varies depending on the intended use of land:

- if the plot provided for individual housing construction is part of the land of a settlement, then the state duty is 2000 rubles. for citizens and 22,000 rubles. for legal entities,

- if this is a summer cottage plot, or it is provided for private household plots, gardening, orchard farming, then the state duty is 350 rubles. for citizens,

- if the plot belongs to lands with agricultural purposes, then the state duty is 350 rubles,

- The state duty for registering a share in the common ownership of a plot related to agricultural land is 100 rubles.

If the plot is owned by several persons, the state duty is paid by each of them in full.

If the legal basis of the procedure is a certificate of the right to inheritance, then the state fee is divided among all heirs in proportion to their shares.

Is it possible to build a house in SNT?

According to legislative innovations, a certificate of ownership is currently not issued. The owner receives an extract from the Unified State Register of Real Estate containing all the necessary information about the property.

Such an extract is also subject to a state fee, the amounts of which are as follows:

- For a paper extract you will have to pay 400 rubles. citizens and 700 rubles. legal entities,

- For an electronic statement you will have to pay 250 rubles. citizens and 1100 rubles. legal entities.

What happens if you don’t re-register the land in time?

A careless attitude to land registration issues entails a number of negative consequences.

Please note! The ability of the property to participate in civil circulation is lost, namely:

- the plot cannot be sold,

- the plot cannot be mortgaged,

- the plot is not inherited either by law or by will.

If there are no permanent buildings located on the site, the local administration has the right to seize it and then sell it at auction. If there is a building, then the local administration retains the right to reduce the area of the site. These actions are legal, since it is the municipality that is the owner of the site, the rights to which have not been re-registered.

The exception is plots that are in lifelong inheritable ownership. In this case, the plot is inherited.

Now that you know how you can re-register ownership of a plot, it will be useful to get information on how to maintain your legal rights to the plot. Remember about the three forms of ownership operating on the territory of the Russian Federation: state, private, municipal.

Do not forget that it is the right of ownership that gives you the widest range of powers with respect to real estate; you can dispose of it through entering into transactions of various kinds, actually own it and use it for your needs.

Watch the video. Donation of land:

Re-register a land plot