All articles

9373

2020-03-13

In this article you will find out how much the state fee for an extract from the Unified State Register of Real Estate will require, how you can make the payment, what method will help you save and when is the best time to deposit money. You can order an extract from the Unified State Register on our official website, signed with the digital signature of a Rosreestr employee.

When selling a residential property, the buyer has the right to request a certificate from the Unified State Register . This document confirms ownership and may be required in other situations. Having submitted a request to certain government agencies, the applicant will be placed in a queue for the issuance of a document and their application will be accepted only after paying the mandatory fee.

Payment of the state fee for an extract from the Unified State Register is a mandatory step in order to obtain a certificate. The method of receipt does not matter whether the subject applies independently to Rosreestr or submits an application online using the website, the application will be accepted after depositing funds, the amount of the state fee in 2020 for an extract from the Unified State Register depends on the method of obtaining the document.

The amount of state duty for an extract from the Unified State Register of Real Estate

The fee is paid to the state, in return the state provides the necessary services and issues certificates. The amount of the mandatory monetary fee, the procedure for payment methods are regulated by law, for all regions of the Russian Federation the conditions are the same and must be fulfilled. There are no benefits or discounts; the subject pays the amount specified in the law.

The amount of the fee depends on the data specified in the document, on the type of certificate, on the method of receipt:

- State duty for an extract from the Unified State Register of Real Estate (standard) – price 350 rubles. (electronic version) , 600 rub. (paper type).

- The state fee for an extract from the Unified State Register of Rights on the transfer of rights is 850 rubles. (electronic version) , 1800 rub. (paper type).

- Certificate of cadastral value - price 350 rubles. (electronic version) , 600 rub. (paper type).

The amount of the state duty for an extract from the Unified State Register of Real Estate, which displays information about how many owners had real estate from 850 to 1800 rubles. To obtain documents confirming ownership (title papers), you need to pay a fee in the amount of 350 to 600 rubles, depending on the method of receipt. Payment of the state fee for an extract from the Unified State Register through Rosreestr depends on the information displayed.

Attention! Today, an extract from the Unified State Register (electronic), signed with a qualified electronic signature (EDS), is recognized as equivalent to a paper document with a blue seal from a Rosreestr employee, in accordance with Art. 6 of the Federal Law of April 6, 2011 No. 63-FZ “On Electronic Signatures”. You do not have to order a paper extract; you can buy an extract from the Unified State Register without leaving your home, and without paying a state fee.

Amount of state duties

The cost of state fees differs. State registration of rights to real estate in the MFC, as well as in the branches of Rosreestr, will cost 2,000 rubles. Fees are charged to verify data about the property, prepare documents, and enter information into databases.

Individuals and legal entities pay different amounts. So, when registering, for example, a garage, a person will pay two thousand. For the same object, the organization will have to contribute up to 22,000 rubles. The difference is very big, but the needs of the two sides are completely different.

The state fee for obtaining a foreign passport has increased in 2020. Now the innovations have not come into effect; a child under 14 years of age will have to apply for an old-style passport and pay a fee of 1,000 rubles, and adults - 2,000. New-style passports will be subject to a fee of 3,500 rubles for those who are already 14 years old, and 1,500 rubles for those who have not yet received a passport of a citizen of the Russian Federation.

How to pay the state fee - procedure

When paying the state fee for an extract from the Unified State Register, you need to find out the recipient’s details first. After this, you can choose a method. If you do not find out the details in advance, the proposed methods will lose their relevance.

When contacting a government agency in person, the applicant is given a payment receipt, which displays all the necessary details. You can make a payment at a terminal, ATM, or bank cash desk.

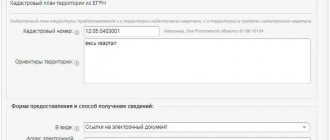

In order to understand how to pay the state fee for an extract from the Unified State Register, you need to determine which body (MFC or Rosreestr) the funds will be transferred to.

Then you need to choose a method of depositing money.

Payment is made in the following ways:

- Internet banking (if such a service is provided by the bank in which the applicant’s personal account is opened).

- Terminal.

- ATM.

- Bank.

At the time of submitting your request, you can use the service for ordering statements. The state fee is paid to the MFC for an extract from the Unified State Register, and a terminal is installed in government agencies. The subject can contact the MFC for a certificate and pay the fee there.

Details of popular state fees

Details of government agencies whose services can be offered at the MFC include different budget classification codes with basic payment data. Thus, errors may occur during payment. You will need to write an application to clarify the code incorrectly indicated on the receipt.

During the process of completing the application and documents, the registrar will provide payment details. If the applicant is officially recognized as low-income, he is exempt from payment.

In the multifunctional center you can issue a foreign passport; the state fee for it must be paid using the details containing KBK18810806000018003110 for citizens over 14 years of age and KBK 18810806000018005110 for children.

The remaining data for these two operations will be the same:

- INN – 7703037039;

- Checkpoint – 770301001;

- BIC – 044525000;

- Account 40101810845250010102.

Among the frequently requested services is the registration of ownership rights to real estate. The organization providing the service is Rosreestr, and the MFC acts only as an intermediary. Registration of rights is necessary for the party acquiring real estate after concluding a purchase and sale transaction, donation, exchange, investors in shared construction and other transactions.

Payment information for depositing funds when submitting documents to the MFC must contain KBK 32110807020018000110, which differs from the code entered during registration in Rosreestr.

Payment of the state fee for registering ownership of an apartment is carried out using the same details. The recipient of the payment will always be the Moscow division of the Federal Criminal Code of the Russian Federation. The recipient's TIN is 7727270299, it is universal data. Using it, you can find Rosreestr among other organizations in the drop-down list. Also, among the details:

- BIC of the main department of the Bank of Russia for the Central Federal District: 044525000;

- Checkpoint: 502401001;

- account 40101810845250010102.

To complete the procedure for the applicant to submit documents for state registration, the registrar must submit a document confirming payment. A check or printed receipt is enough for this. An MFC employee does not have the right to refuse to accept documents if they do not have the bank’s seals.

Applications for registration of rights to the MFC can only be submitted in person; payment details will be provided by a center employee upon application.

Registration of rights to real estate is an expensive service, so it is better not to rush into payment. Details for paying the state fee for registering property rights in 2020 through the MFC can be found on the State Services website. Here it is also possible to receive some services remotely, bypassing a trip to the department of the multifunctional center.

OKTMO is a classifier of municipal territories, and for each region its meaning will be different. You can find out what data you need to provide at your location using the service https://www.nalog.ru/rn36/service/oktmo/.

Important information when paying the state fee for registering real estate rights

State duty is a fee levied on individuals and legal entities when they apply to government agencies and local governments

, other bodies, for the commission of legally significant actions provided for by the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation).

Payers of the state duty can be both individuals and legal entities (Article 333.17 of the Tax Code of the Russian Federation).

More details

The payer of the state duty is obliged to independently fulfill the obligation to pay the fee (clauses 1 and 8 of Article 45 of the Tax Code of the Russian Federation).

If the payer of the state duty is unable to pay it independently, then he can make the payment through a legal or authorized representative (Clause 1 of Article 26 of the Tax Code of the Russian Federation). The powers of the representative must be documented (clause 3 of Article 26 of the Tax Code of the Russian Federation).

State fee for registration of rights

is charged in accordance with the legislation of the Russian Federation on taxes and fees (Article 17 of the Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate” (hereinafter referred to as the Registration Law)).

Implementation of state cadastral registration of real estate objects

is not subject to state duty.

Procedure for paying state duty. Details of payment of state duty for registration of rights to real estate

The state duty can be paid both in cash and in non-cash form (clause 3 of Article 333.18 of the Tax Code of the Russian Federation).

The fact of payment of the state duty is confirmed in one of the following ways:

- in non-cash form - by payment order with a bank mark;

- in cash - a receipt of the established form issued to the payer or by a bank, official or cash desk of the body to which the payment was made.

The fact of payment of the fee can be confirmed using the State Information System on State and Municipal Payments (GIS GMP) (Federal Law of July 27, 2010 No. 210-FZ “On the organization of the provision of state and municipal services”).

If there is information about the payment of the state duty contained in the GIS GMP, additional confirmation of payment is not required.

If the state registration of rights

Several payers applied at the same time, the state duty is paid by payers in equal shares (clause 2 of Article 333.18 of the Tax Code of the Russian Federation), with the exception of certain cases of registration of a share in the right of common shared ownership.

When registering a share in the right of common shared ownership arising by force of law (for example, during inheritance

) and carried out at the request of the owner, the state duty is paid by each of the owners in full.

If you have any questions, we can advise you

!

When submitting documents to Rosreestr, it is not necessary to provide documents confirming payment of the state duty along with an application for state registration of rights - the applicant can submit it on his own initiative. However, if the fact of payment of the state fee is not confirmed (i.e.

information on payment is not available in the GIS GMP or the document on payment was not submitted along with the application for state registration of rights), the documents required for state registration of rights are returned to the applicant without consideration after 5 calendar days from the date of filing the relevant application.

A notification of return is sent to the applicant by the registrar of Rosreestr within 3 working days (Article 25 of the Registration Law).

Details for paying the state fee for state registration of rights are available at the following links:

- for legal entities;

- for individuals.

Amounts of state duty for registration of rights to real estate

State duty amounts

for state registration of rights to real estate, Art. 333.33 of the Tax Code of the Russian Federation, if no benefits are established for performing the relevant registration actions.

Benefits for paying state fees for registering rights to real estate

Benefits for paying state fees for registration actions are established by Art. 333.35 Tax Code of the Russian Federation.

The following are exempt from paying state duty:

- Federal government bodies, government bodies of the constituent entities of the Russian Federation and local government bodies

; - The Central Bank of the Russian Federation in connection with its performance of the functions assigned to it by the legislation of the Russian Federation;

- individuals-veterans of the Great Patriotic War, disabled people of the Great Patriotic War, former prisoners of fascist concentration camps, ghettos and other places of forced detention created by the German fascists and their allies during the Second World War, former prisoners of war during the Great Patriotic War (the basis for providing benefits is certificate of the established form);

- individuals recognized as low-income in accordance with the Housing Code of the Russian Federation

- for state registration of rights, contracts for the alienation

of real estate

, with the exception of state registration of restrictions (encumbrances) of rights to real estate (the basis for granting benefits is a document issued in the prescribed manner) ; - individuals - for state registration of ownership

of residential premises or shares in them, provided to them in exchange for vacated residential premises or shares in them in connection with the implementation of the housing renovation program in the city of Moscow.

The state fee is not paid in the following cases of state registration:

- for state registration of the right to operational management of real estate in state or municipal ownership;

- for state registration of the right to permanent (indefinite) use of land plots in state or municipal ownership;

- for making changes to the Unified State Register of Real Estate (USRN )

in case of changes in the legislation of the Russian Federation; - for making changes to the Unified State Register of Real Estate when the organization (body) for recording real estate objects submits updated data about the real estate object;

- for state registration of arrests, termination of arrests of real estate;

- for state registration of a mortgage

arising under the law, as well as for repayment of the

mortgage

; - for state registration of an agreement to change the contents of the mortgage, including making appropriate changes to the USRN records;

Source: https://vladeilegko.ru/situations/oplatit-gosudarstvennuyu-poshlinu-za-registratsiyu-/

Where can I pay the state fee?

Transfer of ownership requires payment of a state fee upon registration. The amount of tax will differ depending on the status of the owner. If the application is submitted by an individual, the state fee will cost 2,000 rubles. The cost of payment for legal entities is much higher - 22 thousand rubles.

If the change of owner is made through inheritance, then an additional 0.3% of the value indicated in the cadastral passport must be paid if the heir is a close relative. If the new owner is not a relative, the amount of the additional fee increases to 0.6%, but not more than 1 million rubles.

Registration of ownership rights to real estate in the MFC is carried out quickly and without delay. In case of an unreasonable refusal to issue an extract from the Unified State Register of Real Estate, it is necessary to challenge the decision of government agencies in court.

In order to legalize the right to a plot that belonged to you by right of ownership, you need to go through several instances. This will involve quite a bit of expense, where registration and collection of fees is not the biggest expense.

https://www.youtube.com/watch?v=ytdevru

It will not be possible to carry out these steps on your own; you need a competent specialist with the appropriate qualification certificate. A cadastral engineer most often operates within a company that has the appropriate license.

They coordinate boundaries, create plans, fix boundary signs on the ground, determine the area and prepare the necessary package of documents, which are sent to the relevant organizations.

It is there that, before registration, prepared documents and an application with a request to be registered with the cadastral registry are submitted.

How many?

In order to find out how much the state duty for registering a land plot will be, you need to look at the Rosreestr website. There information is always updated very quickly

. Rosreestr is the executive body for collecting and systematizing real estate objects and transactions with them in our country. It is this federal body that is engaged in the formation of a database in the Unified State Register of Real Estate.

Documents for registration of property rights are submitted through Rosreestr. They are processed and entered into the Unified State Register, from where a document is received - an extract from the Unified State Register.

The state fee for registering ownership of a land plot for individuals is 2,000 rubles, for legal entities - 22,000 rubles.

There is a separate state duty for registering vegetable garden lands, private plots, individual housing construction or land for a garage. According to Article 333.33 of the Tax Code of the Russian Federation (clause 1, subclause 24), the state duty in this case will be 350 rubles.

Registration of ownership of an apartment in the MFC: step-by-step instructions

The owner will be able to independently obtain a certificate of ownership of housing through the MFC following step-by-step instructions:

- You must first make an appointment at the MFC; this can be done remotely online or by phone, or in person. Read more here.

- Then collect the required list of documents.

- On the appointed day and time, you must attend an appointment with the registrar of the multifunctional center and, under his supervision, fill out an application for registration of the object with the state cadastral register.

- At the terminal, pay the state registration fee. You can pay in advance. Receipt forms with details for individuals in Moscow and the Moscow region (only when submitting an application through the MFC. In case of contacting Rosreestr KBK, the forms must be changed to 32110807020011000110).

- The applicant will receive a receipt indicating that the papers have been accepted. By the number of this paper you can track the readiness of the certificate.

The procedure for registering ownership rights to real estate and liability for non-compliance with requirements is established by Federal Law No. 218-FZ of July 13, 2015.