Mortgage conditions without down payment

For a “mortgage without a down payment,” some banks often issue an ordinary consumer loan secured by real estate, not purchased, but existing, and the rate can easily exceed 15% per annum, comments commercial director of Seven Suns Development Anton Barulin . In addition, the value of the collateral property should not be less than the amount of the loan issued. Therefore, you will need to prove to the bank, especially if you have a secondary home, that in the worst case scenario they can actually sell it and get their money back. Confirmation is usually an appraiser's report, for which the owner - you - will have to pay.

Another guarantor of collateral can be a plot of land, a car, precious metals, or securities. But each such asset must be highly liquid and attractive to the bank in the event of its sale.

What is a down payment?

Every person understands perfectly well that a mortgage is the main source of income for any banking organization. It is the real estate loan that allows banking companies to flourish. This is due to the high interest rate and large loan amount.

Nobody wants to take out a mortgage because paying a large amount every month is a very difficult task that requires a high level of earnings, as well as a permanent job. This is a big responsibility that is difficult to bear for a long time.

However, it is almost impossible for a person with an average income to purchase their own real estate through independent efforts. It is this fact that increases the need for obtaining a loan from a banking organization.

Before you sign a loan agreement, you need to choose a banking organization to which you will entrust your financial resources. It is important to find a bank that guarantees you compliance with all rules generally established by law.

Sberbank is an ideal option for every person who is going to take out a mortgage agreement for themselves. Over the many years of its existence, Sberbank of the Russian Federation has proven its constancy. He guarantees his clients stability and security.

Before applying for a loan, you need to find out all the nuances of obtaining a mortgage. Perhaps there is something that doesn’t suit you in the rules for drawing up a loan agreement. Find out the period for which the bank is willing to issue you a loan, as well as the interest rate that affects the lost funds.

After you have eliminated all the gaps in your knowledge about mortgages, start collecting a package of documents that must be presented to the banking organization in order to receive a positive response to receiving a loan agreement from Sberbank of the Russian Federation.

A down payment is an integral part of the mortgage process. Sometimes it is this contribution that prevents people from agreeing to get a mortgage. This is due to the fact that they do not have the necessary amount of money required by the banking organization.

The down payment is created to ensure that the bank is convinced of the person’s solvency. To understand that a person has funds that allow him to pay his mortgage debt for a long time and on time.

Down payment is the amount that must be paid to the banking organization before obtaining a mortgage. It is calculated based on the amount that a person must receive from the bank for the purchase or construction of housing. You must provide documents indicating the exact amount required to improve your living conditions.

Special requirements

Due to existing risks, banks are placing increased demands on borrowers who want to get a mortgage without a down payment. Thus, it is necessary to have a stable income, which is confirmed by a 2-NDFL certificate from the place of work. Individual entrepreneurs and business owners are unlikely to be able to get approval for such a loan, notes Andrey Kolochinsky.

Also, to obtain this mortgage, it is important to have an ideal credit history for the last 10 years. “You must have closed loans without arrears in amounts from 500 thousand rubles and there must be no loans from microfinance organizations or frequent requests for them. Close attention will also be paid to the number of loans (if any) during the period of consideration of the mortgage application and the number of dependents in the family,” says Andrey Kolpakov, executive director of the credit agency KM Center.

How to recover from the blacklist of banks?

To whom do banks give a mortgage for an apartment, and to whom do they refuse?

Features of obtaining a mortgage from a developer

When applying for a loan for residential real estate, it is important to know and take into account some points. The first thing you need to understand is that the loan terms from the developer are fixed. Be prepared to repay the loan in a short time.

Be careful if the developer offers too good terms. In such cases, there are usually many additional payments. When drawing up an agreement, carefully study the terms of the loan and check for any additional payments. Also find out the types of loan repayments. Contact only trusted developers at the early stage of construction!

In St. Petersburg and Kazan, mortgages without a down payment from the developer are very common, which is why they attract many scammers. Often, scammers offer to buy apartments in a building under construction, under the guise of cooperation with the developer. Carefully check the documents and study them for compliance with the laws of the Russian Federation. Before concluding an agreement, look at the bank or developer’s website for information about intermediaries. Apply for a loan only with well-known and experienced construction companies.

If you have a government subsidy or simply show ingenuity, it is quite possible to get a mortgage without a down payment

Procedure and documents

The procedure for obtaining a mortgage without a down payment is no different from the procedure for obtaining a regular mortgage: selecting an object and bank - collecting documents - submitting an application - reviewing the application/approval - transaction and its closure. As for the necessary documents, there is also a standard package of papers (passport, certified copy of the work book, documents confirming marital status), to which are added a 2-NDFL certificate and documents for collateral housing. Most likely, you will need papers confirming ownership of this property, as well as a real estate appraisal report.

How to get a mortgage with a down payment

A down payment on a mortgage loan involves paying some of the funds as payment when purchasing an apartment. The missing funds are handled directly by the financial institution, that is, the bank. Depending on the credit institution, its value can range from 6 to 91%.

What is the source of the contribution? Usually these are the client's personal savings. If such funds are not available, then the money can be borrowed directly from a financial institution by first obtaining a loan.

In this situation, you must act extremely carefully. If a person first takes out a consumer loan, then he may well be denied a mortgage.

To avoid such a sad set of circumstances, you need to have high solvency, which will allow you to repay the finances for two loans at once. Financial institutions will issue the necessary funds without any particular difficulties if the loan repayment does not exceed 40% of the monthly income.

There are situations in which the property being purchased is valued lower than the price for which it is sold. Banking organizations issue loans exclusively as part of an official housing assessment. In this case, it will be impossible to do without an increased down payment.

There are also situations when a down payment is simply not needed. Banks make concessions and implement programs. It is through these programs that they are ready to provide 100% of the finance needed to purchase a home.

Here the question may arise: if a person does not have funds for a down payment, then where will the funds for monthly maintenance come from? The bank usually takes on a significant risk of non-repayment of the loan issued. Therefore, interest rates on mortgages without a down payment are some percentage higher than with one.

On the other hand, making a contribution solves the issue of saving on a mortgage loan.

The more the borrower contributes at the beginning, the less money he will have to pay later. This factor also allows you to increase your chances of getting a mortgage loan and makes it possible to get significantly favorable lending conditions.

A number of banks offer mortgage deposits. They are designed to store the down payment during the period of paperwork for the loan.

Typically, the process of preparing documents takes approximately 3 months. It is recommended to place your funds in this account and increase the contribution by a certain percentage.

"Tricky move

In the absence of savings for a down payment, some people, in order to avoid taking out a mortgage at an inflated rate, take out a consumer loan. However, the rates on it are also high, and the loan period is limited. “If the bank comes to the conclusion that the borrower will not be able to service two loans at the same time, the likelihood of being denied a mortgage is very high,” comments Andrei Kolochinsky.

The main thing about maternity capital for buying a home

Matkapital in 2020

How is it happening?

For the bank to approve a mortgage, it is not enough just to express a desire to purchase real estate at the stated price. A financial institution, when considering an application from a potential borrower, requires a report on the assessment of the property, compiled by independent experts and containing comprehensive information about the property, from the infrastructure of the area to the condition of the housing.

Inflating the price when buying an apartment with a mortgage is only possible if the buyer agrees with the seller. After this, the contract specifies the “required” cost of the property, and the excess amount is indicated as already transferred to the property owner as an advance. To better understand the principle of the scheme, it is necessary to consider it using an example:

- The apartment is sold for approximately 1 million rubles and if it is purchased using a mortgage loan, you must make an initial payment (20% of the price) - 200 thousand rubles.

- The buyer agrees with the owner that the deposit has already been transferred to him, about which a corresponding receipt is drawn up (advance agreement). It must be written correctly, since if there are errors, the bank may suspect overstatement.

- The advance agreement is submitted to the financial institution as evidence that the borrower has the funds for the down payment on the mortgage.

- Next, the bank issues a loan that should cover the “starting” amount, although in fact the buyer does not transfer anything to the seller.

State support programs

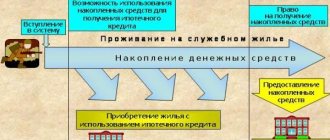

Another maneuver for obtaining a mortgage without a “down payment” can be called situations in which the bank’s requirements are met with the help of government support, for example, by raising funds under the “Young Family” program or maternity capital. “On the one hand, this is not a zero-payment mortgage. On the other hand, the client minimizes the amount of his own invested funds. The same thing happens with the mechanism of military mortgages. Both the initial contribution and payments are formed from funds received into the serviceman’s individual account,” says Natalia Kuznetsova, General Director of the BON TON Academy of Sciences.

Which is more profitable?

The advantages of lending without a down payment or with a minimum investment: there is no need to save for years to buy your own apartment. If you have maternity capital or are a participant in the Young Family bonus program, the borrower enjoys additional trust from the bank and will not have to mortgage additional real estate or provide guarantees from third parties.

The disadvantages are high monthly payments and a limited selection of properties.

Important! The “Young Family” mortgage is the most radical. The interest rate is as high as possible; the number of certificates and supporting documents is enormous; the overpayment to the bank can sometimes reach 90% of the amount taken.

Advantages of a mortgage with a 10 percent down payment: employees of the public sector, municipal and state organizations who do not have their own apartment or house, as well as citizens registered as needing improved housing conditions can become a borrower on favorable terms. The larger the client's deposit, the lower the interest rate.

Disadvantages: with a 10% investment, lenders will require all kinds of certificates confirming income and take collateral. According to bank statistics, loans with a down payment of 0 to 10% are the lowest quality. Their registration is the most labor-intensive for clients and does not always lead to approval.

Read about whether a down payment is needed at all and what its percentage of the total amount should be in a separate article.