Why is it difficult to get a mortgage secured by land?

The main criterion for banks is the liquidity of land plots. Many lands are not suitable for the strict selection of banks for mortgages. It is believed that the plots will be difficult to sell, and therefore the borrower is refused.

Financial institutions that offer not only a plot of land for a mortgage, but also the further construction of a country house, including for year-round use, are more willing to make a deal. It is registered as collateral by concluding an agreement with a construction company that will carry out all the work.

Many sites are located at a great distance from the city, which is why they are a priori considered low-liquidity. It is better that the land is located just a few kilometers from a large city, such as Moscow, St. Petersburg, or Yekaterinburg. Then lenders will be interested in the property, since the regions are constantly developing, there is an influx of population, even once-empty areas of the Moscow region are being built up, etc.

Mortgage collateral

As collateral, the bank can consider the real estate that will be built or is already located on a plot of land. If the property is of economic interest and has a certain value, then the bank will accept such collateral. But if there is a dilapidated country house on the property being purchased, then you should not count on using it as collateral.

In the case of collateral of real estate on a land plot, the bank can make a decision much faster and reduce the interest rate.

Mandatory requirements for a land plot with and without a house

Basic requirements for pledging a plot and house in a bank:

- The plot the borrower likes must belong to the territories of populated areas. The land should not belong to urban areas: parks, squares, forests adjacent to the reservoir, environmental protection zones, squares.

- It is necessary to have permission to use the land for individual housing construction.

- A short distance from the city, no more than 30 km. For Moscow, the maximum distance is 100 km.

If agricultural land is mortgaged, then the type of permitted construction must be - dacha construction. Previously, financial institutions did not work with this type of loan at all, but now large lenders have such programs.

A house subject to a mortgage must have access roads and a road. It is necessary to have communications for individual housing construction: water supply, sewerage, electricity, heating. Lenders do not accept dilapidated housing with more than 65% wear and tear.

What is the difference between a mortgage on a land plot?

A mortgage is a targeted collateral loan. Banks issue it for the purchase of a specific property, secured by security. In 90% of cases, the collateral is the purchased object; in other cases, money is issued against the borrower’s own property. An object pledged to the bank can be used for its intended purpose, but without the right to sell, donate, exchange, etc. All major changes (reconstruction, redevelopment) are agreed upon with the pledgee.

A mortgage is issued with a down payment - this is one of the lenders’ conditions that reduce the risk of non-repayment. The more of your own funds the borrower invests in the transaction, the greater the guarantee for mortgage approval at favorable rates. And if, in cases where apartments are pledged, banks receive “hard” collateral, liquid and having a market price, then the valuation of land plots requires a special approach.

Banks are extremely reluctant to issue a mortgage on a plot of land without a building. Lenders see high risks in such transactions and, accordingly, put up their own barriers by limiting the amount, demanding an increased initial payment, etc. There is also a list of strict requirements for the quality of the collateral itself.

Requirements for the land plot pledged as collateral

The basis for approval of any mortgage transaction is the liquidity of the collateral. The bank evaluates the property from the perspective of its market value. For example, a plot of land with communications in the city has a higher value than a plot in the suburbs.

Here is a list of the main requirements for the collateral:

- intended use . The site must be located on an area intended for residential development. Banks do not accept land for dacha construction or sowing crops as collateral due to the complexity of registering it for individual housing construction;

- location . Banks consider the optimal option for lending to be the purchase of urban land plots or those located no more than 100 km from the city. In this case, the site must be located in a residential area. Land in environmental complexes (or reserves) is almost impossible to pledge for a loan;

- communications and infrastructure . There are good chances of getting a loan for a plot of land equipped with communications: sewerage, electricity, gas, etc. The value of the property (and, accordingly, the loan amount) will increase if there is a transport route next to the plot of land, providing constant access to the plot;

- size . You can take out a mortgage loan to purchase plots from 4 to 30 acres. If a larger plot of land is purchased, the borrower will have to prove its intended use (for the construction of a residential building) and the absence of a commercial component. In other words, the bank will not issue a loan for the purchase of a large plot of land, suspecting the borrower’s desire to use the plot for business.

The procedure for a mortgage on a land plot

The specifics of a mortgage on a plot of land and the construction of a house also determine the procedure for registration. Not all banks work with such collateral, so the borrower must first decide on the choice of lender.

Let's look at the stages of getting a mortgage:

- choice of bank . Sberbank, VTB, Gazprombank and other large structures provide citizens with mortgages for the purchase of land. The borrower needs to analyze the offers and choose a bank according to his preferences. Bank ratings, expert advice and user reviews will help you assess the reliability of the structure and terms of the loan;

- program selection . At this stage, you need to evaluate the conditions of the program and your capabilities. For example, if the borrower plans to repay the mortgage with a mother’s certificate, you need to obtain the bank’s consent, etc.;

- site selection and assessment . Specialists will help you select a land plot and evaluate its technical and market parameters. The appraisal company may be recommended by the bank;

- application to the bank and collection of documents . At this stage, the borrower prepares a complete set of documents about his financial situation and the condition of the purchased property. If there is a building on the acquired plot or a foundation has been laid, a technical passport for a residential building, a cadastral plan, etc. will be required;

- agreeing on terms and signing a contract . The bank calculates the loan amount and tariffs based on an audit of all documents. After agreeing on all parameters, the borrower signs the agreement and makes the first payment;

- registration of certificate and transfer of collateral . The final stage is obtaining a certificate of ownership of the plot and registering a mortgage.

The borrower goes through most of the stages with the assistance of banking specialists. The credit manager accompanying the transaction will help in filling out the application, ordering an assessment, and choosing an insurer. In addition, the bank will give advice on special conditions: is it possible for a young family or the holder of a maternal certificate to take out a loan for a plot, etc.

Read on to find out which banks are issuing loans for land plots and construction today.

Bank mortgage programs with land as collateral

A mortgage secured by a house with a land plot or secured only by a land plot can be issued in the following banks:

- Sberbank;

- Rosselkhozbank;

- Zapsibkombank;

- Kuban credit;

- Kaluga.

Sberbank

There are few offers, but Sberbank alone is located in almost every city, excluding the Crimea Peninsula. Now, more about the conditions of lenders for programs with a pledge of land or land with a house/for its construction.

Sberbank offers mortgages under the following conditions:

- Interest rate from 9.2%.

- Advance from personal funds in the amount of at least 25% of the cost of housing.

- The minimum loan size is 0.3 million rubles.

- They give out no more than 75% of the cost.

The maximum mortgage repayment period is 30 years. There are no fees for processing the application, issuing funds, or supporting the loan.

Rosselkhozbank

RSHB has a program under which you can purchase a house with a plot or just a plot of land as collateral. You can pay off a loan not only in differentiated payments, but also in equal amounts.

Mortgage loan terms:

- loan amount from 100 thousand rubles;

- maximum amount 20 million rubles;

- initial payment of at least 10% of the value of the property;

- repayment up to 30 years.

No commissions are taken. The application is processed in 5 working days or less. Bank rates differ by customer category and loan amount. The higher the amount, the lower the rate.

Zapsimcombank

At Zapsibkombank, a person can purchase only a plot of land or the right to lease it as collateral. The bank even insures a plot of land against earthquakes, floods, and rising groundwater levels.

Other mortgage terms:

- The minimum loan amount is unlimited.

- The maximum loan amount is no more than 85% of the land value.

- Mortgage repayment up to 30 years.

- Repayment scheme - equal payments.

Kuban credit

The program at Kuban Credit Bank is intended for the purchase of a house with a land plot as collateral or the acquisition of a plot for building a house on it. A plot of land can be purchased in the city of Krasnodar if the borrower intends to build.

What the lender offers:

- loan rate from 8.99% per annum;

- Advance from own funds from 20%;

- the loan amount has no restrictions and depends on the client’s solvency;

- repayment from one to thirty years.

If the client makes an advance payment on the mortgage of more than 30%, he will be able to apply for a loan with only two documents: a passport and a second identity card.

Bank Kaluga

Kaluga Bank offers loans for the purchase of country houses and land plots. The loan amount is calculated by the company individually depending on the solvency and credit history of the client.

What is included in the mortgage program:

- Debt payment up to 20 years.

- The minimum loan rate is 10.5%, the maximum rate is 16.5% per annum.

- An initial payment of at least 25% of the value of the real estate.

The bank may take additional collateral instead of the initial payment. Its cost must be no less than the minimum amount of the initial payment.

There is early repayment of the mortgage at any time. The loan is issued without commissions. The repayment scheme to choose from is an annuity or a differentiated system.

What are the terms of receipt?

In order to obtain a land mortgage, you must meet certain requirements of the banking organization that provides this opportunity.

They are due to the fact that the company must protect itself in the event that the borrower is unable, for some reason, to fulfill its obligations, which relate primarily to payments.

Is it possible to get a mortgage without a down payment? Requirements for the borrower and land plot

In most cases, banks impose the following requirements on the borrower:

a certain level of income, which is most often higher than the required financial resources to obtain a home mortgage;- the possibility of making a down payment amounting to more than 20 percent of the total cost of the plot (it definitely won’t work without it);

- loan term from 10 to 25 years;

- lending at interest rates exceeding 13-20 percent per annum.

Among the land requirements, banking experts highlight the following important aspects:

- remoteness from the city at a certain distance, which most often is at least 30 kilometers (there are exceptions to this rule);

- lack of land in the reserve, industrial, military and water protection zones, as well as in the territory of nature reserves and wildlife sanctuaries;

- the presence of a land plot in private rather than municipal ownership;

- the absence of any encumbrance relating to the site;

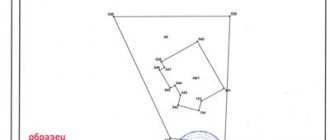

- availability of a site plan with a clear indication of its boundaries;

- plot area from 6 to 50 acres;

- the presence of certain communications connected to the site, such as gas, electricity, sewerage, etc.

IMPORTANT: All of the above requirements may vary slightly depending on the loyalty policy of the bank itself. However, most of them are standard and change only in fairly rare cases.

Necessary documents for making a purchase on credit

In order to obtain a land mortgage, a certain list of documents is required that the borrower must collect to submit to the banking institution. These include:

a special loan application written directly to the bank;- passport of the borrower and his spouse;

- a certificate from the Tax Administration confirming the availability of the identification code of the borrower and his spouse;

- a certificate from the place of employment confirming the duration of work (at least 6 months), as well as a certain level of salary, taking into account all deductions, if any;

- employment history;

- copies of documents for other property in the form of real estate or motor vehicles to confirm the level of solvency of the borrower.

As for the land plot itself, it is necessary to provide the bank with a state-issued certificate of ownership, as well as a corresponding certificate assessing the standard value of the land and the absence of easements.

The need for collateral and a guarantor

Most banks require a guarantor, which is why you need to be prepared at this point when applying for a land mortgage.

Collateral in this case is also quite important, since such transactions are extremely risky for banking institutions.

This is due to the low liquidity of land outside the city. There must be a collateral and a guarantor if a person intends to take out a land mortgage. But this condition directly depends on the bank’s policy and its trust in its own clients.

Why can banks refuse a mortgage even with land as collateral?

There are several reasons why banks refuse loans with collateral. The land and house may be liquid, but the lender will still refuse.

The list of reasons includes:

- non-compliance with the creditor's requirements;

- insolvency of collateral;

- low client income;

- damaged credit history;

- high percentage of loan defaults in the industry in which the borrower is employed;

- False information was provided: inflated salary, non-existent employing organization, etc.

Now more about each reason. Non-compliance with the lender's requirements may be expressed in age, citizenship, or work experience. If the bank requires six months of work experience, and the borrower has 5 months of experience in the last place, you should just wait and re-apply.

A collateral failure means that the property is worth less than the amount the borrower is asking to borrow from the bank. The bank will not be able to approve the loan and will offer a smaller loan.

Low income is not only the size of the salary, but also the loan burden, the number of dependents that the borrower provides financially. In addition to the listed factors, the financial institution takes into account obligations to pay alimony, the limit of credit cards, even if they are not used.

A damaged credit history also includes a set of parameters: the presence of debts, the number of overdue payments, whether there are signs of default, how many loans are in service, how many applications the person has submitted. The CI reflects the credit rating. If it is not enough, the bank will refuse.

The high percentage of refusals in the industry may not be disclosed by the bank in any way. Lenders keep their own statistics and have the right not to disclose the reasons for refusals. If there is a decline in income or a collapse in some industry, then borrowers may be denied a loan, since they will also suffer financial losses in the future, may lose their jobs, and the lender does not want to take risks.

Providing false information results in the person being blacklisted. In the future, other banks may refuse the borrower.

Today, lenders carefully check the identity of the applicant - his employment, criminal record, fines, payment of utilities. There is no need to deceive the lender. If an error is found in the loan application, the borrower will simply return the application and be asked to correct the inaccuracies. Once corrected, you can apply for a mortgage again.

How to increase your chances of getting a mortgage with a plot of land or a house as collateral

First of all, you need to disclose the maximum number of sources of income or attract guarantors. But if the borrower wants to apply for a loan as profitably as possible without the help of guarantors, he can turn to ]dom-bydet.ru.[/anchor]

What does a mortgage broker offer:

- you can apply for a loan even if you have a damaged credit history, but there should be no open arrears;

- interest rate from 7.5% per annum on shares, base rate from 8.7% per annum;

- no down payment;

- minimum loan size 0.5 million rubles;

- maximum loan size 120 million rubles;

- mortgage repayment from one to thirty years;

- You can apply for a loan for those who have unofficial income or work experience of just one month.

To apply for a mortgage, the borrower must have Russian citizenship, permanent or temporary registration in the Russian Federation. You can make maternity capital as a down payment.

Important! Land or a house with land must be located in Moscow, Moscow region, St. Petersburg or Leningrad region.

Loan approval can be obtained on the day of application. Early repayment of the loan without penalties is provided. The company can consider the total income of a family, up to 3 co-borrowers.

Features of a land mortgage

To get approval for the required amount, you need to know the differences between mortgages for the purchase of land.

This type of loan differs from loans for residential real estate, since the object of purchase is less liquid than an apartment or house. As a result, interest rates in such transactions are higher and there are more requirements for the client.

The main features of land mortgages are the following:

- Territory status. You can borrow money from a financial institution only on the security of land intended for individual residential construction or located in gardening and dacha cooperatives.

- Buildings for any purpose can be placed on the site, unless otherwise stated in the contract. However, the lender, as the holder of the mortgage, has rights not only to the land, but also to all buildings.

- In case of violation of the terms of the agreement, the bank has the right to evict third parties living in a house built on the territory of the acquired plot.

In addition, it is difficult to register shared ownership with such a mortgage transaction.

What will be required from the borrower

Requirements for a mortgage loan secured by land:

- Having Russian citizenship.

- Must be at least 21 years of age and not more than 75 years of age at maturity. In a number of banks up to 65-70 years, and the minimum age is from 20-25 years.

- Work experience in the last place from 3-6 months.

- General work experience, for the last 5-6 years, at least one year.

When attracting co-borrowers to a transaction, similar requirements are put forward to them. Among the large banks there are companies that provide loans to foreign citizens. These are Rosbank, VTB, Raiffeisenbank. But VTB does not have a program for purchasing a plot of land on collateral.

To obtain a mortgage, you must have permanent or temporary registration in the Russian Federation. Co-borrowers can participate in the transaction up to 65 years of age at the time of loan repayment. Some banks require registration in the region where the application is submitted, as well as residence in this region. The requirement applies to regional banks that do not have offices throughout Russia.