Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (St. Petersburg) It's fast and free!

Cadastral value is a special value determined by an engineer after carrying out appropriate measurements of the site and assessing a specific territory.

The specialist must take into account the location of the land, its category and purpose of use, general condition, after which the information obtained is entered into the unified data register of the State Property Committee.

To reduce the size of this value, it is necessary to challenge the results of the assessment or the cadastral error committed, and then carry out a recalculation.

Is it possible to reduce the cadastral value of an object?

Local authorities establish a standard for the average cost of plots according to the cadastre, located within a certain municipality.

The cost of the territory according to the cadastre is necessary in the following cases:

- when calculating the amount of land tax collection;

- to determine the amount required to be paid when renting a plot;

- to clarify the value of real estate during its alienation or redemption from state ownership.

When calculating this value, the engineer carrying out the corresponding assessment, state or municipal bodies entering information about the site into a single database of the State Property Committee, are capable of making an error (technical or cadastral).

In this case, information about the price of land will be indicated incorrectly in the documents. This is a good reason to recalculate the value of real estate.

Definition of concepts

In 2020, the cadastral value is considered to be the price established by government authorities, which fully reflects the usefulness of specific territorial plots with constant use. In other words, this indicator is a public analogue of the market price, on the basis of which the tax rate for the cadastre, redemption value and other payments are determined.

It is worth noting that each land holding, immediately after registration in the unified state register, receives an individual cadastral number, on the basis of which the assessment procedure can be carried out.

The cost under consideration acts as a fundamental criterion that determines the economic efficiency of using plots, as well as all costs incurred for their stable maintenance.

What does the indicator affect?

The following categories of persons may be interested in obtaining information about the current cadastral value:

- land owners;

- tenants;

- users of municipal plots.

It is worth noting that the size of the land tax directly depends on this indicator.

Among other things, information about this cost is used to solve the following problems:

- establishing a minimum value within the tax collection;

- determining the lowest cost of redemption from a state or municipal fund;

- calculation of actual rental payments;

- formation of the lowest tax on organizational real estate;

- implementation of other goals - for example, this is relevant in situations where the direct owner has a clear interest in increasing the cadastral value of the property, especially for legal proceedings regarding the determination of rights to land plots.

It is worth noting that some categories of citizens can count on certain benefits that significantly reduce the cost according to the cadastre.

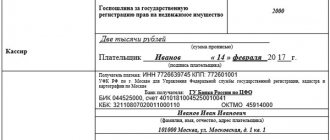

Sample certificate of cadastral value of land

How to reduce the cadastral value of a land plot?

A cadastral valuation carried out by an authorized specialist must be carried out at least once every five years.

If an error is discovered that affects the value of the property according to the cadastre, a citizen may demand a recalculation.

This can be done in 2 ways:

- administratively (by contacting Rosreestr directly);

- in a judicial (compulsory) manner.

The basis for applying to the court or Rosreestr is the discovery by an interested party of an error in the cadastral documentation or determination of the presence of unreliable information used at the time of the assessment.

Where to go first (to court or Rosreestr) depends on the citizen’s decision. The law does not prohibit filing a claim without first attempting to resolve the conflict peacefully.

How to reduce it yourself

Contacting the territorial commission

The pre-trial procedure for considering a case in the territorial commission of Rosreestr includes several additional stages.

The first step is to independently collect the package of documents established by law :

- passport or other identification document (if renting);

- completed application for review of results;

- an extract from the Unified State Register of Real Estate about the cost of the plot;

- a copy of a document certified by a notary indicating the existence of ownership rights (certificate or full extract from the Unified State Register of Real Estate) or possession and use (lease agreement);

- report on establishing market value;

- positive conclusion of independent appraisers based on the report (if an examination was carried out).

Additionally, other evidence is presented to support the citizen’s arguments.

The applicant has the right to use any documents, but it is recommended to attach only papers that directly or indirectly support the arguments.

The collected package of documents is submitted to the regional commission for the consideration of disputes regarding cadastral value.

The application is considered without the participation of the citizen at a commission meeting .

If the result is positive, a decision is made on the basis of which the cadastral value is equal to the market value; if the result is negative, a reasoned refusal is made with an explanation of the right of judicial appeal.

To court

Citizens-right holders have the right to begin proceedings in judicial authorities, bypassing the pre-trial stage. The package of documents provided for applying to the Rossreestr commission is retained, but additional papers are added :

- a notice indicating that a copy of the statement of claim has been served on other persons participating in the case;

- receipt of payment of state duty (300 rubles).

The statement of claim is submitted together with the mentioned documentation to the court of the subject. After checking the submitted package of documents, the court accepts the case for proceedings, involving the relevant department of Rosreestr as a defendant.

The outcome of the case depends on the evidence of the plaintiff , so the applicant is recommended to attach additional documents.

Arbitration courts have not considered this category of cases since 2015 after the adoption of the CAS RF.

Appealing the commission's refusal does not differ significantly in the procedure and the attached documentation. The content of the statement of claim is changed, and a reasoned refusal by the authority is attached. In addition to equalizing the cost, a court decision will lead to the recognition of the commission’s refusal as illegal

How to reduce the cadastral value of a land plot yourself without the participation of the court?

How and where to find out the cadastral value of a property - read here.

Registration of ownership of a garage in a garage cooperative is a detailed procedure.

How to quickly save up for an apartment without a mortgage?

A commission specially created by Rosreestr deals with cases of revising the value of certain plots.

If five years have not passed since the last assessment, the citizen has the right to draw up the text of an application with a request to review its results or to correct a technical error.

In addition, the commission must provide:

- a certificate of the value of the plot according to the cadastre;

- applicant's passport;

- title papers for the object and/or extract from the Unified State Register;

- documents confirming the presence of an error (for example, the conclusion of an independent specialist).

The citizen’s application must be considered by the authorized commission within 30 calendar days. After this, the applicant is provided with a written response from the state authority (in case of refusal, the decision must be justified, then the citizen will be able to challenge the conclusion in court).

If the decision is made in favor of the applicant, the commission undertakes to notify Rosreestr and the Cadastral Chamber of a revision of the cost of the site. As a result of recalculation, a citizen can achieve a significant reduction in this value.

Changes in the cadastral value of land in 2017

In December 2020, there was a sudden and surprising recalculation of the cadastral value of land plots, namely, an increase in price by hundreds and thousands of times.

It would seem that you need to rejoice, the land has become more expensive, and therefore it is more profitable to own it. But it's not that simple. If, for example, in November 2020 the cadastral value of the plot was 100,000 rubles, then in December it increased to 15 million rubles! But the characteristics of the site did not change, but, as often happens with us, they deteriorated - the fields were overgrown, the buildings collapsed, the roads became muddy.

Also, an important point is that no one from the cadastral service comes to evaluate the site. Hectares of land of approximately the same area, but of different location and quality of land (near a highway, near a reservoir, in impenetrable forest thickets, with and without power lines) began to cost the same, all 15 million.

Why has the cadastral value of a land plot increased?

Typically, the market reacts sharply to demand indicators by increasing prices. For example, one factor may be an increase in the number of announcements for the construction of new houses

. Market value directly affects cadastral indicators, depending on which, in turn, the amounts of tax collections are formed.

The cadastral value is the average price that can be offered by a buyer for a specific territorial plot. Re-evaluation of indicators is carried out once every 5 years.

Specific federal subjects independently make a competent decision on conducting an assessment procedure for assessing the cadastre, after which representatives of the territorial branch of Rosreestr are engaged in filling out lists of registered lands.

After this, the state register involves third-party assessment institutions that have the appropriate clearance in the process. Employees of such organizations determine the specific indicators of the cost under consideration.

It is the resulting parameters that are the average cost for each square meter. In addition, the final amount is directly affected by the type of permitted use of the territory, for example, individual construction.

In fact, the operation to determine the new cadastral value is carried out not by municipal authorities, but by representative offices of the federal regulatory agency.

Each interested party can easily become familiar with the current value of their own plot of land. This can be done online by going to the official website of Rosreestr and entering the land cadastral number there.

Changes in legislation

Many citizens of the Russian Federation are interested in the pressing question of why the cadastral value of a land plot has increased. This problem is fully reflected in the current land legislation

. The amounts of rent and taxes collected upon the use of land depend on the cadastral value, which, in turn, has increased significantly in recent years.

The owners of territorial plots themselves, as well as municipal administrations, can change these indicators. The planned cadastral valuation procedure is carried out by government officials once every five years.

. For example, if the previous assessment was carried out in 2013, then the next change in the cadastral value will be carried out in 2020.

It is worth remembering that at the local level the assessment in question may be carried out somewhat more often.

Among the key reasons for initiating the procedure, it is worth highlighting the following:

- change in the actual footage of a land property as a result of merger or division;

- land surveying;

- change in the type of permitted use;

- introduction of a previously unfinished facility into official operation;

- changing the infrastructure in a specific area - this could be the construction of new transport interchanges, the opening of municipal institutions, etc.

Market indicators of land values change on an ongoing basis. This directly points to the fact that any related transactions can act as an objective basis for municipal authorities to initiate a re-assessment

. Based on the results of such measures, the increased amount of tax collection will be included in the next tax receipt.

As for land owners, they can carry out independent revaluation an unlimited number of times. After changing any land parameters, amendments must be included in the unified state register of cadastral provision.

Who installs

The cadastral value of land in each specific case is determined by the territorial authorities responsible for the cadastre. At the federal level, this is dealt with by the relevant chamber

.

The relevant organizations carry out their professional activities independently, without taking into account the notification of those persons who have the legal right to use the land

. A massive evaluation method is used.

The value according to the cadastre changes with some frequency in each federal subject - often this happens once every five years. Such an event is officially called a cadastral valuation

. The implementation of the relevant work is fully financed by the regional budget levels.

The following property is subject to assessment:

- territorial allotments;

- buildings;

- apartments;

- private houses and so on.

The result of the cadastral assessment is the development of a special resolution, which necessarily includes information about:

- categorical ownership of land;

- specific units of cost per individual square meter - such parameters are established taking into account the territorial affiliation of the plots;

- average values according to the cadastre within a separate municipality;

- on the date of application of the new cadastral valuation format.

It is worth noting that until the subsequent official change in value, its current value is valid legally, as a result of which it can be used to make a wide variety of calculations.