Disabled child: benefits for parents in 2020

Students with disabilities have the same rights when entering schools.

Depending on their health status, they can attend general and specialized school institutions. Financing of training and maintenance is carried out at the expense of the state and is determined by the Government of the Russian Federation. A parent accompanying a disabled child to a medical sanatorium, if he needs additional care (a certificate is issued by the attending physician), is provided with a sick leave certificate for the duration of treatment and travel.

Benefits for parents of disabled children in 2020

The fundamental document defining the foundations of the rights of children with disabilities at the international level is the Convention on the Rights of Persons with Disabilities adopted by the UN Assembly in 2006. On its basis, relevant legislative acts and bills are created in those states that have ratified the Convention. The general principles laid down in the Convention are to protect and ensure the equal and full enjoyment by children with disabilities of all fundamental human and civil rights and freedoms. Issues of rights and freedoms of disabled children are covered by Article 7 of the Convention.

The basis for the list of benefits provided to parents of disabled children, and, in fact, to children with disabilities themselves, is laid down in Federal Law 181 “On Social Protection of Disabled Persons in the Russian Federation,” which defines what rights a disabled child has and benefits to parents in 2020.

What benefits are available to parents of disabled children?

After this, the tax amount on your total monthly income will decrease significantly. Moreover, if the tax was withdrawn monthly in an amount greater than the minimum wage, about 70% of its amount will be returned to the parents. However, it is necessary to take into account that the rule applies only to one parent; this cannot be done for two.

Disabled children, according to current legislation, have the right to a 50% discount from October 1 to May 15 on travel by air, river, road and rail. The discount also applies to one parent with whom he is traveling.

Disabled child benefits for parents 2020: types of payments and methods of processing them

- if this person is a parent (biological or adoptive), then he is entitled to a deduction of 12,000 rubles;

- if this person is a legal guardian, then the amount of his deduction is 6,000 rubles.

A tax deduction can be provided for each disabled child in the family, provided that he has not yet reached the age of majority. The exception is when a child with a disability completes full-time education and graduate school/residency - in this case, the period is extended to twenty-four years.

How to determine the amount

Once an individual has a desire to return income taxes, he immediately wonders how to do this. The answer is quite simple - you need to fill out and collect the necessary package of documents, send it to the tax office and wait for the money to be credited. However, already at the first stage, many applicants for personal income tax refunds have difficulty calculating the amount of monetary compensation that must be indicated in the application and other types of documentation.

In order to correctly determine the amount by which the amount of income of an individual subject to mandatory tax levies in 2020 will decrease, it is necessary to take into account the degree of relationship with the disabled person that the applicant for the deduction is related to. There are several options for the size of tax discounts:

- 12,000 rubles - if the mother, father, wife or husband of one of the parents of a disabled person, as well as an individual who is an adoptive parent, wants to return personal income tax.

- 6,000 rubles – if the tax deduction is issued in the name of an individual who has guardianship or trusteeship of a child, as well as a person who has the status of an adoptive father or mother. The wife/husband of the adoptive parent also has the right to receive a tax discount on their income in the specified amount.

In some cases, tax legislation provides for the accrual of tax discounts in an increased amount - 12,000 rubles instead of 6,000 rubles and 24,000 rubles instead of 12,000 rubles. The following categories of people are eligible to take advantage of this increase:

- Individuals who are involved in raising and providing for a child with a disability status on their own. For example, a single father or mother.

- An individual who is equally responsible for a disabled person with another person who, in turn, decided to refuse the possibility of receiving a deduction and expressed the corresponding desire in writing. That is, if one parent does not receive a tax credit, then it rightfully goes to the other.

If a child is disabled, what personal income tax deduction is due for him is one of the main questions causing difficulty for applicants for such a tax discount. The amount of wages, taking into account personal income tax and deductions, is calculated quite trivially:

- We determine the amount by which the tax base is reduced. To do this, it is just enough to understand to what degree of relationship the applicant for a tax discount is related to the child. Let’s say, if this is the mother’s birth, then it is 12,000 rubles.

- We subtract the deduction amount from the monthly salary. If the mother of a disabled person earns 25,000 rubles a month, then subtracting 12,000 rubles, we get an amount equal to 13,000 rubles - this is the size of the tax base.

- We find 13% of the tax base. Dividing 13,000 rubles and multiplying by 13%, we get 1,690 rubles, which is the amount of income tax.

- We subtract the received personal income tax amount from the salary. After this operation, it turns out that the child’s mother will receive 23,310 rubles. And if she had not filed a deduction, she would have received 21,750 rubles.

We invite you to read: How a tax refund is made when purchasing an apartment with a mortgage

What benefits and payments are available to a disabled child and his parents in 2020?

Funds from maternity capital can be spent on the purchase of goods and payment for services aimed at the social adaptation and integration into society of a disabled child (any of the children in the family, and not the obligatory one who has given the right to a certificate), in the form of compensation for money already spent on this.

- From April 1, 2020, the amount of pension for disabled children is 12,681.09 rubles.

- Disabled people from childhood are paid the following amounts: 12,681.09 rubles. - with disability group I;

- RUB 10,567.73 - in group II;

- 5283.85 rub. - disabled people of group III.

Transport benefits for parents of disabled children in 2020

When applying for a pension payment, including for disability, the pension recipient is automatically assigned social benefits, such as a pass on public transport, free medicines from a closed list and vouchers to sanatorium-resort institutions. The cost of all benefits taken together is estimated at approximately 930 rubles (depending on the region). But the pensioner has the right to leave a statement of refusal of benefits to the USZN, thereby receiving the right to compensation in the amount of the cost of these preferences. That is, the pension of a disabled child will be increased by 930 rubles if the parents issue a waiver of benefits. In addition to the pension, parents will have the right to receive:

- Housing benefits (discount of half the cost of utilities, including telephone charges and contributions for major repairs).

- Educational benefits (extraordinary enrollment in kindergartens and free education in them, home curriculum for schoolchildren, preferential admission to universities, social scholarship).

- Medical benefits:

- free prescription medications;

- wheelchairs and other devices for social adaptation;

- prosthetics and orthopedic devices;

- a trip to a sanatorium or resort for annual wellness;

- voucher to a sanatorium-resort institution for an accompanying person.

- Social benefits:

- social payments;

- travel on public transport without payment;

- free medicines;

- obtaining an apartment in the first place;

- discounts on utility bills.

- Tax benefits (personal income tax deduction in the amount of 3 thousand rubles from the amount of monthly income on which income tax is paid).

- Transport benefits:

- travel without payment in any public transport of urban and suburban importance (not taxi);

- a discount in the amount of half the cost of a ticket for travel to a place of treatment, recovery, recreation (round-trip ticket on river, railway, air transport) in the period from October 1 to May 1, plus once a year at any other time;

- free travel to and from the place of treatment once a year;

- free travel to the place of treatment of the child for the parent who will accompany him;

- free travel on public transport within the region for parents of a disabled person (a certificate is issued at the local USZN).

We recommend reading: What benefits are available to regional labor veterans in Yaroslavl in 2020 2020

What tax benefits are there for a disabled child?

In addition to other preferences, the state and regions provide tax benefits for parents of disabled children. Such privileges can significantly reduce the financial burden of a family raising a child with disabilities who require careful ongoing care and financial costs.

Tax benefits for parents of disabled children under personal income tax (NDFL) A tax deduction for personal income tax is issued by the employer, and if two professions are combined, the deduction will be provided only by one of the employers. In relation to the payment of personal income tax on wages and other regular payments, only federal benefits - tax deductions - apply. The amount of the tax deduction will depend on the order in which children appear in the family and on the degree of relationship between the child and the parent:

- Tax deductions for the first child in a family are provided in the amount of 1.4 thousand.

We invite you to familiarize yourself with: Commission and agency agreement similarities

Here are some basic examples of paying taxes based on several popular regions:

- In the Republic of Crimea, disabled people of WWII groups 1 and 2, as well as people with limited ability to work, are exempt from paying transport taxes.

- The Ivanovo region is characterized by benefits for disabled people who have at their disposal a car with a power of up to 100 hp. They pay 50% of the total established amount of transport tax.

- Moscow tax legislation provides a benefit for only one vehicle with an engine power of 200 hp. If a family has several cars, a tax benefit can be applied for by choice, for example, on the most expensive car.

- In St. Petersburg, parents raising a child with limited physiological and mental capabilities may be exempt from paying taxes.

The time spent caring for such a disabled child is also counted as work experience. Providing benefits under labor legislation:

- Women with a disabled child under 16 years of age can receive a part-time work week or part-time work with payments in proportion to the time worked.

- It is prohibited to involve women with disabled children in additional work and send them on business trips without their permission.

- It is prohibited to refuse to hire such women or reduce their salaries on the basis of motives related to the presence of a disabled child.

- It is prohibited to dismiss mothers who have a disabled child in their care, except in the case of liquidation of the enterprise.

Housing benefits for families: Families who have disabled children in their care can apply for housing.

- If the child has reached 24 years of age and continues to study, the deduction stops from the beginning of the next year.

Property tax benefits for disabled children: For disabled people and families with disabled children, the state provides a discount of at least 50% on apartment rent (in municipal, state and public housing) and on utility bills (does not depend on accessories to the housing stock), and in houses without their own heating, from the price of fuel purchased within the normal range for sale to the public. This includes a 50% discount on telephone fees. Transport tax benefits for disabled children: Disabled child, his guardians and social workers.

Forbidden

articles:

- Labor benefits

- Early retirement

- Tax and housing benefits

- Care payments

- Procedure for applying for benefits

- The most popular questions and answers regarding benefits for parents of disabled children

- List of laws

- Samples of applications and forms

- Conclusion

A separate column of the state’s social work is support for disabled children.

In addition to cash benefits in the form of pensions, families with disabled children are entitled to a significant number of benefits, the main purpose of which is to create a comfortable life for this part of the population.

How to get an apartment for a disabled child in 2020

The Housing Code also provides for the right of priority receipt of housing for citizens (including disabled children) whose residential premises are duly recognized as unfit for habitation and cannot be repaired or reconstructed.

Disabled children belong to a group of people that is commonly called vulnerable. This position is based on the fact that children with disabilities need to live in certain conditions where it would be possible to fulfill their everyday needs with maximum convenience.

Benefits for disabled people of group 1

In addition, for the category of citizens and for the accompanying person, they are given the opportunity to travel free of charge to the resort and back if they have a voucher from social security; A citizen with a disability can continue his education. According to the law, this category can enter educational institutions on a non-competitive basis, after satisfactory passing of exams.

After the start of training, the student receives an increased scholarship; A person with group 1 disability by law enjoys free medical care.

This category of privileges includes preferential treatment for rehabilitation funds and free prosthetics.

How much does a group 3 disabled person earn in 2020?

The law of the Russian Federation states that all disabled people are granted various benefits and pensions. Disabled people of group III receive the smallest benefits. Of course, disabled people of group III have it the easiest time (compared to other disabled people), but this does not mean that they do not need additional financial support. Below we will look at how much they pay for the third group of disabilities in 2020 and what financial assistance is available to disabled people of the third group, and also touch on related issues.

- Monthly allowance for disabled people of group 3. They are entitled to a social pension. Its size is fixed and amounts to 4,215 rubles per month. However, you need to understand that a social pension is assigned only if a person does not have the right to receive a labor pension. In other words, a group 3 disabled person can work; in this case, subject to certain conditions, he can begin to receive a disability pension. The labor disability pension depends on many parameters - length of service, number of dependents, age, and so on, but its amount must be no less than 2,402 rubles per month.

- Cash benefits. Also, disabled people of group III are entitled to some cash benefits. The main benefit is the monthly cash payment (MCA). The monthly allowance for disabled people of group 3 in 2020 is 2,022 rubles per month. Also, people with disabilities are entitled to a set of social services (NSS), which consists of free medicines, treatment in a special type of sanitary resort institution, and so on. You need to understand that the cost of NSI is deducted from the EDV, but NSI can be completely or partially abandoned. There are other payments - a regional supplement to pensions for group 3 disabilities, cash assistance to disabled people who participated in the Second World War or were prisoners of concentration camps (DEMO), as well as various one-time payments to group 3 disabled people.

- Privileges. Now you know what the amount of payments will be for disabled people of group 3 in 2020, but disabled people are also entitled to benefits. The most popular benefit programs are the provision of technical equipment (prosthetics, wheelchairs, etc.) at discounts, partial payment of utilities at the expense of the state, and other benefits.

27.09.2020

Housing and communal services benefits for a disabled child

Advice from lawyers:

1. They do not provide benefits for housing and communal services to a disabled child due to debt.

1.1. Hello! As a general rule, social support measures in the form of compensation for housing and communal services expenses are provided in the absence of arrears in payment for housing, utilities, or contributions for major repairs, and the presence of debts may be grounds for suspension or termination of the provision of benefits, recognizes the RF Armed Forces. However, as stated in paragraph 47 of the resolution of the plenum of the Supreme Court dated June 27, 2020 No. 22, the mere presence of arrears in payment for housing and utilities cannot serve as an unconditional basis for refusal to provide social support measures. “When resolving disputes related to the provision of social support measures for paying for housing and utilities, the court must find out the reasons for the formation of this debt, the period of its formation, as well as what measures the citizen has taken to repay the debt. These circumstances must be reflected in the court decision,” the resolution says. The Supreme Court notes that if there are good reasons for the lack of payment for housing and communal services, the provision of social support measures cannot be refused. Such reasons may include non-payment of wages on time, the difficult financial situation of the tenant and capable members of his family due to their loss of work and inability to find employment, illness, hospitalization of the owner or members of his family, the presence of disabled people and minors in the family children, etc., explains the Armed Forces.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. What benefits does the family of a group 3 disabled child have for housing and communal services?

2.1. Benefit of 50% of the full cost of utilities in accordance with Art. 160 Housing Code of the Russian Federation.

Did the answer help you?YesNo

3. What benefits does a disabled person of group 2 have and if the child is disabled from paying for housing and communal services.

3.1. • Hello, In each region of Russia, benefits for people with disabilities are different, so find out your benefits from the social protection authorities. I wish you good luck and all the best!

Did the answer help you?YesNo

4. Is the income for benefits from 3 to 7 years included in the allowance for a disabled child to pay for housing and communal services in the amount of 50%?

4.1. The income is the child’s pension, but this benefit is not.

Did the answer help you?YesNo

5. I am a grandmother and guardian of a disabled child. Do benefits for housing and communal services apply to the guardian and the disabled child, or only to the disabled child?

5.1. Good evening! Benefits for utility services are provided for in Art. 29.2. and art. 17 181-FZ “On social protection of disabled people”. They can be received by the legal representative of a disabled child or the guardian of an incapacitated disabled person in the form of monetary compensation for paid utilities.

Did the answer help you?YesNo

6. I am a grandmother and guardian of a disabled child under 18 years of age. The child's mother, my daughter died, the father gave custody of the child to me. Free care. The child is registered and has been living in my apartment, in my family since birth. What benefits for paying for housing and communal services apply to me (the guardian) and the disabled child? And are we a family according to the law?

6.1. Survivor benefits, contact guardianship.

Did the answer help you?YesNo

6.2. The child receives a pension as a disabled child. Next, he needs to re-register his disability at the age of 18, where a pension will be assigned to him. You need to check with the social security organization what benefits for housing and communal services are provided in your situation. In our region, for example, you can apply for a subsidy for certain services and monthly monetary compensation for housing and communal services.

Did the answer help you?YesNo

7. I have a disabled child. In 2020, I submitted documents for housing and communal services benefits - 50%. In the Leningrad region. They charge me a maximum of 10% referring to the Social Code of the Leningrad Region. Is this legal?

7.1. Read this social code?

Did the answer help you?YesNo

8. Housing and communal services sent the debt to the bailiffs. To apply for benefits, I need debt restructuring. I have a disabled child and I don’t work. Raising a child alone. Housing and communal services were not provided. Such restructuring can be achieved through the bailiffs.

8.1. Bailiffs are not a judicial body. Everything can be resolved only in court because... there is a court decision. And the maximum that the court will award you is payment in installments. Restructuring is no longer possible here.

Did the answer help you?YesNo

9. Does a bailiff have the right to seize a nominal account and write off funds if it receives the pension of a disabled child and compensation for caring for a disabled child, as well as social benefits? benefits for housing and communal services -

9.1. No, he does not have such a right. Social bank accounts cannot be seized for debts. Thus, this action is prohibited in relation to: maternity capital; various compensation payments; benefits (disability, children, etc.); amounts paid for the loss of a breadwinner or compensation for injury to health; one-time financial assistance. In addition, bailiffs do not have the right to seize a credit account; it is not intended for making payments, it belongs to the bank and is used to record loan debt. In the case where the above-mentioned income was subject to collection, the citizen should contact the bailiffs with a statement and a document confirming that the specified payments are being made to this account. If a credit account is frozen, then you must present the corresponding agreement.

Did the answer help you?YesNo

10. Interested in the question: we are a large family and have a dependent child with a childhood disability. Is it possible to take advantage of two benefits: 30 and 50%. Refunds for housing and communal services.

10.1. — Hello dear site visitor, DEFINITELY NO! If there are several grounds for benefits, choose one of the grounds that is beneficial! Good luck to you and all the best, with respect, lawyer Legostaeva A.V.

Did the answer help you?YesNo

11. Such a question. 4 people live in the apartment: 2 pensioners (by age), 1 disabled person of 2 groups and a minor child. Pensions and disability pensions are minimal. In this case, some kind of benefit or subsidy for housing and communal services is provided. Thank you. Sincerely, Ludmila.

11.1. Group 2 disabled people have benefits. Whether or not there are subsidies depends on your income level.

Did the answer help you?YesNo

12. I have a disabled child, and we receive benefits for housing and communal services, my father-in-law, who is registered in our living space, wants to apply for housing and communal services benefits as a labor veteran, whether or not I can use housing and communal services benefits for two preferential categories.

12.1. His right to submit documents, and social security will give an explanation.

Did the answer help you?YesNo

13. In a private, rural house, live a mother, a labor veteran, a daughter, a disabled person of the first group with oncology, and two minor children. What benefits for housing and communal services are they entitled to?

13.1. Contact the Social Insurance Fund at your place of registration with your request.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. My mother is 85 years old. She is disabled 2 degrees. due to health reasons and belongs to the category of “children of war”. Does she have benefits for paying for housing and communal services (except for major repairs), and if so, what are they?

14.1. Hello. You can receive a subsidy for utility bills.

Did the answer help you?YesNo

14.2. Good afternoon. For disabled people of group 2, federal legislation provides for compensation of 50% of the costs of paying for housing and communal services, for the maintenance of housing and the surrounding area. Wish you luck.

Did the answer help you?YesNo

15. I have a disabled child. Main residence in Bashkiria. And we live in Kaliningrad. With temporary registration, we can receive benefits for housing and communal services.

15.1. Hello! For an accurate answer, you need to look at the regional legislation of the Kaliningrad region. Federal Law No. 181-FZ dated November 24, 1995 “On social protection of disabled people in the Russian Federation” does not specify this detail. Most often in practice, EBC is used to pay for housing and utilities at the place of residence (permanent registration) or place of stay (temporary registration). Those. a disabled person has to make a choice where he will receive EDC.

Did the answer help you?YesNo

16. Can a disabled child receive benefits for housing and communal services, for heating under temporary registration? We are registered in Safonovo, Smolensk region, and live and registered in Yartsevo, Smolensk region.

16.1. Benefits are provided only at the place of registration. Try writing an application to the Criminal Code at the place of registration about not providing benefits, because... You will receive them at your place of temporary registration. And write the same statement to the Criminal Code at the place of temporary registration, just change the conditions for providing benefits.

Did the answer help you?YesNo

17. Question, in a large family with a disabled child, how much will the Benefit for housing and communal services be, 50 and 30 percent, or only on April 50 for a disabled child?

17.1. The benefit will be only for the disabled child himself, the size is different in each city, check with social security.

Did the answer help you?YesNo

17.2. A benefit for paying 50% of the cost of housing and communal services is provided to the WHOLE family with a disabled child. According to the Decree of the Government of the Russian Federation No. 901 of July 27, 1996, which approved the Rules for providing benefits to disabled people and families with disabled children to provide them with living quarters, pay for housing and utilities, 13. Disabled people and FAMILIES with disabled children are provided a discount of no less than 50 percent on housing costs in state, municipal and public housing stock, on utility bills (REGARDLESS OF THE OWNERSHIP OF THE HOUSING STOCK), and in residential buildings that do not have central heating - on the cost of fuel purchased within the limits established for sale to the population. In addition, according to Federal Law No. 399 dated December 29, 2015, “On amendments to Article 169 of the Housing Code of the Russian Federation and become. 17 Federal Law “On social protection of disabled people in the Russian Federation”, CITIZENS WITH DISABLED CHILDREN are provided with compensation for the costs of paying a contribution for the capital repairs of common property in an apartment building, but not more than 50 percent of the specified contribution, calculated based on the minimum amount of the contribution for the capital repairs per one square meter of total living space per month, established by a regulatory legal act of a constituent entity of the Russian Federation,

Did the answer help you?YesNo

18. The child has been disabled since 2020. There were no benefits for housing and communal services. Can I ask for a recalculation of rent or penalties?

18.1. You cannot, since the benefit for housing and communal services is issued from the day you submit your application for the benefit to social security.

Did the answer help you?YesNo

19. The child is disabled. I can apply for a housing and communal services benefit for 2020. now this year. Thank you.

19.1. The benefit is no longer paid from the moment you write your application.

Did the answer help you?YesNo

20. I have two children, one of them is disabled and he is 2 years 6 months old. I wanted to apply for benefits for housing and communal services, but due to rent arrears, I was denied. Is this legal and how can I obtain benefits?

20.1. Good afternoon, yes, this is legal, the subsidy is provided only if there are no debts or if an agreement has been concluded for installment payments on the debt (not all regions provide a subsidy if there is an installment plan agreement).

Did the answer help you?YesNo

What benefits am I entitled to as a single mother and a low-income family with a disabled child?

I would like to ask. How to get benefits for housing and communal services if the owner is not registered in the apartment.

I am caring for a disabled child, what benefits are available? Taxes, housing and communal services, and then we live in a private house without communications,

I have a child who has been disabled since birth (cerebral palsy). He is 9 years old. We are registered and live with my parents (the four of us).

In a family, a disabled child is denied a benefit when paying for housing and communal services, arguing that this benefit does not apply in this region. Dagestan. Makhachkala. Thank you.

Tell me, I have a disabled child and his father, we are divorced and live in another apartment,

Am I entitled to benefits for housing and communal services because I am disabled, group 3? In our house,

I have a son who was disabled since childhood. He is entitled to 50% benefits for housing and communal services (according to meters).

Our housing and communal services benefits were canceled for a child with disabilities according to what right.

The apartment has 2 owners, me and my eldest adult son. My second son, who is a disabled child, is also registered.

We have a communal apartment. There are 10 people registered in our room, but in fact only 3 live (a single mother with a child (5 months)

Benefits for parents of disabled children in 2020

The legislative framework is very extensive. Allowance for caring for a disabled child in 2020, monthly and pension payments to disabled children and other benefits are provided for by such acts as Federal Law No. 166-FZ “On State Pension Provision in the Russian Federation”, Federal Law No. 181-FZ, as well as Decree of the President of the Russian Federation and Resolutions of the Government of Russia.

This form of support, such as benefits for parents of disabled children, is established in 2020 by the Labor Code, a number of federal laws, as well as the Tax Code regarding the implementation of the right to deductions. At the same time, the legislation defines a wider list of concessions for those who act as the legal representative of disabled children and are forced to care for them.

Do disabled people pay transport tax? what benefits?

General information

Attention

But the law of the Komi Republic does not provide benefits for parents of disabled children at all. What documents are required? The set of documents required to provide a vehicle tax benefit may vary in different regions, so it is advisable to clarify what papers will be needed in the relevant law of a particular subject or directly with the tax authority at the taxpayer’s place of registration. Analysis of regional legislation allows us to form a general picture regarding the documents justifying the right to benefits.

Disabled people are usually required to bring a disability identification card or disability certificate to the tax office. Those injured in battles must present a certificate or certificate of the established form, which is the basis for the application of the benefit in accordance with the law of a certain region.

Such housing is initially provided to people suffering from severe forms of certain chronic diseases from the list of diseases. The right to living space can be obtained by certain categories of citizens with diseases, the list of which was approved in accordance with Government Decree No. 214 and the Order of the Department of Health.

Tax deduction: What is the personal income tax deduction if a child is disabled? According to Russian legislation, a tax deduction for a disabled child in 2020 is issued if the amount of income per year does not exceed 350 thousand rubles. Such benefits are accrued from January and continue until the month in which income reaches the set limit.

For disabled children who cannot attend general preschool institutions for health reasons, special preschool institutions are created. If it is not possible to educate and educate disabled children in general or special preschool and general education institutions, education authorities and educational institutions provide, with the consent of parents home-based education of disabled children according to a full general education or individual program.

We invite you to read: How to give an apartment to your son or daughter in 2019: procedure

The procedure for raising and educating disabled children at home, as well as the amount of compensation for parents’ expenses for these purposes, are determined by the laws and other regulations of the constituent entities of the Russian Federation. In my article, I listed the main benefits and social guarantees provided by our legislation to families with a disabled child. Let me remind you that I ONLY advise on issues related to labor relations.

Any citizen of the Russian Federation who is a disabled person of category 1 or 2, from January 1, 2020, in order to receive tax benefits, must submit an application to the tax service for tax benefits and prepare the following package of documents:

- Passport of a citizen of the Russian Federation (you must provide the original document, not a copy);

- A current extract from Rosreestr about the existing property (house, apartment, land and vehicle);

- Certificate confirming the status of a disabled person;

- A medical report with an assigned disability group, containing the results of a medical examination;

- Certificates confirming ownership, purchase and sale agreements.

Let us note that the provision of supporting documentation today is a citizen’s right, not his obligation. The taxpayer can simply indicate the details of documents confirming his right to preferential taxation. Then the tax authority employee himself will send a request to those organizations that issued the documents specified by the taxpayer.

Another important point that you need to pay attention to is the ability to recalculate for previous years and return the overpaid amount. The taxpayer has the opportunity to present his right to preferential taxation within three years from the date of its occurrence, and the tax service will recalculate the entire amount of taxes for this period.

Benefits for disabled people when selling an apartment

According to paragraph three of subclause 1 of clause 1 of Article 220 of the Code, when selling property that is in common shared ownership, the corresponding amount of property tax deduction calculated in accordance with this subclause is distributed among the co-owners of this property in proportion to their share. This norm, in accordance with paragraph 1 of the operative part of the Resolution of the Constitutional Court of the Russian Federation of March 13, 2008 N 5-P, applies only in the case of disposal of property in common shared ownership as a single object of ownership. It follows from the appeal that the taxpayer sold 1/2 of the share in the right of common shared ownership of the apartment to another owner of the apartment. In this case, the taxpayer has the right to receive a property tax deduction in the amount of 1,000,000 rubles. At the same time, we inform you that in order to obtain the necessary information on filling out a tax return for personal income tax to obtain a property tax deduction, you should contact the tax authority at your place of residence.

My father is a disabled person of the first group, and due to illness he is incompetent (by a court decision). I, his son, am my father's guardian. As a result of the death of his father's sister, he became the heir to 1/3 of the apartment belonging to his sister. And I have a question about how the inheritance of an apartment occurs for disabled people of group 1. All relatives who are heirs decided to put the apartment up for sale. The Board of Trustees allowed these actions to sell the apartment, with the condition that the portion due to the father be transferred to his bank account.

We recommend reading: Benefits for a Single Mother in the Krasnodar Territory 2020

Do people with disabilities pay property taxes?

Taxation is used to fill both federal and local budgets. The collected funds are redistributed for social support of the population, payment of earned funds to employees of state enterprises and organizations, and protection of the state from attacks. Therefore, the more taxes flow into the state treasury, the better it will be for our citizens.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Citizens are charged mandatory fees for owned real estate, wages, transportation, but do they need to pay property tax for group 2 disabled people if they receive government subsidies?

For some categories of the population, the country's authorities provide significant benefits and tax breaks, especially for persons with disabilities.

The collected funds are redistributed for social support of the population, payment of earned funds to employees of state enterprises and organizations, and protection of the state from attacks.

Benefits for disabled people of groups 1 and 2 in 2020

Benefits for persons with disabilities are provided at both the federal and local levels. Issues of granting privileges in the field of taxation of this category of citizens are regulated by sections 391 and 407 of the Tax Code of the Russian Federation. From the text of this document it follows that the right to tax deductions is mainly given to people who have been assigned disability groups I and II.

In accordance with Russian legislation, they are provided with:

- Exemption from property tax assessed annually by the Federal Tax Service. The benefit applies to any property of the owner’s choosing: a residential building, apartment, utility building, garage or parking space. Such real estate should not be used for business purposes, and its value cannot exceed 300 million rubles. In cases where a disabled person owns a share of real estate, the remaining co-owners pay tax on a general basis.

- Exemption from transfer of land tax in whole or in part. The benefit applies to a plot of 6 acres. If a disabled person owns a larger plot of land, the territory exceeding this limit is subject to taxation. As with property taxes, privileges apply to only one piece of land. If the owner does not make his choice, the benefit will automatically begin to apply to the plot with the largest tax payment amount.

Also in many regions, disabled people from non-working groups are given benefits for utilities and payment of transport tax

In the latter case there may be restrictions. For example, in some localities, people with disabilities do not pay tax on transport if it is adapted for the movement of people with disabilities and the engine power does not exceed 100 hp. In Moscow the maximum number of horsepower is 200, in St. Petersburg - 150, in Voronezh - 120.

If a disabled child grows up in a family, his parents receive tax benefits. They can also apply for tax deductions for personal income tax (its amount is 500 rubles) and other privileges.

For example, in some localities, people with disabilities do not pay tax on transport if it is adapted for the movement of people with disabilities and the engine power does not exceed 100 hp.

First

Citizens with group 1 are completely exempt from paying property taxes. The conditions are standard - the benefit applies only to one piece of property chosen by the owner. And other similar real estate will be taxed as usual.

The main thing is to choose an object for which the fee will not be paid before the due date.

Who can be considered disabled?

According to the law, a citizen who has lost the ability to work for any reason can be recognized as disabled only by decision of the MSEC.

Benefits for parents of disabled children

- have the right to housing under social rent conditions if they are specially registered. The area of housing provided must exceed established standards. If a family has a child with mental disorders, disorders in the central nervous system, or there is a need to use a wheelchair, then the family applies for an additional room or 10 sq.m. housing;

- are entitled, first of all, to receive land for building a house, farm or garden;

- receive compensation for half the cost when paying utility bills according to standards, amounts for major repairs.

If a parent or guardian does not work while caring for a child, he is paid a monthly allowance . Such a payment may also be addressed to another person (for example, a relative) who is looking after the disabled person.

Benefits, rights and privileges for children with disabilities of groups 1, 2 and 3 in 2020

In the question of what payments are due to a family with a disabled child, a pension should be allocated to the child himself and his parent as compensation. From the moment the child receives the status of a disabled person, a monetary benefit corresponding to the disability group is awarded - a disability pension.

Since 2014, the concept of “childhood disabled” has ceased to be a legal status. Today, upon reaching the age of 18, a disabled child receives the appropriate disability group. Those who were assigned the abolished status before 2014 are entitled to the previously introduced benefits for children with disabilities.

Benefits: what is a disabled person of group 1 entitled to?

Benefits for disabled people of group 1 include various monthly cash payments, benefits and additional payments. Persons with group 1 disabilities are entitled to monthly pension payments, the amount of which currently amounts to 13,000 rubles.

List of benefits for disabled people

They undergo a medical examination and receive an appropriate certificate of disability.

With its help, you can receive additional government support. The benefits provided to disabled people of group 1 are varied. But before you study them, you will have to get a disability. As we have already said, for this the citizen will have to undergo a medical commission. In addition, doctors will take into account external factors.

For example, the following features will have a positive impact on disability decisions:

- the citizen has a serious illness;

- the patient is not able to take care of himself independently.

- a person needs full social protection;

It is these features that must be observed when assigning the 1st degree of disability.

You can get to MSEC with the help of social services. protection, the attending physician or the Pension Fund of the Russian Federation. What payments are due to a disabled pensioner of group 1?

Today a huge role

Buying an apartment where the child is disabled

During the year, disabled people of group 1, as well as those accompanying disabled people, receive one-time free travel to the place of treatment. Provision of medicines free of charge according to doctor's prescriptions. Disabled people of group I also have the right to free dressings and certain medical products, if there is a conclusion from the ITU bureau on the need to use these funds. Providing free vouchers for sanatorium treatment, at least once a year for the first three years after establishing disability Benefits for disabled people who need prosthetics in the form of prosthetic limbs are provided free of charge, as well as orthopedic shoes Free dental prosthetics Non-competitive enrollment for admission to secondary vocational and higher vocational state or municipal educational institutions in case of successful passing of entrance exams, if such training is not contraindicated by medical conclusion Increased scholarship amount for full-time students For working disabled people, the working week is reduced to 35 hours a week with the same earnings, vacation at your own expense up to 60 days a year Free travel in all types of urban and rural ground transport (except for taxis and private minibuses) throughout the year, disabled people of group 2 receive a one-time free travel to the place of treatment; this does not apply to accompanying persons. Provision of free medications according to doctor’s prescriptions.

Issues of assistance to disabled children are a priority when considering the possibility of providing housing for vulnerable social groups, since a disabled child in the care of parents or relatives requires the organization of special living conditions. Often, persons falling under this category have physical limitations, and therefore, the implementation of their own household and social needs is associated with great difficulties. The legislation of the Russian Federation provides for a special mechanism that allows families with disabled children to obtain housing.

How can I reduce my payments?

In family law there is no clear list of circumstances that may serve as a reason for reducing the amount of alimony payments for a disabled person.

At the same time, practice has formed a number of theses that most judges adhere to. In general family law, reasons for reducing the amount of payments may be:

- A disabled person of group 2 must pay alimony even if he himself needs outside care. At the same time, this very circumstance may cause a significant reduction in payment amounts. The situation is similar with disabled people of group 1.

- If the alimony recipient has a source of stable and high income (even if it is a child who started working at the age of 16), then the amount of alimony for a disabled person can be reduced.

- In cases where the disability was acquired at least a year before the divorce, the ex-spouse’s reciprocal payments for his maintenance may go towards paying off alimony obligations.

- If the alimony recipient is fully supported by the state (the child ends up in an orphanage).

- When a person with disabilities has new children, the amount of child support obligations may decrease.

- If a disabled person has an excessively high income (for example, from creative activities) and the recipient of alimony objectively does not need such amounts for his life support.

- If a person with disabilities pays child support to another child (other children) and the amount of payments for all obligations is equal to his income.

In any of the above circumstances, in order to reduce the amount of payments, it is necessary to apply to the court of first instance or to the magistrate's court with a claim. The judge will make a decision at a civil hearing.

Disabled child - benefits for parents in 2020

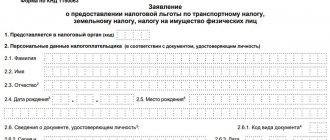

- Statement.

- SNILS.

- Guardian's ID.

- Payment papers proving the purchase of medical goods and services necessary for the offspring.

- Individual rehabilitation program for a minor citizen.

- A certificate of inspection of purchased goods, which the parent received from the social protection authorities of the Russian Federation.

- Bank account details.

- Registered before 01/01/2005 For such citizens there is a separate queue for obtaining housing. Refers to persons with additional benefits.

- Registered after 01/01/2020. This refers to entities without a preemptive right to acquire personal living space in the first place.

Tax benefits for selling an apartment in 2020

General tax rules provide for the possibility of choosing benefits when paying personal income tax to the state. So, if a person has owned an apartment for less than three (five) years, he will not be completely exempt from the fee. But a citizen can use one of the deduction options:

5 years is the period for all other cases. It applies to all objects, regardless of whether they were purchased on the primary or secondary market. This option began to be used with the introduction of changes. Therefore, it applies to those persons who became owners after January 2020.

Benefits and allowances for parents of disabled children

In Moscow and the Moscow region. individuals who are responsible for guardianship of incapacitated individuals under the age of 23 are transferred 12,000 rubles every month. And children under 3 years old are given compensation for increased food prices in the amount of 675 rubles. monthly, students receive subsidies for shoes and clothing - 10,000 rubles. in year.

When it is necessary to maintain the right to free use of railway transport, the actual subsidy will decrease to 2402 rubles. Provided that guardians do not plan to prescribe subsidized medications, the EDV will be 1,719 rubles.