What does the owner of non-residential premises in a residential building pay for?

The issue is truly controversial. On the one hand, you are members of the HOA, and accordingly, as the owner of the premises in the house, you are obliged to participate in the payment of general expenses. And even more so pay for major repairs. On the other hand, you don't use much.

In different HOAs this is decided differently: in some by law, in some by justice, in some by fraternity. This is regulated by the general meeting of homeowners and HOA members. Bring this issue to the meeting and try to defend your point of view. Or call an extraordinary meeting.

You will still have to pay for major repairs, since this issue is regulated by law, and not by the meeting.

How to convert residential premises on the 1st floor into non-residential ones?

Does the HOA receive income from businesses in the building?

Answered by lawyer, K. Yu. n. Yulia Verbitskaya:

In accordance with the Housing Code of the Russian Federation and the judicial practice that has taken place in accordance with it, the owner of non-residential premises in a residential building must, on an equal basis with the owners of residential premises, pay for major repairs of the house, and cleaning the entrance, and lighting in the entrance, and other expenses associated with the maintenance of the common property in an apartment building.

If you have installed individual metering devices, including your own electric line, you have the right to pay for this type of service yourself, notifying the management company about this and excluding payments for electricity in relation to your specific premises, which, however, does not relieve you of the obligation to participate in payment expenses for maintaining common property in an amount proportional to your share in the ownership of the entire house.

If you have two valid contracts with one subject and you are offered to enter into a third, then you need to familiarize yourself with their terms. No one has the right to receive money twice for the same service or impose it on you.

All disagreements that arise regarding the volume, cost of services provided and the person to whom you must pay them (especially when changing management companies) are subject to resolution in court.

Is it possible to change the calculation for heating non-residential premises?

How do you know if commercial organizations on the 0th floor are legal?

Anna Gorbenko, consultant to the real estate commission of the Consumer Society of St. Petersburg and the Leningrad Region, answers:

The owner of non-residential premises in an apartment building, just like the owner of residential premises, is obliged to pay for the maintenance of common property, regardless of whether he uses all the property or not (Article 39 of the Housing Code of the Russian Federation). Thus, you are obliged to pay.

For example, all entrances are illuminated, therefore, electricity costs are borne proportionally by all owners. As well as washing all stairs and flights.

The set of payments may vary in each specific case, for example, supplemented by the cost of servicing lifts for the disabled, and so on.

Leading legal consultant of Legal Services Center LLC Vladimir Brazhnikov answers:

Housing legislation does not contain differences in the legal status of non-residential and residential premises in the matter of maintaining common property and imposes equal responsibilities on the owners of any premises in the house, in accordance with Art. 39 Housing Code of the Russian Federation.

Consequently, the owners of both residential and non-residential premises are equally involved in the maintenance of common property.

The law establishes the obligation of individuals and legal entities to pay for utilities and major repairs in the house on time and in full.

The owner's payment for utilities and premises includes payments for the maintenance, as well as repairs of the premises (including for work and services through which the residential building is managed), payment for major repairs and routine repairs of property in an apartment building, in accordance with Art. .154 Housing Code of the Russian Federation. The amount of maintenance amounts paid depends on the size of the share of a particular owner in the right of common ownership of the common property.

Is it possible to remove the fence around a high-rise building?

Is there a tax deduction for the purchase of non-residential premises?

Thus, the owner of non-residential premises in a residential building is obliged to pay for the maintenance of common property, regardless of the amount and in what order he pays for the maintenance of his premises.

Having your own electrical line and contracts for cleaning and maintenance does not relieve the owner of non-residential premises from bearing the burden of expenses for maintaining the common property of the house. Non-residential premises cannot exist independently and are a structural part of a residential building.

The owner of non-residential premises, just like apartment owners, is obliged to make payments required by law on time and in full. At the same time, the actual non-use of common property by the owner of the premises does not relieve him of his responsibilities for maintaining the common property.

Yulia Dymova, director of the Est-a-Tet secondary real estate sales office, answers:

Theoretically, the owner of the non-residential premises does not use the common property of an apartment building. However, Article 36 of the Housing Code provides that, by right of common ownership, the owners of apartments and non-residential premises own load-bearing structures, equipment, as well as the land plot itself on which the house is located. Accordingly, the burden of maintenance also lies with them.

Text prepared by Maria Gureeva

Do not miss:

All materials in the “Good Question” section

Is it possible to register an office in an apartment?

I bought non-residential premises and converted them into residential ones. Can I get a tax refund?

How to convert an apartment from residential to commercial real estate?

The articles do not constitute legal advice. Any recommendations are the private opinion of the authors and invited experts.

Source: https://www.domofond.ru/statya/za_chto_platit_sobstvennik_nezhilogo_pomescheniya_v_zhilom_dome/7049

Creation and operation of a homeowners association

In accordance with the Housing Code, the possibility of the existence of such subjects of housing relations as homeowners’ associations remains possible.

Relations regarding the creation and activities of such partnerships are regulated by the norms of Chapter. 13 LCD.

Homeowners Association

(hereinafter -

HOA)

is recognized as a non-profit organization, an association of owners of premises in an apartment building for joint management of a complex of real estate in an apartment building, ensuring the operation of this complex, ownership, use and, within the limits established by law, disposal of common property in an apartment building (Part 1 of Art. 135 ZhK).

Homeowners Association in accordance with Part 3 of Art. 135 of the residential complex can be created provided that the number of members who created it exceeds 50% of the votes of the total number of votes of the owners of premises in the apartment building.

The Charter of the Homeowners Association is adopted at a general meeting, which is held in the manner established by Art.

45-48 of the Housing Code, by a majority vote of the total number of votes of the owners of premises in an apartment building. A homeowners' association is created without a limitation on the period of activity,

unless otherwise provided by the charter.

A homeowners association is a legal entity from the moment of its state registration

and has a seal with its name, current and other bank accounts, as well as other details.

A homeowners association is liable for its obligations with all the property it owns, but is not liable for the obligations of its members. Members of the Homeowners Association are not liable for the obligations of the Homeowners Association.

According to Art. 136 Residential complex owners of premises in one apartment building can create only one

Homeowners Association.

The decision to create it is made by the owners of premises in an apartment building at their general meeting. Such a decision is considered adopted if the owners of premises in the corresponding apartment building, having more than 50% of the votes of the total number of votes of the owners of premises in such a building, voted for it .

In addition, a Homeowners Association can be created by merging:

- several apartment buildings, the premises in which belong to different (at least two) owners of the premises in the apartment building, with land plots located on a common land plot or several neighboring (bordering) land plots, utility networks and other infrastructure elements;

- several nearby buildings, structures or structures - residential buildings intended for single-family residence, country houses with or without personal plots, garages and other objects located on a common land plot or several neighboring (bordering) land plots, engineering and technical support networks and other infrastructure elements.

Article 137 of the LC defines the rights

Homeowners' Associations. These include the following:

- conclude, in accordance with the law, an agreement for the management of an apartment building, as well as agreements on the maintenance and repair of common property in an apartment building, agreements on the provision of utility services and other agreements in the interests of members of the partnership;

- determine an estimate of income and expenses for the year, including the necessary expenses for the maintenance and repair of common property in an apartment building, the costs of major repairs and reconstruction of an apartment building, special contributions and deductions to the reserve fund, as well as expenses for other expenses established by the housing complex and the charter of the HOA goals;

- establish, on the basis of the accepted estimate of income and expenses for the year of the HOA, the amounts of payments and contributions for each owner of premises in an apartment building in accordance with his share in the right of common ownership of common property in an apartment building;

- perform work for the owners of premises in an apartment building and provide them with services;

- use loans provided by banks in the manner and under the conditions provided for by law;

- transfer material and monetary resources under the agreement to persons performing work for the Homeowners Association and providing services to the partnership;

- sell and transfer for temporary use, exchange property belonging to the Homeowners Association.

In cases where this does not violate the rights and legitimate interests of the owners of premises in an apartment building, the HOA has the right to:

- provide for use or limited use of part of the common property in an apartment building;

- in accordance with the requirements of the law, in the prescribed manner, build on, rebuild part of the common property in an apartment building;

- receive for use or receive or acquire land plots into common shared ownership of the owners of premises in an apartment building for housing construction, construction of utility and other buildings and their further operation;

- carry out, in accordance with the requirements of the law, on behalf and at the expense of the owners of premises in an apartment building, the development of allocated land plots adjacent to such a building;

- conclude transactions and perform other actions consistent with the goals and objectives of the HOA.

If the owners of premises in an apartment building fail to fulfill their obligations to participate in the general expenses of the Homeowners Association, the Homeowners Association has the right to legally demand forced reimbursement of mandatory payments and contributions.

A homeowners' association may demand in court full compensation for losses caused to it as a result of the failure of the owners of premises in an apartment building to fulfill their obligations to pay mandatory payments and contributions and pay other general expenses.

The homeowners association is obliged to:

- ensure compliance with the requirements of Ch. 13 of the Housing Code, provisions of other federal laws, other regulatory legal acts, as well as the charter of the Homeowners Association;

- enter into agreements on the maintenance and repair of common property in an apartment building with the owners of premises in the apartment building who are not members of the Homeowners Association;

- fulfill the obligations under the contract in the manner prescribed by law;

- ensure proper sanitary and technical condition of common property in an apartment building;

- ensure that all owners of premises in an apartment building fulfill their responsibilities for the maintenance and repair of common property in this building in accordance with their shares in the right of common ownership of this property;

- ensure compliance with the rights and legitimate interests of the owners of premises in an apartment building when establishing the conditions and procedure for ownership, use and disposal of common property;

- take measures necessary to prevent or terminate actions of third parties that impede or interfere with the exercise of the rights of ownership, use and, within the limits established by law, of the owners of premises with common property in an apartment building;

- represent the legitimate interests of the owners of premises in an apartment building, including in relations with third parties (Article 138 of the Housing Code).

Article 139 of the Housing Code provides for the possibility of creating a Homeowners Association in apartment buildings under construction

persons who will own the ownership of premises in such houses. The decision to create such a partnership is made at a general meeting of these persons, which is held in the manner established by Art. 45-48 LCD.

Liquidation

The homeowners' association is carried out on the basis and in the manner established by civil law.

As provided in Part 2 of Art. 141 of the Housing Code, the general meeting of owners of premises in an apartment building is obliged to make a decision on the liquidation of the HOA if the members of the partnership do not have more than 50% of the votes of the total number of votes of the owners of premises in the apartment building.

In accordance with Art. 142 LCD two or more homeowners associations can create an association of homeowners associations

for joint management of common property in apartment buildings. Such associations are managed according to the rules of Chapter. 13 LCD, i.e. in the same order as the management of the HOA.

Individual owner of non-residential premises

608 of the Civil Code of the Russian Federation). At the same time, a citizen can carry out the activity of leasing property as an individual who is not an individual entrepreneur (hereinafter also referred to as an individual entrepreneur), since the law does not contain a requirement to register an individual as an individual entrepreneur as a necessary condition for leasing property owned by him.

Renting out premises is one of the “quiet” and profitable types of commercial activity. Under two conditions - the demand for real estate given its location and the availability of free funds for its purchase - you can ensure income for yourself with minimal risks for yourself.

Premises rental tax - payment procedure for non-residential and residential premises

or legal entity. for example, LLC. An individual can also rent out premises without registering as an individual entrepreneur, but provided that this premises is residential (for example, a house or apartment).

In this case, the individual transfers 13% of the rent to the budget.

If an individual intends to rent out non-residential premises, he must register an individual entrepreneur. Such conditions are explained by Russian legislation, which prohibits conducting business activities without state registration.

What is commercial real estate from the owner? Rights and obligations of the owner of non-residential premises in an apartment building

The right of inheritance is guaranteed.

Ownership of non-residential premises entails certain rights.

In fact, they are expressed in free, unhindered possession of the premises, using them at one’s own discretion, in accordance with the intended purpose of the object. The owner has the right not only to dispose of his property, but also to protect it from encroachment by third parties, including a lawsuit filed at the location of the premises (Art.

35 Arbitration Procedure Code of the Russian Federation)

Renting non-residential real estate: advice for renters

The business of leasing non-residential premises is usually profitable. How to maximize this benefit through taxes? This will be discussed in the article, which will be useful both for individual entrepreneurs and individuals who are already renting out real estate, and for those who are just planning to start this business.

The first question that arises usually concerns the method of registering non-residential real estate for subsequent rental.

What is commercial real estate from the owner?

Rights and obligations of the owner of non-residential premises in an apartment building

The owners of non-residential premises are an individual entrepreneur (IP) or a founder, a legal entity that has legally registered ownership of an object belonging to the non-residential fund and disposes of it within the limits established by law. Since the owner owns his share along with other persons sharing ownership of separate premises in the same building, regulations must be observed.

Who can the lessor be?

In accordance with Article 608 of the Civil Code of the Russian Federation, the right to transfer property for rent belongs to the owner . The owner can be: an individual, individual entrepreneur, or legal entity.

By renting out non-residential premises, an individual exposes himself to risk. Tax authorities classify this activity as entrepreneurial.

Entrepreneurial activity is considered to be activity carried out at one’s own risk and aimed at systematically obtaining profit from the use of property, sale of goods, performance of work, provision of services (Clause 1, Article 2 of the Civil Code of the Russian Federation).

The Civil Code regulates that

a person has the right to engage in entrepreneurial activity only from the moment of state registration as an entrepreneur.

To prevent questions from the tax authorities, you must register as an individual entrepreneur with the type of activity “Rental and management of your own or leased non-residential real estate.”

Is it necessary to register an individual entrepreneur for transactions with such real estate?

If an individual is registered as an individual entrepreneur, the question does not arise at all: everyone understands that entrepreneurs can rent premises for offices, shops, warehouses or workshops - and can, if possible, rent out such real estate. But is registration with the Unified State Register of Enterprises required in order to enter into such agreements?

In reality, no. Art. 608 of the Civil Code of the Russian Federation states that property can be leased either by the owner, or by a person authorized by him, or by someone who, by virtue of law, is granted the right to act on behalf of the owner. The law no longer mentions any additional restrictions (for example, the need to have individual entrepreneur status and register with the Unified State Register of Individual Entrepreneurs) and does not establish any barriers.

The mere fact of leasing real estate of any type is not enough to talk about entrepreneurship.

The Plenum of the Supreme Court of the Russian Federation in 2004, by resolution No. 23 concerning illegal entrepreneurship, clarified that if an individual has real estate, but he personally does not need it at this time, he has the right to use it, including for renting out (clause 2 resolutions). A similar position was expressed in paragraph 13 of the resolution of the Plenum of the RF Armed Forces No. 18 of 2006.

Thus, a one-time transaction is not enough to hold a citizen accountable for illegal business or to require him to urgently register with the Unified State Register of Individual Entrepreneurs. It is required that such transactions be systematic.

Details on the question of whether an individual can rent out non-residential premises

Russian legislation does not restrict the right of citizens to own real estate - and many people own non-residential premises. But how actively can they manage them?

Does a citizen have the right, in particular, to lease or rent this type of property? Let’s figure out what exactly the current law says about this.

For organization

Accordingly, from the point of view of current legislation, there is no prohibition on leasing real estate from an individual to a legal entity - and is not expected in the foreseeable future.

Are there any restrictions?

The only legal limitation for renting is the need to pay taxes. No one has canceled personal income tax - and therefore if an individual rents out non-residential premises, he will need to pay:

Is it possible to enter into an agreement as a tenant?

Another thing is that renting clearly commercial real estate can raise questions from regulatory authorities - and even provoke an audit. But the law itself does not contain a ban on such actions.

Conclusion

Thus, having owned non-residential real estate, a citizen has the right to rent it out without registering as an individual entrepreneur in the Unified State Register of Individual Entrepreneurs. If the transaction was a one-time transaction and has no signs of systematicity, the law does not establish any obstacles.

Questions may arise only in cases where the object bears clear signs of a commercial purpose - but even in this situation there is no direct legal prohibition.

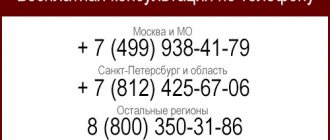

+7 (St. Petersburg)

Source: https://mirovoj.okd1.ru/spravka/fizicheskoe-liczo-sobstvennik-nezhilogo-pomeshheniya/

What documents and information do you need to obtain from the owner of non-residential premises?

The owner of non-residential premises is required to provide you with a number of documents and information. They are necessary to manage the MKD, so it is in your best interest to receive them on time.

The documents that need to be requested from the owner are copies of resource supply agreements with RSO. You have the right to demand a copy of the contract from the moment of its conclusion (clause 18 of Rules No. 354). But, most likely, you do not know when exactly the owner entered into an agreement with RSO and whether he entered into one at all. Therefore, it is worth sending the owner a request with the wording: “Please provide copies of all contracts with resource supply organizations. If the agreements have not yet been concluded, please provide copies of them within 5 (five) days from the date of conclusion.”

In addition, receive two groups of information from the owner.

- Volumes of utility resources consumed during the billing period under resource supply contracts. Owners of non-residential premises are required to provide this data in the same manner and within the time limits established for the submission of IPU readings by consumers of utility services (clause 18 of Rules No. 354).

- Volumes of MSW management services provided during the billing period under an agreement with the MSW recycler. To obtain this data, please send a request to the owner. He must provide information within three working days (paragraph 4, paragraph 148(1) of Regulation No. 354).

Situation: what to do if the owner of non-residential premises in an apartment building does not transfer data on the volume of consumed utility resources to the management authority, homeowners' association, residential complex, housing cooperative

You have the right to send a written request for information:

- the owner of non-residential premises (clause 18 of Rules No. 354);

- the corresponding RSO (subclause “e(1)” clause 18 of the Rules, mandatory when concluding contracts with resource supply organizations, approved by Decree of the Government of the Russian Federation of February 14, 2012 No. 124, hereinafter referred to as Rules No. 124).

RSO should not take into account the volume of supply of utility resources to owners of non-residential premises in apartment buildings when determining the volume of utility resources for settlements with the utility service provider. This is established by paragraph 21 of Regulation No. 124.

- Can a management organization provide utility services through intermediary agreements?

Resource supply agreements with non-residential premises

From January 1, 2020, by Decree of the Government of the Russian Federation of December 26, 2020.

No. 1498 “On the issues of providing utility services and maintaining common property in an apartment building”, the MA/HOA/housing association is excluded from the scheme “non-residential premises - provider of public utilities (UO/HOA/HOSK) - resource supplying organization".

Now, owners of non-residential premises are required to independently enter into contracts with resource supply organizations (RSOs) and pay them for consumed utility resources.

However, as practice shows, despite the entry into force of the new norms more than a year ago, not all RSOs have begun to work with the owners of non-residential premises, and many management companies/homeowners' associations/housing cooperatives continue to present payment to such owners for the cost of consumed utilities. Let's try to understand the problems that arise during the transition from contracts with a management company/homeowners' association/housing cooperative to contracts with RSO.

New norms and positions of courts

In accordance with paragraph 3 of clause 6 of the Rules for the provision of utility services to owners and users of premises in apartment buildings and residential buildings, approved by Decree of the Government of the Russian Federation of May 6, 2011 No. 354 (hereinafter referred to as Rules 354) as amended, effective from 01.01.

2017, the supply of cold water, hot water, thermal energy, electrical energy and gas to non-residential premises in an apartment building (MKD), as well as the disposal of waste water, is carried out on the basis of resource supply agreements concluded in writing directly with the resource supplying organization .

It would seem that everything is clear - from January 1, 2020, RSOs must provide utility services in non-residential premises, and management companies/homeowners' associations/housing cooperatives, accordingly, lose the right to provide such services from the same date. However, it is necessary to pay attention to several nuances.

Paragraph 4 of clause 6 of Rules 354 imposes on management organizations, homeowners' associations, housing cooperatives the obligation to notify the owners of non-residential premises about the need to conclude an agreement directly with the RSO, and to send information about the owners of non-residential premises to the RSO.

It is important to note that the period for sending such a notification is not regulated; accordingly, holding the management organization accountable for failure to send or untimely sending will be quite difficult, and most likely impossible.

However, it is precisely the failure of the management company/homeowners association/housing association to fulfill this obligation that can be accepted by the courts as a basis for recognizing as valid the contract for the provision of utility services concluded specifically between the management organization/homeowners association/housing association and the owner of non-residential premises in the apartment building, and, accordingly, recognizing the fact that there is no legal relationship between this owner and RSO.

Thus, in the Resolution of the Thirteenth Arbitration Court of Appeal dated March 5, 2020 No. 13AP-33733/2017 in case No. A56-55921/2017, a claim for debt collection under a heat supply agreement was considered, since the homeowners’ association had not fulfilled its obligations to timely pay for the supplied heat energy .

The essence of the dispute was that the HOA did not make payments under the heat supply agreement regarding non-residential premises. The partnership referred to paragraph 6 of Rule 354, but did not send a notice to the owners, did not provide information to the RSO, and did not make any other changes to the agreement regarding non-residential premises.

The court collected the resulting debt; the appeal ruling declared the decision of the first instance court to be justified and not subject to change.

In the Resolution of the Arbitration Court of the Volga-Vyatka District dated March 05, 2020 No. F01-6032/2017 in case No. A28-3497/2017, the court indicated that “ the absence of a direct agreement between the owner of non-residential premises and the resource supply organization during the disputed period does not relieve the management company from the obligation to pay the utility resource supplied to apartment buildings in full .” Additionally, the court about. The court also took into account that “since Resolution No. 1498 does not contain any rules regarding the timing of concluding agreements between the owners of non-residential premises in MKD and resource supply organizations in writing, and also does not establish the timing of the transfer by management organizations of information about the owners of non-residential premises in the RNO, Until the termination of the contract for the provision of utility services concluded with the management company, the owner of non-residential premises may pay a fee to the management company .”

According to the position of the court, set out in the Resolution of the Thirteenth Arbitration Court of Appeal dated March 5, 2020.

No. 13AP-766/2018 in case No. A56-73290/2017, the management organization is obliged to take measures aimed at concluding with the owners of non-residential premises separate resource supply agreements with resource supply organizations, which include, in particular, sending notifications and information provided for in paragraph 6 of the Rules 354. The specified list of activities established by paragraph 6 of Rules 354 is exhaustive, specific and must be carried out by the Company as a provider of public services in apartment buildings managed by the applicant. In the said Resolution No. 13AP-766/2018 o. Notification to the owner of non-residential premises must be individual in nature and cannot be intended for an indefinite number of persons. Additional posting of this information on the website or in public places of the MKD will not constitute a violation, but has no legal significance.

Uncertainty of the date of conclusion of the agreement with RSO

It is important to take into account that if a notice is not sent to the owner or information is not provided to the RSO, this is not an obstacle to concluding an agreement . The conclusion of an agreement with the RSO can be initiated by the owner of the non-residential premises. According to clause

23 of Rule 354, the owner of premises in an apartment building and the owner of a residential building (household) have the right to initiate the conclusion in writing of an agreement containing provisions for the provision of utility services. It is worth pointing out that, based on the interpretation of the rules, the “obligation” to initiate the conclusion of a written agreement is assigned to the owner of the non-residential premises.

However, there are no direct prohibitions on the fact that the resource supply organization can initiate the conclusion of an agreement.

Clause 18 of Rule 354 provides that if the contractor providing utility services to consumers in an apartment building in which the owner’s non-residential premises is located is not a resource supplying organization, the owner of the non-residential premises in the apartment building is obliged within 5 days after concluding resource supply contracts with resource supply organizations provide the contractor with copies of them , as well as in the manner and within the time limits established by these Rules for the transfer by consumers of information on the readings of individual or common (apartment) meters - data on the volumes of utility resources consumed during the billing period under these contracts.

It is worth mentioning paragraph 7 of Rules 354, which provides that an agreement containing provisions for the provision of utility services, concluded through the performance of implied actions by the consumer, is considered concluded under the conditions provided for by Rules 354.

It would seem that from the above norm it follows that the very fact of consumption of a utility service by a consumer, including the owner of a non-residential premises, means the conclusion of an agreement for the provision of a utility service. And since the person obliged from 01.01.

2017 to conclude such an agreement with the owners of non-residential premises is the RSO, then the agreement between the RSO and the owners of non-residential premises is concluded, regardless of its signing in writing and regardless of the actions of the management authority/homeowners association/housing cooperative in sending notifications to the owners of non-residential premises.

However, it should be noted that Rules 354 establish that it is not an agreement for the provision of utilities, but a resource supply agreement, that is concluded between the RSO and the owner of non-residential premises .

Taking this into account, the question of the possibility of concluding a resource supply agreement with the RSO through the commission of implied actions by the owner of a non-residential premises (consumption of a communal resource) becomes ambiguous.

We will talk about the features of resource supply agreements concluded between the owners of non-residential premises and RSO in one of the following publications on the AKATO website. In this article , emphasis is placed on indicating the type of agreement only for the purpose of warning against the dubious conclusion about concluding an agreement with RSO by performing implicate actions.

How do HOAs and owners of residential and non-residential premises interact?

Increasingly, residents of apartment buildings are organizing homeowners' associations. In this regard, the question arises whether it is necessary to become a member of such a community. First of all, you need to understand how owners interact with the HOA.

How is the HOA related to the owners of the premises?

A homeowners' association is created by the owners of the premises of an apartment building in order to independently manage the common property. According to Article 136 of the Housing Code of the Russian Federation, such a non-profit organization can be created only with the consent of at least half of the owners of apartment buildings.

Due to the fact that the HOA independently manages the building in the housing and communal services sector, residents can rationally use funds to improve their living conditions. The Partnership performs a number of functions, such as:

- use of common property of one or more apartment buildings;

- creation of special funds to raise funds for home repairs;

- carrying out activities aimed at beautifying the apartment building and the surrounding area;

- collection of funds from residents as payment for utility services provided to them, as well as various types of voluntary contributions;

- concluding relevant agreements with resource supply organizations;

- provision of utilities to residents of apartment buildings;

- maintaining records of all income and expenses of the organization.

The list of functions that the community performs does not end there. The HOA carries out many more actions aimed at improving the living conditions of citizens.

Homeowners have the right to independently decide whether to join an HOA or not. In addition, they can:

- elect the board of the community and its chairman by election;

- participate in the activities of the organization, making decisions at meetings;

- control the financial activities of the partnership;

- make voluntary and mandatory membership fees;

- leave the community membership at your own request based on an application.

In other words, premises owners can take an active part in the partnership for the improvement of their home and surrounding area.

How does the HOA and property owners interact?

HOAs can include both residential and non-residential premises. In both the first and second cases, the organization interacts with their owners.

Non-residential premises

Non-residential premises are defined as independent objects. However, they cannot generally be separated from common property. Owners can become members of the community if they wish.

Owners who are not members of the community enter into an agreement with it, which stipulates the owner’s share in the common property and the costs of its maintenance.

Payment for the maintenance of common property for owners of non-residential premises is calculated in the same way as for apartment owners.

Note! The agreement is signed in order to prevent problems with access to non-residential premises. Most often these include attics and basements, where communications and equipment may be located.

But by law they have autonomous status.

Because of this, HOAs may have problems with access to communications necessary for the life support of the entire apartment building if they are located in premises that are owned by a private individual.

Living spaces

Legislatively, there is no difference in the statuses of residential and non-residential premises included in the common property of an apartment building. The procedure for interaction between the partnership and the owners depends on whether they are its members or not.

Thus, HOA members are considered as individuals who are part of a non-profit organization. In turn, appropriate agreements are concluded with people who do not want to enter into a partnership. Both categories have specific rights and responsibilities.

For example, the maintenance of common property is the responsibility of both community members and people with whom agreements are concluded.

Rights and obligations of premises owners in relation to the HOA

Each owner of an apartment building managed by a partnership has specific rights and obligations.