Property owners are required to pay a fee on it. In this regard, many people ask whether pensioners should do this, i.e. do they pay land tax? After all, they are often considered beneficiaries and are exempt from various types of payments. Needless to say, land tax is considered a local fee, and therefore many aspects related to its payment are decided by the municipality of a particular subject of the federation.

Let's take a closer look at the land tax for pensioners.

Legal basis

Speaking about whether a pensioner should pay land tax, it is worth noting that the Tax Code of the Russian Federation is considered the main standard regulating the specifics of calculating land tax for pensioners in 2020. At the same time, local authorities can also issue their own by-laws regulating the extent of land tax the pensioner will pay.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 Moscow,

Moscow region

+7 Saint Petersburg,

Leningrad region

+7 Regions

(free call for all regions of Russia)

Do pensioners pay land tax?

Many people who have reached a certain age are interested in whether pensioners are exempt from paying land tax? It must be said that all individuals are required to pay the fee, this also includes pensioners. Thus, there are no payments completely exempt from making payments under federal regulations.

However, although this group of citizens is not exempt from paying land tax, they pay funds with some privileges. In addition, the municipality has the right to establish additional benefits, even completely exempt from payments. Both from land tax and from another type of tax classified as local. True, such liberation in one region does not oblige other subjects of the federation to do the same.

The duty is completely canceled, as a rule, in exceptional situations, which include:

- residence of small peoples in the territory of Siberia, the Far East and the North;

- ownership of the plot according to the lease agreement;

- exploitation of soil under the right of free use;

- ownership of plots that make up a mutual investment fund.

In addition, there is no need to pay a fee for the following objects:

- withdrawn or restricted in circulation;

- representing part of the forest or water resources;

- considered to be the possession of an apartment building.

Remember, we are talking about local duty. Therefore, the amount that I pay in my territory may vary significantly from the amount of funds that a citizen living in another area will transfer.

Taxpayers

They are recognized as all individuals and legal entities that have land plots. At the same time, it is important that the real estate itself falls under the objects of taxation, which are set out in Article 389 of the Tax Code of the Russian Federation. It is necessary to pay for land in the following cases:

- The plot was received as a gift or acquired ownership through purchase or privatization.

- The allotment was inherited with the right of lifelong use.

- A contract of unlimited use has been drawn up.

We suggest you read: Questions about apartment privatization where to contact

The list of taxpayers who are subject to legislative provisions and are required to pay regular contributions is set out in Article 388 of the Tax Code of the Russian Federation.

Individuals

Individuals, as taxpayers, include not only citizens, but also individual entrepreneurs who own land on the basis of a registered property right, a formalized perpetual right of ownership, or received as a lifelong inheritance.

Payers of taxes attributed to individuals can be not only citizens of the Russian Federation. More precisely, citizenship does not play any role here. A citizen of another country can also obtain rights to a plot of land; the very fact of acquiring real estate on the territory of the Russian Federation imposes on him the obligation to pay tax contributions to the country’s budget.

Legal entities

Legal entities are required to pay land taxes if the organization has plots of land on its balance sheet that it owns by right of ownership or under a contract of perpetual use.

The following legal entities are not recognized as taxpayers:

- Owners of land with the right of free use - fixed-term or indefinite.

- Renting plots of land.

A separate category includes plots that are the property of mutual investment funds. The responsibility for paying taxes on them falls on the management of these companies. The contributions themselves are deducted from the property owned by the investment fund.

Land tax benefits for pensioners

We have already determined above that representatives of retirement age are also considered subjects of taxation, and all lands and property located on them are subject to land and, accordingly, property tax. However, in order to somehow reduce the financial burden on this part of the population, regulations establish benefits for land tax, as well as for property tax (for real estate of a different nature: houses, apartments, parking spaces, etc.).

Regardless of whether the tax is local or federal, all privileges are divided into two types. So, pensioners are provided with two types of land tax benefits: federal and regional. The beneficiary receives the first benefits regardless of the location of the allotment. But second citizens have the right to receive it only if they use a site located within the relevant municipality.

You can find out in more detail whether allotment tax is payable in a particular area on the Federal Tax Service resource.

Land tax benefits for pensioners

Since last year, there has been a tax benefit for pensioners on 6 acres of land they own. Those. Retired citizens are entitled to a deduction, the essence of which is to reduce the tax base by the price of 600 square meters. m. cadastral value of taxable soil.

It is possible to use the privilege only for one plot, regardless of its location at the taxpayer’s choice.

Speaking about what other citizens this privilege applies to, it is worth determining that the following categories do not pay the tax in full:

- persons receiving a pension;

- pensioners by age;

- war veterans and disabled people;

- disabled people of groups 1 and 2, as well as people with disabilities since childhood;

- heroes of the Russian Federation and the USSR;

- victims of the Chernobyl explosion and some others.

Regional land tax benefit for pensioners (2019)

Previously, it was stipulated that municipal authorities could establish additional privileges for paying land tax on a land plot. Let's look at a few of them as an example.

Examples of selected regional privileges

The obligation for pensioners to pay land tax exists throughout the country. This year, the following tax benefits apply at the local level:

- in Moscow 1 million rubles. provided to the following categories:

- disabled people since childhood, and groups 1 and 2;

- war veterans and disabled people;

- victims of the Chernobyl nuclear power plant;

- large families;

- in St. Petersburg, pensioners do not pay a fee for plots of up to 2500 sq.m.;

- in Yekaterinburg, the privilege is set at 800 thousand rubles. for plots on which private farming is carried out, individual construction is organized, as well as in the amount of 200 thousand rubles. for country, garden or garden farming.

Categories of beneficiaries exempt from paying tax

The category of beneficiaries, unfortunately, currently has only one option. It includes nationalities represented by a small number of people belonging to them. We are talking about peoples:

In addition, not all plots are eligible for benefits, but only those on which the represented nationalities lead a traditional way of life, while they engage in fishing like their ancestors.

In this article we will look at the amount of land tax, what categories of beneficiaries exist and how to apply for benefits to the tax authorities.

It is imperative to take into account that for some individuals it is possible not to completely cancel the payment, but to partially reduce it. Thus, the following have the right to reduce the financial base for calculating the amount of the fee by ten thousand rubles:

- citizens with disabilities;

- combat veterans, etc.

liquidators of the accident at the Chernobyl nuclear power plant and liquidators of similar man-made disasters;

For this group of the population there are various benefits, including tax benefits. A complete list of tax breaks can be found in our article.

Since the cadastral price of land becomes more and more every year, such a trifle as ten thousand rubles will not have a serious impact on the amount of deductions paid subsequently. However, it is nice to know that some savings did occur.

Payment of tax is made after receipt of a notification from the inspection by an individual. At the same time, it sometimes happens that service employees indicate the amount, forgetting to apply the benefit described above. In this case, you need to contact them; it is better to personally go to the department to which you belong according to your place of residence, provide notice and documents confirming your right to reduce the financial base for calculating the amount of the fee.

All other preferential opportunities no longer belong to individuals, but to legal entities that perform specialized functions. In this case, benefits will be applied only to the land that takes part in the performance of these functions.

We are talking about areas:

- used for the development of state highways;

- for folk art crafts;

- belonging to various institutions.

It is also necessary to draw your attention to the fact that some institutions may also be completely exempt from paying tax. We are talking about enterprises, organizations or other types of associations that have public status and work for people with disabilities.

At the same time, disabled people in the organization must number at least 80% of the total composition

In addition, preferential conditions are applied by organizations whose authorized capital was created thanks to contributions from public associations for the disabled. At the same time, for the required organizations, the presence of disabled people in the composition must be at least a quarter of the entire association. The use of preferential taxation, that is, its abolition, is prohibited for them if companies from the categories listed above produce and sell goods from the list established by the state, and also provide services or work.

Residents of specialized economic zones also do not have to pay tax on land ownership, but this benefit is provided to them temporarily. Let's list the deadlines:

- residents of special economic zones are exempt from payments for up to five years;

- organizations whose core activity is shipbuilding have not paid tax for ten years;

- Residents of economically free zones do not have to pay for three years.

This is interesting: Refusal to relocate from emergency housing - if the apartment is owned, in 2020

How to apply for a land tax benefit for a pensioner

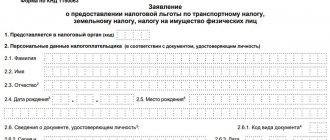

When a taxpayer is sure that he has the right to demand a privilege, in order to receive it, he will need to contact the Federal Tax Service with an application. You can submit it using one of the following options:

- bring in person;

- send by mail;

- use the services of the MFC;

- online through your personal account.

In case of correctly executed documents, the beneficiary is granted a privilege. If the response does not indicate the period for its application, then persons receiving the benefit do not write a similar application again for the next year.

Required Documentation

To receive a privilege when paying land tax for pensioners in 2020, along with the application, you will need to submit the following materials:

- for disabled people - medical documentation;

- for heroes of Russia or the USSR - papers confirming the assignment of such a title;

- for pensioners - an appropriate certificate, etc.

Local benefits

There are also local incentives that are set for specific areas. They are approved by regional and municipal executive authorities. For example, in some regions large families, orphans under 18, and relatives of military personnel who have lost their breadwinner may not pay for land.

This is interesting: Usn income minus expenses minimum tax

At the same time, people can either be completely exempt from taxation or receive a 50% discount. This point should be clarified with the Federal Tax Service, because each region has its own rules.

Important! Before receiving a benefit, you must make sure that a particular citizen has the right to it.

In this case, you need to collect the necessary official papers, fill out an application at the tax office and submit it along with the documentation. Moreover, the procedure must begin before December 1 of the current year. It is advisable to apply earlier as the process takes time.

If necessary, a person can send an application remotely, for example, through the Federal Tax Service website. To do this, you will have to register, fill out the form online and attach copies of documents converted into electronic format. All that remains is to wait for a positive decision on exemption from payments or provision of a discount. After this, you will be able to personally evaluate the benefits of preferential conditions.

In some cases, a person receives a refusal with an explanation of the reasons. Perhaps the situation can be corrected, for example, if there are not enough documents or the application is filled out incorrectly. It is necessary to attach a passport, Taxpayer Identification Number (TIN), a receipt for no debt, documents for the plot, as well as a certificate proving the right to the benefit. It is best to immediately fill out the form carefully and check the full list of papers so that there are no problems later.

Calculation of the duty amount

Whether or not pensioners need to pay a fee and how much it will be has been decided. It is important to stipulate that if in the region the tax has not been abolished for the group of persons in question, and payment by pensioners must still be made, it is calculated in the same way as for other individuals.

So, if the cancellation does not occur, or does not completely exempt the citizen from paying the fee, its amount will be calculated from the following indicators:

- B - tax base (cadastral value of the plot);

- C - rate (its own in each subject of the federation);

- K - coefficient (calculated based on the resource ownership time);

- D - share of ownership;

- L - amount of benefit (if any).

Formula for calculating the amount of tax: B * C * K * D – L.