Everyone likes to receive gifts, especially valuable ones, such as land. But they bring not only joy, but also expenses. One of them is income tax.

Real estate (and other gifts of value) are considered income received. Therefore, tax must be paid on its value.

Further in our article we will look at what tax is on the gift of land and what are the conditions for paying it, as well as who is exempt from it.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Do I have to pay for the donated land?

The specifics of paying personal income tax (personal income tax) are determined by Chapter 23 of the Tax Code. According to paragraph 18 of Article 217, inheritance received is not taxed, except for:

- income from works of science and art;

- rewards for inventions.

Gifts worth more than 4,000 rubles are taxed. Its size depends on what exactly is being donated.

According to Articles 224 and 225 of the Tax Code, real estate donated as a gift is taxed at a rate of 13% of the value (30% for non-residents). As you can see, calculating the amount of tax after the changes has become much easier.

Who is taxed?

According to paragraph 18.1 217 of Article 217 of the Tax Code, close relatives, which include:

- spouses;

- children, including adopted children (we talked about how to correctly register a gift deed for children here);

- parents (adoptive parents);

- brothers and sisters with whom at least one parent is common;

- grandparents;

- grandchildren.

No, you don’t need to pay, because the mother is the parent, and they are exempt from paying tax on gifted land. Other relatives (aunts, cousins, etc.) pay it on a general basis. Diplomats and members of their families also do not pay tax on land donations.

As a result of the transaction, the donee receives property, and the donor does not acquire material assets. Therefore, the person who received a valuable gift pays personal income tax.

It may happen that the tax service will require payment of tax under the land donation agreement. This happens because Rosreestr, after registering the transfer of ownership of the land, sends a notification to it. But it does not contain information whether a donation occurred or a sale (we discussed in detail the question of what is more profitable - donation or sale of a memory in a separate article).

Then you need to send an explanation. It is written in free form, a copy of the deed of gift for the land is attached to the letter, the tax must be asked to be cancelled.

For residents of Russia, the tax rate is 13%, for others – 30%. A resident is a person who has spent at least 183 days in the country in a year. That is, foreigners living in the Russian Federation for a long time pay a lower rate.

Personal income tax is calculated based on the cadastral or market value of the land. The latter can be determined based on the cost of neighboring plots.

Information about the first is contained in the certificate of cadastral value, which is obtained from Rosreestr.

In the latter case, you can choose the method of receipt:

- personally;

- by mail;

- electronic version by email;

- through MFC.

In all cases, obtaining the document is free.

When contacting the Rosreestr office, it is enough to present your passport and fill out an application, which will be issued on the spot. Moreover, information about the cadastral value is open to everyone, so the donee can receive the document even before the land is transferred to him.

After 5 working days (about 10 if the application was submitted to the MFC) the certificate will be ready. Regardless of the submission method, you will have to receive the paper version at the Rosreestr office or wait by mail.

The cost is multiplied by 0.13 and a figure is obtained, which will be the tax.

Donating real estate to relatives: what are the differences?

Let us immediately note that in relation to real estate, a deed of gift is one of the types of transactions in which the owner of the property transfers ownership of it free of charge to the donee at the time of signing and registering the agreement or at a certain time, which must be indicated in the contents agreement.

Thus, the legislator recognizes as income the benefit that the recipient received without spending his own funds on the object. Simply put, a person receives the desired property without allocating money for it and thus saving his money, saving it for future spending.

After registering the donated apartment or house in the Unified State Register of Real Estate and obtaining ownership rights, the new owner, in accordance with Article 217 of the Tax Code of the Russian Federation, namely, paragraph 18.1, does not have to pay the established tax only in 2 cases:

- The gift agreement was concluded between persons who are classified as close relatives or family members.

- Consular employees and members of their families are not subject to tax (according to the terms of the Vienna Convention on Diplomatic and Consular Relations).

All other new property owners will have to pay tax.

The first question of people who are offered to receive an apartment, house, garage, dacha or any other real estate as a gift, whether from strangers or acquaintances, is whether it is necessary to pay tax to a non-relative who received an apartment as a gift {q} As we have already mentioned, a deed of gift for such the object creates an obligation for the recipient individual to pay income on profit, after which the person receives ownership upon registration and can dispose of the gift at his own discretion (donate, sell, etc.).

In 2020, there are still no benefits for the payment of this tax by non-relatives. At the same time, very often unscrupulous citizens try to reduce the actual amount of taxation by covering up the gift purchase and sale transaction, allowing them to receive a tax deduction from the purchased real estate. But, if such a fact is disclosed, the transaction is considered void.

But who definitely doesn’t need to worry about taxes when accepting real estate as a gift is the relatives of the donor! But, in order for this condition to apply to the parties to the transaction, both the donor and the donee must be included in the category of close relatives, the list of which is established in the Family Code of the Russian Federation, namely in Article 3.

According to the norms established there, the following are exempt from tax on a donated apartment:

- grandparents, and grandchildren;

- brothers, sisters (both full and half-blood);

- adopted and natural children, as well as their parents.

Other relatives (uncles, aunts, as well as cousins and brothers) are required to pay income tax, equal to non-relatives.

At the same time, although a close relative does not pay tax and does not fill out the corresponding 3-NDFL declaration, but, according to the norms of the Tax Code of the Russian Federation, he is obliged to pay property tax on the property received as a gift.

We invite you to read: Deadline for refund of overpayment of tax upon application

Examples of personal income tax calculation

Example 1:

The plot worth 167 thousand rubles was donated to the citizen of the Russian Federation by his uncle. In this case, he must pay personal income tax at the rate of 13%. This will amount to 21 thousand 710 rubles.

Example 2:

Another plot, the cadastral value of which is 231 thousand rubles, was donated to a non-relative. The income tax rate will also be 13%. That is, you will have to pay 30 thousand 30 rubles.

Example 3:

The plot was donated to a non-citizen of the Russian Federation who spent less than 183 days in Russia in the year it was received. The cadastral value of the plot is 270 thousand rubles. He must pay 30%, that is, 81 thousand rubles.

How to pay?

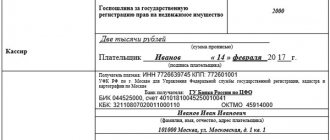

If it is necessary to pay income tax on the donated land, a 3-NDFL declaration is filled out. It must be sent to the territorial branch of the Federal Tax Service no later than April 30 of the following year.

For example, if real estate was donated in 2020, the declaration must be completed by April 30, 2020.

This declaration is submitted to the tax office at the place of registration.

You can submit it:

- in person at the branch;

- by mail (by a valuable letter with a list of attachments);

- or through the Federal Tax Service website.

The declaration is filled out on site or at home on a special form. It is necessary to indicate:

- Full name of the department to which it is submitted.

- Full name, passport details and TIN.

- Address and phone number.

- Cost of the plot.

- That it was received as a gift.

- Information about the donor.

- Tax amount.

The declaration can be submitted in three ways:

- personally;

- by mail;

- or on the Internet (via the website of the Federal Tax Service or State Services).

Each method has its pros and cons. If you submit the declaration personally to the inspector, he can immediately review it and point out obvious errors. On the other hand, it may require additional documents and not accept the declaration without them, without giving a written refusal.

In addition, you can send a letter from another city if you are not at your place of registration. After sending a letter, the delivery process can be tracked by number through the Russian Post website.

How to fill out a declaration for a donated plot:

If over the past year a person had other income subject to taxation, all of them are indicated in one declaration. Personal income tax is calculated for each type separately, then the amounts are added up.

After checking the declaration, the tax inspector issues permission to pay the tax and indicates the date by which this must be done.

These documents must be prepared before filling out the declaration:

- Passport.

- Deed of gift.

- Certificate of cadastral value of land.

- Certificate of ownership.

A certificate of ownership is issued by Rosreestr after registration. If lost, a duplicate can be obtained there.

Deadlines for personal income tax payment

The land deed tax must be paid by July 15 of the following year. That is, until July 15, 2020, if the plot was received in 2020. This can be done at any bank branch.

If income tax is not paid on time, penalties may be charged (1/300 of the Central Bank refinancing rate). In case of prolonged non-payment, a fine (from 20% to 40% of the cost) and seizure of property and bank accounts may be imposed.

Then you need to send a response and attach evidence of relationship. They can serve as birth, adoption, and marriage certificates. You don’t have to wait for such a requirement, but immediately send a letter to the tax authorities.

When receiving a plot of land as a gift, you will have to pay income tax. Only close relatives are exempt from it.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow) It's fast and free!

A land donation agreement is a document that is almost always concluded between relatives, but there are also cases of conclusion between strangers. The article describes the difference between the two types of agreement and the process of concluding it.

General information on the deed of gift for a land plot

The donation is formalized as a gratuitous transaction, that is, when it is completed, the party who gives does not receive a profit. As a result, the transfer of property to the new owner is formalized with the re-registration of all property. An important nuance can be noted that the donation of a plot occurs only during the lifetime of the owner.

Upon conclusion of the contract, ownership is transferred instantly to the new owner. Regulation of all procedures is provided if the adjacent real estate is donated along with the house. Then you will have to pay the property rate according to the given dimensions of the real estate that was donated. The tax on donation of land at the conclusion of this transaction is 0 or 13%, depending on the relationship of the citizens.

It is also necessary to point out an essential distinctive feature of the land, as a gift from one person to another - its complete indivisibility. That is, this fact means that receiving a plot under this agreement gives it the exclusive right of ownership; on the part of the recipient, it will be impossible to take away the plot through the court using any documents.

The law establishes restrictions on those who cannot be the donor of a plot:

- persons of minor age;

- people who are unable to adequately perceive the situation;

- citizens who do not have legal rights to land;

- officials in government agencies;

- workers of social and medical services, in the case of the object of donation in the person of wards.

Legal entities are also prohibited from making real estate donations. But there are exceptions, in the event that the company acts on the side of the citizen in the process of concluding an agreement. In case of receiving a plot from an organization or individual entrepreneur, a timely payment of 13% of the personal income tax rate is also required.

The law establishes that if the gift amount is less than 4,000 rubles, there is no tax payment, but this point does not apply to plots because of their higher value. Also, when filing the appropriate declaration, it is possible for the donor to withhold tax, but for this it is necessary to draw up a 3-NDFL declaration.

Combining several types of deductions in one period

Benefits in the form of income tax reduction are provided depending on the emergence of the right to receive them. Deductions are applied within the limits of the income received and the limits on the maximum amount established for each type.

We invite you to read: Summoned to the tax office for questioning: what to say and what to remain silent about

Resident of the Russian Federation Nikolaev V.V. received an apartment in 2020 from a person not closely related to him. The value of residential property under the contract was absent and was accepted for tax purposes according to cadastre data in the amount of 2,800,000 rubles. The amount was reflected in the declaration submitted in 2016.

- The amount of the taxable base was determined: D = 2,800,000,225,000 = 3,025,000 rubles;

- We determined whether the taxpayer has the right to a deduction and determined the amount of the benefit: B = 2,000,000 120,000 = 2,120,000 rubles;

- Provided tax benefits: C = 3,025,000 – 2,120,000 = 905,000 rubles;

- We determined the amount to be paid to the budget: N = 905,000 x 13% = 117,650 rubles.

- Conclusion: The taxpayer applied the property deduction in full and the social deduction within the limit established by law.

Differences in types of gift agreement

Payment of the tax rate on a gift transaction is provided only if the parties to its conclusion do not have family ties. As for taxation when donating a land plot, the standard tax applies here, that is, 13%.

So the Tax Service adopted changes in 2006, according to which the tax is taken only from strangers with the status of the donee. It should be clarified that the procedure for executing a transaction in both cases, both for an agreement with relatives and with strangers, is completely identical.

When making a transaction of this kind with relatives, the state provides a benefit that provides exemption from paying the personal income tax rate. Now let’s look at who is the donor’s relative in this case:

- children, both natural and adopted;

- parents;

- blood relatives on the paternal and maternal lines of the parents of the donor of the plot;

- sisters and brothers of the donor by blood line;

- husband or wife.

Among other things, it is possible to give a gift to a minor child, but this case requires acceptance of the gift by the responsible party:

- father or mother of the child;

- the child's guardian;

- guardianship and trusteeship authorities under whose supervision the child is.

At the age of 14, a child has the right to sign a personal liability agreement in connection with the receipt of a passport identification card. Then the document contains a column indicating the signature of the person responsible for the child. This document states that the actual owner of the plot until the gifted person comes of age is his guardian, but in this case he is not allowed to take any legal actions.

Such measures are inherently a means of storing them for a while in order to retrieve them later. After reaching the age of majority, he has the right to carry out all operations with his plot.

Now let's decide on the tax on donated land. A report to the tax payment regulation service is submitted by the recipient in a situation where he is a stranger to the donor.

There is also a case when the tax service accidentally sends a document for payment, but the agreement was concluded between relatives. Then you need to submit documents confirming your family relationship to the tax service.

The following approved algorithm applies when the parties to the agreement are not listed as relatives:

- Submit an appeal to the tax service in whose jurisdiction the client is located.

- Submission of the corresponding declaration before the beginning of May of the following year after the donation procedure.

- Next, a declaration is received from the tax service, and the citizen is obligated to pay tax until the end of July of the given year.

If the recipient does not have resident status, you will have to pay 30% as income tax instead of the standard rate.

Residence is quite easy to obtain; you just need to live in the Russian Federation for more than 200 days a year. The gift tax for a land plot is calculated in the declaration itself according to the cadastral data regarding the plot indicated in it.

For a significant discrepancy in the value of the tax, an additional fine is imposed on the citizen, for violating the law and submitting incorrect information.

Local authorities in the area where the transaction was concluded in this case estimate its value according to the cadastre. So they are obliged to accurately assess the value and its discrepancy from the market value, which cannot be more than a fifth of the average at the place where the land donation agreement was concluded.

Peculiarities of paying taxes for a plot received by gift

A real estate gift agreement, which includes a plot of land, is traditionally concluded between close people and much less often between strangers. In terms of the number of transactions concluded, this operation ranks second after agreements on the donation of apartments and houses. The tax on the donation of a land plot by an individual is paid only if the recipient is a stranger to the owner. Between relatives, the procedure is carried out without taxation.

Deed of land: general information

Donation is a gratuitous transaction. One party transfers property to another without receiving any profit from it. The result of the transfer is the registration of the new owner of the land in Rosreestr and receipt of the appropriate certificate. The plot can be donated only during the lifetime of the owner.

The right passes to the recipient instantly, and not after death or other circumstances. The legislation allows for the gift of a house and a plot of land together; the tax amount in this case is the same - 0 or 13% of the cost.

The peculiarity of land as a gift is its indivisibility. The land received under such an agreement will belong exclusively to the recipient and cannot be taken away through the court by the heirs, relatives of the donor, or divided in the event of divorce.

The following cannot be donors:

- minor children;

- incapacitated persons;

- citizens who do not have legal rights to land;

- civil servants;

- stateless persons, if the site is located in the border zone;

- social or medical workers, if the donors are their wards.

Real estate gift transactions between legal entities are prohibited. But an organization can act as a party to an agreement together with an individual. So, if a citizen receives a plot of land as a gift from a legal entity or individual entrepreneur, a 13 percent personal income tax is also paid.

If the amount of the gift does not exceed 4 thousand rubles, no tax is paid at all, but this hardly applies to plots of land. The tax amount can be withheld by the donor organization (if the parties to the agreement are an employer and an employee, for example) or by filing a 3-NDFL declaration.

Giving to relatives and strangers

Donation of a land plot is subject to personal income tax at a rate of 13% if the recipient is a stranger (not a relative). Personal income tax is paid by the new owner. In this case, the tax is calculated based on the cadastral value of the plot, which is actually the market price. Therefore, it is mandatory to indicate such a cost in the contract. The form of the agreement for this type of gift is no different from a transaction with relatives.

The legislation establishes a benefit for donating real estate between relatives - exemption from personal income tax. Close relatives are:

- children, in particular adopted children;

- parents;

- grandfathers;

- grandmothers;

- sisters or brothers;

- spouses.

In addition, there is the possibility of donating land to a minor child. However, his legal representative must accept the gift instead:

- father;

- mother;

- guardian;

- employee of the guardianship and guardianship authorities.

From the age of 14, minors have the right to independently sign contracts of this kind. In this case, the written consent of the representative is indicated in the text of the document. The latter is also the actual owner of the land until the recipient turns 18 years old. However, the child’s representative does not have the right to make transactions with the plot - donate, exchange, lease. The land is essentially in his custody. After reaching adulthood, the child takes ownership and has the right to do whatever he wants with the plot of land.

Paying tax

Not everyone knows what tax is paid when donating a land plot in 2020. If the transaction takes place between relatives, no tax is paid under the land donation agreement. Accordingly, reports are not submitted to the Federal Tax Service.

If the recipient has mistakenly received a notice demanding payment of the amount, a document confirming the family ties of the parties to the agreement is provided to the Federal Tax Service at the place of residence:

- marriage or birth certificates;

- passports of the parties.

If the recipient is not a family member or relative of the donor, after receiving the land he must do the following:

- Contact the tax office at the place of registration in your passport.

- The declaration must be submitted by May of the following year.

- Based on the receipt received, you must pay the tax by mid-July.

If the recipient is a non-resident of the Russian Federation, the rate for him increases to 30%. Non-residents are citizens who do not reside in the country for more than 183 days a year. If the land was received on the territory of Russia, then the tax is paid here.

The declaration is a “combined” document - any income received during the year must be reflected in it. So, one document indicates the profit received from performing one-time work, selling housing, receiving real estate as a gift (for parties to the contract that are strangers to each other), and so on.

The tax is calculated in the declaration. The base is the cadastral value of a plot of land. Accordingly, to confirm it, you need to attach a cadastral passport. However, a standard price can also be used, which is sometimes several times lower.

The recipient is responsible for inaccurate information regarding the value of the land. He may even be held accountable and fined. The maximum deviation from the actual cost of the plot should not exceed 20%.

creditnyi.ru

Documents required when paying tax

When concluding an agreement, the following documents are sent to the tax service:

- The agreement under which the land was donated. The document guarantees the acceptance of the required cadastral value of the received gift.

- A cadastral passport of the plot is provided. This document in the form of an extract can be ordered from the state real estate register; the cadastre will be verified in accordance with the legal framework.

- A certificate of re-registration of property, which is issued when a transfer has taken place from one owner to another.

- The completed document indicating the exact amount that must be paid to the citizen is submitted to the Tax Service for detailed verification.

After the donation, if it occurred between strangers, a declaration must be filed.

In this case, the filing must occur strictly before the end of April of the year when the transfer of ownership to another citizen occurred; the regulation of the issue is described in Article 221 of the Tax Code of the Russian Federation. So, if the donation agreement is not submitted or the tax is not paid on time, sanctions are imposed.

Termination of such an agreement is a complex process, and if there is no consent of the recipient party, you will have to go to court. Receiving as a gift not only a plot, but also property, requires payment of property tax.

Usually, when filing an application, the court, if there are compelling reasons, almost always makes a decision in favor of the donor of the plot.

Land gift tax 2020

While the procedure for drawing up a gift agreement is regulated by the provisions of civil legislation, taxation rules are contained in the Tax Code of the Russian Federation. In accordance with its instructions, land ownership transferred free of charge is considered as income of the donee.

Based on the above, upon receipt of such an object into ownership, a tax is collected from the recipient, which is deducted to the budget. In addition, the execution of such a transaction requires reporting in relation to the property being donated.

Filing a return and paying taxes is the sole responsibility of the donee.

The transferring party pays personal income tax if a purchase and sale agreement is drawn up for the alienated property, and since it does not receive any income when donating, it is not subject to taxation.

Taxes on land plots transferred as a gift are included in the taxes on personal income, the amount of which is the same throughout the territory of our state and is equal to 13%. No increase is expected for this year. For citizens of foreign countries, the personal income tax amount is higher, it is equal to 30%

. The tax base is based on information about the cadastral or market valuation of land ownership.

The gift agreement itself does not provide for the need to indicate the value of the plot, however, when calculating the amount of tax, Federal Tax Service employees, as a rule, rely on the cadastral valuation. It is equal to the average market indicators and is formed depending on the location of the property, its main characteristics and condition in general.

Check out an example of calculating gift tax: according to the cadastral valuation, the value of the plot is 100,000 rubles. The personal income tax rate is 13%

.

The amount of tax payable by the donee is thus equal to 13,000 rubles (100,000 * 13/100)

. If the donee is a non-resident, the amount increases to 30,000 rubles.

After concluding a land donation agreement, the recipient’s obligation is to pay land tax.

In this case, personal income tax belongs to the municipal category, therefore the size of its rate and the establishment of the tax base are established by municipal authorities. For agricultural plots, its amount is no more than 0.3%, for others - 1.5% of the cadastral valuation.

Most often, tax authorities themselves send payment documents with the amount of tax due, so the taxpayer does not have to calculate anything on his own.

Tax calculation and payment

Tax payment is required when concluding a gift agreement between strangers. For correct payment, a 3-NDFL declaration is drawn up:

- The first page contains information about the payer, such as full name, passport details, registered place of residence of the citizen.

- Then a simple tax calculation occurs, that is, the amount of the cost of the site is multiplied by the tax rate, which can be 30 and 13%. The indicators are contained in columns 1 and 2 of section 1.

Tax calculation example:

- The cost of the plot is 55,000 rubles, then the tax for a citizen of the Russian Federation will be 55,000 × 13% = 7,150 rubles.

- In the second case, for a non-resident 55,000 × 30% = 16,500 rubles.

The declaration is submitted no later than April 30 of the year of the transaction. Payment of the tax must take place no later than July of the same year. For payment to the Tax Code, the documents described above are provided.

How to draw up a deed of donation of a dacha?

To formalize a dacha donation agreement, the parties have two ways:

- do it yourself and draw up an agreement in simple written form;

- contact a notary.

Each method has its pros and cons. To understand how best to proceed in the specific case of registering a deed of gift for a dacha, let’s consider both options.

A donation agreement for any property can be drawn up in simple written form. So the deed of gift for a dacha can be drawn up by the parties independently. To do this, you can familiarize yourself with the standard form of the document. The mandatory clauses that the parties must include in the dacha donation agreement are:

- data of the donor and recipient. For each of them, you must indicate your full name, residential address, and passport details;

- information about the subject of the donation. It is necessary to indicate the address or location of the dacha, area, number of floors, characteristics of the plot of land on which it is located. The absence of correct and comprehensive information about the subject of the gift makes the contract automatically void;

- date of transfer of the gift, if it is not planned immediately. A gift deed may contain a promise to transfer the gift in the future;

- signatures of the donee and the donor.

In order to ensure that all the characteristics of the property and the data of the parties to the transaction are indicated correctly, it is necessary to prepare the following documents in advance:

- technical passport of the dacha;

- cadastral plan of the land on which it stands;

- passports of the donor and recipient;

- certificate of state registration of the donor's right to the dacha;

- a document of title according to which the dacha is the property of the donor.

The correspondence of the data specified in the documents and the gift agreement is the key to the correct preparation of the deed of gift.

After signing the donation agreement for the dacha, it is necessary to register the ownership. To do this you need:

- Contact the registration authority at the location of the dacha.

- Write an application for registration and submit documents. Upon receipt of the papers, an employee of the registration authority will issue a receipt and inform you of the date of application for the completed certificate.

- Pay the state fee for registration.

- On the appointed day, submit a receipt to the registration authority and receive a certificate and documents submitted there.

The donee is required to pay tax on income received as a result of a gift at a rate of 13% of the cost of the dacha. If the donee is a close relative of the donor, then he is completely exempt from paying tax.

If the parties decide to draw up a dacha donation agreement with a notary, then they have this right.

The notarized form of the deed of gift is not required, but is possible, since it is not prohibited by law. The parties apply for its registration in order to:

- eliminating errors in document preparation;

- certification by a notary as a guarantee of the correctness of the deed of gift;

- reducing the grounds for challenging a gift agreement.

The notary draws up the contract independently. To do this, he will need documents for the dacha and identity cards of the parties to the transaction. The notary also carries out state registration of rights independently. As a result, in the process of drawing up a gift agreement by a notary, additional costs will be required from the parties:

- payment for specialist services. For assistance in drawing up an agreement, the notary charges a separate fee;

- state fee for notarization of the gift agreement;

- state fee for registration of rights, which is paid to the notary, and he already pays it to the registering authority;

- tax on income received from a gift, if the parties to the agreement are not close relatives of each other.

Obviously, the cost of registering a deed of gift from a notary will significantly exceed a self-executed agreement.

Tax under a land donation agreement

Advice from lawyers:

1. Is tax charged under a gift agreement on a land plot if a mother gives it to her son.

1.1. No tax is not charged.

Did the answer help you?YesNo

1.2. No, since the transaction takes place between close relatives.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. Is it necessary to pay a 13% tax on the value of a share of land under a gift agreement?

2.1. If you did not receive this share from a close relative, then you will have to pay 13% personal income tax.

Did the answer help you?YesNo

3. The husband sent the 3-NDFL declaration to the MIFTS in February 2020 (the tax is calculated based on the cadastral value of the land plot received under a gift agreement), but the receipt for the tax payment did not arrive. Now my husband has died. Do I have to pay personal income tax for it?

3.1. Hello! The receipt should not have arrived. The following procedure applies: a tax return must be submitted by April 30 and tax must be paid by July 15. In your case, the tax obligation ceased to exist due to the death of your husband Article 44. Origin, change and termination of the obligation to pay taxes, fees, insurance contributions 3. The obligation to pay tax

and (or) collection

is terminated

: 3)

with the death of an individual

- the taxpayer or with his declaration of death in the manner established by the civil procedural legislation of the Russian Federation.

Did the answer help you?YesNo

4. There is a plot of land that was owned by my grandmother. 2 years ago, under a gift agreement, my mother became the owner. Now the question has arisen about selling this plot. Question: do I have to pay 13% tax on it? Question 2: if you need to pay tax, how can this amount be transferred to the buyer with the buyer’s consent? Thank you.

4.1. Hello. No need. According to Article 217 of the Tax Code of the Russian Federation Income not subject to taxation Income received as a gift is exempt from taxation if the donor and recipient are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive and adopted parents, grandparents and grandchildren

, full and heterogeneous (having a common father or mother) brothers and sisters);

Did the answer help you?YesNo

5. In 2020, I received a plot of land from my father under a gift agreement. In 2020 I was forced to sell it for 550 thousand rubles. Will I have to pay 13% tax on the sale of property since I have been using the property for less than 3 years? Will a tax deduction of up to 1 million rubles be applied in this case, since I did not purchase it, but received it as a gift?

5.1. The million deduction is applicable.

Did the answer help you?YesNo

6. In 2020, I received a plot of land under a gift agreement. Now I want to sell it, but another 3 years of ownership have not passed. How to avoid paying sales tax? There is information about the sale for no less than 70% of the cadastral value and filling out 3 personal income taxes. Please check the relevance of this data or other options.

6.1. The data is of course up to date, but it does not exempt you from paying tax. The tax base is determined based on the value of the sold plot, but not less than 70% of its cadastral value.

Did the answer help you?YesNo

7. The seller sells a plot of land worth 518,000 rubles. She has owned it for less than a year, under a gift agreement from her husband. Will the seller pay sales tax?

7.1. Oksana, yes, it will. Now, even more so, the period for owning property so as not to pay sales tax has been increased to 5 years, from 2016. This is true, for your information. All the best.

Did the answer help you?YesNo

8. What tax will the donee pay on the donation of 33/100 shares. The entire house is estimated at cadastral value at 2 million rubles, and the land plot is 1 million. Rubles (allocated) From the amount of the cadastral value or the amount specified in the donation agreement.

8.1. Hello, Love! If the donee is not a close relative of the donor, he will pay a tax of 13% of the cadastral value of the donated share.

Did the answer help you?YesNo

9. This is the question! 10 years ago, under a gift agreement, I received a plot of land from my father. I recently surveyed it into 2 plots and registered ownership. Will I have to pay income tax if I sell them? After all, they were separated from one donated plot? How can I sell a plot of land without having to pay taxes?

9.1. Hello, Alexander! Since after land surveying you have formed two independent plots, the countdown of the period will begin from the moment of their registration. Therefore, when selling a plot before the expiration of 5 years, you must pay tax. When selling a plot at a price of less than 1 million rubles (but not less than 70% of its cadastral value), tax can be avoided by applying a tax deduction.

Did the answer help you?YesNo

9.2. Unfortunately, you have two new sites that have recently been registered. This is not the perfection of the Tax Code of the Russian Federation,

Did the answer help you?YesNo

10. Will it be necessary to pay tax after registering ownership of real estate and a land plot with it under a gift agreement from father to son?

10.1. No, it is not necessary since the gift agreement was concluded between close relatives.

Did the answer help you?YesNo

11. We bought residential premises and a share of the land plot in the house under a purchase and sale agreement, as well as under a donation agreement for a common area. Do I have to pay tax for public spaces?

11.1. If, according to the gift agreement, the donor and the donee are not close relatives, then tax must be paid.

Did the answer help you?YesNo

12. There is a house with a plot of land. Until 2020, the owners of the house were me, my father and mother. In December 2020, my mother transferred her share of the property to me under a gift agreement, so I now have 2/3 of the share of the house and land. Now my father and I are selling a house for 3 million rubles. Please tell me whether I should pay tax on income from the sale of the house. Thank you in advance.

12.1. Let's start with the sellers, as you indicated two. You will both receive income and both will have to pay tax. Article 217 of the Tax Code of the Russian Federation establishes the types of income of individuals that are not subject to taxation. Clause 17.1 of this article states that this is income received by an individual from the sale of real estate, as well as shares in this property, which they owned for at least the established minimum period. For real estate objects received under a gift agreement from close relatives, the minimum period is 3 years (Article 217.1 of the Tax Code of the Russian Federation).

Did the answer help you?YesNo

13. The mother transferred a plot of land with a house to her husband under a gift agreement in 2020. In 2020 we want to sell for 1,450,000. What amount will be taxed in this case?

13.1. Hello! Tax from 450,000 rub. Article 220 of the Tax Code of the Russian Federation, Part 2: 1) property tax deduction is provided: in the amount of income received by the taxpayer in the tax period from the sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses or land plots or shares (shares) ) in the specified property that was owned by the taxpayer for less than the minimum maximum period of ownership of the real estate object established in accordance with Article 217.1 of this Code, not exceeding in total 1,000,000 rubles.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. My friend received a land plot worth 900,000 rubles under a gift agreement. Does she have to pay tax on this gift? Thank you.

14.1. No, it’s not necessary, because... according to Article 220 of the Tax Code of the Russian Federation, she has the right to take advantage of a tax deduction, which amounts to 1 million rubles. Tax = 0 = 13%* (900-1000) million. rub., because the tax base is negative.

Did the answer help you?YesNo

14.2. Your friend received income on the basis of a gift agreement, Article 572 of the Civil Code of the Russian Federation. According to Article 217 of the Tax Code of the Russian Federation, such income is not exempt from taxation. You will have to pay 13% of the cost of the land.

Did the answer help you?YesNo

15. What is the best way (cheaper in terms of taxes) to re-register back a land plot given under a compensation agreement: by sale or purchase or gift?

15.1. Purchase and sale, of course, otherwise you will have income and will have to pay a tax of 13% on the value of the gift. When selling, the seller will be able to deduct from the contract price his costs associated with the acquisition of the property.

Did the answer help you?YesNo

16. What taxes and state duties must be paid on the land plot received under a donation agreement, the cadastral value is 600 thousand rubles, the donor is not a relative?

16.1. 1. The donation of a land plot, like any other property, is subject to personal income tax in the amount of 13% of the value of the property, with the exception of donations to close relatives (wife, husband, children, grandparents), the relationship must be confirmed. 2. After the transaction, not only the ownership of this property passes to the donee, but also the obligation to pay property tax (paid once a year).

Did the answer help you?YesNo

17. Question: under a gift agreement, my wife was given a real estate building (shop) and a plot of land by her sister. The wife wants to sell the donated store building and the land plot underneath it. Will I have to pay tax?

17.1. If your spouse wants to sell the property immediately after the donation (in the same year), then you will have to pay tax, or if 5 years have passed after the donation, then you do not need to pay tax.

Did the answer help you?YesNo

17.2. Hello. If less than five years have passed since your spouse received the said property, you will have to pay an income tax of 13%.

Did the answer help you?YesNo

18. It is necessary to transfer ownership of the land plot. If you execute a transaction under a gift agreement, there is reason to believe that the donee is obliged to pay 13% of the cadastral value of the land plot, since he is not a close relative of the donor. (The donor is the legal spouse of the recipient’s mother). 1. Is this correct? 2. Are there any nuances under the purchase and sale agreement if you indicate a formal price, for example, 10 thousand rubles? 3. How can I legally avoid paying exorbitant taxes on this transaction?

18.1. 1.Yes. In addition: Income received as a gift is exempt from taxation if the donor and donee are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandfather , grandmother and grandchildren, full and heterogeneous (having a common father or mother) brothers and sisters); 2. For the tax, the seller will be calculated 0.7 from the cadastral tax. 3. Apply a deduction of 1 million.

Did the answer help you?YesNo

19. I have owned a plot of land for 1 month. Is the transaction under the gift agreement for this land plot subject to tax if I give it to my daughter? Do I need to take my spouse’s consent to donate this plot? 'Based on materials from the legal social network www.9111.ru ©'

19.1. Good day, such a transaction will not be subject to tax according to clause 18.1 of Art. 217 of the Tax Code of the Russian Federation, namely, a contract of gift of real estate between persons recognized as family members and close relatives is not taxed (in your situation, mother and daughter). Was this land plot acquired by you as a gift, inheritance or purchase and sale using money jointly with your husband? If in the order of inheritance and donation, then consent is not necessary, if in the order of purchase and sale, the consent of the spouse is necessary, since this property will be jointly acquired.

Did the answer help you?YesNo

20. Please, is income from sold property taxable? I own a house and a plot of land; they belong to me under a donation agreement, which was executed in February 2014. If I want to sell this property, for example, for 3 million rubles, how much tax will I have to pay? Thank you!

20.1. According to the law, sold property is subject to tax. But also, if the apartment has been owned for 3 or more years, then you do not need to pay tax. This is regulated by Art. 217 clause 17.1 of the Tax Code. This applies only to those apartments that were registered no later than January 1, 2020.

Did the answer help you?YesNo

Please tell me whether I will be subject to tax as a donee under a donation agreement for 9 shares of a land plot.

Please tell me how much I will have to pay personal income tax for 2020.

In 2006, a house was purchased under a purchase and sale agreement and a land plot of 1/2 of 6 acres under the house under a gift agreement.

In 2006, a house was purchased under a purchase and sale agreement and 1/2 of 6 acres of land under the house under a gift agreement.

The land plot and the house were inherited from the mother of the daughter under a gift agreement. The daughter, in turn, sold the above for 300,000 rubles.

- owns 1/2 of a house S=300 sq. m and 1/2 of a land plot of 12 acres, received under a gift agreement.

In September 2020, I sold the garden received under a gift agreement for 320,000 rubles.

If I received a plot of land under a gift agreement a year ago, the tax notice did not arrive and I wrote an application to pay the tax.

In 2013, under a gift agreement, I gave a plot of land with a house to my sister.

In December 2015, under a donation agreement, I received a house with a plot of land from my sister.

My mother, under a gift agreement, transfers ownership of a plot of land to me; what taxes do I have to pay?

Gift deed for a dacha between close relatives

A deed of gift for a dacha between close relatives is drawn up according to general rules. No specific features arise due to the fact that the parties are close relatives of each other. If it is certified by a notary, then the state fee for certification is paid at a reduced rate. In addition, there is no tax on gifts between close relatives.

Thus, the agreement for donating a dacha can be drawn up in simple written form by the parties to the transaction or certified by a notary. The costs of compiling it will always vary. After registration, the deed of gift for the dacha is presented together with other documents to register ownership. Tax is not paid only in case of transfer of a gift in favor of a close relative.

Stages of filing a tax deduction

A person has the right to receive a property deduction from the Federal Tax Service or from an employer after receiving a notification from the Inspectorate about the right to a benefit in the current year. The most common option is to present the deduction on the same return as income.

| Registration stage | Description |

| Registration of a gift agreement | The agreement is drawn up in simple written form; when transferring a share, a notary certification is required |

| Registration of ownership | Ownership of property arises after state registration |

| Filing an income tax return indicating the deduction | Carried out at the end of the year of the donation transaction |

| Document attachment | The fact of receipt of property, its value, income, and the right to deduction are confirmed |

| Submitting an application | Represented in case of overpayment of tax |

We suggest you read: How to challenge an apartment donation agreement

When planning to use a deduction from an employer, a package of documents and an application to receive the document are provided to the Federal Tax Service. The possibility of obtaining a deduction arises if there are several types of benefits, which entails an overpayment of tax.