On the territory of Russia, inheritance by law and by will operates.

In one case - when the testator did not leave the corresponding document after death, the inheritance passes to the relatives. But if a capable citizen has expressed his dying will, to which he has a legal right, then the second option occurs. A will is an opportunity to dispose of one’s own property at one’s own discretion. The person named in the will will become the legal owner of the inherited property. But what is a will? More than one generation has known about this method of expression of will since ancient times. History has brought to us the great testament of the Templars or the “testament” of Byzantium (otherwise, the Eastern Roman Empire) to its successor – the Russian Empire.

In the same Russian Empire there was a Code of Laws on Inheritance. There was a time when the very concept of “will” was not legally defined in the RSFSR. But today the legislator pays enough attention to the development of this area.

The concept of a will

There is more than one definition for this document. But they all come down to a common denominator: in essence, this is the free expression of the will of a citizen regarding his property in the event of death. This action is considered unilateral; it confers powers and responsibilities, but only after the inheritance case is opened (clause 5 of Article 1118 of the Civil Code of the Russian Federation).

In his order, the testator stipulates the transfer of his own property and non-property rights to the persons designated by him in connection with his death. Moreover, at the time of registration, the testator must be mentally healthy, capable of being responsible for his actions and their consequences.

A will is a personal expression of the will of a citizen regarding a piece of real estate in his ownership in the event of death, which is made not orally, but in the form established by regulations (notarial or equivalent).

The peculiarity of this document is that, although it is drawn up here and now, the recipients of the posthumous gift will be able to inherit property only when the testator dies. In addition, inheritance by will takes precedence over inheritance by law.

This document is characterized by the following features:

- this is a classic example of a unilateral, sole (on behalf of a single person), urgent (the death of the testator eventually occurs) transaction;

- is of an exclusively personal nature, signed only with one’s own hand, is not executed on the basis of a power of attorney, and with rare exceptions, is notarized;

- the onset of legal consequences of the transaction is possible strictly after the death of the testator;

- this transaction is of a strict form (properly executed, always in blank form, must be certified, and is invalid without the personal signature of the testator).

Now let's talk about this document in more detail.

Strength of a will

The idea of taking care of our own, something dear to us, visits us often. But the objects of care can be completely unexpected, and the conditions for receiving bequeathed funds also vary. Let us cite some more cases in which one can only be surprised at the enormous power of the will , the persistence of the heirs in trying to receive an inheritance and the ingenuity of the testators in inventing difficulties for those who remained...

Henry Budd

1. It's all about the mustache!

Henry Budd lived in the 19th century and had a good fortune. He also had two sons, to whom he decided to leave his savings. True, it was necessary to divide not just in half. The first person to grow a mustache was to receive most of the inheritance. The brothers turned out to be strong guys - no one in their life has ever appeared in public with facial hair! They divided in half a huge fortune of 200,000 pounds sterling at the end of the 19th century.

2. Shakespeare's Testament

The playwright's will is considered the main confirmation of his real existence. The whole will is very strange, but one phrase is simply killer: “I bequeath the second best bed in the house to my wife.” It has not yet been possible to understand its meaning and emotional connotation (humor, mockery, completely serious version).

3. A Skull for Hamlet Juan Potomac was an avid theatergoer. And in 1955 he left 200 thousand pesos to the Buenos Aires theater. But there was one condition - his skull had to be used in productions of Hamlet. The theater easily agreed to the terms and uses Haun's skull on stage to this day.

4. Smoke from Charlie Chaplin Charlie Chaplin was a heavy smoker. In his will, he left $1 million to anyone who could blow 6 smoke rings out of their mouth, and then pass the seventh through them. Chaplin passed on his fanatical love for the pipe and smoke to thousands of lovers around the world who passionately wanted to get a million.

5. Trolling Charles Millar

Charles Millar was a Canadian lawyer who greatly revitalized his hometown. The first unusual item in the will was a stake in his brewery. Charles gave them to three priests who were actively fighting alcoholism. The shepherds took the inheritance.

Next were three lawyers he knew who hated each other with a passion. They got joint ownership without the right to sell a house in Jamaica. And the most striking point was the following: 600 thousand dollars was to be received by the most prolific mother - the woman who, in 10 years of legal marriage, will give birth to the largest number of children in Toronto. The depression of the 1930s gripped the country, and storks circled over Toronto.

The results began to be summed up in 1938. At first, two ladies with 10 kids were in the lead. But one of them did not give birth to all her children in Toronto, and the other had children from different husbands. So women were out of the running. And the inheritance was divided equally between four women who gave birth to 9 children.

But these are not all cases of strange wishes; there are other Special Wills.

What does the law say?

The Civil Code of the Russian Federation is the main legislative act, where Article 62 regulates the procedure for inheritance by will, and it corresponds to the private law:

- Article 1125: “Basic requirements”;

- Article 1149: “On compulsory share”;

- Article 1127: “On a will officially equivalent to a notarial will”;

- Article 1128: “On the execution of a will in special circumstances”;

- Article 1129: “On persons who have the right to certify a will.”

This is in general terms. In more detail, the law declares the freedom of expression of any person regarding the disposal of his own property. And in accordance with the requirements provided for by law, this means:

- the order must be a personal decision of the person without any outside pressure;

- the testator is not obliged to inform anyone about his decision;

- it is allowed to bequeath any personal property - cash and securities, real estate, business, corporate rights, animals, etc.;

- any degree of specification of property is allowed in the text of the document;

- both things and shares in them can be distributed in the inheritance;

- the testator has the right to deprive the rights of any relative (and all successors in general) without giving reasons. His will in general can be reduced to deprivation;

- at any time the will can be changed and even annulled;

- there can be any number of such orders, each dedicated to a specific part of the property;

- any subjects can be chosen as recipients of the posthumous will, from close relatives to legal entities and foreign states;

- the testator has the right to indicate an alternative recipient of the gift in the event of the initial refusal of the inheritance or his death or recognition as an unworthy heir;

- the testator can express a “testamentary refusal”, which means the right of the donee to receive monetary support by living in housing, at the expense of property or in another way, excluding inheritance of property;

- The recipient may also be entrusted with instructions of an intangible nature, the so-called “testamentary assignments”, such as caring for the testator’s pet, etc.

At the same time, the law limits the willful disposal of acquired property with certain requirements:

- Allocation of a mandatory share in the inheritance.

- Prohibitions:

- to formalize such an order for a child and an incapacitated citizen;

- to a joint expression of will by two or more subjects;

- to hire a representative with instructions to draw up a will in his place;

- to an invitation to act as a witness for the recipient or his relatives; persons under the age of majority, incompetent, unable to read and write, mentally ill, who do not speak the language of the testator.

The main purpose of such restrictions is to protect the interests of the author of the will.

In general, the Civil Code of the Russian Federation has fairly detailed regulation of the procedures for accepting a will.

Features of inheritance

Entering into an inheritance always raises many questions, especially for those who are faced with such a procedure for the first time.

To understand where to start and what to pay attention to, you should highlight the main features of inheritance rights:

- There are only two types of rights to inheritance: legal and testamentary.

- The general period during which persons acting as heirs must accept the inheritance is six months. The period begins to be calculated from the day following the day of death of the testator, recognition of him as dead (there must be a court decision), refusal of the inheritance, etc. It is these legal facts that are taken as the beginning of the opening of the inheritance. It is worth noting that if a waiver of the right to inheritance has been made, the subsequent heir must carry out the necessary procedures within three months.

- To fully enter into an inheritance, you will need to collect the necessary papers that confirm the death of the testator and the identity of the heirs, indicate the rights to the inheritance, property transferred in this manner, and other additional documents, depending on the circumstances.

Since the testator has the right to dispose of his property at his personal discretion, the will left may be of an unexpected nature.

For example, the testator may not include any of his relatives in it, indicating persons who are not included in the heirs by law, or leave all his property to the state.

Warning

The testator is also not subject to the obligation to provide information about the contents and conditions of the testamentary document and changes made to it.

When deciding to deprive a relative of an inheritance, the testator should not explain the reasons that prompted him to take such actions.

Procedure for registering a will

The validity of the document depends on how correctly the dying will of the citizen is drawn up. So the question of how to properly draw up a will is not an idle one. There are many nuances to this procedure, and they must be approached with all responsibility. And yet, what should a testamentary disposition look like?

Forms

The document is drawn up in writing and must comply with the requirements imposed on it by the Civil Code (Article 1124).

In addition to the handwritten version, the document is printed on a printer or typewriter.

Content part

The date in the posthumous disposition must be clearly indicated (necessarily in words), as well as the place of execution.

The text of the declaration of will must contain clear information about each heir:

- personal data (date of birth, place of residence);

- property to be transferred;

- as well as other instructions of the testator that he deems necessary to include in this document.

If the shares of the heirs are not specified, they will all be considered equal, and this may become the reason for lengthy proceedings on the division of property in court.

In order for the prepared document to gain legal force, it must be certified by a notary, and in other situations provided for by law, by the relevant official.

Actually, the testator can fill out the text of the will himself or a notary can do it from his words.

Documents for registration of a will

- form for expression of will;

- civil passport of the testator;

- receipt of payment of state duty;

- real estate documents.

Notarization

The document, which is recorded by a notary from the words of the expresser of the last will, is certainly provided to the latter for reading.

- If the testator is unable to read the will himself, then it is read aloud, and on the document itself an appropriate signature is made listing the reasons why the person himself could not read what was written.

- Signature of the testator. He personally signs the paper. When this was prevented by a severe illness, some kind of physical defect, or lack of literacy, then, at his request, a third party can sign for him, exclusively under the supervision of a notary. The order must indicate the reasons for this, along with the full name of the person who signed the document at the request of the testator and presented proof of his identity.

- Witnesses. When papers containing the last will are notarized, a witness may be invited at the request of the author. At the same time, he also signs his autograph, and the document indicates his full name according to his passport.

- Warnings The witness and expresser of the last will must be warned by the notary about observing testamentary secrecy. And also, before certifying the document, the testator is warned about the obligatory share in the inheritance, and a note is made about this.

The law provides for cases when a document is certified by other persons, and it has the same force before the law as if certified by a notary.

Who has the right to register a will?

- For those serving a criminal sentence, the document will be certified by the head of the correctional institution.

- For those undergoing treatment in medical clinics - the head physician.

- For the military and their families - the commander.

- For those on a voyage on ships flying the State Flag of Russia - the captain.

- For those on expeditions - a leader.

About the witnesses

All of the above circumstances necessarily require the presence of witnesses: being in a clinic, a nursing home or other similar institution, serving in a closed military unit, serving a sentence in places of restriction of freedom, being on reconnaissance or survey expeditions, working on a ship. These include the expression of a person’s will in circumstances that pose a danger and threat to his life.

Will in a special situation

If a citizen’s position threatens his life, and therefore there is no possibility of writing a will in any other legal way, he has the right to express his will in simple written form. This will be recognized as a will when the document is written in the hand of the testator and signed by him in the presence of 2 witnesses, and the content of the document itself clearly indicates that it is a will.

But if, after eliminating the negative circumstances, a will is not made in another legal form within a month, the document loses its validity.

The last expression of will expressed in this way will be executed, but only when the court confirms the emergency of the circumstances, if so requested by the interested parties within the six-month period established for accepting the inheritance.

But there are other options.

Orders of depositors regarding their deposits in banks

Rights to funds in a bank account can also be bequeathed through a testamentary disposition in writing (Article 1128 of the Civil Code of the Russian Federation). The document will be certified by an employee of the financial institution, and it is considered as notarized.

The depositor has the right to give orders to one or more persons to whom the deposit is intended. In the latter case, it is advisable to indicate the size of each share, otherwise equal shares will be established.

In all these cases, the document, except the testator himself, is signed by the person certifying the document and one witness.

Rules for making a will

A few words about how to correctly draw up a will. The legal force of the document will depend on this. As already mentioned, you will have to follow many rules and nuances.

For a testamentary document to be recognized as valid, it is necessary:

- Draw up a document by hand. Printed sample wills are easy to revoke.

- Write the text of the will in the presence of witnesses.

- Be sure to register the document with a notary. To do this, you will have to invite at least two witnesses.

- When writing the text of a will, follow the rules of business correspondence and structure (heading - title - main part - list of documents - conclusion).

- Clearly indicate information about the inheritance and heirs. Any typo can cause huge problems in the future.

That's all. These principles will help you cope with the task. A will takes effect on the day of the testator's death if the document is properly executed. Otherwise, it can be easily annulled in court.

About maintaining secrecy

There are different types of wills: open and closed. First, about the latter.

Closed will

This type of document is drawn up if the expresser of the last will does not want anyone to know about its existence, and especially its contents. And he has the right to keep the essence of the document secret. The decision is made solely by the author of the will.

Such a document, written in the testator’s own hand and signed by him personally, is sealed in an envelope in the presence of two witnesses and, closed, is handed over to the notary. Witnesses must be present when drawing up a closed will.

Moreover, no one except its compiler gets acquainted with it and knows its contents, but all participants in the process sign the envelope. After which it is sealed in the second, and already on this the notary makes a note that the author of the document was warned not only about the handwritten writing and personal signing of the paper, but also about the obligatory share in the inheritance. The contents of the sealed envelope are revealed after the death of the person whose decision is expressed in the sealed will.

The procedure for drawing up an open testamentary disposition involves familiarization with it by the persons who certify the document, register, store it and are obliged to announce its text after the death of the testator. It is these people who keep their last will secret from other people.

Important! The secret of a will is the very fact of writing, its essence, including information about the heirs, property, adjustments made and cancellation.

The law also requires secrecy regarding the duplicate. Only the originator of the document has the right to receive it. And after death - his heirs, and only if they present the appropriate certificate from the registry office.

Failure to maintain secrecy can have unpleasant consequences. The responsibility of notaries for maintaining secrecy is determined by the basic legislation of the Russian Federation on notaries. And previously it only applied to them and employees of notary offices.

Article 1123 of the Civil Code of the Russian Federation establishes the principle of secrecy of a will for a wider range of persons obliged to keep the secret, and defines measures of liability for its disclosure. They also include witnesses and translators, the executor and the executor.

Important! The notary is obliged to warn all these people about the need to maintain secrecy and warn about punishment in case of its violation.

By the way, liability is also discussed in the provisions of the Criminal Code and the Code of Administrative Offenses of the Russian Federation. The above-mentioned entities do not have the right to disseminate any information regarding the will until the very moment of its opening or cancellation.

What sanctions can be applied

The violator may be charged a penalty or compensation for moral damage (this is most often), the legal relationship may be changed, or even terminated.

The decision is made by the court on the basis of a claim from the testator. And the amount of compensation is determined during the court hearing.

- Administrative liability according to the Code of Administrative Offenses (Article 13.14) can be expressed in penalties of up to 1000 rubles. for citizens and up to 5000 for officials.

- Criminal liability for such a crime provides for up to 4 years of imprisonment. And the notary will be excluded from the notary chamber of his region, and there can be no question of him carrying out further professional activities.

Important! Even if false information is disclosed, liability arises in the same way.

Features of the entry into force of a will

From the moment of the death of the testator, the countdown begins, before the expiration of which it is necessary to contact a notary to declare your rights to the apartment of the deceased. According to the Civil Code of the Russian Federation, six months are allotted for this.

If this time is missed, you will have to restore your rights to the inheritance in court. And if the reasons that made it impossible to submit an application on time are recognized as valid, the right to inheritance will be restored. The following are considered respectful: illness, caring for a seriously ill relative, ignorance of death, business trip, etc.

The procedure for a will for an apartment to come into force after the death of the testator

According to the Civil Code of the Russian Federation, a testamentary disposition comes into force the next day after the event that led to its opening. And the heirs mentioned in such an order will have six calendar months to register their rights.

However, there are other deadlines for accepting an apartment under a will, which are determined by the following events:

- The heir abandoned his part of the apartment in favor of another person. In this situation, no more than three months are allotted for registration of this property from the moment the refusal is written;

- The heir died before entering into the inheritance. Then the rights to register the property by testamentary disposition pass to his direct heirs. In this situation, a residual period is allocated from the date of death of the maker of the testamentary document. However, if this period is less than 3 months, according to the Civil Code, it is extended for another 90 days.

Thus, the timing of property acceptance may vary. Therefore, it is always worth considering events that occurred within the 6-month period after the opening of the will.

Mandatory share in bequeathed property

A citizen who has decided to dispose of property according to his own understanding and who appoints heirs himself must understand that, regardless of his will, those to whom the state guarantees an obligatory share in the inheritance will be included in the number of heirs after his death. Persons in this category include:

- under the age of majority;

- disabled dependents (including parents, spouses of the testator and his children, regardless of age).

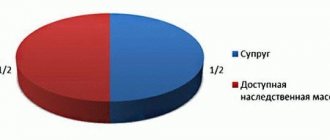

Mandatory share

The amount that the above-mentioned persons can claim is established by law - 50% (not less). It does not matter whether the property is willed or not. When a citizen (perhaps more than one) can count on an obligatory share, but he is not named as an heir under the will, the notary proceeds as follows: when the will is drawn up only for part of the property, the intestate inheritance is allocated first, but if it is missing, the remaining share of the property is allocated bequeathed

But there are cases when the mandatory share may be reduced:

- if she does not allow the heir to receive the property that is due to him under the will;

- when the inherited property is the main source of income for the heir, while the obligatory heir has never used that property.

Registration procedure

- How to properly draw up a will for an apartment

There is no need to write the document by hand yourself, but to avoid challenge, you should entrust the drafting to a notary. The document is kept in a closed envelope, which is opened after the person’s death becomes known for certain.

It is enough to issue 1 copy, but more often they keep 2 copies. A notary is involved in the preparation, who then certifies the paper.

Mandatory details include:

- Date and place of registration.

- A detailed list of the estate and heirs, including the appointment of sub-heirs.

- Link to legal regulations.

- An indication of the testator's capacity.

- Number of instances prepared.

- Where the document is stored.

- Testator's signature.

To confirm the legality of the order, you will need to present documents proving your identity and ownership of the mentioned objects.

Capacity requirements

Only capable persons can dispose of property. This means that citizens have the right to make a will:

- have reached the age of majority;

- do not have mental pathologies;

- restrictions by law.

If it is determined that the court has made a decision declaring a person partially or completely incompetent, the will will be declared invalid. Since the notary has the right to independently determine whether the testator gives an account of his actions, it is recommended to involve him in assisting in the execution of the last will.

If the notary doubts the legal capacity, he will require a medical examination before certifying the will.

To whom is property transferred by will?

Anyone can inherit an apartment by will. The size of the inheritance is also not limited. According to a will, apartments, houses, parts of property, allocated shares of real estate are transferred. If desired, the owner draws up a will for a share in the apartment. The question of whether an apartment can be bequeathed to the state is resolved in a similar way. If such a decision is made, a will is drawn up in favor of the state.

The exception is cases when the testator's capabilities are limited due to the presence of obligatory heirs, who cannot be refused.

According to Article 1149 of the Civil Code of the Russian Federation, regardless of the will of the owner, a mandatory share in the inheritance will be allocated in favor of:

- minors;

- disabled citizens who are retired.

Dependents will be allocated at least half of the inheritance. A portion of the inheritance may be reduced if the heir does not use the right to live in the apartment during the life of the testator, as well as if the recipient of the inheritance under the will does not have another place of residence.

During his life, a person has the right to rewrite a document taking into account the changed situation. Situations often arise when two wills are written for one apartment - which one is valid is determined by the date of writing. The last option according to the date of expression of will is selected, subject to its proper execution.

Entry into inheritance

If you still don’t know when a will comes into force after the death of the testator, remember. In order to enter into inheritance, the heir has six months. This is established by law.

How to do it?

Within six months, contact the notary office closest to the place of residence of the deceased and present the following papers:

- passport;

- will;

- death certificate;

- certificate from place of residence.

When for some reason the deadline is missed, you will have to go to court with a claim to restore your rights.

From the very opening of the inheritance, it belongs to the heir, regardless of the actual acceptance or the time of state registration and paperwork.

If one of the heirs, six months later, has restored their inheritance rights, the heirs are determined anew by the court, and previously received certificates are declared invalid. But the heirs can come to an agreement without resorting to legal disputes.

How long does it take for a will to come into force?

When a will for an apartment comes into force after the death of the testator, many heirs are concerned. The will comes into force from the moment of death of the testator.

You can exercise the right of inheritance after submitting an application to a notary, documents confirming the death of the testator, property papers, and the original will. There are situations when it is reliably known that a will was drawn up, but it could not be found on the deceased. It is necessary to contact a notary and draw up an application to search for a will. The notary will issue a certificate indicating the location of the document.

When a will takes effect after death may depend on the type of document. A closed type order becomes valid after opening the envelope in the presence of all relatives.

A fairly common phenomenon is the disagreement of relatives with the terms of distribution of property specified in the will. Interested parties can file a claim in court, indicate the reason for disagreement, and document the reasons for disagreement. There may be attempts to recognize one of the applicants as an unworthy successor.

It is necessary to declare your rights to bequeathed property within six months. If the successor did not submit applications in a timely manner, the applicant may file a claim in court. If there are compelling reasons that need to be documented, the court may extend the deadline.

How to find a will

In Russia, it is quite difficult to find out whether a deceased relative left a will. Keeping the will secret makes it impossible to know this in advance. Only after the death of a person can action be taken to search for a document.

Wills are not recorded in the Unified State Register, which only complicates the search and turns it into a real problem. And if the person named in the will as an heir does not assume this, there is a risk after six months of being left without his share of the inheritance, because it will go to the heirs by law.

So what can you do:

- It is good to look in the apartment where the testator lived.

- Contact the notary office closest to the registration address of the deceased, and if he is an old sick person, find out whether he has recently been in a medical institution or in a nursing home and contact the head of the institution, as a person who also has the right to certify the will.

- Send a request to the notary chamber.

Perhaps one of the steps taken will bring results.

Documents for receiving inheritance

The will comes into force after the testator dies or is declared dead. How to get an inheritance?

The potential recipient must take with him to the notary office:

- your passport;

- certificate of death of the testator;

- will;

- statements of relationship with the testator;

- a copy of the deceased's passport;

- court ruling declaring a person dead (if any);

- extracts for this or that property;

- a certificate from the last place of residence of the deceased.

In reality, everything is simpler than it seems. Having a will simplifies the inheritance process. Especially if the testator correctly executed this document during his lifetime. The will comes into force from the moment of death of the potential testator. Everyone needs to remember this.

Invalid or void will

A will is considered invalid:

- If it is invalid from the beginning, then it is void. These are recognized as wills, the execution of which violated the provisions of the Civil Code of the Russian Federation on the written form of the document and its certification, drawn up:

- incapacitated citizens or those with limited legal capacity;

- representatives of the deceased;

- on behalf of several persons;

- without witnesses;

- as well as those not written by the hand of the testator, when this condition is called mandatory.

- If the court recognizes it as such, it is a contestable will. At the court hearing, the case will be considered based on the claim of someone who believes that the will violates his legal rights and interests. But he will do this only after the opening of the inheritance.

Minor violations of order (this includes typos and other little things that do not affect the understanding of the expression of will) are not sufficient grounds for the court to declare the document invalid.

If there are situations where:

- the witness does not meet the requirements of the law;

- there are doubts about the authenticity of the signature;

- the court was not convinced that the will was drawn up under extraordinary circumstances;

- the document was written under pressure or threat;

- the compiler did not realize what he was doing;

- The order may be declared invalid either in its entirety or in its individual paragraphs.

Such recognition will not deprive anyone of the right to inherit by law or by other testamentary disposition. When there is a document drawn up earlier, if the will is declared invalid in relation to the previous will, legal force will be restored. There was no such thing - inheritance will be carried out according to the law.

Cases involving voidable transactions or insignificant consequences are resolved within three years, after which the statute of limitations expires.

Legal force of a will

As such, a will has no expiration date. It remains valid until it is changed or annulled by the testator. When considering the timing of a will, it is more appropriate to talk about the timing of the heir’s entry into the legal rights of the owner of the property, namely no later than 6 months from the date of the testator’s death.

When the will comes into force, the heir must submit an application to accept the inheritance, thereby expressing full consent and desire to enter into legal relations with the object of inheritance.

How to act correctly to challenge an inheritance will and prove its invalidity

It is allowed that heirs by law, applicants for the obligatory share, who do not agree with the decision of the testator, who believe that their rights have been infringed, in an effort to challenge the will, apply to the courts with claims to declare the document illegal.

Cases when a document:

- incorrectly composed or forged;

- does not contain the signature of the testator or it is falsified;

- compiled by an incapacitated person;

- violates the rights of the deceased’s spouse or other legal heirs;

- and also if the witnesses do not meet the requirements of the law.

True, grounds alone are not enough for a trial; it will require strong evidence provided to it. In this case, the arguments given by the heirs may be taken into account depending on the circumstances:

- The plaintiff is convinced that the will was not executed properly. In this case, one can rely on the fact that the requirements for notarization were violated, the transaction could have been carried out through a representative, etc.

- The heir believes that the real will of the deceased contradicts that stated in the document. There may have been coercion or an intellectual inability to control one's actions. And then you will need medical documents and witness statements, messages and audio recordings confirming the fact of threats, if any.

Important! The death of the testator is a key moment. Before this, it is impossible to challenge the document in court.

Deadline for entering into inheritance under a will

From the moment the testamentary disposition comes into force, the countdown of the 6-month period for accepting the inheritance begins. During this period, the heirs must perform all the actions required by law: visit a notary’s office, submit an application and a package of documents, pay the state fee, receive a certificate of inheritance (see “How to inherit under a will”).

If, for good reasons, the 6-month deadline for accepting the inheritance is missed , the heir may

- contact the heirs who have already accepted the inheritance to obtain consent to the redistribution of shares;

- go to court with a claim to restore the missed deadline (of course, if there are good reasons).

If all else fails, the right to inheritance is considered lost. The property of the deceased will go to the remaining heirs who declared their rights in time.

Brief conclusions:

- A will is a person’s written will about the fate of his property after death.

- Comes into force on the next day - after death, a court decision or the birth of conceived children during the life of the testator.

- The period for entering into an inheritance is 6 months from the date of its opening. Latecomers lose the right to property unless they prove that the missed deadline was for a good reason (departure, illness).

- A closed will is made public 15 days after the death of the testator. Comes into force from the moment it is announced by a notary.

Heirs may make the wrong decisions when they hear about the will. For example, keep it at home without handing it over to a notary. Very often the situation is complicated - a person has gone missing, is in a military conflict zone, or the original will has been canceled or changed. It’s not easy to understand all the nuances. Many heirs are not on the best terms. Therefore, they may not even know about the existence of a will - hence the risk of missing deadlines or violating the order of inheritance.

Fake will

This is still the way to gain an inheritance. Moreover, it is not so easy to catch a swindler by the hand. On his side is the fact that the heirs become aware of such a document too late. As a result, the courts are considering cases challenging the last orders of the deceased.

The army of scammers that circulates in this area is not enough. Unscrupulous notaries and judges find themselves in the same “harness” with them, according to whose decisions the wrong document is recognized as legal. And most often they operate in the secondary housing market.

With the advent of the electronic register of wills, it becomes much easier for relatives to find out about the presence of this document. And an independent examination (handwriting and technical) will make it possible to reliably establish the legality of a testamentary disposition. There is hope that the problem may be closed.

In any case, it is not easy for legal heirs to defend their rights in court. It will take strong evidence to convince the court that the will is fake.

When does a will come into force in Russia?

In Russia, issues related to the inheritance procedure are covered in the Civil Code. According to the provisions, the will comes into force immediately after the death of the testator. Often, the heirs know about the existence of the will, and soon after the death of the testator they begin to deal with the registration of the bequeathed property.

We advise you to read:

- ✅ Which notary should I contact to enter into an inheritance?

- ✅ Who can challenge a will for an apartment?

- ✅ Inheritance procedure by will

- ✅ How is the inheritance divided if there is a will?

Of course, cases in which persons may not be aware of their mention in a testamentary document also occur; then, to clarify the situation, you can try contacting a notary at the place of residence of the deceased and find out about the existence of such a document. Unfortunately, today there is no single register in the Russian Federation.

Features of different wills

Will for an apartment

When the owner intends to leave his own apartment after his death (this could be a dacha with a plot of land, a room, etc., a piece of real estate) to a specific person (a relative, a stranger or even an organization), it is advisable to draw up a will. This is also appropriate when there are no legal heirs or the existing ones are disliked by the testator.

The main thing is that the citizen is legally capable and all registration rules are followed.

Document text

It must contain the following information:

- last name, first name, patronymic of the testator, passport details;

- the essence of the last will and the conditions under which the inheritance can be received;

- description of the apartment, its exact location;

- last name, first name, patronymic of the recipient, date of birth of each.

In addition, the document must meet certain conditions - be written in the language of the testator, by hand, in legible handwriting without corrections or blots, with an accurate and very detailed description of the inherited property.

Will for a share in a privatized apartment

Today this is one of the most common types of inheritance. If the deceased owns a share in a privatized apartment, has appointed the future owner by his own will, and there are no legal heirs who claim the obligatory share or a spouse who claims the marital share, the heir can safely enter into the inheritance.

In the absence of such an order, the share of the deceased will be divided in equal shares between the legal heirs of the same order. Moreover, any of them has the right to refuse their own share or sell it to another heir.

Will for a car

In his last will, the testator may indicate a car as an inherited property. After the death of the owner of the vehicle, it will be inherited by the closest relatives by law. So, in order to avoid possible disputes, the testator has the right to name any person, regardless of the degree of relationship, to whom he will transfer his car, as well as other property, without violating the rights of other heirs.

And in the document itself, the vehicle should be described as accurately as possible.

Will with condition

This is a form of testamentary document (it is also called conditional), in which the testator can make the fact of acceptance of the inheritance dependent on some circumstance (encumbrance) and determine the conditions under which the heir will take possession. This condition itself becomes the basis on which inheritance relations arise, but only if it is fulfilled by the heir.

The condition mentioned in the will does not necessarily have to be associated with the heir or some of his actions (getting an education, having a child, living in a specific place, getting married, etc.), but at the time of opening the inheritance it must exist .

If the will of the testator is contrary to the law or moral standards, it will be considered void.

Will for a minor

Often, an order in favor of a child who has not reached the age of majority becomes a protection for him from the claims of unscrupulous relatives.

Minor citizens to whom property can be bequeathed can, by law, be anyone, a son, for example, or a daughter, a grandson, a nephew, even a conceived and unborn baby. The document may indicate several persons and determine the shares of each.

But when someone with the right to an obligatory share turns up and turns to a notary, the share will definitely be allocated to him.

Until the minor heir reaches his 18th birthday, he does not have the right to fully dispose of his property. If the testator has not appointed a property manager, transactions will be handled by guardians (up to the 14th birthday) or trustees (from 14 to 18 years old). But in any case, the transaction is possible only with the consent of the guardianship authority.

Will of an incompetent person

If such a document is drawn up, it does not have legal force. Only legally capable citizens have the right to bequeath their own property.

If a person is recognized by a court as having limited legal capacity, the consent of the trustee is required to draw up a will. If the court has declared a citizen partially or incompetent, he does not have testamentary capacity.

Grounds for amending a will

The testator has the right to change his will and at any time, after the will has already been drawn up, to edit it. At the same time, he is not obliged to explain to anyone the reasons for his decision.

The reasons for this decision may be different:

- when the testator decides to increase or reduce the number of recipients, their shares, make additional orders, etc.;

- errors were discovered during the life of the testator;

- when drawing up a will, pressure was put on the person; perhaps he was in a sick state; with recovery and identification of violations, a new version of the document was required, or even its cancellation altogether.

It happens that the new will turns out to be invalid by a court decision, then the old will becomes valid.

Cancellation of a will

The law does not restrict citizens from canceling a document expressing the citizen’s last will. Moreover, each subsequent expression of will cancels and replaces the previous one.

If the next will does not contain a direct indication of the cancellation of the previous one or individual orders in it, it still cancels it, perhaps only in part, which contradicts the newly appeared order. And after this, the previous document can no longer be restored.

When the deceased's newly expressed will is invalidated, probate is carried out in accordance with the last valid will.

There is another way to cancel a document. For this purpose, the law provides for a cancellation order (its form is in Article 1124 of the Civil Code of the Russian Federation). And then the previous will comes into force.

Important! If the will of a citizen is expressed in an emergency situation, it can be changed or canceled in exactly the same way.

It is enough to follow the procedure established by law and you can change your will as many times as you like.

When does a will come into force after the death of the testator?

After death, the time frame within which the heir can exercise his rights is counted. When does a will come into effect after death? This happens the next day, and the basis for issuing the inheritance is the following circumstances:

- Death of the testator;

- Making a decision by a judicial authority to recognize the death of the testator;

- The birth of an heir after the death of the person who made the will;

- The heir who was first in line refuses to accept the funds or property assigned to him according to the will of the testator.

In the latter case, the time frame for accepting the inheritance is reduced and is three months.

The time limit for a will to come into force is 6 months.

Features of the entry into force of a will for an apartment

When does a will for an apartment come into force after death? This happens the day after the death of the testator. To obtain all rights, you must go through the following procedures:

- Applying to a notary with an application and documents, including a death certificate;

- Preparation of title documents for real estate, which includes a privatization agreement, an extract from the Unified State Register;

- Issuance of a document on the right to inheritance;

- Registration of real estate in Rosreestr.

When registering an apartment, you will need to pay a fee. Almost similar rules apply to inheriting a house.

Nuances of the entry into force of closed wills

A closed will is a document whose contents are known to one testator.

Even the notary does not know about the paper points. The document is submitted to the notary's office in a closed envelope. In order to obtain inheritance rights, you will need to provide documentation confirming the death of the testator. This could be a death certificate. The envelope is opened within 15 days after confirmation of death. The document must be read in the presence of all heirs, as well as witnesses. Based on the results of the procedure, a protocol is drawn up, which indicates the text of the will and the persons participating in the announcement of the will of the deceased. The document comes into force after the envelope is opened and the contents of the paper are announced.

A closed will comes into force after its publication.

How should heirs behave correctly if there is a deed of gift, is it necessary to enter into an inheritance? Read about it in our article. What is more beneficial for testators and heirs: a deed of gift or a will, find out here. Before registering the transfer of property using one of these methods, you must carefully weigh the pros and cons.

How does a will differ from a deed of gift?

This is a question many people ask when they think about the fate of their property after death.

Differences (the table shows individual characteristics of the documents)

| Will | Gift deed |

| one-sided deal | bilateral deal |

| the inheritance will become the property only after the death of the testator | the recipient becomes the owner immediately or within a certain period of time, which is in no way connected with the death of the donor |

| property may be bequeathed without specifying specifics | the object of the gift is very specific |

| secret deal | no confidentiality requirement |

| will – a person’s sole disposition of his own property | the donation can be made by a person or group of persons of common property (donation on behalf of minors and incapacitated persons is not allowed) |

| it is possible to bequeath to anyone, from an individual to a foreign state | deed of gift is not issued to medical staff, employees of government and banking institutions, etc. |

| Only a written form of a will is acceptable, which must be notarized | It can even be done orally or in the form of a gift deed. Certified by a notary at the request of the parties |

| done only in person | can be issued with a notarized power of attorney through a representative |

| succession | the gift is not inherited unless this is stipulated in the gift agreement |

| cancellation without explanation | You can refuse to execute a deed of gift, but only for significant legal reasons |

| not taxed | 13% income tax is paid |

And the conclusion is this: Donation is a bilateral obligation, mutually binding the rights and obligations of the donee with the donor, significantly limited in terms of the subject of the gift and the possibility of canceling one’s own decision. A will is a one-sided, personal expression of the will of a person only, protected by the requirement of maintaining secrecy, but at any time having the property of being revoked. A deed of gift ensures immediate gratuitous transfer of property, a will only after the death of the testator.

Will in ancient Russian law

The idea of drawing up a will in Ancient Rus' was associated with the moral obligation on the eve of death to take care of one’s soul, freeing oneself from earthly affairs, therefore the will was called a “spiritual letter” (later “spiritual letter”). The fact of the existence of inheritance law and the practice of drawing up wills in Rus' is recorded in the oldest chronicle monument “The Tale of Bygone Years”. The agreement of Prince Oleg, concluded with the Greeks in 911, states that if a “Rusyn” serving the Byzantine emperor dies, then his property should be transferred to the heir, designated in the “spiritual”. The authentic “spiritual letters” of the Grand Dukes of Moscow have reached our time. [ source not specified 2005 days

]

Translation of a will

It may turn out that a citizen’s property is located in different states. Then it will not be possible to do without translation of the testamentary document. Otherwise it will not be valid in foreign countries.

The testator will need an excellent lawyer and a good translator. After all, the document must be drawn up in strict accordance with the laws of the country for which it is written. Some places require notarization, some require the signature of a witness-executor. In most cases, an apostille is sufficient to legalize a will in a foreign country. But double consular legalization may also be required. Otherwise, the heirs will face many problems.

The transfer can also be made in the country of residence of the testator. But the legalization of a certified translation will still be required, so it is better to translate it before applying the apostille. If the translation is made in the country where the property is located, apostille will not be required, since the document will be certified by a notary of the country where the will was presented.

Each state requires its own version of the translation, and each time it must be notarized.

Opening a closed will

If the testator left a closed will, that is, one whose contents are unknown to anyone, even a notary, then the procedure is slightly different: according to Article 1126 of the Civil Code of the Russian Federation, the opening of such a document is carried out 15 days after the official fact of death has been established or a court decision has entered into force.

The opening of such a will by a notary takes place in the presence of heirs and witnesses, and a protocol is kept. The protocol includes the data of all those present and what was read out. Copies of this document are issued to the participants in the process, and the original is kept by the notary.

The testamentary document comes into force immediately from the moment of its publication. Next, the procedure for entering into inheritance is carried out in the standard manner:

- the heirs provide the notary with documents that confirm their rights to the inheritance;

- documents are checked, heirs pay state fees;

- six months after the reading of the testamentary documents, the heirs enter into their rights, in confirmation of which they receive a Certificate of Inheritance;

- Based on the certificate, ownership is registered with the registration authorities.

It is important to declare your rights in time, since the time frame for entering into an inheritance is limited - 6 months from the date of death of the testator.

Facebook

About the will tax

Legislators abolished the mandatory tax ten years ago. So there is no need to pay inheritance tax in 2020. The only payment that exists today is the state duty.

State duty

It must be paid when the heir acquires the right to inherit the property of the testator after his death (Chapter 63 of the Civil Code of the Russian Federation). Its size is determined depending on the degree of relationship and the value of the property. The heir will have to present a document indicating the value of the inherited object on the day the inheritance is opened.

For parents and children, brothers and sisters, as well as spouses, the duty will be 0.3% of the total cost, but will not exceed 100 thousand rubles.

Any other heirs must pay 0.6%, but not more than a million rubles.

Procedure for entering into inheritance

The inheritance procedure involves a certain sequence of actions. You must contact the notary who certified the document. When drawing up a document, one copy is kept by the testator, the second is kept by the notary until the heirs apply. If there are applicants for the allocation of a mandatory share in the inheritance, the interests of this category of citizens must be taken into account. If this value is not taken into account, distribution occurs regardless of the presence of a will.

It will be possible to receive a certificate of right six months from the date of opening of the inheritance.

To exercise your rights to inheritance, you must contact the specialist who certified the document. After the death of the testator, the original document must be found from the deceased. If the paper could not be found, you should find out the address of the office that certified the document.

An application for a desire to receive an inheritance is submitted to the notary's office. The document is submitted in person, through a representative, or by mail. A document sent by mail must be notarized and delivered with notification. The representative must have a power of attorney.

Along with the application, you must provide a package of documents:

- Passport;

- A document confirming the death of the testator;

- Certificate from your last place of residence;

- Will;

- Property papers.

If there are no obstacles, six months from the opening of the inheritance, a certificate of property will be issued. Upon receipt, you must pay a state fee, depending on the degree of relationship, the value of the property, and the availability of benefits.

After receiving the certificates, it is necessary to complete the registration through government agencies. The vehicle must be registered with the traffic police within ten days. The apartment is registered through Rosreestr. The registration period for real estate is seventy-five years from the date of receipt of the certificate. Without registration, the new owner will not be able to sell, formalize a deed of gift, or transfer by inheritance.

If the owner decides to sell the inherited property before the five-year period, he will have to pay tax. The amount of the contribution will depend on the cost of the property and the availability of benefits.

Effective time

The will comes into force simultaneously with the opening of the inheritance, that is, from the date of death of the testator. From this moment, the appointed successors have the opportunity to accept the property, rights and obligations determined for them by the testator during his lifetime.

The date of opening of the inheritance is confirmed by the date indicated in the medical report and subsequently in the death certificate. If there is no such information (the body of the testator was not found), the day of his death is established by the court. This happens when:

- the testator did not appear at his place of residence and his family members did not hear anything about him for five years;

- six months have passed since he disappeared under life-threatening circumstances;

- the serviceman did not return to his place of residence and did not make himself known in any way from the day he disappeared and after two years had passed from the end of hostilities.

This is interesting: How to find a will after death 2020

It is important for heirs to remember that the validity period of a document is limited to six months from the date of death of its originator. After this period, the inheritance is considered not accepted and the rights to it are transferred to the designated successors, distributed among those who have already registered the property of the deceased or those who in this case acquire the possibility of inheritance by law.

The period can be extended only if the omission was made for valid reasons, and the “unpunctual” citizen will be able to prove this to the court. Or rely on the goodwill of the remaining heirs, who, after registering their rights, will give unanimous permission to include the late successor in their circle.