Money or meters?

There are several options for requirements for a developer in case of bankruptcy. Since August 15, 2011, in accordance with the amendments to the federal law “On Insolvency (Bankruptcy)”, not only monetary claims can be made against the developer, that is, the amount paid under the DDU can be returned, but also the transfer of housing can be demanded if the house is completed, but not yet commissioned. If the house is not completed, then the shareholder also has the right to receive the unfinished object. In all three cases, you must file a claim with the arbitration court, and the lawyer will add you to the register of creditors. However, it is impossible to make both demands. That is, you must clearly understand what goal you are pursuing: getting an apartment or money.

Defrauded shareholders must be included in the register

The state began to realize that it bears some responsibility for the situation with defrauded shareholders. Therefore, government bodies began to compile lists of defrauded shareholders. What does inclusion in such a register give? At the level of constituent entities of the Russian Federation, programs are being developed according to which problems with the housing of shareholders included in the register should be solved at the expense of public funds. In the city of Moscow, for example, there is a State program of the city of Moscow “Housing”.

If you want to submit documents to be included in the register of defrauded shareholders, you first need to check whether your situation meets the criteria defined by law. So, to include information about a shareholder in the register, the following facts must be present:

- 9 months of delay in transferring the residential property to the shareholder, but provided that there is no increase in investments in the construction of a residential building during 2 reporting periods. The data is taken from the reports that the developer provides to the control body;

Exceptions: houses where there are double sales, houses that are built on land plots without title documents for them, a house is built on a plot on which the construction of an apartment building is not allowed, houses that are built in violation of the requirements of the urban planning plan, design documentation, permits construction.

- relations for the purchase of an apartment between a construction company and a citizen are formalized by an equity participation agreement concluded in accordance with the requirements of Law 214-FZ;

- the shareholder has properly fulfilled his obligations under the agreement;

- the developer did not transfer the apartment to the shareholder;

- the developer does not have a legal successor who could fulfill his obligations to the equity holder;

- the construction company's liability is not secured by a bank guarantee or is not insured by an insurance company, or the shareholder cannot receive payments under the insurance or guarantee due to the fact that the bank or insurance company has gone bankrupt;

- a shareholder cannot be included in the register twice for the same house or for another house.

As can be seen from the list of requirements for inclusion in the register of defrauded shareholders, it will be impossible to get there if the developer conducts his activities in violation of the law. Also, you are not officially recognized as an injured citizen if you have not drawn up an agreement for participation in shared construction.

At the observation stage, two registers are opened. One for those who want to eventually get their housing, and the other for those who demand a refund. After opening these registers, the commissioner must send letters to all shareholders indicating that they have the opportunity to present claims to the developer.

In order for your name to be included in the register of creditors, you must submit a corresponding application to the temporary manager. If the procedure began at the observation stage, you have a month to do this, if at the bankruptcy stage, then two. Letters do not always arrive on time, so it is better to check the official arbitration website to be aware of what decision was made regarding your developer.

Based on the transfer of the company and the project to external management, construction participants with an equity participation agreement have the opportunity to unilaterally refuse to fulfill their obligations under the agreement. To do this, you need to decide on the requirements. If you want to return the money paid for the apartment, you must submit an application stating that you renounce the DDU. The application must indicate the following:

- DDU number and date of signing;

- information about the construction company and its manager;

- information about the property;

- arbitration court;

- a copy of the receipt confirming payment for housing;

- evidence that the contractor cannot fulfill previously assumed obligations.

We suggest you read: Are debts on loans of the deceased inherited and can they be waived?

In the envelope with the letter for the court, you must also add a document that confirms that you sent the letter to the developer and manager.

In the event that the court has declared the company insolvent, the law provides several ways in which housing can be transferred to buyers. So, here's what the court can do under the law:

- Recognize the shareholder's ownership of the housing.

Please note that in order for shareholders to receive property rights, two mandatory conditions must be met:

- the developer managed to obtain permission to put the house into operation;

- the acceptance certificate was signed before the developer’s application for bankruptcy status was received.

If the transfer and acceptance deed was signed later, then the chances of satisfying the shareholders’ demands largely depend on the talent, experience and skill of the lawyers.

- Transfer the residential premises to the buyer.

When one of the conditions is met - permission to put the house into operation has been received, but the acceptance certificate has not been signed - the residential premises can still be transferred to the buyers. However, for this you need to meet some conditions:

- most of the fourth priority creditors agree;

- the cost of the property remaining after the transfer of apartments to shareholders covers the amount of mandatory expenses;

- the construction project has not been laid down;

- There are enough apartments available to satisfy the requirements of all shareholders participating in the project.

- Give the unfinished house to the lenders so they can complete the construction themselves.

This option is considered the most expensive. Shareholders will have to invest more of their own funds to complete the construction. If we are talking about a facility at the initial stage of construction, there is practically no chance of successful completion of the project.

This option for resolving the problem in the law appeared only a few years ago, so there is not yet enough judicial practice by which to judge its effectiveness in resolving bankruptcy cases.

- Transfer the facility to a new contractor.

A change of developer implies that the new construction company assumes its own responsibility for fulfilling all obligations of the old developer in full.

Construction companies in Russia regularly go bankrupt. Of course, this does not happen to every company, but still more often than we would like.

Because of this, buyers of apartments in new buildings with shared participation agreements, who have already managed to partially or fully pay the cost of housing, cannot start using it.

Today we will try to understand what a shareholder should do if the developer goes bankrupt.

The bankruptcy procedure will be launched after the court makes a corresponding decision. To do this, the judge must recognize that the organization is insolvent and does not have the ability to fulfill all its obligations in full in the future.

The actions of shareholders in a situation where the developer has gone bankrupt largely depend on the stage of construction. For example, if the company has managed to put the house into operation, it would be logical to demand that the buyer’s ownership of his apartment be recognized. And if construction has just begun, then it will be much more profitable to return the payment made for housing.

2019-03-29T08:31:29 03:00

In 2011, a new section 7 appeared in the Bankruptcy Law (127-FZ), entirely devoted to the issues of bankruptcy of developers. His appearance was caused by urgent need.

Because a huge number of Russians, participants in shared construction, having given their last money, were left without the desired apartments and the money invested in the construction project.

There is no city on the map of Russia where the developer has not gone bankrupt and people have not taken to the streets with posters demanding justice.

Now there is a law, and shareholders have hope that the state will finally give them the protection that the Constitution has long promised.

The work of Russian developers should be constantly monitored. Bankruptcy does not happen suddenly. The first signs of approaching trouble can be recognized in advance. Any pause in construction or violation of deadlines is already a reason to hit the rail with a pipe.

Indirect signs of impending bankruptcy can be considered situations when:

- the company’s office has stopped answering phone calls and is closed during business hours for personal visits;

- construction has been completed, and the developer is in no hurry to hand over the finished apartment.

Shareholders should immediately collectively contact the management of the construction company with a written complaint. Or to the arbitration court. You can't hesitate.

If a shareholder wakes up when the developer is already going through bankruptcy proceedings, it is still not too late for him to include his claims in the register of creditors. There are still sixty days at the bankruptcy stage.

Typically, the insolvency practitioner notifies all creditors that the register of claims is open. He must do this in writing, by registered mail, or through the Kommersant newspaper.

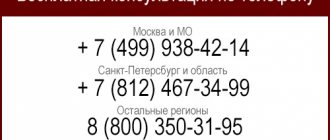

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

In case of bankruptcy, the costs of the shareholder under the DDU and the damage determined by the difference between the market price of the apartment and the amount actually paid are taken into account.

Free legal consultation

If a company goes bankrupt, you can only get back the money you paid to the developer for a parking space or non-residential premises.

Developer bankruptcy is a terrible word that any person who has entrusted their money to a construction company is most afraid to hear.

Unfortunately, this happens quite often today; large and small companies go bankrupt with enviable regularity, leaving behind a trail of unfulfilled obligations and debts. But it also happens differently - an enterprise deliberately declares itself insolvent and is liquidated in order to evade responsibility.

What can a shareholder count on if the developer goes bankrupt during shared construction, what to do in this case, and how to get out of the situation with the least losses?

Bankruptcy is a complex judicial procedure carried out by an arbitration court, which does not occur simultaneously. It can last up to one and a half years and includes several stages, described in detail in 127 Federal Law.

- participate in meetings of construction participants - this is especially important, since at meetings with the participation of an arbitration manager, the issue of how to satisfy the demands of shareholders is decided - through the transfer of finished apartments or an unfinished construction project;

- participate in creditors' meetings and vote. The number of votes depends on the amount you paid the developer for the home (the value of the property transferred), as well as the amount of your losses in the form of actual damages. At meetings of creditors, all key issues in the course of bankruptcy are resolved, incl. on the sale of the debtor's property;

- object to the claims of other creditors (in accordance with Articles 71, 100 of the Federal Law on Insolvency). This right will allow you to oppose unscrupulous creditors of the developer or its affiliates who want to be included in the register of creditors and unjustifiably receive money from the developer;

- petition to transfer the bankruptcy case to the court at the location of the unfinished object / place of residence or the location of the majority of construction participants (clause 4 of Article 201.1 of the Federal Law on Insolvency). As a general rule, a bankruptcy case is considered by an arbitration court at the location of the debtor. If your developer has a legal address in another region, of course, this will complicate interaction with the court and entail additional transport and postal costs. It is precisely for such cases that there is the possibility of transferring the case to another court.

We invite you to read: Law on Collectors: What rights do collectors have and what can they do?

Everyone's in line

If you want to return the money, you must understand that this requirement will be satisfied only in the third place. First, money is paid to citizens to whom the debtor is responsible for causing harm to life or health (if any). Then - the salary and severance payments to the developer’s employees who worked under an employment contract, and to the authors of the results of intellectual activity. So it is almost impossible to return the entire amount of investment while in the third stage. Therefore, if the house is ready, I would recommend demanding not a refund, but the transfer of the living space. This is the best way out of their situation. You will definitely get an apartment, there is simply nothing to worry about.

Transfer of the construction project

In the event that the court has declared the company insolvent, the law provides several ways in which housing can be transferred to buyers. So, here's what the court can do under the law:

- Recognize the shareholder's ownership of the housing.

Please note that in order for shareholders to receive property rights, two mandatory conditions must be met:

- the developer managed to obtain permission to put the house into operation;

- the acceptance certificate was signed before the developer’s application for bankruptcy status was received.

If the transfer and acceptance deed was signed later, then the chances of satisfying the shareholders’ demands largely depend on the talent, experience and skill of the lawyers.

- Transfer the residential premises to the buyer.

When one of the conditions is met - permission to put the house into operation has been received, but the acceptance certificate has not been signed - the residential premises can still be transferred to the buyers. However, for this you need to meet some conditions:

- most of the fourth priority creditors agree;

- the cost of the property remaining after the transfer of apartments to shareholders covers the amount of mandatory expenses;

- the construction project has not been laid down;

- There are enough apartments available to satisfy the requirements of all shareholders participating in the project.

- Give the unfinished house to the lenders so they can complete the construction themselves.

This option is considered the most expensive. Shareholders will have to invest more of their own funds to complete the construction. If we are talking about a facility at the initial stage of construction, there is practically no chance of successful completion of the project.

This option for resolving the problem in the law appeared only a few years ago, so there is not yet enough judicial practice by which to judge its effectiveness in resolving bankruptcy cases.

- Transfer the facility to a new contractor.

A change of developer implies that the new construction company assumes its own responsibility for fulfilling all obligations of the old developer in full.

The law provides for several options for transferring housing to citizens in the event of a company’s insolvency:

- recognition of their ownership of the apartment;

- transfer of residential premises;

- the unfinished house is given to lenders to complete the construction themselves;

- the project is completed by a new contractor, who assumes responsibility for all existing obligations of the company.

The third option is the most expensive; citizens must invest funds to complete construction. If it is at an early stage, the likelihood of completing the project is doubtful. This opportunity appeared in 2020; there is not yet enough judicial practice on it to assess its impact on bankruptcy cases.

The legislation provides for 2 conditions that are mandatory for recognizing the rights of owners to a shared construction project and satisfying their requirements. The organization must have documents permitting the commissioning of the house. The acceptance certificate was signed before receiving the application requesting that the construction organization be declared insolvent. If it is signed later, the positive outcome of the case is largely determined by the presence of experienced lawyers.

If the commission has accepted the house, but the acceptance certificate has not been signed, then shareholders can receive apartments subject to the following conditions:

- most of the creditors belonging to the fourth stage agree;

- the property remaining after the transfer of residential premises to shareholders is sufficient to pay obligatory expenses;

- the house is not mortgaged to other persons;

- There are enough apartments to meet the requirements of all citizens participating in the project.

Your own builder

In the case of unfinished construction, unfortunately, you will have to finish building the house using money from your wallet. Weigh the pros and cons: consider what is more profitable - to add funds to complete construction or to try to return the money. In this case, everything is purely individual and depends on the stage of readiness of the house, the number of shareholders and other things. If you decide to demand the transfer of an unfinished construction project, then together with the other shareholders you need to create a housing construction cooperative, raise money and find a contractor. This is the most difficult path, since the likelihood that all buyers will agree to complete the building at their own expense is extremely low.

Is it possible not to pay a mortgage if the developer is bankrupt?

If you purchased an apartment in a building under construction with credit funds, then a logical question arises: what to do with the mortgage if the construction company goes bankrupt? First of all, it is important to remember the main thing: the bankruptcy of a company is not a reason to unilaterally stop fulfilling obligations under a mortgage agreement.

The process of housing construction connects only the equity holder and the developer, and the bank is a third party. If the buyer paid the full cost of the apartment from credit funds, and the construction company squandered the money for other purposes, then the bank is not to blame for this.

At the same time, there is a valid agreement between the credited shareholder and the credit institution on the return of funds. If construction stops, your debt to the bank will continue to exist, which means that you will have to make mortgage payments on schedule.

Unfortunately, the bankruptcy of the developer is not grounds for a unilateral refusal to fulfill obligations under the loan agreement. Relations related to the construction of an apartment building arose between the shareholder and the developer, and for one reason or another, the money paid by the construction participant was spent by the developer for other than intended needs.

What scenarios do a shareholder have when a developer is declared bankrupt? In this situation, you can suggest contacting the financial institution that issued the loan with a request to defer payment of the debt. But it is worth remembering that the bank is not at all obliged to make concessions in this situation.

If you have financial difficulties and cannot pay the loan, then what should you expect in this situation? After all, the bank has an apartment as collateral that is not yet actually completed. In this situation, representatives of the credit institution have the right to sue you and demand collection of the debt and foreclosure on the mortgaged property, that is, in fact, on the unfinished apartment.