Until what date is the debt for housing and communal services subject to write-off?

From the date the court issues a ruling recognizing the application for declaring a citizen bankrupt as justified and introducing the restructuring of his debts (Article 213.11 of the Federal Law on Bankruptcy):

- a moratorium is introduced on satisfying monetary claims against the debtor;

- the deadline for fulfilling obligations that arose before the date of the court's decision is considered to have occurred.

Obligations to pay for housing and communal services that arose before the date of the court ruling are subject to inclusion in the register of creditors. Obligations to pay for housing and communal services that arose after the date of determination are considered current, and creditors for current payments are not recognized by persons participating in the bankruptcy case.

Thus, if a debtor for housing and communal services is declared bankrupt and the procedure for settlements with creditors is completed, then his obligations to pay the debt for housing and communal services as of the date of the court’s ruling declaring the citizen bankrupt are considered terminated.

Is it easier to get your money back if you have a receipt?

Obtaining a loan by receipt is the most popular method of “certification” among Russian citizens, most of whom have little idea of how exactly to give a handwritten document legal force.

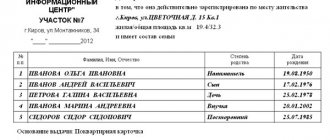

A properly executed receipt is drawn up in two copies and must contain information such as:

- Full name, passport details of the lender and borrower;

- Their actual place of residence and registration;

- The loan amount in words and in numbers;

- Date of receipt and return of money;

- The fee for use is at the discretion of the lender, the penalty for failure to repay within the prescribed time is mandatory;

- Full name, passport details of the witness (if any), his signature;

- Signatures of the parties.

Failure to repay a debt on a receipt implies both administrative liability provided for

, and criminal -

, if the borrower’s actions show signs of fraud.

Be sure to read it! Illegal access to computer information: punishment

It is worth remembering that criminal liability in some cases is more effective for debt repayment than administrative liability. According to

The statute of limitations is 3 years, and a criminal case can be initiated after 6-10 years. For the debtor, such consequences are an excellent motivation to repay the money on time.

Is the debt for housing and communal services subject to write-off after the date the debtor is declared bankrupt?

As stated earlier, the debt for housing and communal services that arose after the decision to declare a citizen bankrupt is current.

In turn, the claims of creditors for current payments remain valid and can be presented after the end of the bankruptcy proceedings of a citizen (Part 5 of Article 213.28 of the Federal Law on Bankruptcy).

Thus, after declaring a citizen bankrupt, the management authority has the right to collect debts for housing and communal services that arose after the date of the court’s ruling declaring the citizen bankrupt.

What should the management authority do if the debtor applies for debt write-off?

After the bankruptcy procedure was completed, the debtor applied to the management authority, homeowners association with an application to write off the debt, attaching to the application a court ruling declaring him bankrupt, terminating the procedure for settlements with creditors, etc.

The question immediately arises: what to do and is it obligatory to write off the debt?

It should be noted that in this case there is no single algorithm for the actions of the management authority to write off debt, just as I noted earlier, there are no requirements for maintaining personal accounts for housing and communal services. When receiving an application from a bankrupt, the management authority is obliged to take into account the provisions of the Federal Law on Bankruptcy regarding the termination of obligations.

The article will be useful: If you have decided to create an HOA - do you need to obtain a license?

Many management companies continue to make accruals taking into account the debt that is subject to write-off, and payments received in the future from the owner are counted against this debt. There is no need to talk about the legality of accounting for payments against obligations that are considered by virtue of the Federal Law on Bankruptcy, and therefore there is no point in reflecting debts in payment documents as of the date of the court’s determination.

Traditionally, there are two options for reflecting debt write-off from the point of view of maintaining personal accounts:

- closing the current personal account on the date of debt recognition of the debtor as bankrupt and further opening of a new personal account;

- making changes (adjustments) to the current personal account in terms of “writing off” the debt on the date the debtor was declared bankrupt.

HOA: debts and decisions

The debt of the defaulter is the first reason why the HOA may develop a debt to resource providers. The second reason is, in theory, the theft of money from the HOA itself, that is, when they collected the money, but did not pay the bills. The situation in this case is extremely interesting: if the HOA has a debt to resource companies of 100 (one hundred) thousand rubles and failure to repay it at least partially within 3 (three) months leads to the liquidation or bankruptcy of the first. Despite the fact that, according to the law, the HOA is obliged to pay off the debt, in fact, law-abiding citizens again pay off long-paid bills.

So, homeowners can choose one of three forms of management:

The main disadvantage of an apartment building is that both law-abiding citizens and malicious defaulters live in it. But it is precisely the first category of citizens who suffer from this. And here only the practice of disconnecting from the service until the debt is repaid is applicable, be sure to notify about it in advance. However, according to the law, they do not have the right to turn off cold water and heating. But as far as electricity is concerned, the situation here is extremely twofold. Based on the law, only the resource supplying organization has the right to turn off electricity, and then only if there is an existing debt (but not to everyone and everyone, which we will talk about in the following articles). However, if there is a debt to the management organization or the HOA, the lights are turned off first. And if this happens, you need to complain to the prosecutor’s office and the housing inspection.

However, it is not always possible to assign the responsibility for paying for the received operating services, paid for by the HOA, to this HOA, and if this is impossible to do due to factual or legal circumstances, the burden of expenses for paying for the services provided will additionally fall on the shoulders of the home owners.

Under these circumstances, the question arises: aren’t the home owners who paid the HOA for the services consumed, and through no fault of which the payment did not reach the HOA to the service provider, bona fide payers? The answer in this case, unfortunately, is clear and not in favor of the home owners. Payment for the operating services of the HOA is the accumulation of funds for the further transfer of these cash flows to service companies. Failure to receive funds to the latter's current accounts is grounds for collecting the cost of services provided directly from consumers of such services, i.e. from the residents of the house.

Why do homeowners pay for HOA debts?

Let's assume that the HOA is declared invalid, or goes bankrupt, or simply ceases to exist for any objective reasons, or the HOA simply does not have funds received from residents. In this case, the obligations to repay existing or emerging debts in relation to organizations are transferred to the owners of the house, and not to service providers.

The carelessness of residents can lead to the fact that management companies will legally distribute the arrears among conscientious citizens, explains Fursov, but the amount of the “additional payment for a neighbor” will depend on the total area of the residents’ apartment. This means that owners of large apartments will pay many times more than owners of one-room apartments. As practice shows, it is low-income citizens who are the most vigilant, because they have to monitor the expenditure of every penny they earn. They constantly receive complaints about the fact that wealthy citizens living in their house do not want to come into conflict with managers by paying any payment, even an inflated one.

We have to deal with different situations, including those when management companies force residents to take action against defaulters from their home,” says Anatoly Fursov, “the managers’ imagination is at work. For example, in one of the residential complexes in Moscow, the management company required residents to influence non-payers through social networks, reminding them that the time had come to make a payment. All this is on the verge of complying with the law. The management company should do the following: engage in pre-trial settlement of the issue, collect materials that will serve as the basis for applying to the judicial authorities. This is the only legal way for the management company. But due to lengthy legal proceedings, which also require material costs, they do not want to do this.

Should we pay for our neighbors?

But management companies still undertake this kind of manipulation, despite the ban. According to Anatoly Fursov, who is the managing partner of the Dombrovitsky and Partners Bar Association, any management company can force residents to enter into a direct agreement with resource supply companies.

We recommend reading: Child population as of 01/01/2020

I didn’t ask for documents about this from the Criminal Code, but looked at everything on the Housing and Communal Services Reform website. You can do the same: study copies of decisions of general meetings and estimates. If it seems that the company accounted for something it did not do, or paid too much for some repairs, you can ask the management company to show supporting documents.

The procedure is as follows: the management company first warns the debtor that after 20 days it will partially disable a specific service. And after another 10 days - after a total of a month - it can disable the service completely. But in practice, it is difficult to ensure that water or electricity is supplied partially, so the first stage is most often performed nominally.

Why is it difficult to collect debts on residential complexes?

In my apartment building, many owners have debts to pay for the services of the management company. The director of the management company constantly makes this argument when it comes to repairs in the entrances or maintenance of the local area. When asked about penalties in court, he meaningfully throws up his hands and says that it is not so simple.

What is a penalty? In simple terms, a penalty is a penalty that is charged to the debtor for the fact that he has a large delay in utility payments. The amounts of penalties differ depending on the period during which the consumer of services does not pay for them.

Are RSOs obligated to write off the owner’s debt to reduce the debt of the management company, HOA to RSO

In the presence of a classic scheme for the provision of public utilities - RSO - UO (HOA) - consumers, the legal relations of all parties are regulated by the relevant rules of law and contractual relations. RSO is not obliged to write off the debt of the management company or HOA in terms of utilities, since the party obligated to pay to RSO for utilities is not consumers, but

Note! This article does not touch upon the issue of reflecting debt write-off transactions in accounting, nor does it touch upon the issue of the technical feasibility of software for accounting for accruals and payments for housing and communal services. Also, the article was written without taking into account the extrajudicial bankruptcy procedure.

Who is responsible for the debts of the HOA

Residents of apartment buildings are increasingly having problems due to HOA debts. If the latter refuses to pay the costs of operating the house, its upkeep and maintenance, then who, if not the residents, should do this?

Subscribe to the daily IRN.RU newsletter

Understand the terms First, what is an HOA? A homeowners' association seems to be simply an organization whose responsibilities include receiving funds from residents and directing them to the specified destination, that is, to resource supply companies (Article 135 of the Housing Code of the Russian Federation). Therefore, it seems logical that the HOA debt should remain with this organization and the consequences of non-payment should concern only it.

A certain amount that the management company can handle in a month will be distributed in the organization’s accounts. Thus, a financial chain is obtained that helps, albeit slowly, but still pay off the debt .

We recommend reading: What Documents Can You Use to Get a Free Train Ticket for a Pensioner in St. Petersburg?

The essence of the restructuring is that the management company turns to defaulters and offers them not to pay the entire amount of debt at once , but to pay a certain fixed amount monthly that the debtor can pay.

How to restructure?

You have to pay for everything, but many residents refuse to do this, thereby putting other owners in an awkward position and driving the management company into debt to resource supply organizations. Let’s try to figure it out in this article about what management companies should do in such situations.

And everything would be fine, but the employees of the HOA (or management company) themselves understand when they are acting far from within the bounds of the law. In this case, you can only rely on the debtor, his knowledge of his rights and obligations, or the help of an experienced lawyer.