A mortgage is a heavy financial burden. Despite the long term of this loan, the monthly payments are quite high.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

And it is quite natural that borrowers are looking for funds to replenish their budget in all available ways. Including renting out purchased housing.

And some even initially plan to buy an apartment in order to use it as a source of income.

But how permissible is such use? After all, according to the mortgage agreement, until the debt to the bank is fully repaid, the apartment is pledged to him.

What does the law say?

And the law proceeds from the fact that the borrower owns the apartment. This means that he has the right to own, use and dispose of it. Renting out property is included in these powers, as is pledging property to a bank.

But among the provisions of Article 209 of the Civil Code of the Russian Federation, there is also a limitation, a limit of authority. These are the interests of third parties, which cannot be violated. In the case of a mortgage, this third party is the bank.

Relations with him are regulated not only by the Civil Code, but also by other regulations. The main one is the Federal Law “On Mortgage” No. 102.

Article 29 of Federal Law No. 102 states that the borrower has the right:

- use the apartment for its intended purpose, that is, live in it;

- extract fruits and income from it.

That is, from the point of view of the law, using an apartment to generate income by renting it out is quite acceptable.

At the same time, the mortgagor is obliged to take measures to protect the housing pledged from destruction and damage. The list of possible causes of damage indicates the encroachments of third parties.

Bank conditions

Banks may include conditions in the agreement establishing the need to notify them, as mortgagees, about the use of the apartment for profit. Or even outright bans. There are two reasons for this.

The first is related to the bank’s concerns:

- lose the collateral;

- As a result, obtain property that has a lower value than when placed under collateral.

It's no secret that many tenants do not treat their rental housing in the best way. And landlords are in no hurry to repair the damage caused, as this will reduce their rental income.

As a result, the apartment loses its marketable appearance and its market value falls.

In the most extreme case, due to the fault of the tenants, the apartment may be destroyed, for example, burned. However, this option is more profitable for the bank, since it is covered by insurance, which the owner is obliged to provide under the mortgage agreement.

But if payments are late, it will be difficult to sell real estate that has significantly lost in value, which means there is a chance that you will not receive the amount that the borrower owes for it.

The second reason forcing banks to include conditions prohibiting the rental of mortgaged apartments is considerations of their own benefit.

Mortgage loans are provided to citizens to meet their personal needs. And using an apartment to generate income is a commercial activity.

For representatives of small businesses, loans are provided on other, more stringent conditions:

- with shorter deadlines;

- with high interest rates.

It is not surprising that banks want to know whether they should offer the borrower more favorable conditions.

In addition to banks, insurance companies are also interested in the purpose of using the apartment. Different tariffs apply for residential and commercial properties. Because the risks are significantly different. Insurers do not want to pay for the consequences of other people's mistakes.

Which banks allow you to rent out a mortgaged apartment?

This can only be found out directly from the mortgage lending department of the bank. If this issue is important, look for a bank that does not impose a strict ban. If renting out a mortgaged apartment is permissible with the permission of the bank, clarify what exactly is needed to obtain this permission.

Important! Please note that the bank may require the insurance company’s consent to such a transaction. The insurer should not refuse to compensate for losses if something suddenly happens to the mortgaged apartment due to the fault of the tenant. So, a ban may also come from the insurance company.

Is it possible to rent out an apartment with a mortgage?

The law gives a clear answer as to whether it is possible to rent out an apartment with a mortgage. Yes, you can. And the bank cannot prohibit the borrower from doing this. The inclusion of such a clause in the contract is void.

After all, housing is used for its intended purpose - for living. Just not the borrower himself, but his tenant.

But there is a clause in Article 29 of Federal Law No. 1020 of the Mortgage Law that states that additional conditions may be contained in the mortgage agreement. And some banks use this loophole.

Others do not pay attention to the borrower’s relationship with the tenants and the tax service as long as he regularly makes monthly payments.

For rent

In order to rent out housing to the same citizens, there is no need to obtain the status of an individual entrepreneur or legal entity. That is, it will be very difficult for banks to prove that this is a commercial activity.

Relations between the apartment owner and his tenants, as well as with the tax authorities, do not concern the bank.

Exactly as long as payments are received and the apartment is in good condition.

A dollar mortgage is beneficial only to those who receive salaries in the same currency. Is it possible to defer mortgage payments upon the birth of a child at Sberbank? See here.

For military mortgage

As for military personnel and the housing they purchase under the military mortgage program, the situation is very ambiguous:

- On the one hand, the owner can use his property freely, including entering into a commercial lease agreement.

- But on the other hand, any commercial activity for military personnel is expressly prohibited.

Again, it is highly controversial whether the rental of housing is a commercial activity if it occurs from time to time and without concluding a contract?

One of the signs of entrepreneurial activity is systematicity (Article 23 of the Civil Code of the Russian Federation). There is no clear answer.

There is one more point. In addition to the bank, the state is also the mortgagee of the serviceman’s apartment.

If the bank turns a blind eye to the use of an apartment to generate income, then one can hardly expect such loyalty from the state.

In Sberbank

Among the conditions of Sberbank contained in the mortgage lending agreement, there is a ban on renting out a mortgaged apartment without the bank’s consent.

That is, according to the rules, you need to contact the bank with a corresponding application, the bank will consider it and make a decision. As a rule, it is positive.

All risks are insured, so the bank’s rights are not violated.

In practice, few borrowers pay attention to this clause of the contract. Especially when it comes to informal relationships that are not formalized in any way.

Neither the bank nor the tax office can track such “gentleman’s agreements”. But there is still a risk.

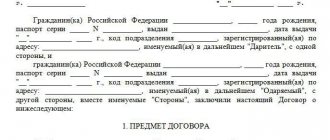

Here is a sample mortgage agreement at Sberbank.

Taking out a mortgage and renting out: pros and cons

If you undertake to take out a mortgage and rent out an apartment, the pros and cons need to be calculated before making a decision. Mortgage loan terms have nuances.

Positive aspects of a mortgage:

- A person has an asset that is growing in value, it can be rented out, you only need to find money for the first payment.

- Monthly mortgage payment. Due to inflation, it becomes smaller over time.

- Reduced expenses as a result of receiving a tax deduction for the purchase of real estate.

- When the bank rate decreases, it becomes possible to refinance the loan at lower interest rates.

Flaws:

- Funds are required for a down payment on a loan.

- If a payment is late, your credit history deteriorates.

- A reduction in monthly payments as a result of a difficult financial situation (debt restructuring) is possible only with the consent of the bank, but the entire amount will still need to be paid.

Before you take out a mortgage and rent out an apartment purchased with this money, you need to calculate all the risks, other nuances, the pros and cons of buying a home, and only then make a decision.

You need to study the law on how to rent out an apartment purchased with a mortgage correctly.

Related Posts

- Entering into inheritance under a will for an apartment There are two ways to become an heir to real estate: by will, and in accordance with the law. In the second...

- State duty for inheriting an apartment When a citizen becomes the owner of an inheritance, he is obliged to pay a state duty, and only after such payment has been made...

- Renting an apartment with subsequent purchase Renting an apartment with subsequent purchase is an excellent solution for citizens who are at the same time interested in purchasing…

Is it profitable?

Renting a home is a very popular service today. In the absence of a civilized market, the cost of rented apartments is very high. Income from such activities helps pay off mortgage payments.

It is not surprising that many borrowers prefer to take advantage of this opportunity without thinking about whether it is possible to rent out an apartment taken on a mortgage.

But with all the advantages, there are also several very significant disadvantages to this method of loan repayment:

- First, there is an increased risk of damage or destruction to the home. The bank will receive its funds from the insurance payment. But whether any of it will remain for the borrower is a big question.

- Secondly, after the end of repayment of the debt, the apartment will have to be renovated. Depending on the attitude of temporary residents towards it, such repairs can be very expensive.

- Thirdly, banks still do not welcome such initiative from borrowers. The reasons are stated above. And if they deem it necessary, they will record a violation of the terms of the contract.

The rating of banks for mortgage lending will help you obtain a home loan on the most favorable terms. What is the state fee for registering a mortgage? Read here.

Are you interested in a mortgage from VTB 24 for new buildings? Detailed information in this article.

Let's calculate the benefit

The cost of housing in different regions is not the same. Let's take for example an average Moscow one-room apartment worth 5 million rubles. In the following, all numbers will also be averages.

Option 1. The interest rate on our loan is 13% per annum. We take a loan amount of 4 million, with a minimum down payment of 20% (1 million rubles). The amount of the monthly payment will be 45 thousand 113 rubles. We will rent out the apartment for 30 thousand rubles. per month.

Recommended article: What to do with your mortgage after paying off your mortgage

Option 2. Take out a loan without a down payment. We will calculate the same percentage, although this is unlikely.

Option 3. The down payment will be 60% - 3 million rubles.

Now let’s compare the amounts obtained through simple calculations in rubles. At the same time, utility bills and expenses for periodic repairs in the apartment were not included in the settlement amounts.

| Option 1 | Option 2 | Option 3 | |

| Monthly payment | 45 113 | 56 392 | 22 556 |

| Payment for 1 year | 541 342 | 676 704 | 270 672 |

| Insurance | 3000 | 3000 | 3000 |

| Income tax (360,000 x 0.13) | 46 800 | 46 800 | 46 800 |

| Expenses for 1 year | 591 142 | 726 504 | 320 472 |

| Expenses over 25 years | 14 778 550 | 18 162 600 | 8 011 800 |

| Income for 1 year | 360 000 | 360 000 | 360 000 |

| Income over 25 years | 9 000 000 | 9 000 000 | 9 000 000 |

| Net profit | -5 778 550 | -9 162 600 | 988 200 |

With the first two options for a rental mortgage, the apartment owner remains at a loss. And in the third case, renting out a mortgaged apartment not only pays off, but also brings net profit.

Consequences of breach of contract

The first time a borrower is found to be violating an agreement with the bank, they may be told that such behavior is inadmissible and given a warning.

If violations continue, the bank has the right to demand early repayment of the debt. Fully, with interest. Where the borrower will find funds for this is not the bank’s concern.

If the client is unable to pay the debt, the bank will turn its attention to the collateral. The borrower and his tenants will be evicted and the apartment sold.

The mortgage will be closed in this way, but the credit history will be damaged.

What is the benefit

In the previous section, we compared options for renting a Moscow one-room apartment, but everything is not so bleak. Not everyone has an extra $3 million to put down a mortgage down payment.

The great benefit of a buy-to-let mortgage is the fixed mortgage payments. They will not change not in a year, not in ten years. But the cost of rent, like the cost of housing itself, is constantly growing. Therefore, after 10 years, it is possible that rent will completely cover the amount of any monthly payment.

Let's take as an example a small studio for 2.5 million rubles, with a good location relative to the metro and other infrastructure. We will take out a mortgage for 15 years at 10% per annum and the down payment is also 10%. Now our monthly contribution will be 24,178 rubles. At the same time, mortgage payments will amount to 4 million 602 thousand rubles. in 15 years.

Thanks to a good location and marketing tricks, we will be able to rent out this living space for 25 thousand rubles. per month without downtime. Based on simple calculations, this acquisition will pay for itself in 18 years.

Recommended article: What will happen to the mortgage if the bank goes bankrupt, do I have to pay

And if, taking into account inflation, the rent increases, then a full refund of the funds spent will occur in 13 years.

| Rent | Per month | During the period | Total income |

| First 2 years | 25 000 | 600 000 | 600 000 |

| 3-4 years | 27 000 | 648 000 | 1 248 000 |

| 5-6 years | 30 000 | 720 000 | 1 968 000 |

| 7-8 years | 32 000 | 768 000 | 2 736 000 |

| 9-10 g. | 34 000 | 816 000 | 3 552 000 |

| 11-12 | 36 000 | 864 000 | 4 416 000 |

| 13th year | 38 000 | 456 000 | 4 872 000 |

This option showed that renting out mortgaged housing fully covers all loan payments. It turns out that tenants will help pay off the mortgage in full through rent.

What to do if the bank does not agree

If the borrower decides to rent out the property after concluding a mortgage agreement that contains a ban on this action, the problem can be solved in three ways:

- Rent out housing without approval from a financial institution. The bank's ban on providing rental property is only of a legal nature. In fact, the borrower may take responsibility and enter into a lease agreement without notifying the bank. Despite the fact that the financial institution reserves the right to check who exactly lives in the apartment, in practice such cases are isolated. In addition, the bank will not be able to prove that the property is being rented if it does not see the corresponding agreement between the borrower and the tenant of the property.

- Remortgage the property to another financial institution that can provide more favorable conditions, including the possibility of renting out the apartment.

- Obtain bank permission. Even if the contract stipulates a ban on renting housing, you can always try to establish a dialogue with a financial institution. It is possible that the bank will meet its client halfway and draw up an additional agreement allowing the rental of credit real estate.