Home / Acquiring real estate / Buying and selling / Buying an apartment

Back

Published: March 31, 2018

Reading time: 9 min

0

964

Offsetting is a scheme in the real estate market that involves the simultaneous sale of an old apartment and the purchase of a new one. This scheme is most common in the primary market, when a buyer sells his apartment from a secondary fund to buy an apartment in a new building.

- Advantages and disadvantages of netting

- Difference between netting and exchange

- Step-by-step offset algorithm

- List of required documents

- Risks during netting

What is it and how is it different from exchange

In the standard version, the offset of apartments for a new building involves the following actions:

- They select a suitable new building according to the specified criteria and make a reservation.

- Selling their own home.

- The money received is used to pay for the new building.

In fact, we are talking about two ordinary purchase and sale transactions with the reservation of the purchase object for a certain time. This is the main difference from an exchange, where one of the parties simply pays the difference in value.

It is advisable to resort to this procedure if you want to move into a new home if you have an old one. With the help of a real estate agent, you can save time and, on the one hand, sell your apartment in a fairly short time, and on the other hand, immediately receive ownership of a new building.

Offsetting when selling and buying an apartment is sometimes confused with Trade-In. The corresponding technology is widely used to conduct transactions with cars. As part of the current commercial program, the dealer buys out old equipment at a negotiated price while simultaneously registering new ownership.

For your information! Similar procedures are rarely used in the real estate market with new buildings. As a rule, quick redemption offers are associated with significant discounts relative to the average price level.

How can I buy an apartment to offset existing secondary housing?

The procedure and general rules in both cases presented above will be almost identical. It is important to remember that often in such schemes a person loses an apartment and receives nothing in return. To avoid such risks, it is recommended to work through a legal representative.

Procedure

- Choose a suitable apartment from a developer/seller who supports the possibility of completing a transaction with simultaneous offset (not everyone agrees to this, which is worth taking into account).

- Conclude a contract for sale or directly sell the property to the developer/seller.

- Obtain ownership of a new apartment and either pay the missing amount or receive the difference between the sale and purchase price.

- Register ownership.

To complete such a transaction you will need the following documents:

- Passports of all apartment owners.

- Documents for housing (technical passport, extract from the Unified State Register, etc.).

- Implementation agreement.

- Documents for a new apartment.

- Information about the developer (charter and so on, this is necessary in order to check the company, its reliability and business reputation).

Costs and deadlines

The main expense item: payment for new housing, provided that it costs more than what will be sold. Also, developers or real estate agencies often take a certain commission for selling a client’s old apartment. Its size depends on many factors, but rarely exceeds 10% of the amount. Among other things, you will have to pay a state fee when registering property rights: 2,000 rubles for each new owner of the apartment.

It is very difficult to determine deadlines in advance. Some apartments sell quickly, while others may wait several months, or even years, for a buyer. It depends on the condition of the property, the terms of sale and, most importantly, the cost. Often, buyers prefer to opt for those apartments that are cheaper than the standard price on the market. Thus, if you need to sell your home as quickly as possible, you should reduce the price by exactly that 20-30%.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Settlement scheme

There are three parties involved in a typical new building transaction:

- client;

- real estate agency;

- developer.

It is permissible to conclude an agreement only with a realtor if there is appropriate authority from the company that owns the apartments in the new building. Usual scheme:

- The cost of the housing you like is fixed for 3-4 months.

- The agency evaluates old real estate and sells it.

- After sale, the proceeds are transferred to the developer’s account.

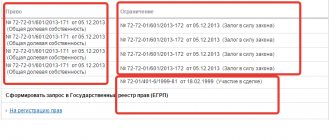

- A new building by offset is registered in the name of the client with registration of the property in Rosreestr.

In terms of terms - some agencies (developers) offer a year or more to search for buyers. However, in such cases it will not be possible to exclude a change in cost. Typically, contracts take into account inflation based on the current Central Bank rate with an increasing coefficient. If the time frame is reduced to 1-2 months, in order to quickly sell your apartment, you will have to take a significant discount from the average level in the corresponding market segment.

In more complex schemes, external financing is added - mortgage loans. For the down payment, use the amount received after the sale of the old apartment. The new building will be purchased in full, but it will be possible to dispose of the purchase without restrictions only after the mortgage has been repaid and the collateral in the Unified State Register has been removed.

Settlement transaction procedure

Such a transaction involves the following stages:

- Choosing a real estate agency. Experts recommend choosing large companies that cooperate with a large number of developers. There will be a larger selection of apartments in new buildings.

- Selection of new housing from among the offers that are in the agency’s database.

- Reservation of apartments from the developer for the period of sale of the apartment.

- Valuation of old square meters by company specialists at market price.

- Start of an advertising campaign with the goal of selling real estate on the secondary market. It is good if the agency offers a wide range of advertising opportunities. This will increase the likelihood of apartments being sold as soon as possible.

- After a buyer for the apartment is found, a contract for the sale of the old living space and the purchase of housing in the new building is signed at the same time. As a rule, legal support during the entire offset process is the responsibility of the real estate agency.

Concluding such a transaction is possible in relation to any objects owned by the client. The main thing for the seller is to assess his financial capabilities and the cost of housing. When offsetting, the company imposes certain requirements in relation to the client and his apartment. Some of them (they are often different for each agency):

- housing must be owned for three years or more;

- legally free (not on credit, not under an outpost, etc.);

- physically free - owners are required to vacate the apartment within a couple of weeks after the agreement to purchase their living space.

Agencies may also require that an apartment on the secondary market be located in a certain area and be in “good” or “excellent” condition and be of the appropriate type of housing.

Note! Apartments under construction are often offered by mutual offset. The buyer has to wait for the move-in date, and delivery dates can sometimes be changed by the developer. It is worth considering the issue of temporary registration and residence until the completion of all construction work.

Approximate costs for collection

When purchasing an apartment by offset, the final costs depend on the chosen scheme. Realtors take a fee from buyers or make a profit through cooperation with the developer.

To avoid problems, you should carefully study the proposed conditions and the text of the agreement. In case of early termination, the agency has the right to demand reimbursement of advertising and other costs. Exceptions and payment procedures, along with penalties, are specified in detail in the thematic sections of the agreement.

As a standard, you need to take into account the following offset costs for a new building:

- remuneration to a real estate agency – from 50,000 rubles;

- state fee for registering a right in the Unified State Register of Real Estate – 2,000 rubles;

- obtaining an extract from the Unified State Register of Real Estate for the sale of your apartment – 300-600 rubles;

- notary services (spouse consent for purchase and sale) – from 1,000 rubles.

For your information! Notarization of contracts for realtor services is not required. Notarization of the DCT is required if a share in an apartment is being sold or if the owner of the property being sold is a child.

Step-by-step algorithm for offset when purchasing an apartment

Offsetting when purchasing real estate involves going through the following stages:

- The client selects an apartment in a new building in which sale is carried out on a mutual basis.

- Real estate agency specialists assess the market value of the apartment they own and announce the terms of purchase and sale.

- If the conditions suit him, an agreement is signed for the provision of intermediary services for the sale of the apartment.

- The client makes an advance payment to fix the cost of an apartment in a new building and enters into a reservation agreement with the developer. It is advisable that it be notarized for the period necessary to sell the old apartment.

- The client's apartment is put up for sale.

- After a buyer is found, a purchase and sale agreement is signed with him and ownership rights are re-registered in his address.

- The proceeds immediately go to the developer as a contribution for an apartment in a new building, and at the same time a purchase and sale agreement for an apartment in a new building is signed.

- After the facility is put into operation, a transfer and acceptance certificate for the apartment in the new building is signed.

- Based on the agreement with the developer and the received certificate, ownership rights are registered through Rosreestr. The state fee for the procedure is 2000 rubles.

- Based on state registration, the client receives an extract from the Unified State Register of Real Estate, which confirms his legal status as the owner.

- After securing ownership of the apartment, you can register.

One of the legal consequences of declaring a marriage invalid is the termination of the marriage contract. Don't know how to get a divorce certificate after a court decision? Our article will help you in this matter.

You separated from your husband, but you still have a joint loan. Find out how he shares in case of divorce by reading our material.

Tax issue

Two points need to be taken into account when offsetting an old apartment for a new building:

- tax on the sale of your home;

- receiving a tax deduction when purchasing a new building.

Taxes upon sale are paid on the income received at a standard rate of 13%. The report on form 3-NDFL is submitted for verification until the end of April next year after the sale of the old home. Moreover, if you have owned the property for more than 5 (3) years, you do not need to pay anything. Read more about personal income tax on sales at this link. Additionally, read the rules for applying the seller's tax deduction.

After purchasing a new building, you can receive compensation from the state of up to 260 thousand rubles, plus a refund of mortgage interest up to 390 thousand. Property taxes are regularly paid for new properties. Tax authorities send a notification of this obligation with the exact amount annually.

Advantages of participating in a trade-in

Let's talk about the most painful thing - the timing. The developer, as a rule, agrees to wait three months (in rare cases, a longer period is specified in the contract). During this time, realtors must find a buyer, agree on a price with him, conduct a purchase and sale transaction, register ownership in Rosreestr and receive the proceeds for the old property in order to immediately pay for the new apartment.

What happens if you don't meet the deadline? Depends on the state of the market. If primary demand is sluggish, then the developer may agree to extend the reservation agreement and wait another one to three months. If sales are brisk, the agreement will most likely be terminated. In this case, the client risks losing the booking commission, which is 1-2% of the cost of the selected object or a fixed amount of 20-30 thousand rubles.

Let's imagine an optimistic outcome: a buyer is found, the transaction is completed and the money is received. In this case, the client, having paid the difference, becomes a participant in shared construction or the owner of a newly built apartment.

But this is only one of the “qualifying” options. Some banks that provide loans for the purchase of apartments in new buildings offer their own trade-in scheme - with the opportunity to live in an existing apartment until housewarming. A citizen chooses an apartment in a new building, receives a mortgage loan from the bank for its purchase, and his existing housing becomes collateral for it. He continues to live in his apartment until the house is put into operation. Having moved to a new apartment, the client sells the old one - usually within six months after signing the transfer and acceptance certificate, if he purchased an already built apartment, or within nine months after putting the house into operation, if the housing was purchased during the construction stage. The proceeds go towards partial early repayment of the loan provided by the bank.

A similar “stay before moving in” scheme is sometimes used by developers, although much less frequently than banks.

Let's summarize. This scheme has two main advantages. The selected object is assigned to you for several months (or even until the new building is put into operation), and the price for it does not change. Meanwhile, professionals handle the sale of your property without creating any problems for you.

Pros and cons of netting

How much is lost during offset will become clear during the implementation of the project. The realtor's interest in accelerating the sale explains the proposals to the client to reduce the cost of his property. Other cons:

- limited period for reserving apartments;

- the risk of violation of obligations by the developer (in terms of quality, equipment, commissioning);

- a small number of offers in the relevant market segment.

Additional difficulties are created by agencies that prefer to work with highly liquid real estate. In addition to discounts, the following requirements are quite common:

- favorable location of the apartment;

- long-term ownership (3 years or more);

- absence of encumbrances;

- preliminary or expedited discharge of residents with written obligations.

A significant advantage is qualified legal support of the transaction. It should also be noted positively:

- effectiveness of professional promotional activities;

- no additional costs when searching for a buyer;

- purchasing new real estate at an affordable price;

- reduced mortgage obligations due to a large down payment.

Option #1

The first scheme is as follows: a person signs an agreement with a developer to sell his property to third parties. At the same time, a new house can be at any stage: just under construction or already put into operation. The choice of a specific object depends on the client’s wishes.

As for the sale, this is handled either by a third-party realtor or by an agent who is an employee of the development company. It is extremely important that this person is a professional and takes a responsible approach to finding a buyer. His tasks include adequate assessment and pricing, which will facilitate a fair but quick sale of the old premises. It is prohibited to underestimate the value of real estate in order to speed up the sale. This is beneficial for the company, but not for the owner of the secondary home.

Please note that the sale of real estate must be carried out within a certain time frame, which is provided for by the signed agreement. As a rule, 90 days are allotted for this, since this period is considered sufficient to find a real buyer. Depending on certain factors, the period may increase or decrease if the parties to the transaction so desire.

The importance of meeting deadlines is justified by the fact that at this time the room you like in a new building is booked. If during this period it is not possible to sell your home, the reservation will be canceled and another person will be able to purchase the property.

Offers for exchanging apartments for new buildings in 2020

Maria Litinetskaya, managing partner of Metrium Group, gives the following example of a scheme for accepting an apartment as credit for the new building “New Vatutinki District”:

New Vatutinki

“An agency agreement is concluded with the buyer for the sale of his old apartment. Also, during the sale of the old housing, a reservation agreement for the apartment is signed for a period of 3 months. The service costs 50 thousand rubles, which are ultimately deducted from the total cost of the apartment when the transaction is concluded. It is important that the price is fixed for the entire duration of the contract, that is, clients do not have to worry about changes in the price list.

After the sale of the old apartment, a DDU is signed with the client. If the amount from the sale of secondary housing is not enough to purchase a new home, the buyer can contribute his own additional funds or take out a mortgage loan. If within three months a buyer for the old apartment is not found or the client, after booking, refuses to sell the secondary apartment via trade-in, the property in the new building will go on free sale. However, cases where an apartment would not be sold within three months are rare today.

If suddenly there are very few calls or showings for the apartment being sold, a new, lower price is agreed upon with the client in order to still attract attention to it.

A similar offset scheme operates in the residential complex “Novy Zelenograd” (Solnechnogorsk district), where the cost of housing, taking into account all promotions, is reserved for a period of two months with the possibility of extension on an individual basis. However, as the developer of the IKON Development project states, cases where two months would not be enough to sell a secondary apartment are rare. The client pays only for booking the apartment.”

Residential complex New Zelenograd

Unfortunately, this commentary does not say what will happen if the agency encounters difficulties in selling the apartment. The client probably only risks the fee for booking an apartment in a new building.

"Metrium Group", being an agency - the exclusive representative of the developer, with the help of the service of offsetting an existing apartment when purchasing a new building, enters the market of agency services in the secondary market. But developers who have their own sales departments prefer to enter into agreements with partner agencies that help their potential clients exchange an apartment for a new building.

Yana Maksimova, director of information policy and PR at Urban Group, reports that Urban Group offers a trade-in service for all properties. Its essence lies in the fact that the Trade-In Realty company, a partner of the Urban Group, helps the client sell an apartment and at the same time reserves housing for him in one of the Urban Group complexes, while fixing the price for 60 days. This allows the client to sell an apartment at a market price in a comfortable time frame, without fear that the property he has chosen in a new building will rise in price. The program applies to clients with real estate in Moscow and the Moscow region.

As we can see, this message does not quite correctly say “trade-ine”. In addition, nothing is said either about the conditions for booking apartments, or about further actions in the event of a prolonged exposure of the old apartment.

The conditions of LSR Group look, although less attractive, but more realistic.

Here's what Yuri Ilyin, director of investor relations and public relations, says: LSR Group in Moscow offers, thanks to which you can exchange your apartment for a new one in one of the Moscow properties. Of the residential complexes located outside the Moscow Ring Road, the program operates in the Luchi residential complex and the Nakhabino Yasnoe residential complex.

Residential complex Nakhabino clear

First of all, you need to select the apartment you are interested in with the help of the sales department manager, then order a free assessment of your apartment and sign an agency agreement for sale with the Azbuka Zhilya real estate agency, a partner of LSR Group.

The next step is, without waiting for the sale, to enter into a DDU for the selected apartment and contribute 10% of its cost. The balance of the amount is paid after 3 months, during which the specialists of the ABC of Housing Academy will sell your apartment. One of the many advantages of the program is that the current price is fixed even if there is only 10% of the cost of the apartment.”