Citizens of the Russian Federation have the opportunity to use several ways to obtain a housing plot legally. One of the most progressive and modern mechanisms for purchasing housing is the conclusion of a lifelong maintenance agreement. Such a document, in contrast to a banal gift agreement, guarantees that older people will receive care and attention in exchange for the provision of real estate.

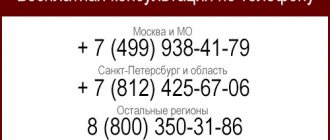

Note! If you have any questions, you can chat for free with our lawyer at the bottom of the screen or call Moscow; Saint Petersburg. Free call for all of Russia.

What is a lifelong maintenance agreement?

A life maintenance agreement, or annuity agreement, is a document signed by the owner of the living space and the person who undertakes to care for the owner until his death. The paper regulates the details of providing the property owner with everything necessary and includes the conditions under which termination of the agreement is possible.

The contract specifies the methods and details of care. Typically, the signatory who inherits the property agrees to:

- provide the property owner with food and medicine;

- provide constant care if the owner needs it;

- pay a certain amount of money monthly.

Important! Contributions from the annuity payer are considered income and are taxed at 13%.

Permanent and lifetime annuity. What is the difference?

A permanent annuity is a type of transaction that provides for the perpetual nature of the obligations. They are entrusted to the guardian for the payment of the annuity. In this case, the validity of the contract is not limited to any period of time and does not depend on the life expectancy of the apartment owner. The transaction is considered completed after receipt of the entire amount for the property.

Help with services is not excluded here: purchasing food, medicine, medical support. That is, the agreement can be concluded like this: part of the contributions is made in money, and the second part in services or goods.

In the case of a permanent annuity, the annuitant has the right to purchase the property before the death of the owner. He can receive funds in completely different parts; the main thing here is to discuss this with the owner in advance. With a life sentence, this is impossible.

This is important to know: Features of an annuity with lifetime maintenance

Who can draw up an agreement

There is a certain list of conditions, subject to which the parties have the right to draw up a rent agreement:

- the recipient of the content must be an individual;

- the property must be individually owned;

- the living space should not have any encumbrances;

- both parties must be fully capable.

Important! Both a legal entity and an individual have the right to act as a payer.

Attachments to the contract

Documents must be attached to the contract - together with the main agreement, they are an integral part of the contract:

- Technical passport or cadastral plan of a residential building, land plot (depending on what kind of property will be issued).

- Power of attorney for the representative of the annuitant, if the elderly person chose to act through his representative. Such a power of attorney must be signed by a notary.

- If an apartment or other property was acquired during the marriage of currently living spouses, it is also necessary to attach the written consent of the second spouse to the actions of the first (with whom the rental agreement is concluded).

- It is possible to attach documents that are related to the expert assessment of the property (expertise conclusion).

The agreement is signed only in the presence of a notary. If necessary, he can be invited to the home of an elderly person, but such a service will cost more.

A specialist's commentary on the legal essence of a life annuity agreement is presented in the video.

How to conclude an agreement

The agreement must be made exclusively in writing. The law does not provide for a uniform form for such papers, so the best option would be to contact a specialist for detailed advice.

The life annuity paper must necessarily contain the following information:

- place and date of conclusion of the agreement;

- full details of signatories;

- the most detailed description of the property being transferred;

- the procedure for providing content;

- rights and obligations of signatories;

- liability of the parties for violation of the agreement;

- actions in case of unforeseen circumstances;

- duration of the agreement;

- other subtleties, for example, the distribution of costs for legal posting of a document.

Note! If at least one of the points listed above was not reflected in the contract, it can be challenged and declared invalid.

Documents required for execution of the contract

Since the agreement is related to the subsequent transfer of property into the possession of another person, to draw up the paper, the notary will request the following list of documents:

- originals and copies of passports of the parties;

- consent of the property owner to conduct the transaction;

- consent of the signatory's spouses, if any;

- a certificate from the BTI containing the estimated value of the property;

- papers confirming that the property really belongs to the rentee;

- certificate of absence of encumbrances on the living space;

- floor plan of an apartment or house, issued by authorized government agencies;

- certificates confirming the absence of drug addiction or mental illness;

- application for registration of the agreement;

- a certificate confirming the validity of the paper’s conclusion;

- a receipt confirming the fact of payment of the state fee for registration of the agreement.

How much does it cost to apply for an annuity?

The costs of registering an annuity agreement consist of several components, the amount of which depends on certain variable circumstances:

- There is no standard unified form of annuity contracts. In each case, the parties describe individual parameters appropriate to the specific situation. You choose the form and amount of monthly payment, penalties, the possibility of replacing the monthly payment with equivalent services, as well as many other important points. In such a situation, the formulation of all provisions of the document should be entrusted to an experienced lawyer who will be able to foresee all the likely risks of the parties and take them into account. The cost of a lawyer’s services is the first component of the cost of drawing up a rental agreement.

- The renter is required to prove his ownership of the property. To do this, just one document is enough - an extract from the Unified State Register, which is obtained at the local branch of Rosreestr. If the ownership right has already been properly registered, then you will only have to spend money on obtaining an extract (400 rubles). Otherwise, the costs will include payment for the entire title registration procedure.

- The rent agreement must be notarized. If this is not done, then according to Art. 165 of the Civil Code of the Russian Federation, the contract is invalid. Costs include notary fees. The size depends on which particular notary office you contact for this purpose.

- So that when certifying a transaction in a notary’s office there is no doubt that the rentee is voluntarily signing the agreement, and most importantly, is aware of his actions, it would not be amiss to invite a specialist who has the right to certify legal capacity to the transaction, or to present a document confirming it (dated date closest to the signing of the deal). The rentee will have to pay for the certificate or specialist services.

- In addition to the notary, it is also required to carry out state registration of the annuity agreement in Rosreestr. From the moment the documents are submitted to the registration chamber, an encumbrance will be assigned to the apartment. This will not allow the owner to sell, bequeath, donate or otherwise dispose of it. After the rent payer receives the death certificate of the rent recipient, he will have the right to submit an application to Rosreestr to register the transfer of ownership. Costs include payment of state duty, the amount of which can be found in the Rosreestr office.

annuity agreements with lifetime maintenance

Download a sample life support agreement with dependents

Inheritance of a lifelong maintenance agreement

According to the law, if the annuitant dies, the responsibility for maintaining the dependent is transferred to the heirs. If the heirs repeatedly violate the agreement, the rentee has the right to go to court and terminate the agreement due to failure to provide the services described in the document.

In a situation where none of the heirs of the rent payer entered into the inheritance, the agreement passes in favor of the state. At the same time, government agencies also have the right to refuse the lifelong maintenance of the annuitant. In this case, the latter has the right to sue and terminate the transaction.

Advantages and disadvantages of lifetime rent of an apartment

Such a transaction has certain risks and losses:

- The guardian may be an ordinary fraudster who does not fulfill the terms of the contract, and may choose an unscrupulous executor to provide services to the rent payer.

- The renter may not be able to provide the landlord with everything necessary.

- The owner may well live much longer than the guardian, and accordingly, the guardian will not be able to get his own apartment.

- After the death of the property owner, relatives can challenge the terms of the contract and file a claim for its termination in court.

- After some time, the annuitant may well want to terminate the contract, but if the guardian conscientiously fulfills all the terms of the contract, then this will be almost impossible to do.

Let us point out the significant pros and cons of the deal:

Advantages of a life annuity:

- The homeowner can terminate the contract only by applying to a judicial institution.

- The rent agreement is always registered with Rosreestr, so the apartment owner can be calm - “black realtors” will not bother him.

- Such a deal is concluded on mutually beneficial terms: the pensioner receives all the necessary care and care, while living in his usual conditions, and the guardian, if he conscientiously fulfills all the provisions of the agreement, will, as a result, receive an apartment.

Disadvantages of a lifetime annuity:

- The renter must transfer a fixed amount to the owner of the property every month.

- If the guardian does not comply with the terms of the contract, the recipient has the right to terminate it, and all funds will not be returned to the payer.

This is important to know: Features of self-rental housing

Frequent errors during registration

Typical design errors are:

- incomplete description of the obligations and rights of the parties;

- absence of some mandatory items;

- ambiguous description of conditions;

- error in the passport data of the parties;

- incorrect description of the essence of the requirements.

To avoid common errors during registration, the parties should carefully study the sample available at the link.

For whom and who needs it - the pros and cons of the deal

Both parties receive benefits from the concluded annuity agreement, of course, subject to all conditions being met. After all, the essence of a life annuity is a mutually beneficial relationship.

The annuity recipient improves his financial situation; in addition, it is possible to agree not only on cash payments.

For example, it is difficult for people with disabilities or the elderly to maintain their household on their own, so part of the monetary compensation can be replaced with cleaning services, cooking, hiring a caregiver, etc.

The rent payer has his benefit in the form of the property he receives.

The conclusion of an annuity agreement imposes obligations on the payer that he must strictly fulfill. If the conditions are not met due to his fault, then the annuity recipient will be able to terminate the contract in court, and the funds paid will not be returned.

Despite all the obvious advantages of this enterprise, there are also a number of disadvantages affecting both sides.

Parties to the contract and their legal capacity

The future rent payer should especially pay attention to the person’s legal capacity. If it is subsequently proven that at the conclusion of the contract the annuity recipient was in an unhealthy mental state, then the document may be declared invalid.

As a rule, dissatisfied relatives of the property owner try to prove this fact when they realize that they will not inherit the property. To protect yourself, you need to contact an expert organization and conduct a psychological and psychiatric examination of the person before signing any papers.

Conditions and circumstances

Misunderstandings often arise between the parties after the conclusion of an agreement, which can lead to conflicts and litigation. The culprits are equally the recipients of the rent and its payers.

The first category of people sometimes begins to believe that they deserve better treatment and, therefore, a wider range of services provided to them that go beyond the scope of the contract, as well as increased payments.

In case of refusal, they show obvious signs of aggression, expressed in threats to break the annuity agreement. By the way, this is not easy to do; termination of a rental agreement is possible only by mutual agreement or through a judicial authority if there are compelling reasons.

The second category, payers, tends to violate the terms of the contract. For example, instead of the weekly cleaning of the apartment specified in the contract, carry it out only a couple of times a month.

Some who especially want to quickly get full use of property try not to improve, but to worsen the life of an elderly person. But you should understand that this may be a reason to terminate the contract and even initiate a criminal case.

When concluding a rental agreement, you need to discuss all the conditions in advance and set them out in detail on paper so that no questions arise later. And annuity recipients should first inform their relatives and family members of their intention.

Cancellation of the contract

The recognition of a transaction as void is carried out exclusively in court. If the initiator of the termination of the agreement is the rentee, in the statement of claim he must indicate:

- reasons for cancellation of the agreement;

- evidence of unfair content;

- receipts and certificates confirming the fact of non-payment of services by the owner.

The law allows the parties to terminate the agreement on a voluntary basis. Wherein:

- the lessee receives his property back;

- the owner has the right to demand compensation for financial expenses during the validity of the agreement.

Characteristics of the gift agreement

The donation agreement is concluded orally, with the exception of a few cases when writing is required (Article 574 of the Civil Code of the Russian Federation):

- a legal entity donates property worth RUB 3,000 or more;

- real estate is given as a gift: house, apartment, land, room in a communal apartment;

- the giver promises to give a gift in the future, upon the occurrence of a certain event or date.

For donation, the consent of the recipient is required - he signs the DD. If a contract of promise of gift has been drawn up, he has the right to refuse the transaction at any time before receiving the gift (Article 573 of the Civil Code of the Russian Federation).

Important! Until 2013 it was necessary to register a deed of gift for real estate in Rosreestr, then submit documents to re-register ownership. Since March 20313 this procedure has been canceled, and now the parties only need to contact the registrar once for the donee to become the owner.

Legal advice: even if the law does not provide for a written form of the DD, it is better to draw it up on paper. For example, a paper DD may be needed to register a donated car - without it, the recipient will be refused by the traffic police.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Contents and sample of a gift agreement

There are no requirements for the content of the gift, but in order to avoid disputes, it is better to immediately formalize everything correctly, indicating complete data about the transaction:

- Full name, series and numbers of passports, registration addresses of the parties;

- information about the gift: date of release/delivery of the property, details of title documents;

- date of conclusion;

- grounds for changing or terminating the DD, procedure;

- liability of the parties to the transaction;

- signatures of the parties.

Sample real estate donation agreement:

Pros and cons of deed of gift

If we consider the advantages and disadvantages of a deed of gift, we can highlight several features:

| pros | Minuses |

| Simplicity and speed of registration | If you do not have legal training, you will have to contact a lawyer or notary to draw up a deed of gift, otherwise the document may not be accepted by other government agencies due to errors |

| Sometimes you can avoid high costs for a notary if notarization is not required by law | Possibility of cancellation under Art. 578 of the Civil Code of the Russian Federation (minus for the donee) |

| No pre-emptive right to a share, as in the case of a sale | The donor receives nothing in return: he has no right to demand money or services from the donee under a gratuitous transaction |

| If a gift is received by a spouse, in case of division it is not divided and remains with him (Article 36 of the RF IC) | If, as a result of a donation, damage is caused to the property or life of the recipient, the donor undertakes to compensate for it voluntarily or in court (Article 580 of the Civil Code of the Russian Federation) |

| Close relatives of donors who receive property under a deed of gift are exempt from taxation | People who are not close relatives of donors will have to pay personal income tax in the amount of 13% when receiving a gift of real estate, a vehicle or other property, except for gifts in cash or in kind. |

Possible pitfalls of the contract

Despite all the obvious advantages, the lifelong maintenance agreement contains a significant number of disadvantages and pitfalls for both signatories:

- Unscrupulous rent payer. The prospect of getting a practically free apartment attracts more and more scammers every day. A citizen who has decided to draw up an annuity agreement must carefully select a counterparty in order to protect himself from problems in the near future.

- Financial difficulties arising during the term of the contract. Sometimes during the term of the agreement, renters lose a source of regular income and, as a result, experience serious financial difficulties. Or, on the contrary, the annuitant begins to demand more maintenance due to illness. Such unforeseen circumstances should be discussed at the stage of drawing up the paper.

- Death of the payer. Sometimes payers die before recipients. In such cases, the contract and obligations are inherited.

- Relocation of the apartment owner to another location. The paper must reflect the possibility of the tenant moving to other apartments or houses.

- Termination of a transaction due to fraudulent actions of one of the parties. None of the signatories has the legal right to terminate the agreement unilaterally. This procedure is carried out only through the court, and in the claim the rentee must indicate compelling reasons for recognizing the transaction as void.

- Failure to comply with the terms and conditions prescribed in the agreement. Fraudsters often take advantage of the fact that most people do not know the laws and their own rights. Such persons simply do not fulfill their duties in the hope that there will be no sanctions from the rent recipient.

- The appearance of relatives of the property owner after his death. There are often cases when, immediately after the death of the annuitant, relatives appear and begin to lay claim to the living space transferred under the agreement.

In order to avoid most force majeure situations, experts recommend:

- keep clear records of funds spent on rent;

- keep all receipts and receipts;

- immediately before signing the contract, ask the rentee to undergo an examination and save the certificates;

- pay utilities and transfer the rent to the recipient, even if the latter refuses it.

Challenging

Elderly people are wary of drawing up a lifelong maintenance agreement and take such a step as a last resort. Unfortunately, real estate is a very attractive target for swindlers, fraudsters and even criminals with more serious crimes.

And they often use a rental agreement for an apartment as an opportunity to get housing quickly and without special costs. Therefore, it is important for an elderly person to find a reliable, responsible, honest person to care for them.

But even with careful preparation for drawing up an agreement, situations often arise when the relatives of the old person or he himself do not agree with the agreement, deciding to break it some time after signing. Is it possible to challenge a lifelong maintenance agreement after death or do this during the lifetime of the property owner?

Termination of the rentee's agreement can be carried out for several reasons that are important to the court:

- The rent payer may not fulfill his obligations and fail to pay the rent amount established by the contract on time. Or he transfers it to the former owner of the apartment partially, not according to schedule. It is important that the money is not transferred in cash, but is transferred to an account; in this case, it is not difficult to check its receipt.

- Heirs can file a claim to invalidate a annuity agreement with the transfer of property if this agreement was not drawn up in accordance with the law. After all, the agreement must undergo state registration or be certified by a notary. Violation of form is an important basis for challenge.

- The contract will not be valid under the law if the owner of the apartment was incapacitated at the time of signing. Relatives can present at the trial a certificate from a psychoneurological clinic, which will confirm that the person may not have realized the seriousness of the transaction at the time of signing.

There may be other reasons that the court recognizes as valid for considering the annuity agreement invalid and illegal . And the right of the owner of the renter will be terminated. If the annuitant has already died, his inheritance will be divided by the court among the heirs, taking into account the provisions of the law, taking into account their right of turn.

ATTENTION! If the rent payer loses the received property by court decision, he can file a counterclaim with relatives, heirs or the rent recipient (during his lifetime) for compensation for the funds spent.

And the other side of the relationship will have to satisfy this claim.

After the death of an elderly person

Only recently did the heirs of a deceased person have the opportunity to challenge the transfer of property to a person under a lifelong maintenance agreement.

Until this time, only the person signing the contract for his maintenance had the right to seek its invalidity if the document was drawn up in violation or the payer did not fulfill his obligations. The challenge was carried out on the basis of articles 177-179 of the Civil Code of the State.

But since there are many examples that relatives or interested parties learn about deception, fraud, and other violations only after the death of the testator, significant changes were made to the law.

The Plenum of the Supreme Court of the Russian Federation in 2012 adopted a Resolution according to which heirs can challenge the annuity agreement of their relative even after his death. If they have serious reasons for this. Previously, they were refused in such a matter.

What means can heirs use to prove wrongdoing in the matter of drawing up and executing a contract? They can provide the court with medical certificates proving the incapacity of the testator, testimony of eyewitnesses who confirm the fact of intimidation of the old person, moral pressure on him, as well as the failure of the renter to fulfill his duties.

ATTENTION! For the court, it is necessary to provide as much evidence as possible of violation of the contract or the rules of its drafting.

One certificate or one expert opinion will not be seriously considered by the court, so you should prepare for the hearings carefully, thoroughly and competently.

During the lifetime of the owner

If the elderly person is alive, it is easier to challenge the illegality of the lifelong maintenance agreement. It can be proven that threats, moral pressure or deception were used to force a person to sign a contract.

The annuitant can also prove that he did not receive the agreed amounts or the care services referred to in the document. Care services can include cleaning, visiting a hospital with an elderly person, preparing meals, receiving qualified assistance, etc.

Arbitrage practice

According to federal judicial practice, there are a huge number of scammers operating under the following schemes:

- An elderly man signs an annuity agreement. The payer carefully adheres to all terms of the contract and pays funds on time. At some point, the grandmother or grandfather begins to interfere in every possible way with the fulfillment of the terms of the contract, for example, they do not accept rent or do not allow them to pay for utilities. Ultimately, if the payer succumbs to the persuasion of the elderly, then they sue on the basis of non-fulfillment of the agreement and keep the living space for themselves. In this case, all funds paid by the other party are non-refundable.

- The grandmother enters into a lifelong maintenance agreement with the fraudster. The latter avoids performing his duties in every possible way, taking advantage of the elderly person’s ignorance. Ultimately, the unscrupulous rent payer gets the apartment for next to nothing, and the grandmother remains out of work.

Is it possible to challenge the contract?

Relatives have the right to challenge the contract only under the following circumstances:

- it was drafted incorrectly;

- some mandatory points were not taken into account;

- the agreement was not notarized and not registered with the justice department;

- the agreement was not accompanied by certificates of full legal capacity of the signatories.

If none of the above factors exist, then it is not possible to challenge the document.

The main points specified in the annuity agreement

What does the Civil Code of the Russian Federation say?

To the rentee from terminating the contract with you on the basis of your dishonest fulfillment of the terms of the contract, write down everything down to the smallest detail. For example, the number of walks with the old man per week and how long they should take. Menu for the whole week. What will you cook, from what products. What and how many times should you do around the house, for example, washing the floors, vacuuming, doing wet cleaning, doing laundry. For example, an old man may have a whim for you to read the newspaper to him.

If you refuse, he may be offended, consider that you are deceiving him and, as they say, make a molehill out of a mountain. Therefore, write down everything, everything, everything. The agreement must fully regulate your mutually beneficial relationship with the elderly person, otherwise receiving an apartment under a rental agreement may become unbearable hard labor for you.

In this case, it is worth bypassing this point. However, if a grandmother or grandfather, with competent support, wants to write down this item, treat it with great attention. It is not recommended to agree to pay rent on exact dates, for example, the 5th of each month. Since you may lose your job or experience some difficulties, you don’t need clear boundaries.

It is best to take a quarter of the year for the billing period - this is every three months or at least two months. This means that you are recommended to schedule all your responsibilities towards the old man at this time.

By the way, if you do not specify the terms of the annuity, then this is also provided for in the legislation:

This article of the law stipulates that you must provide services to an elderly person at a level no less than the subsistence minimum for the region of the country in which you are located. This means that if you do not pay rent in the form of money, then you need to register all the services provided to the elderly person in monetary terms.

For example, going to the grocery store costs 300 rubles. Here you also add a list of products for the week and also write down the amount. In reality, all your expenses should remain in the form of attached receipts.

By the way, do not forget to include in the contract the condition for taking receipts from the annuitant (that is, the grandfather or grandmother) for each action performed. For example, you went to the store, bought groceries, prepared a meal, went for a walk with the old man... This will be your insurance against the old man’s inappropriate behavior. If you have receipts in which the elderly person confirms his approval of the services received, then it is unlikely that it will be possible to terminate the rental agreement with you through the court.

What other pitfalls should you be aware of? The fact is that before you enter into an annuity agreement with an elderly person, you must make sure that he is not recognized as legally incompetent.

This type of deception can be perpetrated by the relatives of an old person. If you draw up an annuity agreement with such an old man, you pay money (which they will secretly take from you from the old man), then after he dies, the children can sue to terminate the annuity agreement, which could not have been drawn up on the basis of for the incapacity of his deceased parent during his lifetime. annuitant is registered to make sure that there is no medical certificate of incapacity against him.

Pay attention to this article. It may happen that you have the money to buy an apartment at rent for the remaining amount. Don't forget to include the terms of this clause in the contract. For example, if after 10 years you get tired of caring for an elderly person, but want to completely manage the apartment and sell it, then you will have to buy it. This is a rather slippery moment, since most likely, according to the court, you will still be obliged to support the elderly person until his death. However, you should consider this point as well. Think everything through.

For example, you can draw up a schedule with the rentee for the cost of an apartment for the next 30 years. Every month this amount should decrease by the cost of services provided. Do not forget to take into account the link to the exchange rate, otherwise you may make a mistake. For example, in 5-10 years you will have money to purchase this apartment. Write this moment down. The rentee must agree that if they receive the remaining rent for the apartment, then your duty of care to that person ends. After all, in essence, rent is nothing more than the opportunity for the rentee to receive care without having money, and for the rent payers to receive an apartment in installments. If you buy the apartment from the renter , then he will have money, which means he can already buy another home or pay for services in a nursing home. In order for this transaction option to be available to you, you need to remember to register it.

If you become unable to pay your rent, you need to make sure you get your money back. Since the apartment, which under the rent agreement becomes collateral, the rentee cannot do anything with it. But the times are such that everything can change.

You will not be able to pay the rent, and the rent recipient will want to sell the apartment or write it off to relatives who will suddenly agree to look after him. Therefore, with the elderly person with whom you will draw up such an agreement, you need to discuss the moment of termination of mutually beneficial cooperation. For example, over several years of care you can spend a decent amount. Don't forget to take into account the ratio of the ruble to the exchange rate. Otherwise, after 5-10 years of providing rental services, it may turn out that the amount that the rentee owes you for terminating the contract is negligible. To keep everything fair, do not forget to write everything down in detail.

Please pay very close attention to this paragraph of the article. What are we talking about here? For example, an old woman has a house, with which, simply put, she wants to pay for the fact that another person will look after her. But this house is countryside, no one lives in it, and this old woman lives in the city and you take care of her in the apartment where she is located. Let's say this house burns down or floods...

That is, this property no longer exists. Your task is to provide for this moment so that in the event of destruction of this property you do not have to bear the obligation to care for this person. Moreover, the fact that such a house burned down or collapsed, due to independent circumstances, can (which would be most likely) relieve the elderly person of the responsibility to return to you the money that you have already spent on care. Imagine if it's several years. 10-20. This is very risky for the rent payer. Therefore, before tackling the issue of obtaining an apartment through rent , you need to assess all the risks, and also draw up a contract very, very competently.

It may happen that several elderly people live in an apartment. For example husband and wife. The apartment is shared. There is no one to look after them and they can be potential rent takers.

By the way, there is an advantage to caring for an elderly person who only has a share in the apartment . Firstly, it may be cheaper. Secondly, if this person dies, you already have the right to live and register in the apartment in which you will receive your share that belonged to the deceased person for whom you were caring. It could be ½ of the apartment or 1/5 or even 1/10. Any share allows you to register and live in the living space. This can be not only an apartment, but also a house. Find out why apartments are so expensive and what will happen to housing in 2020?

Therefore, caring for several elderly people who are homeowners is more profitable, since you can quickly obtain the right to officially reside in this premises.

The legislation provides for a rent amount no less than the cost of living in the region in which the housing is located. Therefore, here you should understand and calculate in what case is it profitable to engage in rent in order to earn an apartment? Let's take Moscow as an example, as the central city of the country.

For example, today the cost of living in Moscow is 14 thousand rubles. It increases every year. For example, in a few years the state plans to raise it to 16-17 thousand rubles. Let's do a rough calculation of the annuity for 30 years. Let’s take an average amount of about 15,000 rubles, multiply this amount by 12 months a year, and then multiply it all by 30 years.

15,000 rub. X 12 months X 30 years = 5,400,000 rubles. This is the amount the apartment will be for you if the elderly person lives that long.

There is a possibility that the annuitant is very ill and needs help for several years, knowing in advance that he will no longer live. Here the annuitant can set his own amount.

For example, he may want to receive both 30 and 40 thousand per month. However, you should study your medical history in this case, otherwise you may simply be deceived. You will be sure that your large payments will last only a few years, but in reality you will simply be deceived with fake certificates. Elderly people often become participants in deception of their children, doctors, etc. So be careful.

This article may cast doubt on the idea of obtaining rental housing. Therefore, you need to clearly state with the rentee that if the property, that is, the apartment , is destroyed, then you are relieved of responsibility for further rental obligations. Destruction is very rare, but situations can be different (fire, earthquake, gas explosion, accident near real estate, resulting in the destruction of the object).

These are perhaps the main points that you should pay attention to when concluding a rental agreement. The more negative situations you foresee, the more points you include in the contract that protect your interests, the better for you and your family. We also recommend that you contact lawyers in your city who will help you understand this issue in more detail and draw up such an agreement.

Remember also that the more witnesses who know that you are conscientiously and responsibly fulfilling your care responsibilities, the better. If the children or grandchildren of an elderly person want to terminate the annuity agreement with you, then the testimony of witnesses can protect your interests in court. Therefore, you should make sure that there are as many people around you with a good opinion of you as possible.

Payments under the agreement and its gratuitous form

The paid form of the contract has its own characteristics:

- Payment is taken exclusively in monetary terms.

- The payment amount is at least 1 minimum wage. Over time, the payment is necessarily indexed.

- The regularity of payments is most often monthly, but the contract may indicate otherwise.

- In addition to the regular payment, a certain amount specified in the contract is paid.

The gratuitous form of the transaction is drawn up similarly to the apartment donation agreement, but has nuances:

- In addition to regular contributions, the renter does not pay a fixed fixed amount after signing the contract.

- Payments cannot be made in kind.

The rent payment is not taken into account as the purchase price of the apartment. The contract should indicate that the transfer of property is free of charge.