Please tell me what is better - a deed of gift or a will for an apartment?

It is better for the owner to have a will, because he lives peacefully in his apartment, as the owner has the right to a subsidy under Art. 159 of the Civil Code of the Russian Federation, a benefit for major repairs based on age, and the heir under the will only after his death and the opening of the inheritance will be able to accept the inheritance in the prescribed manner and ultimately register the right of ownership and dispose of it. Donation to the owner is unprofitable - alienate it free of charge, and where will he live? The new owner can evict him by court decision. Or the donee will sell the apartment, and another new owner will evict the donor. Or the recipient will take out a loan secured by this apartment, will not pay, and the bank will sell the apartment to pay off the debt.

What is better: draw up a deed of gift or write a will for an apartment?

There are pros and cons to both deals. When donating real estate, ownership of it passes to the donee immediately after registration of the transaction. In the case of a will - after entering into an inheritance. Theoretically, a will is somewhat easier to invalidate than a donation (after the death of the donor it is practically impossible), especially if the person is elderly, is registered with a psychiatrist, etc. The tax on income from property received by will has been abolished for all citizens, and on gifts - only for close relatives. If at the time of the death of the testator there are incapacitated parents or children, they will have the right to an obligatory share in the inheritance. These are the main points. It must be determined based on a specific situation, relationship, etc.

I want to re-register the apartment for my daughter. What is better to draw up: a deed of gift or a will for an apartment? I am the only owner, but my son and minor grandson are also registered. What is the best thing for me to do so that neither my son nor my grandson, much less my daughter-in-law, gets the apartment?

If you intend to transfer the apartment to your daughter during your lifetime, you can draw up a gift agreement or a purchase and sale agreement (in this case, when concluding a purchase and sale agreement, you can retain your right to lifelong use of the apartment). Upon conclusion of the above agreements, you cease to be the owner of the apartment and your daughter becomes the owner. In this case, after the death of the testator, the inheritance does not open, and the son will not be able to claim a share of the apartment by inheritance. If you make a will, then after your death the inheritance will open. If at the time of the death of the testator the son is disabled due to age or health, he will have the right to an obligatory share in the inheritance, regardless of the text of the will (the specified share will be half of the share that the son would have received in the absence of a will).

What is better to make a deed of gift or a will for an apartment, and if a deed of gift, can it be drawn up so that it comes into force after the death of the donor?

An agreement providing for the transfer of a gift to the donee after the death of the donor is void. The rules of civil inheritance law apply to this type of gift. The apartment donation agreement comes into force after its state registration. registration with the authorized body (UFRS). The apartment under it will become the property of the donee after registration of the gift agreement. The recipient will have to pay a tax of 13% on the gift (if the donor and recipient are not close relatives). Also for the state. registration is paid by the state. duty. According to the will, the heir will receive the apartment only after the death of the testator. The will must be notarized. Tax on inherited property is not paid, but the state tax established by law is paid. duty.

Will or deed of gift for an apartment - which is better?

Any property owned by an individual can be transferred without payment to another person in one of the following two ways: as a gift or as an inheritance. Before choosing one of the possible options, you need to find out what the difference is between a will and a deed of gift.

This is interesting: Will for an apartment with a mortgage 2020

A deed of gift is a type of legal agreement that provides the basis for the gratuitous transfer of property owned by a person to another person.

A will is a document confirming the will of the property owner regarding who will own the house or apartment after his death

Main differences between forms of property transfer

The main forms of property transfer have a number of differences among themselves according to the main criteria:

- Registration period:

- deed of gift (no more than two weeks pass from the moment of submission to the final registration of the agreement);

- will (the action begins after the death of the person who signed it. The heirs will be able to dispose of the property only after six months).

- Procedure for obtaining inherited property:

- deed of gift (property is transferred from the donor to another person during the official registration of the agreement);

- will (the heirs receive the right to dispose of property only when the person who wrote it dies. In order to obtain these rights, the heirs must draw up a number of documents provided for by law).

- Change of text or cancellation:

- deed of gift (it is almost impossible to change the text of the agreement, and it can only be annulled by filing a claim with the judicial authorities. The claim can be satisfied if it is proven that it was signed under pressure or at a time when the donor was incapacitated);

- will (its contents can be changed any number of times at the request of the testator).

- Registration costs:

- deed of gift (to register it, you need to pay a state fee - 1000 rubles);

- will (the cost consists of the cost of appraising the property that is being inherited, paying for the services of a participating notary, % for providing documents evidencing the inheritance (0.3-0.6%)).

- Tax:

- deed of gift (if the person receiving real estate as a gift does not have close family ties with its owner, then he will have to pay 13% personal income tax on the valuable amount of the property);

- will (in order to enter into an inheritance, you need to pay a state fee. Also, inherited property is subject to tax).

Deadlines for submission and receipt

The deed of gift is issued at the notary's office within 1 day.

Having accepted and checked the package of documents, the notary draws up a standard agreement, certifies it and transfers it to the parties.

When contacting a lawyer or a law firm, the drafting of an agreement can take place by agreement. On average, this lasts from one to 5 days.

When the company's specialists are very busy, clients do not agree to wait longer unless absolutely necessary.

After a lawyer has drawn up an agreement, and also if the agreement is drawn up independently, it is advisable to have it certified by a notary.

The procedure itself will not take much time, it all depends on the conditions of the region in which the notary service operates:

- by appointment;

- on a first-come, first-served basis;

- freely, with virtually no queues.

After certification (or without it), the contract must be registered in the cadastral records of the State Property Committee. Without registration, the deed of gift will not be valid, since the donee will not be able to obtain the necessary documents for the apartment (share).

According to the rules, after submitting an application and a package of documents, along with contracts, registration must be carried out no later than 21 working days.

Documents at the local cadastre and cartography office will be accepted against your receipt, which will indicate the day of return of registered contracts and certificates of ownership in the name of the new owner.

Gift deed: required package of documents

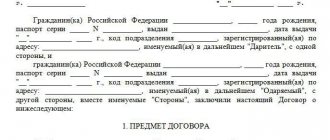

To complete an agreement to donate property, you must provide your data in accordance with the following list:

- passports or other information confirming the identity of the parties to the contract;

- documents with which you can confirm the donor’s ownership of the object of the agreement;

- if the object of the agreement is real estate, it is necessary to provide all available technical documentation;

- receipt for payment of state duty.

In the case where the donor is married, then the certified consent of the spouse to carry out the transaction is additionally provided in writing, and if the co-owner of the property is a minor, it is necessary to provide consent from the guardianship authorities.

By the way! When drawing up a gift agreement, remember that its validity begins from the moment of registration and it cannot be canceled.

When giving a gift, tax exemption to grandmother and grandson

An exception to this rule is in cases of receiving real estate, vehicles, shares and shares as a gift - in general cases of receiving them, the recipient has a tax liability. Important According to Art. 14 of the RF IC, grandchildren are recognized as close relatives.

Deadline for filing a declaration Is it necessary to submit a declaration when donating an apartment to a relative? When donating an apartment to your relative, you must submit a tax return, since the transaction is completed and registered, however, it will be zero due to the fact that by law you were exempt from taxes. You must pay the tax within a month from the start of the registration procedure. But it is advisable to do this even before you start registration.

We recommend reading: What to do if your neighbors are noisy at night

How is a will made?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please use the online consultant form on the right or call the free hotline:

The testator needs to take a number of actions:

- clearly state your own will regarding how the property that is the object of inheritance will be divided and who will get it. Ambiguity in wording may give rise to misinterpretation. The process is regulated by law;

- accurately record the portion that is due to each person named in the will;

- the testator has the right to register the next heirs who will receive the bequeathed property in the event of the death of one of the heirs or refusal of the right of inheritance of one of them;

- determine the executor of his will (this role is played by lawyers and notaries), whose functions are to guarantee the legality of the inheritance procedure and control over its proper execution of the will of the testator.

It is important to know! The will stated in the document can only be challenged by going to court.

The reason for filing lawsuits may be that people who are not mentioned by the testator in the document have undeniable evidence of rights to a share in the inherited property or there are suspicions of the testator’s incapacity at the time of drawing up the document. As a rule, such lawsuits are satisfied.

What is more profitable and better: inheritance or gift

When choosing the optimal form of transfer of ownership, you need to pay attention to various aspects of this issue. If we take the financial aspect as a basis, then a gift agreement is the best solution in cases where it is necessary to transfer real estate to a close relative without presenting any counter conditions. If real estate is transferred to non-relatives, then another form of real estate transfer - inheritance - will be a more attractive option.

This is interesting: How long does it take to challenge a will? 2020

Having analyzed and compared other components of these forms of transfer of real estate and their consequences, and answering the question of what is better: a will or a deed of gift for an apartment, we can draw the following conclusions:

- Having a gift agreement is a more attractive way to obtain rights to real estate for the following reasons:

- the terms of the agreement practically cannot be changed or canceled;

- The recipient will own the real estate immediately after registration of the contract.

- A will is a more advantageous option for the testator for the following reasons:

- the contents of the document and the circle of heirs can be changed any number of times;

- Only the last dying version of the document has legal force;

- the property that is bequeathed remains in the possession of the testator at all times;

- The heir has the right to claim his rights to the property left as an inheritance only after the death of the person who signed it.

Recommendation! When drawing up a document, you should remember that there is a circle of people who have the right to part of the property, regardless of whether they are mentioned as heirs or not. These are the children of the testator under the age of 18, whose parents are pensioners and disabled people.

Real estate donation agreement grandmother grandson

- Passports of participants (originals).

- Donation agreement (one copy is required for each party and additionally for the Registration Chamber).

- Certificate of ownership of the transferred property.

- Technical documentation.

- If the donor's spouse or other relatives have ownership of the apartment, written consent or oral confirmation is required (in the latter case, they must appear at the Registration Chamber in person).

- If the co-owner spouse has died, the original death certificate is attached to the package of documents.

- If the transaction is executed by power of attorney, then the last document must be provided in the original and a copy certified by a notary must be brought.

However, the fact that the donor and recipient are close relatives must be proven by submitting confirmation of this to the tax authority (preferably in person, since anything can happen with mail). Such confirmation may be birth certificates of the donee, as well as the parents of the donee, in which the corresponding inscriptions will be made about who the parents of the donee are and who the parents of the donee’s parents are and the corresponding copies, which (copies) will be stored in the tax office and are evidence of that that the income received is not subject to personal income tax.

Gift deed for an apartment to a grandson

Older relatives often want to take care of their grandchildren. Such care can be manifested in their provision of housing, which will not be lost even if the grandson’s personal life does not work out.

Providing a deed of gift on behalf of a grandfather or grandmother in the name of a grandson or granddaughter is a transaction that requires minimal financial costs.

The basis for the absence of tax obligations in this situation is the fact that the grandfather/grandmother and grandson/granddaughter, in accordance with the provisions of family law, have .

The article will provide the most important explanations of how to draw up a deed of gift for an apartment for a grandson.

justice pro...

If property (for example, an apartment or other real estate, a car, money) is transferred from a grandmother or grandfather to a grandson as a gift, relatives may have questions about taxation: is the gift to a grandson taxed, do grandchildren pay tax when donating an apartment?

Gift to grandchildren: tax

A grandson or granddaughter who accepts a large monetary gift, an apartment (a share of an apartment) or other property from a grandmother or grandfather as part of a gift agreement, thereby receives income. Grandparents do not receive any income when donating and do not have to pay personal income tax (NDFL). Do grandchildren who receive a gift have to pay income taxes?

Is a gift to a grandchild taxable?

According to clause 18.1 of Art. 217 of the Tax Code of the Russian Federation are not subject to taxation (exempt from taxation) “income in cash and in kind received from individuals as a gift, with the exception of cases of donation of real estate, vehicles, shares, interests, shares, unless otherwise provided by this paragraph” . Further in paragraph 18.1 of Art. 217 of the Tax Code states that income received as a gift is exempt from taxation if the donor and recipient are family members and (or) close relatives in accordance with the Family Code of the Russian Federation.

Those. The answer to the question whether a grandson needs to pay tax when donating real estate or a car depends on whether grandmothers and grandchildren are recognized as family members or close relatives.

Yes, grandparents and grandchildren are considered close relatives, as are parents and children, brothers/sisters (family members include spouses, as well as parents and children).

Is gifting an apartment to a grandson taxable?

A grandson who received an apartment free of charge from his grandmother or grandfather under a gift agreement generates income. But the deed of gift for an apartment to a grandson is not subject to tax, because the donor and recipient are close relatives.

You can read about the tax on the sale of a donated apartment.

Do grandchildren pay gift tax on a home?

A grandson or granddaughter to whom a grandmother or grandfather gave a house does not need to pay personal income tax. This is confirmed by Letter of the Ministry of Finance of the Russian Federation dated August 5, 2015 N 03-04-05/45273.

Do I need to file a declaration when donating property between a grandmother and grandson?

The grandson's income in the form of a gift received from the grandmother is not subject to taxation.

Is it necessary to pay tax if a grandmother gives money to her grandson?

Note that when donating between individuals, income in the form of a monetary gift (regardless of the amount) is not subject to taxation, regardless of whether the donor and recipient are family members and (or) close relatives (Letter of the Federal Tax Service of Russia dated July 10, 2012 No. ED-4- 3/ [email protected] ).

When receiving money as a gift from a grandmother, the grandson also does not have to pay tax. However, one should take into account the legal consequences in the case of donating money for certain purposes (purchase of an apartment, house, car).

If a grandson who is a non-resident of the Russian Federation received a gift from his grandmother

The issue of the obligation to pay income tax in the case when a foreign citizen (not a resident of the Russian Federation) receives real estate as a gift from his grandmother was considered in Letter of the Ministry of Finance dated May 15, 2020 N 03-04-05/34692.

The possibility of applying paragraph 18.1 of Article 217 of the Tax Code of the Russian Federation is not determined by the status of a tax resident of the Russian Federation for the donee individual.

That is, the income of an individual - a citizen of a foreign state who is not a tax resident of the Russian Federation, in the form of the value of real estate received from his grandmother as a gift, is not subject to taxation in the Russian Federation.

What is beneficial in this case: a deed of gift or a will?

A will and a deed of gift are one of the types of transfer of rights to things from the original owner to the person chosen by him. Both of them have a number of significant differences, both in terms of registration, the moment of taking possession, and in terms of financial costs associated with the transfer of rights.

When concluding a donation, registration of the transfer of rights occurs immediately after and after its registration. A will is valid only when it has the fact of occurrence. In this case, the ownership right can be registered with the heir no earlier than from the date of opening of the inheritance.

The essence of the will can be changed by the testator, during his lifetime, at any time convenient for him. This cannot be said about a deed of gift, the cancellation of which will require, at a minimum, the consent of the donee, and otherwise, based on the presence of a number of valid factors.

A deed of gift to which close relatives are parties is not a taxable event. When inheriting from his grandfather, the grandson would have to pay a state fee in the amount of the price of the property received, determined by an independent assessment.

As a result, it can be noted that a will is the safest transaction for the original owner of a thing, who can change during his own life the decision to transfer it to a specific person. The conclusion of a deed of gift is most beneficial for the donee, which is associated with the difficulty of challenging such a document and the need to incur minimal costs for re-registration of the property.

This is interesting: Will through a representative 2020

Older relatives who want to protect their grandchildren from the possibility of losing their property, most often, transfer it in the process of conclusion, because as a result of the donation, the thing receives the status, which means it will not be included in the joint property subject to division upon divorce.

Is gifting of real estate taxable?

In relation to real estate, donation is one of the types of transactions - an agreement when the donor gratuitously (without payment) transfers certain property to the donee, or undertakes to transfer it in the future.

Receiving a gift of residential or any other premises is recognized as income, that is, the economic benefit of the person who received this property (in kind, not in cash). In this case, the legislator recognizes as income the benefit received by the donee by saving money that he would have had to spend on purchasing the relevant property.

After the donated apartment is registered in the Unified State Register of Real Estate under the name of the new owner, according to Art. 217 of the Tax Code of the Russian Federation (clause 18.1), the need to pay tax on income does not arise only in two cases:

- if the donation occurred between persons recognized as family members and (or) close relatives.

- gifts to consular employees and members of their families are also not taxed (this is established by the Vienna Convention on Consular and Diplomatic Relations).

All other lucky people who received an apartment or house as a gift are required to pay tax.

Who is the closest?

Not all relatives benefit from the tax exemption. If you make a gift to distant relatives who are indirectly related to you, the tax will need to be paid in full.

Only family members are considered close relatives. Thus, transactions between parents, children, grandchildren, brothers and sisters, and grandparents are exempt from tax.

But there is a certain trick to avoid tax if the agreement is concluded between distant relatives. You can complete two donation procedures using a common close relative. Thus, two pairs of family members go through two agreements, and no one pays taxes.

Attention! In this case, it is necessary to prescribe in the contract the conditions for the transfer of real estate to third parties after the conclusion of the transaction.

Tax obligations

But what about the tax situation when donating an apartment to a grandson? There are no particular difficulties with this, since when transferring an apartment as a gift to a grandson, you will only need to pay for registering the transaction. The amount of registration costs will be 1000 rubles.

Neither the grandson nor the donor will have to bear any other expenses. In Art. 217 of the Tax Code of the Russian Federation states that when making a transaction of transfer of real estate between close relatives, in particular between grandchildren and grandparents, they are exempt from paying taxes.

Gift deed to a minor grandson

As a general rule, a deed of gift drawn up in does not require mandatory notarization. Carrying out such a procedure is associated with the initiative of the parties and can become another “plus” if the transaction is appealed by third parties.

Participation of minor grandchildren as donees indicates the presence of certain features in the concluded agreement. The reason for this is the amount of legal capacity inherent in minor recipients of the gift.

Norms Art. 26 Civil Code, art. 28 of the Civil Code determine that children and minors may be participants in transactions that are not subject to notarization and do not require state registration.

In cases where a deed of gift is drawn up by a grandfather/grandmother in relation to an apartment, they must be a party to the transaction on behalf of minors. Minors are entitled to enter into these transactions, subject to written permission from their legal representatives.

In view of the fact that the grandfather and grandmother can be, by virtue of guardianship, the legal representatives of a minor, their participation as both parties to the contract. If this is required for concluding an agreement, such guardians have the right to petition the guardianship authorities to appoint temporary legal representatives.

If the grandson is classified as a minor, the donor, who is the guardian, has the right to issue written permission and simultaneously participate in the transaction.

The procedure for registering a gift to a grandson

The parties can prepare a draft of the concluded agreement, but it is more correct to ask for its preparation to, which will take upon itself not only the responsibility for drawing up a deed of gift, but also for preparing a package of documents for registration procedures.

Writing a gift agreement for an apartment for a grandson

The deed of gift, which is concluded between the grandfather/grandmother and their grandson/granddaughter, is completed.

Such paper should contain a number of information:

- about the donor;

- about the party receiving the gift, including the legal representative, whose permission or participation was necessary, provided that the recipient is a minor;

- about the item being transferred as a gift, indicating its identifying characteristics;

- about the terms of transfer.

The agreement must be signed by both parties. After its notarization, it can be transferred with the established package of documents for state registration.

Required documents

When making a gift agreement, certain documents must be submitted by its participants.

These include:

- personal documents of the donor;

- personal documents of the donee;

- written permission to sign the agreement received by the recipient from his legal representatives, provided that he is a minor (14-18 years old);

- personal documents of the legal representative, provided that the donee is a minor (less than 14 years old);

- documents for the donated apartment (title and technical documentation);

- consent obtained from the co-owner of the apartment, if it belongs to several persons.

Drawing up a gift agreement for a grandson or granddaughter in 2020

The process of making a gift in 2020 is still regulated by Chapter 32 of the Civil Code of the Russian Federation and is understood as a gratuitous as well as irrevocable transfer of property by the donor in favor of the donee (according to the standards established in Article 572 of the Civil Code of the Russian Federation).

Today, almost any person can act as a donor, except for those listed in Article 575 of the Civil Code (for example, incapacitated or minor citizens). However, these persons can also act as recipients in such transactions.

At the same time, according to our surveys and based on the rich practice of the site’s specialists, in most cases deeds of gift are concluded between close relatives, the category of which, according to Article 14 of the Family Code of the Russian Federation, includes:

- Spouses;

- children;

- parents;

- brothers and sisters (including half-siblings);

- grandchildren;

- as well as grandparents.

Based on the norms established in the RF IC, we can recognize the fact that a gift agreement between grandparents and their grandchildren refers to transactions concluded by close relatives, which, in itself, automatically entails certain consequences of the agreement.

EVERYONE NEEDS TO KNOW THIS:

Donating funds to a non-profit organization in 2020

The legislator has defined a list of requirements relating to such transactions. It includes:

- A certain subject composition of the gift transaction . It is worth noting the fact that if the grandson is a minor, his legal representative (parent or specialist from the guardianship authorities) must participate in the transaction.

- Compliance with the form established for such agreements . We remind you that the gift agreement, according to the current legislation of the Russian Federation as of 2020, can be concluded between the parties either orally or in simple written form. At the same time, notarization of the agreement today is still not mandatory. However, in certain situations, the list of which can be found in Article 574 of the Civil Code of the Russian Federation, a deed of gift must be concluded exclusively in writing!

- The presence of a sign that the transaction is gratuitous . Since donation is a completely gratuitous transaction, it is recommended that the content of the contract indicate the donor’s desire to reduce his own property, thereby increasing the property of the donee without any counterclaims to the latter. If such conditions exist, the donation will be declared invalid (according to Articles 167 and 170 of the Civil Code of the Russian Federation).

- A list of the main properties and characteristics of the donated item that would distinguish it from similar ones.

We also remind you that the parties to the agreement have the right to terminate the deed of gift unilaterally. Thus, according to the norms described in Article 573 of the Civil Code of the Russian Federation, the recipient has the right to refuse to accept the gift, and, based on Articles 577-578 of the same legislative act, the donor may refuse to fulfill the agreement.

Important : A deed of gift between grandparents and grandchildren can be real (the transfer of the object of the gift is carried out upon concluding an agreement) or consensual (the so-called contract of promise of a gift in the future), when the donor promises to transfer the gift into the ownership of the donee within the period established in the contents of the gift agreement.

Thus, when drawing up a gift agreement, the parties are required to include the following clauses, without which the transaction can be classified by the legislator as void and invalid:

Don't have time to delve into legal nuances? Asking a lawyer is faster than reading ! Get a FREE online consultation from the best legal experts - right now !

- Name of the transaction (for example, a donation agreement for a car, apartment, house);

- place of conclusion of the agreement and date;

- important information about the parties to the donation, as well as their real details;

- object of the transaction;

- characteristics and unique properties of the donated item;

- obligations, as well as rights of the donor and the donee;

- a list of special conditions (for example, a list of grounds for changing or terminating the contract);

- degree of relationship between the parties (helps save time when determining exemption from personal income tax);

- signatures.

How to give an apartment to your grandchildren in 2020

Very often, having owned residential property, grandparents, for certain reasons, want to transfer it into the ownership not of their children, but into the ownership of a grandson or granddaughter.

First of all, when drawing up transactions the subject of which are real estate objects (the category of which includes, according to Articles 15 and 16 of the Housing Code of the Russian Federation and Article 130 of the Civil Code, private houses and apartments), it is necessary to take into account that such deeds of gift require mandatory state registration of the right property of the new owner.

In addition, when deciding to transfer an apartment in this way, it is worth considering the following important features of the transaction:

- The donation must be formalized in simple written form. This is a mandatory condition established by the legislator.

- The contents of the deed of gift must list the characteristics of the housing that would distinguish it from similar real estate properties (information from the technical and cadastral passports, floor, area, number of rooms, address, etc.). In the event that we are talking about a gratuitous donation of a share, its size must be indicated.

- The text of the agreement must include a link to title documentation confirming the donor’s ownership of the apartment.

- It is recommended to indicate the degree of relationship of the parties in the deed of gift. This will make the 2020 gift tax exemption process much easier.

- Also, experienced lawyers of the website “Legal Aid” recommend that the special terms of the gift agreement be specified in the deed (any restrictions or encumbrances, the donor’s right to live in the apartment donated to him, etc.).

- The text of the main document should indicate the actual value of the property at the time of the transaction.

- To the main deed of gift, the parties can draw up an act of acceptance and transfer, which reflects the execution of the agreement (this document is not mandatory).

The next no less important stage, without which the gift will be declared invalid, is the state registration of the property rights of the grandson or granddaughter. It is after receiving the appropriate certificate that the donee is considered the legal owner of the apartment.

The registration procedure is regulated by Federal Law No. 122, which was adopted on July 21, 1997 (“On state registration of rights...”). To implement this, the parties to the donation of real estate need to draw up an apartment donation agreement, and then provide it to Rosreestr employees along with the following documents:

- passports of the donor and donee, as well as their legal representatives, if any are involved in the transaction;

- a receipt for successful payment of the state fee for registering the transfer of ownership, the amount of which for 2020 is 2,000 Russian rubles (according to 22 subparagraph 1 of paragraph 333.33 of the article of the Tax Code of the Russian Federation);

- statement;

- deed of gift in 3 copies;

- all available title documents for the donated apartment;

- all technical documentation for the living space (passport, BTI certificates, etc.);

- an extract from the house register stating that the housing transferred under the donation agreement is/is not lived in by citizens other than the owner;

- notarized consent to the transaction of the second spouse, if the donated apartment is part of the property acquired jointly during the marriage;

- written consent of employees of the guardianship and trusteeship authorities, if the donated living space is inhabited by incapacitated or minor persons whose rights may be violated as a result of the transaction.