Is it possible to buy housing from parents and close relatives?

The state supports families with children and strives to protect the interests of the latter and the targeted use of maternity capital.

Federal Law No. 256-FZ of December 29, 2006 (Article 7) provides a detailed explanation of what family capital can be used for and under what circumstances a subsidy is issued for improving housing conditions (for example, money will not be provided for the purchase of a plot for future development).

As for buying a house or apartment from parents, such transactions can be legally carried out, but family capital cannot be used. The reason is simple: there is a high probability that such a transaction is fictitious, and the owners of the certificate for maternal capital simply convert the funds due to them into hard currency. And it is quite possible that the money will subsequently not benefit the young family and child.

This is also true for transactions with other close relatives. Article 14 of the Family Code of the Russian Federation indicates that close relatives include (for a family):

- husband, wife and their children;

- parents-in-law;

- blood brothers and sisters, both full and not full (who only have a common father or mother), along the line of husband, wife, and child;

- grandparents of both husband and wife;

- grandchildren.

Therefore, the answer to the question of whether it is possible to buy an apartment with maternity capital from your parents is obvious - no. The transaction can only be carried out using the buyer’s personal capital.

Purchasing real estate with maternity capital from other relatives

As already mentioned, there is no prohibition on purchasing a home from relatives using maternity capital. It should be recognized that if such a transaction is carried out between distant relatives, then government authorities are more loyal to it. Although such transactions remain under the control of the Pension Fund, they cannot be categorically refused.

A transaction will definitely be approved and will not arouse suspicion among inspectors if it:

- not imaginary or feigned;

- not aimed at purchasing an apartment in a dilapidated building;

- is aimed at improving the living conditions of the family.

One of the common ways to cash out certificate funds is to purchase unsuitable emergency housing. In this case, public money is divided on pre-agreed conditions between the original owner of the emergency apartment and the owners of maternity capital. However, such a scheme is currently being actively suppressed by government agencies.

From March 29, 2020, the Pension Fund independently requests information about recognizing housing as unsafe and subject to demolition and, if the house is truly unsuitable for living, refuses to dispose of maternity capital. The changes were introduced by Federal Law No. 37-FZ of March 18, 2019, their task is to prevent fraud with maternal capital (for example, when parents buy a cheap and unsuitable apartment for living at an inflated price, and share the money from the apartment with the seller, thus cashing out the certificate) .

It often happens that owners of maternity capital share their home with their other relatives. In this case, there is a way to improve living conditions that is not prohibited by law - the remaining share is bought out. Moreover, for such a transaction to be approved by inspectors, the apartment must be the undivided property of the family with maternity capital. That is, the entire home should become the property of the family as a result of the transaction.

Compensatory transactions for the purchase of housing from minor close relatives are prohibited by law

Finally, about purchasing from minor relatives: according to Part 3 of Art. 60 IC of the Russian Federation and part 3 of Art. 37 of the Civil Code of the Russian Federation, neither parents/guardians/trustees, nor close relatives can enter into compensated transactions with their wards.

In this case, the law is so categorical because there is every reason to believe that minors simply will not have the opportunity to express their will both due to age and due to financial dependence on older relatives. Therefore, in order to avoid unprofitable and fictitious transactions, where minors would be used only as a cover, civil and family legislation prohibited the conclusion of such contracts.

Thus, buying a home using maternity capital with relatives is possible and practiced quite often. If the terms of the transaction do not contradict the legislation of the Russian Federation, then the inspection authorities represented by employees of the Pension Fund of the Russian Federation or the prosecutor's office will not express their objections.

Video: buying a home from relatives

Deal with other relatives

If the Pension Fund of the Russian Federation refuses a real estate transaction, then you will either have to cover the entire cost from your wallet, or terminate the contract and look for new options

. For relatives who are not close, you can purchase real estate using family capital, there are no restrictions either from the RF IC or the Civil Code RF, nor the RF Housing Code is provided for.

You can even purchase not the entire apartment, but only its share using maternal capital, but only if the following conditions are met:

- we are talking about an isolated part of the premises, to which the owners of the other part of the housing will not have access;

- after purchasing the share, the entire premises will become the property of the family (that is, the husband or wife already owns some part of the residential premises).

In other cases, such transactions are impossible.

Maternity capital during divorce – Maternity capital

Maternity capital is the property of the whole family. Typically, a maternity capital certificate is issued after the birth of a second or subsequent child.

But what if the child was born after a divorce or in a second marriage? Will the ex-husband, the father of the first child, be able to use maternity capital after a divorce ? Read more about the ex-husband’s right to maternity capital.

Is the ex-husband entitled to part of the maternity capital?

So, divorce! But the capital has not been spent, the certificate is issued to the wife. When a marriage is dissolved, maternity capital often becomes a subject of dispute, since not only the mother, but also the father of the child claims the money.

In case of divorce, the husband has no right to part or all of the capital. Based on Art. 38 of the Family Code of the Russian Federation, upon divorce, only jointly acquired property is subject to division. But according to Article 34 of the Family Code of the Russian Federation, family capital is not it, i.e.

All social targeted payments are excluded from the range of common property of spouses.

Maternity capital is a state targeted payment , therefore it is never included in the common property and maternity capital is not divided during a divorce.

Thus, the QMS funds will be used by the parent for whom the certificate is issued, that is, the mother. All claims of the ex-husband to pay part of the capital have no basis.

In what cases can a father issue a certificate in his name?

During a divorce, the father will be able to dispose of the certificate if it was originally issued in his name.

It is also possible to re-register capital in the name of the father if the right to it is transferred due to certain circumstances. This is possible if:

- the man independently adopted a second child, provided that the court decision came into force no earlier than January 1, 2017;

- the child’s mother died or was declared missing based on a court decision;

- the mother has been deprived of parental rights or has committed a crime against the child.

Do I need the consent of my ex-husband to use maternity capital?

The consent of the ex-husband to dispose of maternity capital funds upon divorce is not required. The ex-wife, as the holder of the certificate for receiving maternity capital, can realize it independently without the consent of the ex-husband.

If the mother is not deprived of parental rights, she can freely spend maternal capital - regardless of who the children remained with after the divorce.

In any case, if the ex-wife buys real estate and pays for the purchase using maternity capital, all her children will necessarily be included in the list of owners.

Example

Irina has been divorced for more than a year, she has three children. Wants to purchase real estate with the help of maternity capital, without using mortgage lending. Do I need the consent of my ex-husband to use maternity capital? - No, she, as the holder of a certificate for receiving maternity capital, can sell it on her own without the consent of her ex-husband.

Is it necessary to give my ex-husband a share in housing purchased with maternity capital?

Using maternity capital opens up many opportunities for the family. However, in the event of a divorce, the father has no reason to claim the capital itself due to the targeted nature of this payment. Therefore, if the relationship is not so strong and divorce is inevitable, it is better to wait with the decision to purchase real estate.

The apartment was purchased during marriage

If this apartment was purchased during marriage, then the husband or, after divorce, the ex-husband has a share of ownership in this apartment. He also does not lose this right after the divorce.

If housing was purchased with maternity capital during the marriage, then the owner of the residential premises is obliged to fulfill his obligation to allocate shares to all family members. Family members include the mother, her children and the official spouse.

The law does not stipulate a certain size of the share, that is, spouses can agree on the size of the share allocated to each. But there are requirements for the actions of notaries, who are obliged to correctly calculate the minimum share: the cost of the housing share must be no less than the size of the share of maternity capital in the cost of housing per person o family member.

Thus, if the wife is still the sole owner of the home, then she is violating her obligations.

The apartment was purchased after the divorce

After divorce, the mother retains the right to use maternity capital. If this money is used to buy real estate after a divorce, then the owners will be the children and the mother.

Thus, the ex-husband will not have the legal right to a share in the apartment purchased using maternity capital funds.

He will not be able to sue any part if the purchase was made after the divorce.

Can an ex-husband sell his share in a residential property purchased with maternity capital?

So you're divorced. The ex-husband has a share in the residential premises purchased by the family using maternity capital. Can he sell his share?

According to Article 250 of the Civil Code, the ex-husband, as a participant in shared ownership, has the right, at his own discretion, to sell, donate, bequeath, or pledge his share.

If the residential premises are pledged to the bank, then the husband will not be able to sell his share.

The ex-husband, the seller of the share, is obliged to notify in writing the other owners of the residential premises (wife and adult children) of his intention to sell his share to an outsider, indicating the price and other conditions under which he is selling it.

When selling a share in the right of common ownership to an outsider, the remaining owners (wife, adult children) have the pre-emptive right to purchase the share being sold at the price for which it is sold.

If they do not purchase the share being sold within a month from the date of notification, the ex-husband has the right to sell his share to any person.

If the loan is repaid, then if they refuse, the husband also has the right to sell his share to a third party.

And if the wife and adult children refuse in writing to exercise the pre-emptive right to purchase the share being sold, such share may be sold to an outsider earlier than the specified deadlines.

If, when selling a share, the ex-husband violates the preferential rights of his wife or adult child, then they have the right to, within three months, demand in court that the rights and obligations of the buyer be transferred to them.

Is it possible to use maternity capital to buy back a share from an ex-husband?

So, you got divorced, now you are not a single family. The ex-husband has a share in the ownership of residential premises (house, apartment). Can the ex-wife buy out this share using maternity capital? Buying out a share for maternity capital is allowed in most cases, provided that a number of requirements are met; read more about buying out a share from your ex-husband for maternity capital.

The ex-husband is not considered a family member and transactions with him using maternity capital are allowed, so you can buy out a share in an apartment or a residential building from your ex-husband using maternity capital funds. To do this, it is necessary to document that the marriage between the spouses is dissolved and submit the documents to the territorial department of the Pension Fund of Russia.

The acquired share in the right is registered as the common property of the family

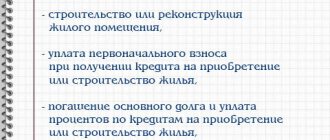

Maternity capital funds can be used to pay for the acquired share of the ex-husband under the following conditions:

- The residential premises (house, apartment) are in common ownership of the family, i.e. wife, husband, children have a share in the ownership of residential premises.

- The ex-husband’s share in the same residential premises is purchased.

- As a result of such a transaction, the ex-wife and children will become the sole owners of this residential premises.

The acquired share in the right is not registered as the common property of the family

If the residential premises are not registered as the common property of the person who received the certificate, his spouse, children (including the first, second, third child and subsequent children), then maternity capital funds can be used for payment under the following conditions:

- The wife must write a notarized written obligation to register the purchased housing as common property for all family members, determining the shares by agreement.

- The entire apartment will belong to the family, i.e. mother and children acquire ownership of this apartment.

How to make a deal correctly

The legality of the purchase with maternity capital will definitely be checked, as well as the extent to which the obligation to allocate shares to children has been fulfilled.

There is no need to prove to the Pension Fund that the buyer and seller are not close relatives (this body independently conducts this check). So, buying real estate from relatives for capital is done in exactly the same way as from another owner who has no relationship with the buyers. The child (after whose birth the certificate was received) must already be 3 years old at the time of such a transaction. The general algorithm looks like this:

- Concluding a purchase and sale transaction. The agreement specifies that family capital will be used partially (or fully) as payment, that is, the transaction will be partially closed with money from the Pension Fund (it acts as the manager of funds provided by the state). Each family member must be allocated their own share in the purchased real estate (mother, father, all children).

- Submission of an application by the buyer to the Pension Fund. A certified copy of the real estate purchase and sale agreement (indicating the details and personal data of the seller) must be added to it.

- Waiting for approval. The period for making a decision on issuing (or not issuing) a certificate for maternity capital has been reduced from 1 month to 15 days since 2020. And the time frame for checking the accuracy of information provided by citizens has been reduced from 14 to 5 days.

Once the money arrives in the seller’s account, the transaction is considered completed. Next comes the transfer of keys and registration of ownership.

Redemption of a share in an apartment with maternal capital

Despite the current trend towards a cessation of growth in real estate prices, for the majority of citizens of our country, maternity capital funds are not enough to acquire separate housing without additional investments. A suitable option for increasing living space with the help of maternity capital may be to purchase a share in an apartment. You can use the certificate to purchase part of an apartment either from a relative or from another person.

Buying a share of an apartment from relatives

According to the law, maternity capital is used to purchase part of the selected apartment if the following basic conditions are met:

- the share represents a separate room (one room or several);

- After purchasing a share, the entire property becomes the property of the purchaser.

It is very important that the share is separated from other living space, because according to the law, the use of the certificate must facilitate the purchase of a separate home.

To approve the transaction by the Pension Fund of Russia, the allocated share must meet certain requirements:

- isolation from other living spaces;

- suitable for permanent residence;

- does not violate the various regulations applicable to this type of housing.

It should be noted that it will be possible to buy part of the apartment or all of it using maternal capital without applying for a loan or a loan only after the child turns 3 years old.

Required documents

To register the purchase of part of a relative’s apartment, the Pension Fund is provided with:

- statement of intention to use maternal capital;

- certificate and copy;

- passport of the person in whose name the certificate was issued;

- SNILS number of the person submitting the application;

- marriage certificate and passport of the spouse (if he is a party to the transaction or a co-borrower on the loan);

- original birth (adoption) certificates of children;

- purchase and sale agreement, certificate of ownership;

- an agreement with a bank on the provision of a loan or mortgage, if one has been concluded. The purpose of funds should be the purchase of a specific object.

In addition, a certificate from the bank must be attached indicating the balance of the debt to repay the loan or mortgage (principal amount, interest), as well as a notarized document that certifies the fact of allocation of shares to children and parents.

Deal Features

Despite the fact that transactions between relatives are legal, there are a number of important features that must be taken into account:

- Conducting a transaction only for the purpose of cashing out certificate funds is illegal. There must be a change of owner of the living space.

- A husband and wife do not have the right to buy out a share from each other, but it is allowed to enter into an agreement with other close people, for example, between a mother and a child;

- You can receive a property tax deduction if the transaction is carried out between non-related parties. These include: an individual, spouse, parents (adoptive parents), children (also adopted), full and half brothers and sisters, guardian (trustee) and ward.

Read also: Maternity capital at the birth of twins

Allocation of shares to children

According to the law, the purchased residential area is registered with the mandatory determination of the shares of the mother, father and children. Parts are allocated for everyone. Shares are also given to children born after completion of all necessary procedures for purchasing a home.

Shared participation must be registered for the entire family, regardless of the square footage of the property being purchased. At the same time, a transaction where only minor children are the owners may be considered illegal. Shares are allocated no later than six months from the date of transfer of capital to the seller’s account or after the removal of encumbrances, if they are provided for in the contract.

In what cases is purchase not possible?

It is a violation of the law to purchase part of the housing located outside of Russia. The condition of the purchased premises is also a determining factor. If its depreciation exceeds 50%, the Pension Fund may refuse to transfer funds.

To ensure the security of the transaction, the Pension Fund may conduct an on-site inspection of the alienated premises. Based on its results, a decision is made on its suitability for habitation. After this, it becomes possible to purchase a share in such premises.

Buying out a share in an apartment from strangers

Purchasing part of an apartment from a third party is not illegal. However, it is necessary to take into account a number of requirements for such housing. A share can be one or several rooms in a multi-room apartment.

Purchasing a room in a one-room apartment is not possible. This situation involves purchasing the entire apartment. Buying a room with the help of maternal capital is possible only if the requirements for its isolation and isolation are met. In other words, documentary evidence of ownership of a separate room.

In ordinary apartments, it is extremely rare that a room is a separate property. Therefore, here we can talk about the possibility of buying a room in a communal apartment, where personal accounts are separated.

You cannot purchase a room in a dormitory. The purchase of such living space is possible only if it belongs to the private housing stock.

Since the transfer of funds is possible only after registration of the transaction, the purchase and sale agreement must contain the following information:

- Payment for housing in full or in part will be made using a maternal capital certificate. The transfer will be made by the Pension Fund to the seller’s bank account.

- The period during which buyers undertake to provide the necessary package of documents (until full payment is made, the property is pledged).

Read also: Regional maternity capital in the Nizhny Novgorod region

List of documents

To purchase part of a third-party’s apartment, you must submit to the Pension Fund:

- statement of desire to sell maternal capital (filled out on the spot);

- certificate and its copy;

- passport;

- SNILS number of the person submitting the application;

- marriage certificate and passport of the spouse (if he is a party to the transaction);

- birth (adoption) certificates of children;

- an extract from the state register confirming the absence of fines and debts;

- original purchase and sale agreement, certificate of ownership;

- an agreement with a bank on the provision of a loan or mortgage, if concluded. We indicate the acquisition of an object as a goal.

In addition, there must be a certificate from the bank indicating the balance of the debt to repay the loan (principal amount, interest), as well as a notarized document that certifies the allocation of shares.

When they can refuse

The pension fund will refuse if the housing is located outside the Russian Federation. Another factor is the condition of the said premises. If the Pension Fund of the Russian Federation recognizes the housing as unsuitable for habitation, the transaction will not take place.

Features of buying a share in a private house

Current legislation does not prohibit purchasing a share in a residential building using maternity capital. For the transaction to be approved, a private house must be equipped with a heating system, running water (water must be potable), and electricity. In other words, the house must be suitable for living in it all year round.

The documentation must indicate that the house has residential status. The most important structures comply with building regulations. The height is less than three floors. The location of the house must be a plot of land for individual housing construction in a populated area. The share must have a separate entrance and be isolated.

It should be remembered that many houses are not registered in ownership with the allocation of shares. Often a residential building has the status of joint ownership. In such a situation, there is no way to find out exactly who owns this or that part of the living space.

By law, a room can be a share of a residential building. The same rules apply here as when buying a room in an apartment.

If a house with two owners is divided, its status changes and it becomes a residential building with two apartments. Transfer of money for the redemption of part of such a house is possible only after the procedure for its division has been carried out. Shares in such a house are called separate apartments if they have a separate entrance and premises separated from other owners.

To buy out a share in the house using mat funds. capital, it is important that the certificate of ownership contains information that it is an apartment or part of a residential building.

Source: https://gosuslugi365.ru/materinskij-kapital/vykup-doli-v-kvartire-materinskim-kapitalom.html

Possible risks

An unaccounted heir may be one who has the right to an obligatory share in inheritance under a will, but he did not know about it, but found out later.

Among the possible risks when purchasing housing from relatives, it should be mentioned only that a so-called unaccounted for share in the apartment may be claimed heir (if, for example, the husband or wife has a brother or sister who does not live in the housing being sold at the time of the transaction). But this is also true for real estate that is not purchased from a relative.

In addition, transactions with relatives are often not approved by the Pension Fund of the Russian Federation, so you may not receive a positive response to your application. Otherwise, there are no risks.