Home / Real estate / Land / Donation

Back

Published: November 26, 2016

Reading time: 9 min

0

645

If relatives have a need to transfer real estate to each other, including land plots, then the best option for them would be to draw up a gift agreement.

Changing the ownership of land through a deed of gift has a number of advantages, such as the availability of tax breaks and a simplified procedure for drawing up and registering a contract compared to a sale and purchase.

- Legislation

- Features and Benefits

- Procedure

- Features of donating a share of land

- Registration and fees

Legislation

Chapter 32 of the Civil Code regulates the process of donation, paragraph 3 of Article 574 states the need for state registration of donations of real estate.

The Tax Code classifies the receipt of property as a gift as a type of individual income and taxes it, but exempts close relatives from it (Article 217 of the Tax Code, clause 18.1).

The procedure for registering documents for donations is set out in Federal Law N122-FZ.

Features and Benefits

So, when relatives donate real estate to each other, they are exempt from all payments, with the exception of the fee for re-registration of ownership.

Payments for registering a gift agreement are not charged in accordance with the amendments to the Civil Code of March 1, 2013, and the Tax Code exempts the donee from income tax when receiving land into ownership. But this relief is valid only when donating a plot of land to relatives. This category includes:

- Parents and children (including adopted children);

- Grandfathers, grandmothers and their grandchildren;

- Official spouses;

- Brothers and sisters with at least one common parent.

Family ties must be documented. Examples of supporting documents include birth certificates, stamps in passports about marriage and the presence of children, certificates from the registry office and guardianship authorities. They are attached to the main package of documents when registering an agreement with Rosreestr.

If real estate is gifted to non-close relatives (cousins, nephews, great-uncles, etc.), then the recipient pays a standard income tax of 13% of the actual value of the land.

Family ties do not cancel the general restrictions on gifts established by the Civil Code. Thus, donation cannot be made:

- Minor children;

- Incapacitated citizens;

- Workers of social and medical institutions;

- Employees of state and municipal structures, military personnel.

In these cases, it is necessary to use other methods of transferring land, for example, through the execution of a sales agreement.

The main disadvantage of donation compared to sale is the possibility of its cancellation in some exceptional cases.

Registration of donation of land in Rosreestr

The transfer of ownership of a land plot is subject to mandatory state registration (clause 3 of Article 574, Article 131 of the Civil Code of the Russian Federation). From March 1, 2013, the registration of the gift agreement itself, as was previously the case, was cancelled. In this case, only the transfer of ownership of the property into the possession of another person is registered. A land donation agreement is a document on the basis of which this property becomes the property of the second party.

Attention

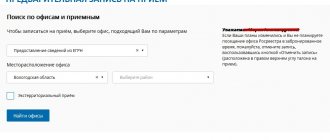

To register a transaction of transfer of ownership of a land plot to another person, you must submit an application to the Federal Service for State Registration, Cadastre and Cartography (territorial division of Rosreestr) at the location of the real estate, as well as a package of necessary documents.

This application can be submitted in any of three ways:

- by personally submitting an application to the registration authority;

- by post;

- by visiting the official website of state and municipal services;

A receipt for state payment must be attached to the application. duties. The person who will pay the duty is not established by law. It can be either the donor or the recipient. The option of dividing the amount in half is not excluded. But as a rule, govt. the donee pays the duty.

After the package of documents has been submitted, you just have to wait 10 working days until the employees of the territorial division of Rosreestr do their work, i.e. will formalize the transfer of ownership. (Clause 3, Article 13 of the Federal Law of July 21, 1997 N 122-FZ “On state registration of rights to real estate and transactions with it” (with amendments and additions).

Important

If the documents are notarized, then the period for registering rights is reduced to 3 working days , not counting the day of submission of documents for registration.

Procedure

The algorithm for the gratuitous transfer of land consists of the following steps:

- Promise of giving. This action is optional. The donor may promise to complete the donation of land within a certain period of time. If a promise is made in writing in accordance with official forms, then it can function as a contract;

- Collection of documents;

- Drawing up the text of the contract;

- Submission of applications to Rosreestr and state registration of transfer of ownership.

The required package of documents consists of:

- Passports of the parties;

- Cadastral passport of the site and its plan;

- Certificates of land ownership;

- Extracts from the house register, if the plot is sold together with residential buildings;

- Certificates of absence of arrears in tax payments for the site, as well as certificates of absence of collateral obligations;

- Information about encumbrances (lease rights, easements) or their absence;

- Spouse's permission to make a gift if the plot is in common family shared ownership;

- The contract itself and applications to Rosreestr;

- Documents confirming family ties.

An agreement on donating a plot of land to a close relative has a prescribed form and includes:

- Personal data of the parties to the transaction;

- Data about the site: location, address, cadastral number, its purpose;

- Nature of the agreement (donation);

- Legal acts that are the basis for donation;

- The contract price, consisting of the market or cadastral price of the donated property;

- Data on other real estate objects on the site;

- Data on debt obligations and encumbrances or data on their absence;

- Conditions for canceling a donation. In general, such a condition is the infliction of serious harm to the health of the donor by the donee. By agreement between the parties to the agreement, it is possible to include some additional conditions. For example, a donation may be canceled if items of non-material value to the donor are damaged.

- Signatures of the parties and the date of the agreement.

A form (sample) of a land donation agreement between relatives can be downloaded here.

Pros and cons of a gift agreement

Let us dwell in detail on the features of the gift agreement. The undoubted advantage of such an agreement is that the property becomes the property of the new owner immediately after registration and usually without additional conditions. Anyone who receives an apartment as a gift is not obliged to financially support or care for the donor. He can dispose of the donated property at his own discretion: sell, exchange, lease.

The disadvantage of a deed of gift is that it, like any other agreement, can be challenged in court. To avoid this, lawyers strongly recommend strictly complying with all legal requirements for a gift agreement.

Registration procedure

The general order looks like this. First you need to prepare a package of documents for registration of a deed of gift for an apartment or house with land. Correctly draw up and sign the deed of gift. And then register the transfer of ownership of the property.

By law, a gift agreement is concluded only in writing and in at least two copies. It is not necessary to notarize it. It would still be wise to arrange it with a specialized lawyer, because it is often difficult for a non-specialist to foresee all the nuances of the transaction.

Features of a gift agreement between relatives and with the participation of minors

Deeds of gift are most often concluded between relatives. It is important to consider the degree of relationship between the donor and the recipient. This directly determines what tax you need to pay for property received as a gift.

If the parties to the agreement are not close relatives, then the tax will be 13% of the value of the property. Only close relatives are exempt from taxation. The law clearly defined their circle:

- parents;

- children;

- spouses;

- brothers and sisters.

If a minor under the age of 14 years accepts an apartment as a gift, then the contract is signed for him by his legal representatives. They are parents or guardians. A minor who is already 14 years old signs the agreement himself, but legal representatives also put their signature on the document. In both cases, the transaction is made only on the basis of written permission from the guardianship authorities.

Note! Gift agreements concluded by legal representatives on behalf of minor children under 14 years of age and other incapacitated persons are considered invalid. And the rights to such real estate will never be registered by the state.

Documents for donation and registration of rights to donated real estate

The list of documents for registration of a deed of gift for an apartment or house with a plot has been approved by the Ministry of Justice:

- A statement from both parties to the transaction with a request to register the transfer of ownership of real estate.

- Three originals of the gift agreement.

- Documents for real estate: certificate of state registration of ownership and title document.

- Power of attorney, if a representative of one of the parties acts (notarized).

- Technical documents of the BTI: cadastral passport, floor plan.

- An extract from the apartment card or house register (no more than a month must pass from the date of the extract).

- Consent of the second spouse to donate common property (notarized). Or documentary evidence that the property belongs only to one of the spouses (prenuptial agreement, agreement on division of property, court decision on the allocation of the marital share).

- Permission from guardianship authorities.

- Passports of the parties.

To the documents for a deed of gift for a land plot, you need to add a cadastral passport for the land and title papers for it.

Note! The donor's land must be registered as his own, and not be in use or in inheritable possession for life. Otherwise, according to the law, he has no right to dispose of it.

The donation of a house and the land on which it stands can be formalized in one agreement. But the cost of the house and land is indicated in the document on separate lines. This also applies to a deed of gift for a garage or dacha.

Video: Lawyer on the nuances of a gift agreement

Costs of concluding a contract

Before you go to register the transfer of ownership at the Rosreestr branch, you must pay a state fee . It must be paid by the new owner of the property in the following amount:

1) 2000 rub. for a house or apartment;

2) 350 rub. for a plot of land.

Note! If the database on government payments does not contain information about the payment of the state duty and the applicant does not attach a receipt for its payment, then the registrar will not accept the documents from him.

Starting from 2020, new deadlines for re-registration of ownership of real estate apply - 10 days from the date of application. After their expiration, the new owner receives a certificate of ownership of the property.

There are three ways to submit documents to the nearest Rosreestr office:

- by coming to the office in person;

- by mail with a description of the contents and notification of delivery;

- via the Internet directly to the Rosreestr portal.

Features of donating a share of land

Donating a share of a land plot has its own characteristics.

The size and location of shares cannot be chosen arbitrarily by the parties; the necessary procedures are official land surveying and registration of shares with the administration. Only after land surveying and the issuance of cadastral titles to the shares will the owner be able to dispose of them as separate objects, including being able to give them to relatives.

Shares have a legally established minimum area, depending on the region of the site. The transfer of ownership for a share of a smaller area will not be registered.

Every citizen of the Russian Federation can lease land for private plots from the state. Do you have a large family and want to buy an apartment with a mortgage? Find out what programs you can use. Read our article. In some cases, you can pay off your mortgage using maternity capital. You can find out what documents you will need for this here.

How to properly draw up a deed of gift for a plot of land

Registration of a deed of gift involves going through several stages, including drawing up an agreement, registering it in the state database, and signing the deed of transfer.

Drawing up and signing a deed of gift

You can draw up an agreement either independently or by contacting specialists. In the first case, you can type out the form yourself, using the tips “How to draw up a deed of gift for a land plot” or, which is drawn up in accordance with all legal requirements.

If the parties are unsure of their legal abilities, they can use the services of a notary who, for an additional fee, will help draw up a competent document.

This is important to know: Gift deed for an apartment and its cost

Required documents

The procedure for transferring ownership requires the preliminary preparation of a certain package of certificates:

- identification documents of the parties;

- agreement template prepared in three copies (two for the parties to the transaction, the third for submission to the registrar’s archive);

- a certificate stating that there are no capital construction projects on the land plot, or documents confirming ownership of such real estate;

- cadastral plan of the plot;

- an extract confirming the cadastral value of the land;

- documents confirming the donor’s right to dispose of property.

Certification by a notary

The gift agreement does not require mandatory legalization by a notary, except in several cases:

- when the donor needs to obtain permission from the marriage partner;

- if during a transaction the interests of minors or persons with complete or limited legal capacity are affected, registration of the transaction is possible if there are documents from the guardianship and trusteeship authorities authorizing the alienation of property.

A voluntary visit to a notary significantly increases the legal purity of the transaction and reduces the risks of its cancellation in court.

To certify the contract, all parties must appear at the time appointed by the notary and sign. If documents are drawn up by a notary, the parties do not need to independently prepare them in Rosreestr. The notary's representative will independently conduct them to the registrar, which reduces the time required to complete the procedure.

How much does registration cost?

Registration of a land deed is subject to a fee in the amount of:

- 2 thousand rubles for individuals;

- 20 thousand rubles - for business entities;

Expert opinion

Mikhailov Evgeniy Alexandrovich

Teacher of civil law. Lawyer with 20 years of experience

If the land has an agricultural purpose, the recipient must pay a state duty in the amount of 350 rubles.

When the parties are not related, the beneficiary will have to pay 13% income tax.

Those who used the services of a notary will have to additionally pay a fee and the cost of technical maintenance of the transaction.

Registration with Rosreestr and obtaining a certificate of ownership

To register a deed of gift in the state database, you must write an application, attach a complete package of documents and submit them to any Rosreestr office or multifunctional center.

This is important to know: Features of canceling a gift agreement for an apartment

When submitting, all citizens specified in the agreement or their proxies must be present and able to confirm their authority with a notarized document.

After accepting the package, the responsible employee will issue a receipt indicating the date of issue of the certificate. The average time for verification of submitted data is 10 working days.